How To Leverage A Triangular Arbitrage Opportunity

Triangular arbitrage is complex, and many traders cannot identify the optimal opportunity to capitalise on market differences. This means it has to be carried out with extreme care. However, it can be profitable for traders with vast experience and considerable capital. Here is everything you need to know to start triangular arbitrage trading yourself.

Over the decades, traders discovered several strategies for dynamic financial markets. Arbitrage is one of those strategies entailing benefiting from market inefficiencies and turning them into profitable trading opportunities.

Key Takeaways

- Triangular arbitrage trading takes advantage of market imbalances, similar to arbitrage, where traders buy from one market and sell in another using three different assets.

- Arbitragers aim to find opportunities, whereas exchanging asset A into asset B and then to asset C is more profitable than directly trading asset A into C.

- A successful triangular arbitrage trade requires careful calculations to find an opportunity and find out the expected outcomes.

What Is Arbitrage Trading?

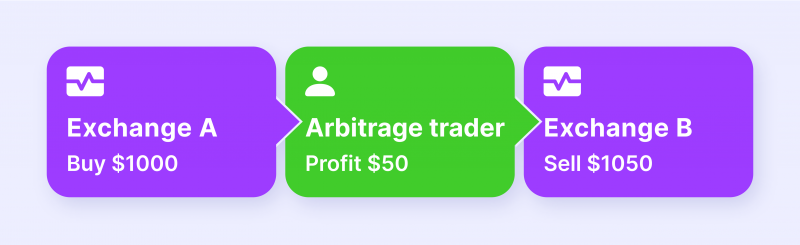

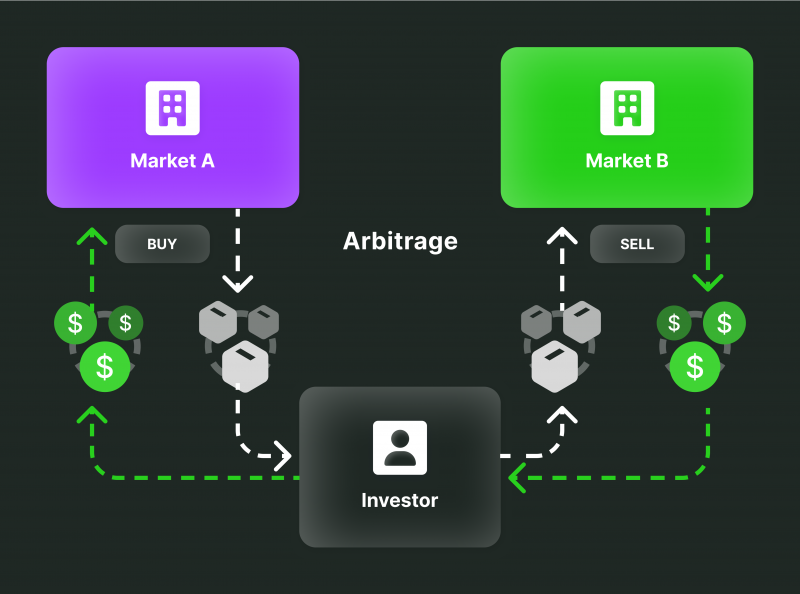

Arbitrage means utilising the differences between different markets to make profits, such as buying one asset in a market, selling it in another for a higher price, and making a marginal profit.

Arbitrage is mainly done when one asset can be bought and sold in different geographically located marketplaces.

For example, a trader may buy company ABC stocks in the New York Stock Exchange market for $100 and sell in another market where ABC company is listed. In this example, a trader can sell these stocks on the London Stock Exchange for $102 per share, utilising the market differences and currency exchange rates to make a $2 profit per share.

This might seem like a fractional profit, but if it is repeated several times and with a large number of shares, then the trade would see considerable gains.

This strategy may not work when an asset is traded on one market. For example, indices like the S&P 500 or the FTSE 100 are unavailable in geographically dispersed marketplaces.

Most triangular arbitrage trades happen in the FX market, taking advantage of its extreme liquidity with a $5 trillion daily trading volume.

Understanding Triangular Arbitrage

To take advantage of price differences and make a profit, triangular arbitrage involves trading in at least three different assets on the same or other marketplaces. Triangular arbitrage trading must be executed with care, as spotting triangular arbitrage opportunities requires extensive market knowledge and analysis.

Traders engaging in triangular arbitrage mostly use cryptocurrencies and foreign exchange markets because they are more dynamic and have better opportunities than the stock market or bonds.

Additionally, currencies are traded in pairs, and their prices depend on each other and move in pairs, making a good chance for arbitrage. The same applies to the crypto market, where several coins and digital currencies are available, and traders can directly exchange BTC for ETH, for example.

However, the volatility of the crypto market can be dangerous for arbitrage traders because prices move quickly and in different ways, and traders may lose the arbitrage opportunity by the time they finish the cycle.

How Does Triangular Arbitrage Trading Work?

Triangular arbitrage is done by buying asset 1, exchanging it for asset 2, exchanging it for asset 3, and finally trading it back with asset 1. This process, with market price differences, creates a gaining opportunity for the trader.

