How to Become a Certified Personal Finance Consultant

Managing financial issues and aspects of life is not a simple task, including complex activities related to planning, budgeting, analysis, information collection, systematisation and organisation of the necessary conditions under which a person’s financial well-being remains stable over time.

Today, personal finance consulting firms are responsible for regulating these issues and providing comprehensive consulting and support in the world of individual finance.

This article is a brief guide on what a certified personal finance consultant is, what key characteristics they possess, and what you need to do to become one.

Key Takeaways

- A certified personal finance consultant is a person authorised to provide advice on all matters related to finance.

- While a degree in finance or related fields is beneficial, pursue certifications like CFP or ChFC to demonstrate expertise and credibility.

- The main duties of CPFCs encompass providing financial guidance, creating budgets, enhancing savings, making educated investment decisions, overseeing debt management, preparing for retirement, etc.

What Does CPFC Stand For?

A certified personal finance consultant (CPFC) represents a recognised professional credential for those who offer specialised advice and support. Individuals in this role provide financial consultations and assist clients in navigating various financial aspects, such as creating budgets, enhancing savings, making informed investment choices, managing debt, planning for retirement, and achieving overall monetary health.

The CPFC designation signifies that the consultant has fulfilled rigorous educational requirements and adheres to established ethical and professional standards, showcasing their proficiency in personal finance. This certification not only enhances the consultant’s credibility but also assures clients of their commitment to providing high-quality financial guidance.

By engaging a CPFC, clients can expect tailored strategies that align with their unique situations and goals. The expertise of a Certified Personal Finance Consultant empowers individuals to make informed decisions, ultimately leading to improved financial stability and a more secure future.

One of the best places to train CPFCs is considered to be the Financial Consultant Certified Institute (IFCCI).

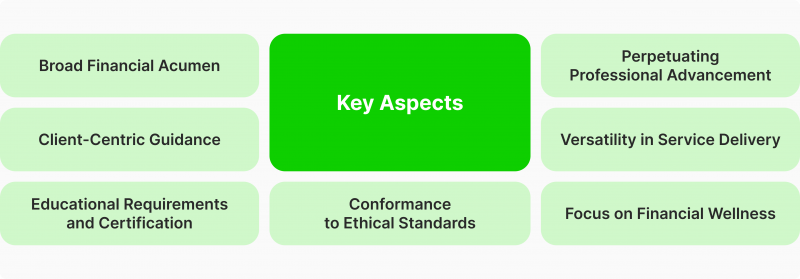

Key Aspects of a Certified Personal Finance Consultant

CPFCs are important cogs in the complex mechanism of managing all aspects of a person’s financial life, which optimise the processes related to the issues of competent distribution of cash flows. Providing consulting services, they have a number of key characteristics that determine their activity. Here are the main ones:

Broad Financial Acumen

CPFCs possess extensive knowledge across a variety of financial disciplines, such as budgeting, debt management, savings, investments, insurance, tax planning, and retirement strategies, which equips them to deliver comprehensive financial advice tailored to individual circumstances.

Client-Centric Guidance

Their approach is centred on gaining a deep understanding of each client’s unique financial landscape, aspirations, and challenges, allowing them to provide customised solutions that resonate with the client’s specific needs and goals.

Educational Requirements and Certification

To achieve the CPFC designation, individuals must complete designated coursework, successfully pass a certification examination, and fulfil experience prerequisites, ensuring they are well-equipped with the essential knowledge and skills to offer trustworthy financial advice.

Conformance to Ethical Standards

CPFCs adhere to a rigorous ethical framework that requires them to prioritise their client’s best interests, uphold transparency, and safeguard confidentiality in all financial interactions.

Have a Question About Your Brokerage Setup?

Our team is here to guide you — whether you're starting out or expanding.

Perpetuating Professional Advancement

Continuous professional development is a requirement for CPFCs, who must participate in ongoing education to stay informed about changes in financial regulations, market dynamics, and best practices, ensuring they provide the most relevant and effective guidance.

