How to Get a Vanuatu Forex License and Start Your Brokerage Business?

Articles

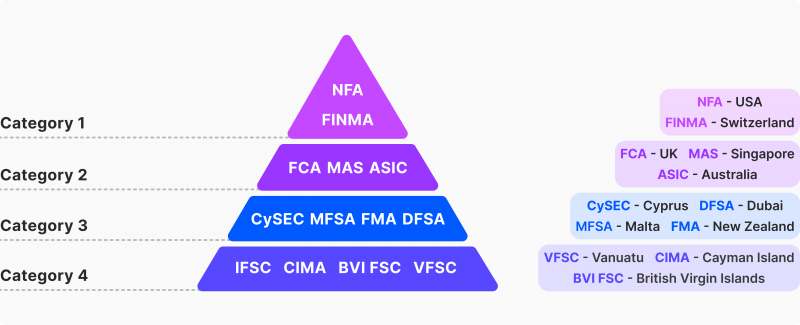

The Forex industry is developing rapidly, creating conditions for new companies to flourish. This market’s peculiarities, high competition, and security nuances have created a system of regulation for companies seeking to provide financial services related to trading.

The subject of regulation in the field of Forex is the activity with operations with funds, which requires a license, the variety of which today allows making a choice depending on preferences and individual characteristics. However, one of the most popular options among FX companies in modern realities is the Forex license in Vanuatu.

This article will explain what a Vanuatu FX license is, what types of licenses are available, and its advantages. You will also learn what is required to obtain this license and set up a brokerage business.

Key Takeaways

- The Vanuatu Forex license is a tool that allows FX brokerage houses to operate legally and safely in the benefit of the jurisdiction.

- The Vanuatu license offers benefits such as relaxed tax and exchange controls, a proven track record and flexibility.

- Vanuatu is considered the best option for obtaining an offshore license among brokerage firms involved in the Forex niche.

What is the Vanuatu Forex License?

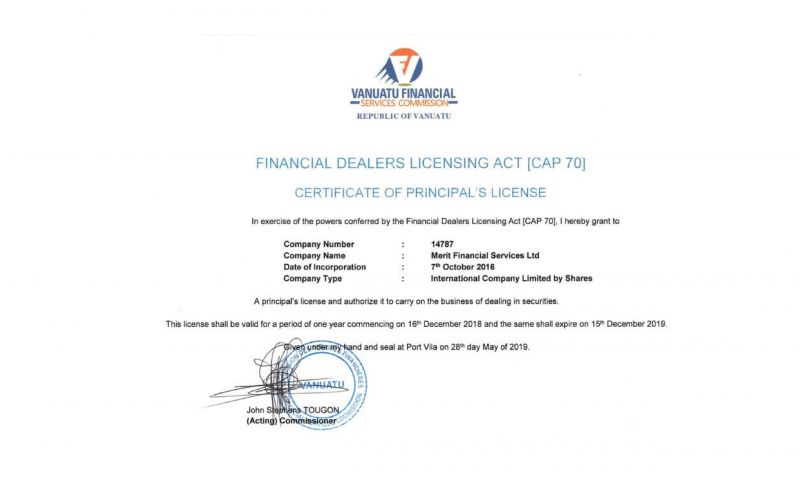

The Vanuatu Forex license is a regulatory authorisation granted by the Vanuatu Financial Services Commission (VFSC) to individuals or companies that wish to engage in forex trading activities within the jurisdiction of Vanuatu. This license allows the holder to legally operate as a forex broker or dealer legally, providing services such as currency trading, investment advice, and portfolio management to clients.

The Vanuatu Forex license serves as a stamp of approval from the VFSC, ensuring that the licensee meets the necessary requirements and standards set by the regulatory body. It signifies that the licensee has undergone a thorough vetting process, including background checks, financial assessments, and compliance with anti-money laundering and counter-terrorism financing regulations.

Obtaining a Vanuatu Forex license can provide numerous benefits to Forex brokers and dealers. It allows them to establish a reputable presence in the global forex market, attract clients from around the world, and expand their business operations. Additionally, Vanuatu offers a favourable tax regime and a flexible regulatory framework, making it an attractive destination for forex trading companies seeking a cost-effective and efficient licensing solution.