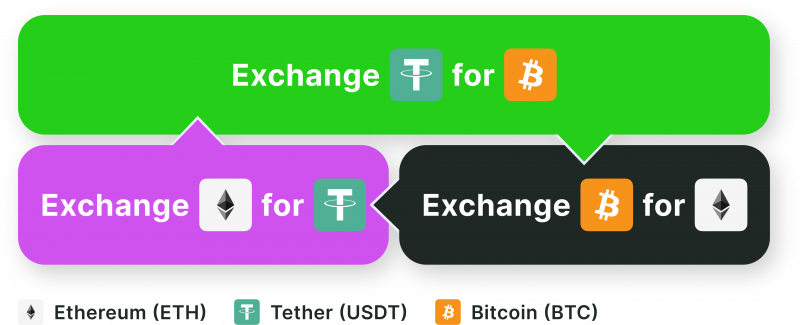

For example, a trader can practise triangular trading in the crypto market using different currencies and the ability to exchange one crypto for another.

A trader may use their holdings in USDT to buy BTC, exchange it for ETH, and then back to the USDT. Eventually, the price differences between these three currencies will be gained.

Alternatively, triangular trading can be executed in the Forex market, where different currency pairs can be exchanged into each other, creating multiple opportunities to gain from market inefficiencies.

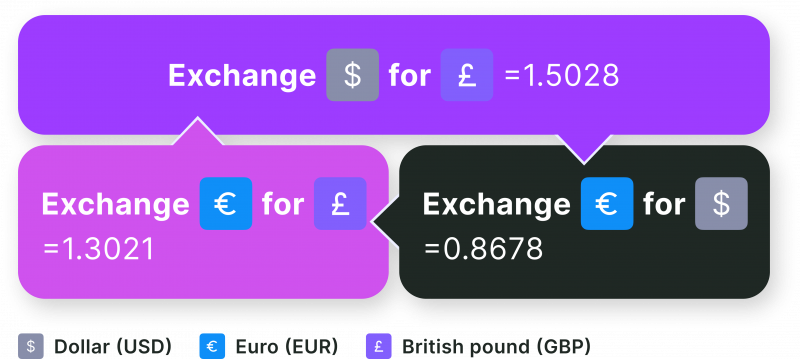

The most famous trio to benefit from triangular arbitrage in the FX market is EUR/USD, EUR/GBP, and USD/GBP. In other words, converting the Dollars into Euros, exchanging EUR to GBP, and then converting the resulting Pounds back to the US Dollar.

It is also possible to use other currencies with the EUR/USD pair, such as Japanese Yen or Swiss Francs. In the end, traders seek ways to make more money than what they invested in the beginning by trading between two assets through a third asset.

Have a Question About Your Brokerage Setup?

Our team is here to guide you — whether you're starting out or expanding.

How To Spot A Triangular Arbitrage Opportunity

According to the crypto triangular arbitrage example shown above, assume a trader has $30,000 in USDT and wants to explore a triangular arbitrage opportunity.

The trader can exchange the USDT holdings for Bitcoin, then use the amount of BTC they have to exchange it for Ethereum. Afterwards, the trader sells the ETHs they got back for BTC. This is done by arbitraging the different buying and selling prices in the market.

If the final amount after this three-way trade differs from $30,000, it was a triangular arbitrage opportunity. Needless to say, traders want to get more than the amount they initially invested, and in this example, more than $30,000.

The trader uses the 30,000 USDT to buy BTC, acquiring 1.13205899 BTC. Subsequently, they use the acquired BTC to buy ETH, resulting in 18.38846931 ETH. The trader then sells the ETH for USDT, receiving 29,825 USDT in return.

In this scenario, the trader lost 175 USDT from this triangular transaction, which does not represent a winning triangular arbitrage. Therefore, a similar analysis shall be done on different currency trios before engaging in triangular arbitrage.

There are different ways to transact in a triangular arbitrage trade using buy-buy-sell orders, like the example above, or buy-sell-sell orders.

Triangular Trading Strategies In Forex

The Forex market is one of the most dynamic markets, with many trading instruments fluctuating several times daily. It has tens of currency pairs, representing an excellent opportunity to engage in triangular trading.

Forex arbitragers take advantage of the price discrepancies through spot and future contracts in the currency market, aiming to buy the low-priced pair and sell a high-price currency pair.

Triangular trading in Forex looks similar to other markets, and there are some famous ways to start triangular arbitrage trading.

Forex Triangular Arbitrage

In a traditional FX position, a trader needs to identify two currencies and exchange one into another, for example, EUR/USD, which expresses how many US Dollars can get for 1 Euro.

However, in triangular trade arbitrage, a trader must identify three currencies where exchanging A into B and C is more beneficial than directly exchanging A into C.

For example, if EUR/USD, then GBP/USD, then EUR/GBP “the implied value” differs from directly exchanging EUR/GBP “the real value”, then an arbitrage opportunity exists.

The pair EUR/USD currently trades at 1.07, or $1.07; the couple GBP/USD is $1.24. Then, we need to find the rate EUR/GBP expressed in US Dollars, which is 1.07/1.24 = 0.8629, the implied value.

