How Blockchain Impacts the Financial Industry

Articles

Following its inception in 2009, blockchain technology made rounds around the financial markets and industries for its innovative qualities. From speed and security to a completely anonymous and decentralised nature, blockchain is the obvious answer to numerous problems in the finance industry.

The global financial system has become increasingly complex, cumbersome, and riddled with third-party intervention. So, as of 2009, blockchain solutions seemed to be a match made in heaven for financial markets. However, as of 2023, blockchain adoption has been slower than expected due to several market downturns and a generally sceptical view of the crypto world.

Today, we will re-iterate blockchain’s best qualities for finance and discuss several drawbacks that keep this tech from being a perfect option for the financial world.

Key Takeaways

- Blockchain technology was invented with the mission to accelerate and simplify financial and other transactions. This methodology also makes transactions considerably cheaper.

- Despite its obvious benefits, blockchain has not been adopted massively due to its controversial reputation on the market.

The Importance of Blockchain Technology For Finance

As a completely decentralised, secure, and direct way to transact and exchange information, blockchain technology is a no-brainer fit with the global financial system. The invention and popularisation of blockchain were triggered due to numerous shortcomings of the existing financial systems.

The Need For Blockchain Invention

Before blockchain’s introduction, financial ecosystems worldwide became overwhelmingly bureaucratic, devoid of privacy, and extremely expensive in some instances. International transactions were the biggest victim of an intricate financial system. Without blockchain, a simple international payment will require at least five business days to complete all the checks and get confirmed.

Of course, significant fees will be tied to this simple money transfer, and several financial entities will monitor and analyse your transaction. So, privacy and anonymity are also out of the question. This simplified example is a gateway to how clumsy the global financial system has become in the 21st century.

Financial companies worldwide needed to enter this complex ecosystem just to operate on an international level. So, the necessity to transact worldwide has forced numerous entities to adopt overly complex financial practices.

Traders, investors and businesses worldwide became increasingly aggravated by the level of needless complexity, and that is precisely why blockchain technology and cryptocurrencies gained such momentum in the late 2010s. After all, blockchain’s innovative methodologies completely reimagined financial operations and how they should be executed.

Enter The Blockchain Revolution

Blockchain’s distributed ledger technology, decentralised nature, low fees, and encrypted security completely changed the status quo. Now, using complex fiat transactions is no longer the only option for customers across the globe. Blockchain was a viable and lucrative alternative that could benefit all parties involved.

As discussed, the main problems with the financial sector were slow-moving transactions, too many fees, lack of transparency, and privacy. Blockchain’s features accommodated these faults and even added other features.

Slow Blockchain Adoption Process

Despite these almost tailor-made solutions to the already age-old financial shortcomings, blockchain networks failed to catch on significantly. The reasons for this are of varying complexity and conditions. First, transitioning from a well-established system to a new methodology is challenging, time-consuming, and massively expensive.

Additionally, the crypto landscape had its fair share of downturns and controversies related to fraud, digital crimes, and other questionable practices. Although this is not directly related to the underlying tech, the infamous status of crypto has affected the entire blockchain industry negatively.

While many companies are still sceptical about implementing blockchain technology within their IT infrastructure, it is difficult to deny that blockchain was quite literally created for finance. Its features and utilities perfectly complement the financial processes locally and globally.

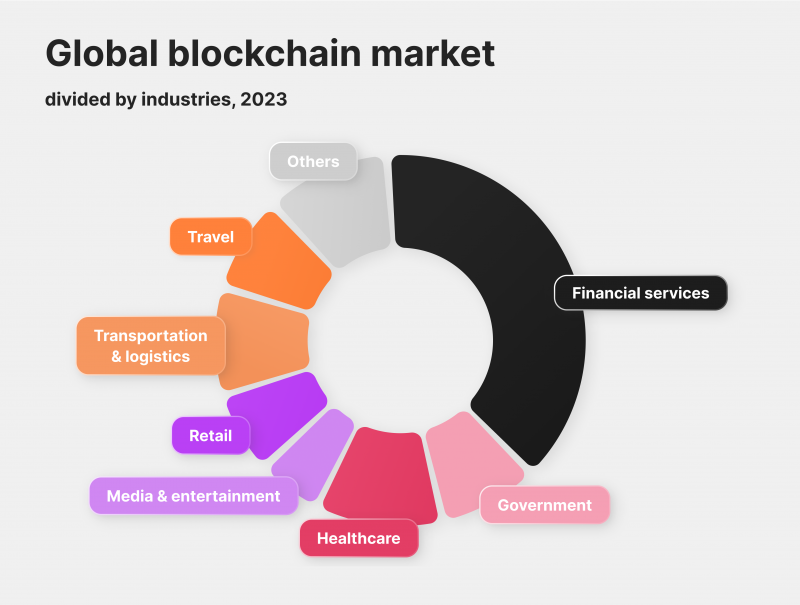

Even traditional financial institutions could greatly benefit from this technology, cutting down costs, resources, and time to achieve the same results. Many financial institutions have already started to implement blockchain practices, and today, the blockchain market is dominated by the financial industry participants.

