How to Become a Forex Broker?

Articles

The Forex market received a boost in development with the arrival of new methods of electronic trading, which greatly expanded the idea of making fast money on the movements of quotations of various Forex instruments. The great popularity of trading in this market was a new milestone in the modernization of the entire trading system. On the other hand, many investors have seen here another opportunity for their capital by creating and developing Forex brokerage businesses, which are now gaining incredible popularity.

This article will shed light on a Forex business and its particularities. We will then give a step-by-step guide for those who want to become a Forex broker. You will also learn the basic models of Forex brokerage companies and the basic elements of the technical infrastructure of each Forex broker.

Key Takeaways

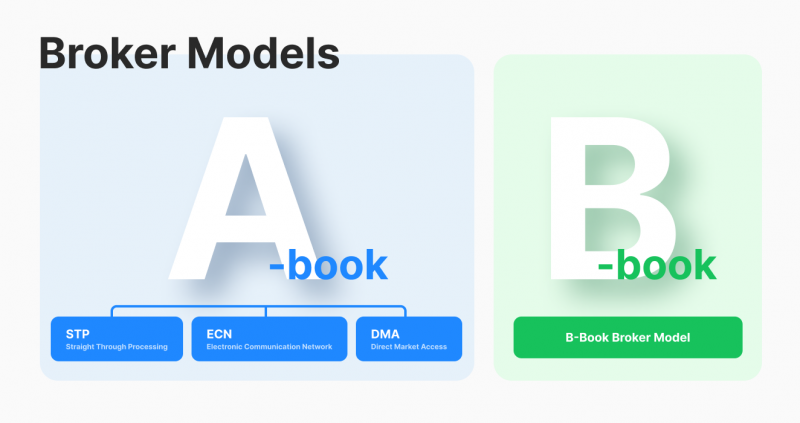

- There are two basic business models of Forex brokerage companies: A-Book and B-Book. However, recently a hybrid model has been developed that combines the advantages of the first two.

- A Forex broker is a kind of bridge between traders and the Forex market, giving access to a number of tools for trading.

- The Forex market is the most liquid market in the world, offering a huge number of financial instruments for trading with great leverage.

What is Forex Brokerage Business and What are Its Features?

Forex brokers are specialized companies that focus on the provision of intermediary services in the international currency market. In particular, they are intermediaries between retail clients and financial institutions. Brokers are the ones who enable individual traders to have access to trading on the exchange market.

Established exchange markets with reliable and secure trading conditions are a significant advantage for any business venture. Although starting up in nascent markets is not necessarily bad, Forex brokers who want to make the most out of it will have to be extra careful and put in more effort into all their operations.

All relations between a Forex dealer and his client are limited to the liability relations between the institutional entity and an individual (investor) who is not an economic entity (individual entrepreneur) regarding the conclusion of contracts that are derivative financial instruments and are not traded on the organized market, and the parties’ liability, which depends on the changes in currency pair rates, and whose conclusion is conditioned on the dealer’s providing the client with an opportunity to make a derivative financial instrument.

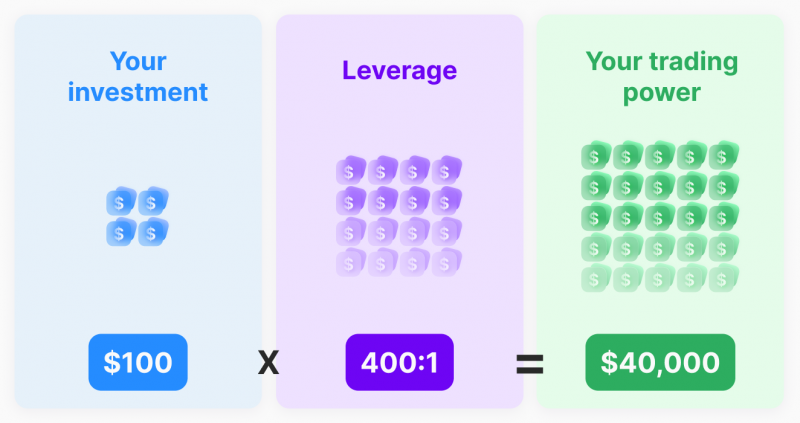

In simple words, the whole point of Forex trading between a dealer and a client is limited to the fact that the dealer sells to the client a non-deliverable off-exchange forward contract, under which the underlying asset is a currency pair (price ratio between two currencies traded on Forex) and provides the client with a leverage for entering into this transaction, which is not more than 50 times the investor’s own funds transferred to the dealer. Depending on changes in the market value of the underlying asset, the “winning” and “losing” counterparties are determined.