Among the worthy offshore alternatives to the Vanuatu FX license are the ones of Seychelles and Saint Vincent and the Grenadines.

Main Types Of Vanuatu Forex Licenses

VFSC plays a pivotal role in the Forex industry by offering two distinct licenses for individuals seeking to obtain a Forex license in Vanuatu. These licenses serve as a means to regulate the industry effectively and ensure that businesses operate in a fair and transparent manner. By obtaining one of these licenses, businesses can demonstrate their commitment to upholding the highest standards of integrity and compliance, contributing to a thriving Forex market in Vanuatu.

Dealer in Securities License

This license enables companies to operate as Forex brokers and provide financial intermediary services to their clients. Such a license empowers companies to offer a diverse range of services, including the receipt and transmission of client orders, trade execution, and providing access to the Forex market. This license is the most commonly sought-after type of license by Forex brokers in Vanuatu.

Financial Dealers License

This license allows companies to expand their operations and offer a broader range of financial services. In addition to Forex trading, companies holding a Financial Dealers License can engage in securities trading, derivatives trading, and other financial instruments. This license mainly benefits companies that want to provide a more comprehensive range of financial services beyond Forex trading.

Furthermore, having a Financial Dealers License enhances a company’s credibility and reputation in the financial industry. It demonstrates that the company has met the necessary regulatory requirements and can provide a wide range of financial services in a compliant and professional manner. This can attract more clients, including institutional investors and high-net-worth individuals, who may prefer to work with licensed and regulated entities.

Selling Points of Vanuatu Forex License

With the increasing stringency of regulations worldwide, non-licensed brokers face numerous challenges. Consequently, alternative license options have emerged, and Vanuatu is among the prominent choices that Forex brokers have recognised as a favourable jurisdiction for incorporating their businesses and obtaining licenses. There are five compelling reasons to contemplate acquiring an offshore Forex license in Vanuatu.

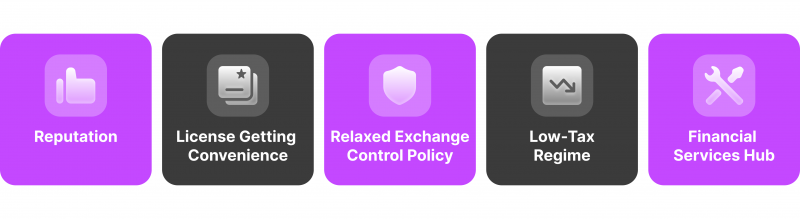

1. Reputation

Vanuatu is recognised as a centre for offshore financial services, encompassing banking, Forex trading, and company registration. This has enhanced its appeal to global enterprises seeking advantageous offshore forex license locations.

Despite its remote nature, Vanuatu’s strategic position in the Pacific Ocean provides access to markets in Asia, Australia, and New Zealand, making it a valuable option for businesses aiming to build relationships in these regions. With English being one of the official languages in Vanuatu, communication with international companies and investors is effectively facilitated.

2. Flexibility and License Getting Convenience

The authorities have taken steps to allure international investments, such as cutting down on administrative red tape. Acquiring a Vanuatu offshore Forex broker license usually entails a relatively straightforward and effective request process, alongside lower expenses associated with obtaining and keeping the permit. This enables Forex firms to initiate their activities more promptly compared to specific regions with more intricate procedures and enhance their operational costs.

3. Relaxed Exchange Control Policy

Vanuatu’s relaxed exchange control regulations make it an attractive jurisdiction for Forex companies. This is because it provides an environment that facilitates international financial transactions more flexibly. Businesses operating within Vanuatu can transact with global partners, clients, and investors without facing significant bureaucratic hurdles or restrictive regulations.

Vanuatu’s exchange control regulations don’t impose any limitations on the types of currencies that businesses can transact in. As a result, forex businesses can operate with a wide range of currencies, which helps them satisfy the diverse needs of their clients and investors.

4. Low-Tax Regime

Vanuatu provides a tax environment that is considered highly advantageous for forex-related activities, with no corporate income tax, personal income tax, capital gains tax, VAT, and withholding tax. This appealing tax structure makes it a desirable choice for forex companies and individuals seeking to minimise their tax obligations and keep a greater share of their profits, ultimately benefiting both the business’s and its employees’ financial well-being.