Practical Value Of Smart Contracts For the Financial Services Industry

While blockchain’s reputation and various market factors may stand in the way of global adoption, there is no denying that this cutting-edge tech has numerous benefits for financial companies.

Any financial institution servicing clients with payment services, savings accounts, investments, and other features needs a fast transactional platform. Almost every large financial entity deals internationally, from central banks to venture capital firms, which is time-consuming and costly for all parties involved.

Using blockchain, these companies can shorten their service periods dramatically, reduce service fees while still making tremendous profits, and offer their clients unprecedented security. But how does blockchain tech manage to do all that? Let’s discuss:

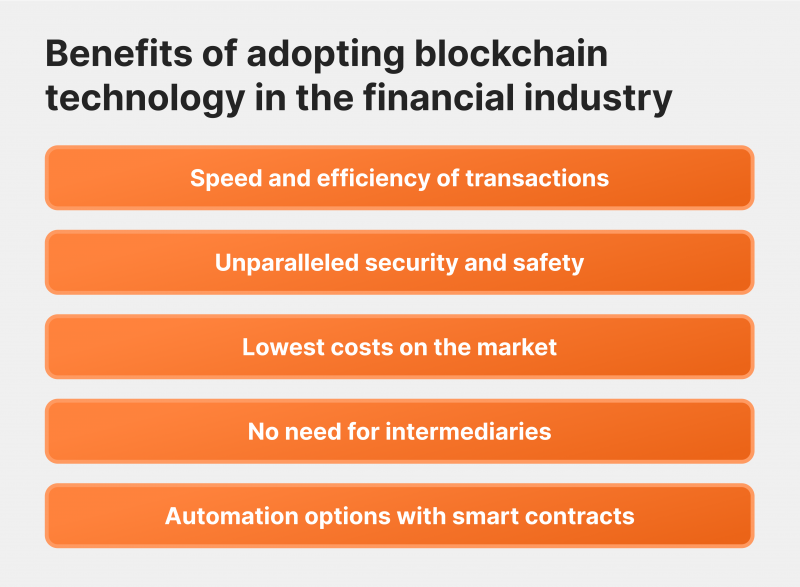

Augmented Financial Transactions

Cryptocurrencies and other blockchain products are digital assets that move through blockchain networks at incredible rates. They do not stop every couple of hours for extensive processing or get interrupted due to third-party involvement. As a result, any crypto transaction is inherently faster and more efficient than the traditional fiat way.

The implications of accelerated transactions go much further than a simple payment example. Numerous companies can benefit greatly from this rapid pace of transaction processing. The speed of blockchain could facilitate unprecedented growth from banks, investment funds, and exchange platforms to entire stock markets.

As of 2023, several stock exchange platforms have become interested in adopting blockchain tech to make their transactional flow faster and more convenient for their users. Even the London Stock Exchange, one of the largest stock markets in the world, has started to dabble in the blockchain landscape with this exact purpose.

Enhanced Security

The other significant aspect of blockchain is security and automation possibilities for financial entities. While speed is the main selling point for improving financial operations, security is necessary to make the blockchain package viable for financial entities.

At this point, blockchain encryption strength has become a widely known and celebrated fact. This digital ecosystem is notoriously impossible to hack for most malicious attackers. The distributed ledger technology also ensures immutability, so your transactions will not get lost or stolen during processing.

So, with such a robust defensive ecosystem, financial companies can receive a double benefit for their blockchain adoption efforts. First, they can ensure that their massive funds will flow without interruption and massive threats of displacement. Second, the financial entities will have a competitive advantage – giving their customers peace of mind regarding their accounts, investments, and other financial dealings.

Automation Opportunities

Aside from fantastic security and unrivalled speed, blockchain also offers automation possibilities with smart contracts. SCs are one of the core features of blockchain, letting developers create immutable and efficient codes that will execute various actions automatically. From automatic payment disbursements and informational exchange to swift operations in trade finance, SCs have practically endless use cases.

However, unlike standard automation, SCs are highly encrypted, immutable, and inevitable. This added layer of security is excellent for insurance companies and other entities that frequently require routine cause-and-effect contracts. Moreover, smart contracts can also prove helpful for online banks to distribute or take interest rates from customers, execute loan restructurings, etc.

Less Need For Financial Intermediaries

In addition to the benefits above, we have the luxury of uninterrupted, direct transactions that don’t require numerous checks along the way. Unlike traditional fiat operations, crypto transactions have all the security, encryption, and inspections required on a single platform.

This means that your payments and other financial operations will not go through numerous central banks and similar authorities. Thus, blockchain transactions have a higher level of privacy and anonymity.

