How to Start an Online Trading Brokerage Business in 2025

There are numerous risks and loss possibilities beyond the first profitable impression. However, with enough preparations and a diligent approach, starting an online trading brokerage business is manageable and highly lucrative. So, let us discuss the basics of starting your business from scratch.

Trading has become one of the most lucrative and seamless ways to jumpstart your online business. With fiat, crypto, and stock markets flourishing and reaching new heights, the stage is set for success. However, the trading scene has witnessed numerous failures as well.

Key Takeaways

- Launching a brokerage requires a blend of market knowledge, a detailed business plan, and a seamless online platform for trading.

- Brokerage firms act as financial middlemen, profiting from commissions and fees. Their success is rooted in experience and market insights.

- Brokers can be categorised as direct, broker-dealers, full-service, or discount, each with distinct responsibilities and revenue models.

- A successful entry into the market demands a bug-free trading platform and robust online marketing to establish a brand presence.

What is a Brokerage Company?

First things first, let us define brokerage as a process:

Brokerage firms are for-profit entities that buy and sell various financial assets on the market. Brokers usually trade on various markets for their clients, acting as intermediaries between aspiring investors and their targeted asset markets.

From fiat and crypto exchange to the stock market, brokerage firms select the most promising options to purchase and sell at a profitable rate. In return, brokers get a commission, trading fees, or the proceeds from their successful dealings.

Brokerage firms come in numerous shapes and forms. Some choose to deal with simple foreign exchange and avoid complex financial mechanisms.

Others tackle more intricate financial assets like an exchange-traded fund or an options contract. Online brokers also vary in scope. Some brokers trade with limited quantities, and some might rival entire exchange platforms with their sheer trading capabilities. However, all brokers are united under the same mission – to provide expert services to their clients and keep them invested as long as possible.

To achieve that hefty goal, broker firms must consistently show winning results from their successful trades. Thus, to open up a brokerage firm, you need lots of experience, in-depth market knowledge, and, sometimes, a bit of luck, as the money markets are often quite unpredictable.

The first online broker was K. Aufhauser & Company, Inc. They introduced their online trading platform, WealthWEB, in August 1994. This was the first instance where individuals could execute stock trades over the Internet, marking a significant shift in the brokerage industry.

Understanding Online Brokers

Online trading brokerage firms are quite similar to classic broker agencies, but with an important distinction – online brokers enable customers to open their brokerage accounts and utilise a streamlined version of brokerage services.

Unlike traditional brokers, there is no need for extensive phone calls, time-consuming meetings, and other activities as online brokers execute every desired transaction digitally. Now, customers can have their own investment account and communicate with a broker through an intuitive online system.

Today, we will focus on how to start an online brokerage firm, from the very first decision to confidently entering the market.

Different Types of Online Trading Brokerages

First of all, you must choose the type of online trading brokerage you envision as the perfect fit for your aspirations. Generally, there are two principal types of online brokers – dealers, brokers, and a mix of both.

Online Broker Agency

As an online broker, your primary responsibilities will be to trade and execute market deals on behalf of your clients. Simply put, you will act as a direct intermediary for your customers on various financial markets and complete their requests. In this case, you do not have official ownership and obligation of the client’s investment portfolios and, therefore, play the role of a middle-man.

However, this does not mean your responsibilities will be limited and carefree. Online brokers must ensure top-notch security, have accessible user interfaces, offer low trading fees, and execute deals without the risk of slippage. So, there is no shortage of challenges for online brokers. However, the possibility of high trading volumes and increasing client demand make this service potentially lucrative.

Online Broker-Dealer Agency

Conversely, online broker-dealer agencies execute trades on their customers’ behalf and on their own. In this case, you can keep all the proceeds to yourself instead of just profiting from the commissions. Mostly, broker-dealer firms start out as simple brokers and enter this stage of their business once they accumulate enough capital to trade on their own terms. Broker-dealers are often massive entities that span numerous countries and possess significant resources.

This highly profitable endeavour gives broker firms more freedom and control over their business. However, it is also a highly risky and capital-intensive activity, not advisable to newcomer broker firms.