5. Financial Services Hub

Vanuatu’s banking and financial services industry is a pivotal contributor to the jurisdiction’s economy and its appeal as an offshore financial hub. With a range of international banks providing services like multi-currency accounts, electronic banking, and global money transfers, Vanuatu ensures transparency and adherence to international regulations while prioritising client privacy and confidentiality, making it an attractive choice for businesses and individuals needing discreet financial solutions.

Requirements For Vanuatu Forex License Applicants

To function as a Forex broker in Vanuatu, companies must meet the precise licensing criteria established by the VFSC. These criteria are implemented to safeguard investors and uphold the credibility of the forex market. If you are contemplating becoming a forex broker in Vanuatu, it is imperative to comprehend and adhere to these licensing prerequisites, among which are the following:

1. Capital Requirements

To obtain a Vanuatu Forex license, the VFSC mandates a minimum capital requirement of USD 50,000. Interestingly, this amount is relatively lower when compared to other jurisdictions’ capital requirements. Meeting this requirement is a crucial step for any business or individual looking to operate a forex brokerage firm in Vanuatu. It ensures that the firm has the necessary capital to start operating and meet its financial obligations.

2. Fit and Proper Test

The VFSC proactively guarantees that forex brokers operating in Vanuatu are reputable and competent. To achieve this, they administer a fit and proper test which assesses the applicant’s suitability. This evaluation involves meticulously examining the applicant’s integrity, competence, and financial standing.

It also involves thoroughly reviewing their background, qualifications, and experience in the forex industry. Additionally, the applicant’s ability to effectively manage and safeguard client funds is scrutinised. By implementing this test, the VFSC aims to protect the interests of investors and maintain the overall integrity of the forex market in Vanuatu.

3. Compliance Obligations

In order to maintain their license, Forex brokers in Vanuatu must meet several regulatory requirements. These obligations primarily involve the implementation of robust anti-money laundering (AML) and know-your-customer (KYC) procedures. Furthermore, brokers are obligated to maintain precise and up-to-date records of their transactions and client information.

Complying with these obligations is essential, as it serves as a crucial deterrent against financial crimes, such as money laundering and terrorist financing. By adhering to these regulatory measures, brokers contribute to the overall integrity and security of the financial system.

4. Company Formation

To obtain a Vanuatu Forex license, individuals must first establish a company within the country’s geographical confines. The company can either be an international organisation or a local entity. Once this initial requirement is fulfilled, the applicant may proceed with the application process and fulfil all the necessary criteria to secure the desired license. With this license, the individual will be authorised to conduct Forex operations within the Vanuatu jurisdiction.

5. Operational Requirements

To ensure compliance with all the regulatory requirements, it is important for applicants to have strong operational policies and procedures in place. This includes implementing internal control mechanisms, risk management processes, and client protection measures. By having these structures in place, applicants can demonstrate a commitment to maintaining a safe and secure environment for their clients and stakeholders and also ensure that their operations are in line with regulatory standards.

How to Establish A Forex Company In Vanuatu?

When contemplating establishing an FX company in Vanuatu, it is imperative to consider the various legal business structures available that align with your business goals and scope. One such structure popular among international businesspeople is an International Business Company (IBC). The incorporation process for an IBC is relatively straightforward, with minimal bureaucratic hurdles. However, it is essential to note that such a company is not authorised to do business in Vanuatu.

This business structure offers a range of advantages, including eligibility for Vanuatu’s favourable tax regime, reduced reporting obligations, and exemption from filing audited financial statements or annual returns with the VFSC.

Additionally, the names of shareholders, directors, and beneficial owners remain confidential, ensuring high privacy. An IBC can be registered within a day, provided all necessary documentation is prepared correctly and submitted following legal requirements. To ensure a seamless incorporation process, we recommend consulting with our team of experts.

Vanuatu’s Jurisdictional Distinctions

Vanuatu’s approach to FX activities differs from many other jurisdictions favouring Forex trading. Unlike these different jurisdictions, Vanuatu does not impose a strict requirement for an International Business Company (IBC) to have a local bank account to carry out Forex activities.