Becoming a Forex Brokerage – Detailed Step-by-Step Guide

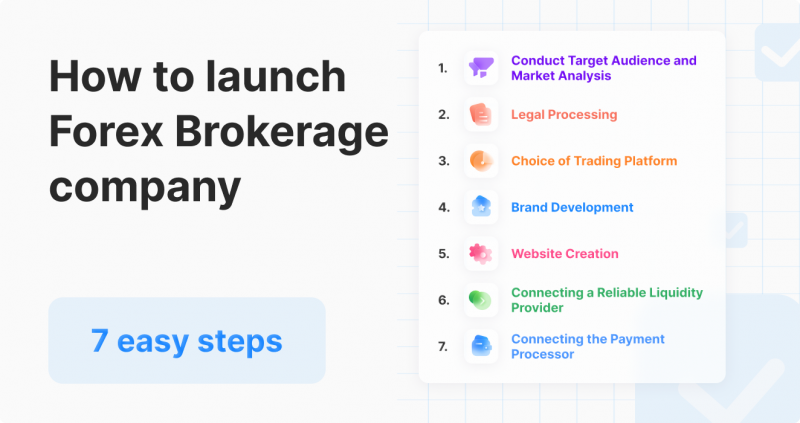

FX brokerage is one of the most popular businesses for interested investors wishing to try their hand in the Forex niche. A Forex brokerage firm is a promising idea that can bring multimillion profits if properly implemented in practice. To become a Forex broker, it is necessary to thoroughly analyze several elements that make up a step-by-step algorithm of required actions to run a successful Forex company. Below is a comprehensive list of steps to achieve your goal.

Identify Target Audience and Conduct Market Analysis

It is essential to thoroughly analyze your competitors and identify your target audience when launching an FX broker and developing such a business. Several parameters need to be considered, such as age, hobby, income level, country of residence, etc. Consequently, your firm’s address will affect several other aspects of your business, including how you approach platform promotion, the number of languages your trading platform supports, etc.

Legal Processing

Setting up a Forex company requires registering and obtaining the appropriate licenses. There are a number of factors traders consider when selecting a Forex broker, but one that stands out is a Forex brokerage license. The licenses issued by different government regulators in different countries are subject to different conditions. The broker’s license indicates which regulatory authority is in charge of the broker’s activities, which determines the reputation of that particular company as well, and of course, the broker’s activity itself.

Choice of Trading Platform

Choosing a good trading platform is one of the most critical tasks when starting out as an FX broker. A trading platform is a key element of the trading process, which lets users comprehensively analyze the market situation using different trading instruments for each trading asset and perform trades. It is a whole ecosystem designed to ensure smooth, safe, and uninterrupted buying and selling of assets within the chosen trading tactics of traders. Nowadays, some of the most popular trading platforms that have gained the trust of millions of traders worldwide are MetaTrader 4 and 5, cTrader, and Match Trader. In order to choose a trading platform provider, you need to prioritize and understand your requirements for the platform.

Brand Development

Brand development for the FX brokerage business is a complex process, which includes a series of steps to create a brand logo that will have a unique design and stand out among competitors in the market. It also includes a unique design for all elements of the software infrastructure, including the website, mobile application, trading terminal software, trader’s room, etc. Since brand recognition directly affects the number of clients interested in cooperation with a broker, paying special attention to each aspect of creating a unique brand will be on everyone’s ears. This will require a good team of designers, programmers, and marketers.

Recently, a very popular option for creating a Forex brokerage business is a Forex broker turnkey, when a specialized company creates a solution with its own efforts, demanding a certain payment for it.

Website Creation

Creating a Forex brokerage website is the next step to starting your own Forex brokerage. A website is the face of any company and a business card that displays all the relevant information related to the firm, its products, and services. The site should be attractive, easy to use, clear, and, most importantly, informative. Users will visit the company’s website to research the company, and the first impression is significant. Enlist the help of experienced programmers and designers who will create a site that will convey the company’s message and detail all the benefits of working with the business.

Connecting a Reliable Liquidity Provider

Most Forex brokers, especially those with straight-through processing (STP), work with several major liquidity providers to maintain a satisfactory level of pricing and liquidity. A liquidity provider is usually a large financial institution or a bank with considerable experience trading currencies and a great deal of liquidity. Brokers can sometimes sell the currency without transferring the deal to any liquidity providers. As a result, when a user initiates a purchase, they are not purchasing from the liquidity provider that the broker sent the transaction to, but directly from the broker. In other words, they represent counterparties in the marketplace and are known as “market makers”.

Currently, quite a few vendors are offering their products and services through various types of technology. There is, however, a need to conduct a comparative analysis to select the most suitable partnering option.

Connecting the Payment Processor

The payment processor acts as a bridge between traders and the broker. Today, there are several types of payment solutions on the market which can be used for transactions. Brokers often offer users to make deposits using bank cards, such as Visa, MasterCard, or American Express. However, on the other hand, there is an opportunity to deposit via electronic wallets and even cryptocurrencies, which is especially popular in recent years due to the growing popularity of blockchain technology.

The history of the Forex market began in 1971 when it was decided to abolish the gold standard (within the Bretton Woods monetary system) and switch to a new system of currency regulation called the Jamaican one.

Basic Models of Operation of Forex Brokerage Companies

In order to start a Forex brokerage, it is crucial to determine which FX brokerage venture model will best suit the level of earnings and the firm’s general scheme of business operations. Currently, all Forex brokers operate according to one of three models. It is worth noting that each of them has its advantages and disadvantages, but their basic principles are the same. Let’s take a closer look at them.