Versatility in Service Delivery

CPFCs have the flexibility to operate in diverse settings, including financial institutions, non-profit organisations, corporate environments, or as independent advisors, offering a wide range of services from financial planning and coaching to specialised consulting on particular financial matters.

Focus on Financial Wellness

Their focus extends beyond mere numerical analysis, as CPFCs strive to enhance clients’ overall financial wellness, empowering them to make informed decisions that contribute to their stability and long-term security.

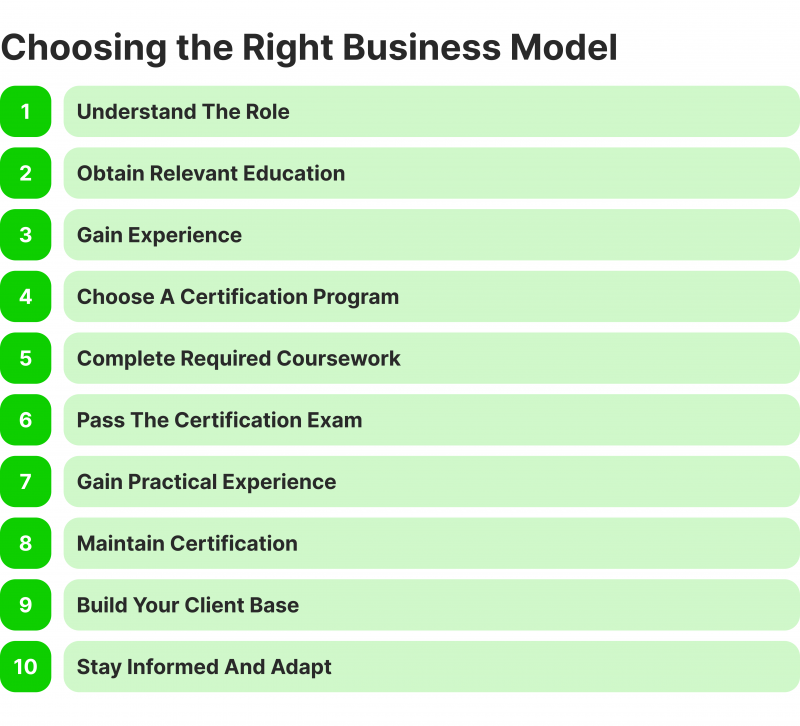

How to Become a Certified Personal Finance Consultant — A Step-by-Step Guide

Consulting in individual financing is a set of sought-after services for many people who wish to have an expert approach to handling, managing, and distributing money. Being a highly competitive profession, finance advisors stand out first for their expertise, professionalism and extensive experience in dealing with activities related to solving money-related issues.

As a consequence, the question of how to become a certified advisor is rhetorical and implies a sequence of actions to be taken to be able to provide high-quality professional services.

These actions are:

Step 1 — Understand the Role

To achieve certification as a personal finance consultation expert, it is first essential to comprehend the role’s nature. This involves conducting thorough research into the field to grasp the various responsibilities associated with personal finance consulting, such as creating budgets, providing investment guidance, planning for retirement, and managing debt.

Besides, it is essential to cultivate skills in financial analysis, effective communication, and problem-solving to excel in this profession.

Step 2 — Obtain Relevant Education

At this stage, it is essential to focus on acquiring pertinent education. Although a degree may not be mandatory, a bachelor’s degree in finance, accounting, business, or economics can provide significant advantages. Further, pursuing further education through courses that cover personal finance, investment strategies, and financial planning is advisable.

Step 3 — Gain Experience

Seek out internships or entry-level positions specifically in the field of finance or consulting. This hands-on experience will provide practical skills and insights into the industry.

Take the time to connect with professionals already working in the finance or consulting fields. By learning from their experiences and gaining insights into best practices, you can build a strong foundation for your career.

Step 4 — Choose a Certification Program

When selecting a certification program, conducting thorough research and considering various reputable options is essential. Look for certification programs such as the Certified Financial Planner (CFP), Chartered Financial Consultant (ChFC), and Accredited Financial Counselor (AFC).