Now, we need to check the current market value of the pair EUR/GBP, which is currently trading at 0.8607, the real value.

The price discrepancies between the three currencies resulted in the implied value being greater than the real value, so we must buy it.

On the other hand, if the implied value was less than the real value, then we would sell it.

Forex Statistical Arbitrage

Although not a triangular arbitrage strategy, statistical arbitrage in the currency markets implies comparing two types of currencies and discovering their price differences, which are more likely to remain in the future.

FX Statistical Arbitrage entails creating two baskets of currencies; one includes over-performing currencies, and the other has under-performing ones. The trader here would sell the high-value basket and buy the low-value one.

The idea here is that the value of comparing two baskets is more likely to fluctuate and then come back to the mean price in the future. Using this information, a trader may find triangular arbitrage opportunities in the currency markets.

Risk-free profit

Some may describe triangular arbitrage trades as riskless trades or profits with no risk. However, this is far from true. A successful triangular arbitrage trading strategy needs careful and timely implementation. Otherwise, the trader will be caught in time, and prices will change, not in the trader’s favour.

Additionally, the reaped gains are usually tiny, and a trader needs to attempt triangular arbitrage trading using a significant capital, like $100,000 or even $1,000,000, to gain a real profit that exceeds a few ten dollars.

Automated Triangular Arbitrage Trading Strategies

Financial markets move at a fast pace, and arbitrage opportunities are rare. However, the market self-corrects itself, and if a triangular arbitrage chance appears, the prices will soon revert, and arbitrage opportunities will disappear.

Moreover, as shown in the previously mentioned examples, triangular arbitrage involves a set of calculations to discover these opportunities and find out if it is a winning one or what are the expected returns.

These calculations may take several seconds or minutes, enough for the market to re-adjust, and the estimates become invalid.

Therefore, some traders use triangular arbitrage bots to automate this process and quickly engage in a triangular arbitrage, if found, before the price re-adjusts itself.

This must be done using trading platforms that offer automated trading bots or auto-trading features, where the trader enters conditions by which the trading bot takes actions, enters and exits the markets, and more.

Advantages Of Triangular Arbitrage

Leveraging a triangular trade can generate profits in no time, utilising the market’s dynamics and price divergences to enjoy the following benefits.

Lowering Trading Risks

Triangular arbitrage trades are done using calculated numbers and risks, giving no room for randomness or luck. Also, it is a timely transaction that does not imply holding on to an asset for an extended period, giving no space for unpredictable future fluctuations.

Discover the Tools That Power 500+ Brokerages

Explore our complete ecosystem — from liquidity to CRM to trading infrastructure.

High Market Liquidity

Triangular arbitrage opportunities are best found in the FX and crypto markets, where one can exchange one currency for another, giving more opportunities to conduct such trades using market price imbalances.

At the same time, these two markets are highly liquid and dynamic, where prices move rapidly every day, creating multiple arbitrage opportunities.

Can Be Automated

These trades are done using given set rules and conditions, and even if done manually, the trader needs to follow the same steps. However, these steps can be automated using trading bots to make the process faster and more secure.

Disadvantages Of Triangular Arbitrage

Given this information, triangular arbitrage trading may seem an ideal trading strategy to generate profits. However, a trader must be aware of the following challenges.

Risk Of Slippage

Prices move quickly, and a split-second can ruin the whole arbitrage trade opportunity. Different trading platforms have different execution systems, and the risk of slippage may prevail, causing you to buy/sell a position at a different price than the intended one.

Requires Very Fast Executions

Arbitrage requires timely and fast executions, so traders use bots to automate this process.

However, if bots were unavailable, this can become challenging because a trade needs to find an opportunity, calculate the risks and expectations, and execute the transaction before the market prices change.

Can Be Complicated

Given its complicated calculations and concept, this may not be the best trading strategy for beginners. Additionally, it may require significant capital investment to see meaningful results, which new traders may not have access to.

Conclusion

Engaging in arbitrage trading through a triangular approach entails transacting between two assets utilising a third one, capitalising on price disparities and market inefficiencies. In this manner, a trader can assume a buy or sell position through a third currency or asset, potentially realising higher profits than through direct transactions with the same asset.

This requires careful consideration to discover the right arbitrage opportunity, calculate the expected outcomes, and determine whether a trader must engage in a buy or sell position. However, this process entails lower risks because it is started and completed within a few seconds, leaving no room for further price fluctuations or unpredictable market movements.

FAQ

Is triangular arbitrage legal?

Buying and selling assets on the financial markets via arbitrage is not against the law since it does not include the manipulation of prices.

How do you trade triangle arbitrage?

Triangular trading involves indirectly trading between two assets using a third asset as a base. This way, traders attempt to make more money than directly trading the first asset into another.

How profitable is triangular arbitrage?

If executed timely and correctly, triangular arbitrage can be very profitable because it is done after careful calculations and timely, leaving no room for future price changes.

Can you really make money with arbitrage?

Yes, traders make money using market inefficiencies and price discrepancies between different assets. Using the proper calculations and timely execution, a trader can make real money with arbitrage.