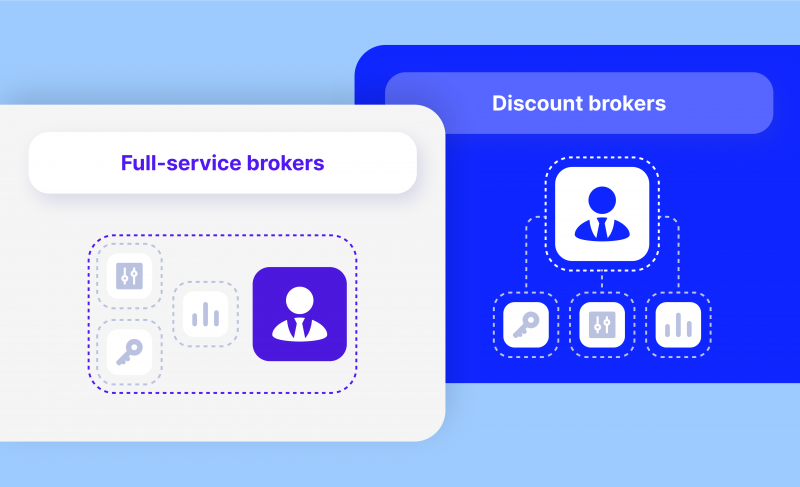

Full-Service vs. Discount Brokers

The next vital choice is the extent of online broker services you are willing to provide. If you choose to become a full-service broker, each client will require extensive one-on-one assistance with a complete package. From advisory services to long-term investment strategies, full-service brokers take comprehensive care of their clients across the board, guiding their every move on the trading market.

Full-service online brokers have fewer clients but charge significantly higher fees due to their comprehensive services. So, while you might invest massive resources in a single client, the returns will often justify the costs.

On the other hand, we have discount brokers, which represent a majority of online brokers. In this case, most brokers simply set up a trading platform for their clients to engage. This trading platform allows customers to request various trade executions at a specific fee. Some discount brokers have additional services like research, analysis, and advanced trading tools to complement their core trade offerings.

Unlike full-service brokers, discount brokers generate profits through high customer volumes and corresponding commissions. While a single commission might be minuscule, most successful discount brokers have a massive trading audience that regularly transacts using their trading platforms.

So, in this case, quantity is the crucial element, and your main goal is to have a cutting-edge trading platform that is intuitive to use and enables online traders to execute their trades seamlessly. Moreover, your platform needs access to the most popular exchange markets to accommodate diverse client interests. You must pave the way toward high-profile exchange markets from Wall Street to the London Stock Exchange.

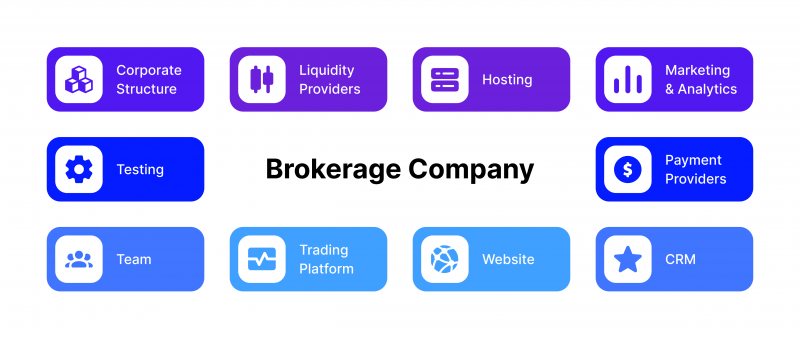

Starting Online Trading Brokerage – Step-By-Step Guide

Now, let’s get straight to the point and overview all the essential steps you need to cover when opening an online brokerage business.

Have a Solid Business Plan

Before going any further with your online broker business aspirations, you need to construct a well-designed and completely thought-out business plan. Your BP should include all relevant details about the online broker business model, startup costs, detailed operations chart, and more.

The topic of creating a perfect business plan is an extensive one and can’t be covered in a single article. It takes weeks and even months of research and preparation to consider every variable and have a rock-solid business plan that leaves no doubt. This includes economic and socio-political conditions, market forecasts, planned marketing campaigns, etc.