The offshore financial environment in Vanuatu allows IBCs to maintain bank accounts within and in international financial institutions. When deciding whether to open a local bank account, there are several factors to consider, such as the type of Forex activities being conducted, operational requirements, and regulatory considerations.

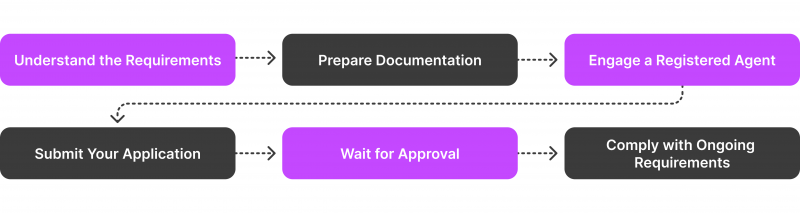

Steps to Apply for a Vanuatu Forex License

The timeframe for completing the Vanuatu FX license application process typically spans approximately three months; however, this duration may differ depending on various factors. These factors include the application package’s intricacy, the specific Forex license offshore type being sought, the quality of the documentation submitted, and the workload of the VFSC.

1. Understand the Requirements

Before applying for a Vanuatu Forex license, it is crucial to understand the requirements set forth by the Vanuatu Financial Services Commission (VFSC). These requirements may include capital adequacy, fit and proper requirements for directors and shareholders, and compliance with anti-money laundering regulations.

2. Prepare Documentation

Gather all necessary documentation, including a business plan, financial projections, KYC documents for all directors and shareholders, and proof of capital adequacy. It is essential to ensure that all documentation is complete and accurate to avoid delays in the application process.

3. Engage a Registered Agent

To apply for a Vanuatu Forex license, you will need to engage the services of a registered agent. The registered agent will assist you in preparing and submitting your application to the VFSC, as well as liaising with the Commission on your behalf.

4. Submit Your Application

Once you have prepared all the necessary documentation and engaged a registered agent, you can proceed to submit your application to the VFSC. The application will undergo a thorough review process, during which the Commission will assess your compliance with all regulatory requirements.

5. Wait for Approval

After submitting your application, the VFSC will review all documentation and conduct any necessary due diligence checks. The approval process can take several weeks to months, depending on the complexity of your application and the workload of the Commission.

6. Comply with Ongoing Requirements

Once you have obtained your Vanuatu Forex license, it is essential to comply with all ongoing regulatory requirements, including regular reporting to the VFSC, maintaining adequate capital levels, and adhering to anti-money laundering regulations.

Obtaining a Vanuatu Forex broker license can be a complex process, but you can navigate the requirements successfully with proper preparation and guidance. By following these steps and working closely with a registered agent, you can set up your Forex brokerage in Vanuatu and take advantage of the global Forex market opportunities.

Conclusion

Getting a Vanuatu Forex license and establishing a company requires careful planning and execution. By following the steps outlined in this article, you can establish a successful forex company that complies with Vanuatu’s regulatory requirements.

From obtaining the necessary licenses to hiring staff and marketing your services, there are many factors to consider when establishing a Forex company in Vanuatu. With the right approach and guidance, you can navigate the process successfully and build a thriving business in this dynamic market.

FAQ

How to obtain an offshore Forex brokerage license in Vanuatu?

The process of acquiring a Forex license Vanuatu involves several steps. First, you must register a company and secure an office space. Additionally, you must prepare various documents such as policies, technical documentation, and other necessary paperwork. Once these initial requirements are fulfilled, you can open an account and deposit the authorised capital. Finally, the last step involves submitting an application to the regulator for approval.

How much does it cost to get a FX license in Vanuatu?

The overall expenses associated with the procedure will be contingent upon various factors, encompassing the specific category of Forex broker you plan to oversee, the number of directors and beneficial owners involved, the nature of the company you aim to establish, and additional considerations like banking and payment systems.

What is the duration of a Forex license in Vanuatu?

Vanuatu licenses Forex are commonly granted for one year. Subsequently, these licenses can be extended annually by fulfilling the necessary regulatory and financial obligations, along with the payment of the renewal fee.