Now, every financial institution will be the only required counterparty for their respective customers in most cases. While this might be a slight upgrade for some individuals, many potential customers value their privacy and anonymity (within legal limits). So, having the opportunity to offer such privacy increases your chances of attracting a bigger target audience.

Lower Costs Across The Board

Last but not least, blockchain is simply a cheaper alternative to fiat. While some perceive a cheaper option as inferior, blockchain has avoided significant transaction costs with simple solutions. As discussed above, fiat transactions go through numerous financial entities internationally and sometimes locally.

These financial entities all require their share of charges. While an individual fee might be mild, accumulating these charges leads to significant transactional costs. In the end, individuals and businesses end up paying three or four times the average amount.

In the past, this needlessly expensive process was the only option on the market. With blockchain technology, that is no longer the case. Since crypto transactions are executed within a single blockchain network, you must only pay the respective gas fees, which are the “fuel” costs of executing a transactional protocol.

While gas fees vary from platform to platform, they are significantly lower than their corresponding fiat alternatives. Lower fees will assist numerous financial sectors tremendously. The trade finance sector, for example, can thrive with lower fees, as individual traders and brokerage firms will have an incentive to trade more actively and with larger volumes.

Potential Risks of Massive Blockchain Adoption

While the benefits are seemingly endless with blockchain adoption, we must also mention some risks and downsides that could negate the overall blockchain package. Remember that this is still a fresh piece of technology, and many uncertainties are ahead.

The Uncertainty Of Regulations

The most significant consideration is the regulatory interference with blockchain. The inherent anonymity of this digital technology means numerous threats of crime and shady practices exist. After all, anonymity cuts both ways – it accommodates regular customers but also gives malicious individuals a chance for manipulations and, sometimes, criminal activities.

So, the introduction of regulations was not a surprise in the crypto landscape. In fact, regulations are welcome and even essential for this industry and technology to function properly and without risks. However, it is almost impossible to tell whether the regulations will become strict beyond reason. Since numerous fraud cases and other harmful practices exist, various governments have heightened their regulatory measures for blockchain.

The short period of 2023 already witnessed several strict regulations related to blockchain, and this trend will most likely continue. While regulations may stay within reason, it is also probable that new laws could severely limit the freedom, speed, and anonymity of blockchain. Even the lower costs could be increased due to new mandatory operations enforced by authorities.

Overall Market Volatility

A financial entity must tie itself to a cryptocurrency to utilise blockchain technology. While generous options are on the market, the entire crypto industry is relatively volatile. There are safer alternatives like stablecoins, but even these cryptos do not offer the stability of fiat currencies.

So, by adopting state-of-the-art blockchain technology, you also need to deal with inherent volatility risks. While this high price variation can be managed with diversification, options contracts, and other instruments, there are no options to eliminate the loss possibilities entirely. So, every financial company has a tricky decision to make when considering blockchain adoption.

Summary

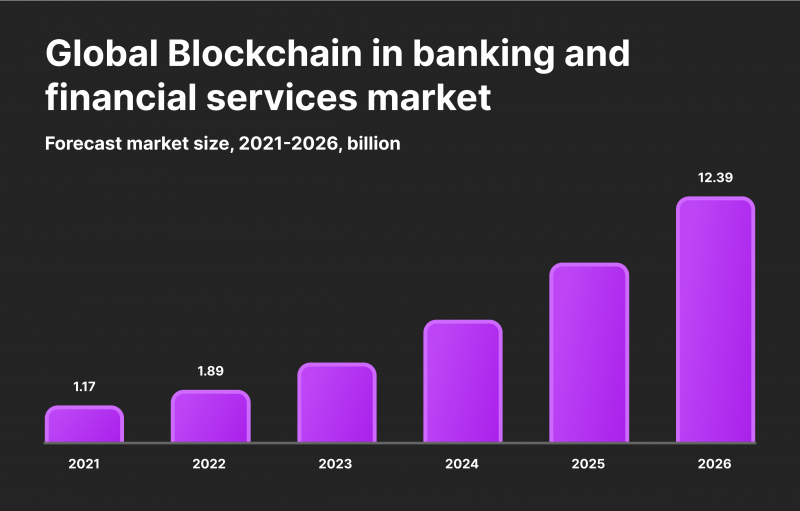

Created to transform the financial landscape, blockchain technology has seen its fair share of struggles and challenges. However, the inherent value remains robust and lucrative for the financial industry. As of 2023, blockchain technology is on an upward trend as the industry is gradually becoming more mature and safe for companies to operate.

With numerous large corporations adopting parts of the blockchain ecosystem, the financial market is slowly but surely warming up to blockchain adoption. But, we are still far from reaching the full potential of blockchain and its influence on the financial landscape.

To achieve this equilibrium, blockchain will have to endure many tests from the free market, regulatory bodies, and other industry participants. It will be interesting to see if blockchain technology comes out victorious and fulfils the initial promise made almost two decades ago.