Once you are done with broad strokes, many financial details must be considered. For example, online brokers have to pay capital gains tax and a financial services compensation scheme in place. These and other highly technical details must be ironed out before you start any business activities.

However, if you do not possess sufficient knowledge to consider all tax implications, government regulations, and financial projections, it is advisable to hire appropriate experts who will assist in the technical side of things. While constructing a business plan is highly intensive and challenging, it is always better to figure out the entire brokerage plan from the beginning. This way, the chances of encountering unpleasant surprises are much lower.

Choose a Target Market

Choosing a niche market to focus on is crucial when beginning an online brokerage. Cryptocurrency, stocks, FX, and other forms of finance are just some of the many options available. There are nuances, difficulties, and prospects unique to each market.

Cryptocurrency investors enter a world of extreme volatility but tremendous rewards. The stock market is a tried-and-true method, offering security in exchange for in-depth knowledge of many businesses and economies. The foreign exchange market, where currencies are traded, is very large and active around the clock.

Some brokers choose to operate in more than one market at once. This increases potential revenue streams but also calls for specialised knowledge in each field. The goals of your company, the available funds, and the available skill sets should all factor into your decision. Keep in mind that it’s usually preferable to thrive in one market than to be mediocre in numerous.

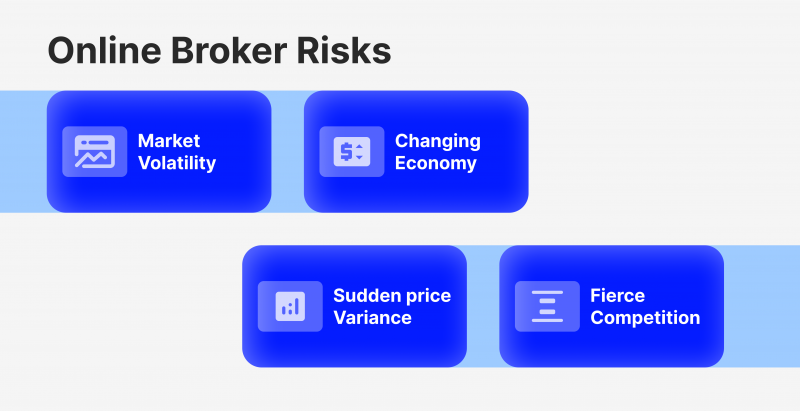

Consider All Relevant Risks

Simultaneously with your planning efforts, you must have a firm grasp of the possible risks and loss scenarios in the online trading market. Regardless of the trading market you choose, there will be significant volatility and uncertainty risks tied to your operations. So, it is essential to have appropriate safeguards in place. Remember, some losses are almost inevitable in the trading environment.

Not every deal will yield the same high-volume profits, and you might even experience a small crisis. However, these are inherent market risks that can be managed with diligent research, appropriate capital, and risk hedging. While potential trading risks might seem intimidating at first, numerous online brokers find reliable ways to mitigate them. So, you shouldn’t be discouraged by these risks but also consider them carefully in your master business plan.

Find a Liquidity Provider and Acquire Sufficient Capital

Once competent experts finish and approve your business plan, it is time to search for startup capital. Online brokers require startup cash for three main reasons – having an initial cash capital to conduct trades, having funds to develop a trading platform and general business costs like marketing and salaries.

In most cases, startups with well-designed and thought-out business plans are more likely to acquire ample financing. However, you need to have a proof of concept. Most investors need to know your business model already works before injecting substantial capital.

For that, most online brokers present similar examples of already successful firms and, in some cases, have demos of their business models. They construct a simplified version of a trading platform with minimal features and a simple trading account. Once investors get their hands on a tangible example, they will be more eager to provide initial financing and give you a chance to hit the ground running.