A-Book Broker Model

Generally, A-Book brokers are counterparties who do not trade directly with a company’s clients and do not earn their income from the losses or profits of the clients. Commissions and margins are their primary sources of revenue. In addition, the brokers that provide such services are broken down into three categories: STP (Straight Through Processing), ECN (Electronic Communication Network), and DMA (Direct Market Access).

Direct connections between the client and the liquidity provider are the main benefit of STP brokerage. Liquidity is typically aggregated from many sources, which leads to better rates and increased liquidity. The spreads offered by an STP broker can be either floating or fixed. Rather than relying solely on large banks for liquidity, which provides a fixed spread, an aggregator can choose the best price from all the available sell-and-buy offers. In some cases, this can result in a zero or even negative spread.

The primary benefit of DMA technology is direct market access; all orders are delivered without a broker’s involvement directly to the liquidity providers. Each order “creates a market” by entering the liquidity provider’s order book. DMA orders often execute fairly quickly. According to the Best Bid – Best Ask principle, traders using this approach get the most transparent execution at the best market price.

B-Book Broker Model

As market makers, brokers who work on the B-Book model usually handle transactions directly. It is their primary responsibility to maintain bilateral buy and sell orders, corresponding to the bank’s requirements regarding the spread (the price difference between the buy and sell orders).

A broker buys and sells from traders in this model. In this instance, fixed spreads and client trading activities provide the primary sources of income. Because the broker is the counterparty in this situation and closely oversees and supervises all of his clients’ trading operations, the clients’ requests to such brokers are kept from the external counterparties. As a result, market makers’ operations involve using various profit-limitation strategies, such as postponing trade orders and canceling deals.

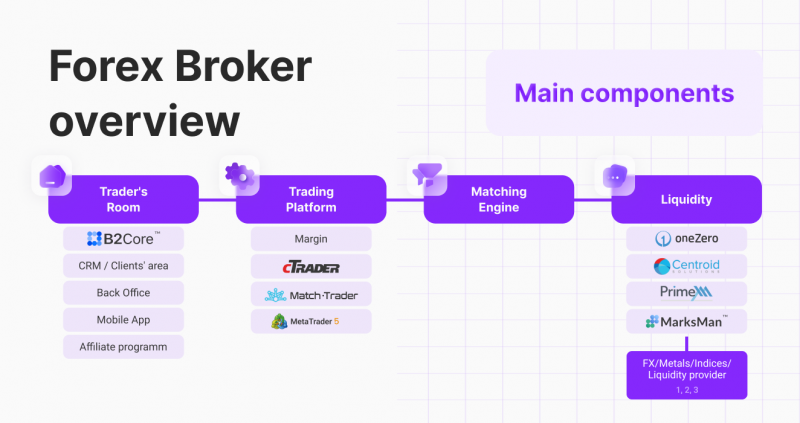

Elements of the Technical Infrastructure of a Forex Broker

Before starting a Forex brokerage, it is essential to remember that the exchange where buyers and sellers come together is a complicated network of connected elements that operate offline and give access to all the tools required for a convenient and, most importantly, uninterrupted trading process. The list of crucial components that comprise the Forex firm’s structure and are necessary to function is provided below.

Trading Platform

A trading platform is an essential ecosystem with many elements supporting the trading process. It includes asset price charts with all the necessary data for fundamental and technical analysis and a wide range of tools to ensure the implementation of the trading strategy in practice. Any trading platform displays a market depth chart and order book, a complete trading interface, and more. Depending on the platform type, it can also contain additional elements such as news, chats and groups, a graph with the investment ideas of other traders, etc. The choice of platform determines the entire trading process and affects all aspects of interaction with it.

Trader’s Room

The trader’s room is a multifunctional space that is an indispensable assistant to any market participant in working with digital assets, their purchase, sale, transfer, and exchange. The trader’s room also gives access to such useful elements and functions as wallets and accounts, transaction history, exchanger, statistics, and analytics of each financial instrument, an advanced reporting system for each transaction, and much more. This element is a vital component of any business related to the trading of financial assets, including also crypto, CFD, etc.

Liquidity

Regardless of the business model according to which a Forex brokerage firm works, liquidity plays an important role providing price stability in the market in case of serious volumes for purchase or sale of any financial asset, which ultimately helps to avoid significant price fluctuations and prevent serious losses of money of those investors whose strategy was not entirely successful. Therefore, if you are wondering how to become a Forex broker, you have to take care of finding a good liquidity provider.

Matching Engine

The order-matching engine is the heart of any exchange and is vital to match buy and sell counter orders. The orders that appear in the order book are pending limit orders that are waiting to be filled. As soon as this moment arrives, the matching engine looks for an opposite order to match and fill the two orders. This process may seem technical, but implementing an order-matching engine with the right software and skilled professionals becomes no more complicated than developing a mobile application. The convergence speed will directly affect the user experience of traders interacting with the trading platform.

Conclusion

There is no doubt that building a successful Forex brokerage company will take a lot of effort, patience, time, and money, but the result will be worth it. It will allow you to take a special place in the young and promising Forex market. With a clear business plan and a little practice, success in the brokerage business Forex is there to be had.