As you research, review the requirements for each program, paying close attention to the prerequisites. This includes considering the required education, professional experience, and any necessary examinations that must be completed.

Step 5 — Complete Required Coursework

In the fifth step of the certification process, you must enrol in and complete the specific coursework required by the certification program you selected. This coursework will cover various topics, including financial planning, investment management, tax considerations, and estate planning. Focus on these areas as you work through the required coursework to ensure you are well-prepared for the certification exam.

Step 6 — Pass the Certification Exam

Now, it is time to prepare for the exam diligently. You can achieve this by utilising study guides, taking practice exams, and enrolling in review courses to understand the exam content thoroughly.

Scheduling the exam by registering and ensuring you have a set date to take the certification exam is crucial. This careful preparation and scheduling will help you successfully pass the certification exam.

Step 7 — Gain Practical Experience

Focus on gaining practical experience. This involves accumulating relevant work experience, which is often required by the certification body. One way to do this is by working under a certified consultant or in a financial advisory role. This hands-on experience will provide valuable insights and practical skills essential for obtaining the certification.

Step 8 — Maintain Certification

Engaging in continuing education is integral to staying current with industry trends and regulations to maintain your certification. Most certifications have specific requirements for ongoing education. Meanwhile, adhere to the renewal process outlined by the certifying organisation to keep your certification current.

Discover the Tools That Power 500+ Brokerages

Explore our complete ecosystem — from liquidity to CRM to trading infrastructure.

Step 9 — Build Your Client Base

To build a client base, use social media platforms like Facebook, Twitter, and Instagram to connect with your audience by sharing valuable content, engaging with followers, and running targeted ads. Attend industry events and host local seminars or workshops to network and showcase your expertise.

Create a professional website to build credibility and attract clients. Highlight your services, include client testimonials, and provide valuable resources. Implement SEO strategies to improve search rankings and make finding you more accessible to potential clients. Regularly update your site with fresh content to align with your brand.

Step 10 — Stay Informed and Adapt

After passing through all the steps, it’s time to continuously educate yourself about changes in financial laws, investment opportunities, and individual finance strategies to stay ahead in the industry; this can involve subscribing to financial news sources, following industry blogs, and participating in relevant webinars or workshops.

Join professional organisations and attend conferences to network with industry peers, stay updated on the latest trends, and gain valuable insights from experts in the field. Connecting with like-minded professionals and engaging in discussions can provide a broader perspective and help you adapt to changes in the industry.

Conclusion

CPFC is a remarkable and highly specialised profession in the world of finance, through which it is possible to obtain a full range of services related to advising, planning and solving issues related to the financial aspects of a person’s life.

To become such a specialist, one must undergo rigorous training and gain the necessary knowledge and experience to prove their level of competence and gain a firm foothold in the industry.

FAQ

What is a Certified Personal Finance Consultant?

A CPFC provides expert guidance on personal financial matters, such as budgeting, investing, retirement planning, and debt management.

Do I need a degree to become a CPFC?

While a degree is not always required, having a bachelor’s degree in finance, accounting, business, or economics can be beneficial. Additional courses in personal finance, investment strategies, and financial planning are also recommended.

What certifications are available for Consultants in Personal Finance?

Typical certifications include the Certified Financial Planner (CFP), Chartered Financial Consultant (ChFC), and Accredited Financial Counselor (AFC). Each has specific requirements for education, exams, and experience.

How do I gain experience in the field?

Seek internships or entry-level positions in finance or consulting to build practical experience. Networking with industry professionals and learning from their insights can also help you understand best practices.

What skills are important for a CPFC?

Key skills include financial analysis, communication, problem-solving, and client management. A strong understanding of financial products, tax laws, and investment strategies is also crucial.

How can I prepare for certification exams?

Enroll in exam preparation courses or study independently using recommended materials. Dedicate time to understanding the exam format and practising with sample questions.