Construct an Online Trading Platform

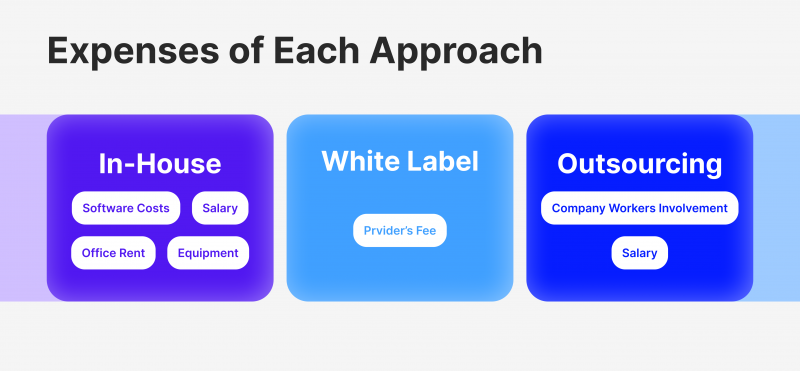

Now comes the most technically complex part of your startup. Designing, implementing, and developing an online trading platform is a complex process requiring several expert developers’ involvement. There are three general options here – you can construct your trading platform in-house, outsource it to a third-party company, or find a white label provider.

There are pros and cons to all approaches. With an in-house team, you are sure to acquire a highly customised and personalised digital platform, but the costs might be too much to handle at the starting stages of your business.

Conversely, outsourcing your platform development will cost you significantly less, but there’s a risk of misalignment with the company’s vision or potential communication barriers. Additionally, while you might save on infrastructure costs, you’ll still incur high fees paying salaries to each outsourced developer.

Lastly, white labelling allows you to adopt a pre-built solution and brand it as your own. It’s the quickest route to market and often cost-efficient, but it may lack the uniqueness or specific features that a company might desire in a custom-built platform.

Set Up a Broker Trading Account System

While trading accounts are technically part of the platform development, they deserve your undivided attention. After all, the most essential part of your business is accommodating your customers perfectly and letting them start trading without inconvenience. Ensure integration of trusted payment gateways so everything flows smoothly once your clients open an account within your system. No delays, slippage, or excessive fees should intrude in the trading process.

Moreover, your customers should find all the right tools, features, and services readily available on their trading dashboards. Your customers should also have a variety of options when it comes to trading – from trading stocks, fiat, and crypto to more advanced instruments like exchange-traded funds; your clients should have all relevant trading options readily available.

Remember, even the slightest inconvenience or delay can encourage your potential customers to convert to your competitors. So, the quality of your digital product and services should be impeccable since we are dealing with highly sensitive consumers.

Prepare for a Strong Launch

Finally, with all the planning, financing, and development, you are ready to enter the online broker market. Now, all that’s left is to ensure that everything is flawless. Your digital platform should be bug-free and perform optimally. It would be best if you also raised awareness of your new business through strong online marketing. First impressions are vital, and it’s essential to establish a sturdy brand presence from the get-go.

Summary

Opening up your unique online trading brokerage business is a challenge that requires composure, long-term planning, and quite a bit of experience. Traders and investors worldwide have many alternatives and will switch to other trading platforms very quickly if you fail to provide high-quality services. So, while online brokerage businesses have an ambitious upside and lucrative potential, they must be sufficiently prepared for the tough competition and consider all relevant risks.

From your local competition and market trends to socio-political developments, you must understand all things trading. Remember, your experience and diligence can be the deciding factor between a resounding success and a disappointing failure. So, weigh your options carefully and build realistic plans to survive this demanding environment.

FAQ

How do online trading brokerage companies make money?

Through commissions, trading fees, and sometimes the spread between buying and selling prices.

What do you need to open a brokerage account?

Personal identification, proof of address, and initial deposit or investment.

What are the risks of online brokerage?

Market volatility, cybersecurity threats, and potential platform downtimes.

What happens if a brokerage fails?

Regulatory bodies often protect assets up to a limit, but cash may be at risk. Always check with your specific broker’s insurance and protection policies.

How to start your own brokerage business successfully?

To start your own brokerage, you need a solid business plan, proper licensing, sufficient capital, and a reliable trading platform. Partnering with liquidity providers and ensuring strong security features is essential for success.

Recommended articles

By clicking “Subscribe”, you agree to the Privacy Policy. The information you provide will not be disclosed or shared with others.