How Will a Prop Trading Software Boost Your Business

The prop trading software enables companies to attract the most elite traders and have them invest on the brokerage’s behalf, resulting in win-win situations in most cases. Let’s discuss in detail what prop trading is and how you can start a prop trading firm.

The world of financial trading and investing keeps on evolving, especially with the massive technological advancements that have lowered the entry barriers and empowered newly launched brokerage firms with everything they need to compete successfully in the market.

PAMM accounts, strategy copiers, and automated trading are a few examples of technology’s interference in today’s trading. Prop trading is an innovative business model that is turning heads in the brokerage industry.

Key Takeaways

- Proprietary trading refers to companies that trade for themselves besides offering brokerage services to their clients.

- Prop traders must pass various challenges before becoming in-house investors at the brokerage house.

- Integrating prop trading software expands the company’s sources of income by earning from their activities and from prop traders’ earnings.

Understanding Prop Trading

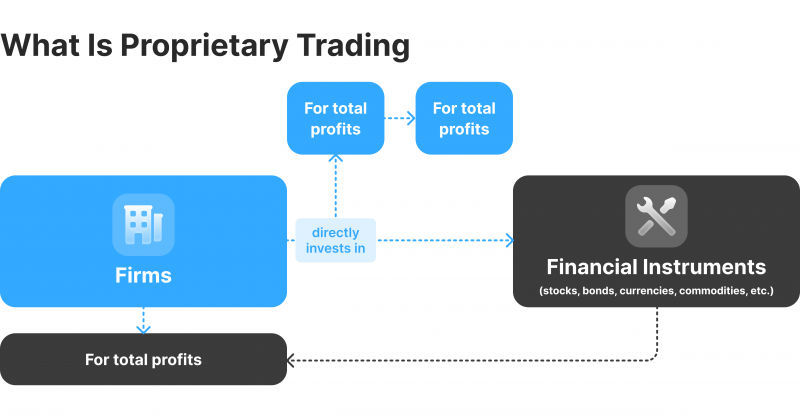

Prop trading – proprietary trading – is a brokerage model where the financial firm uses its resources to trade for itself besides serving its clients.

This way, brokers use their capital and capabilities to pursue financial gain and leverage advanced trading systems, risk management, and successful trading strategies.

Prop trading firms use different methods to attract the most successful traders to their in-house team and make them proprietary traders. Brokerage houses use prop trading software as an arm of their various financial services, aligning with the increasing demand and advanced technologies.

Incorporating a prop trading platform allows brokers to expand their services, attract more users and boost their returns.

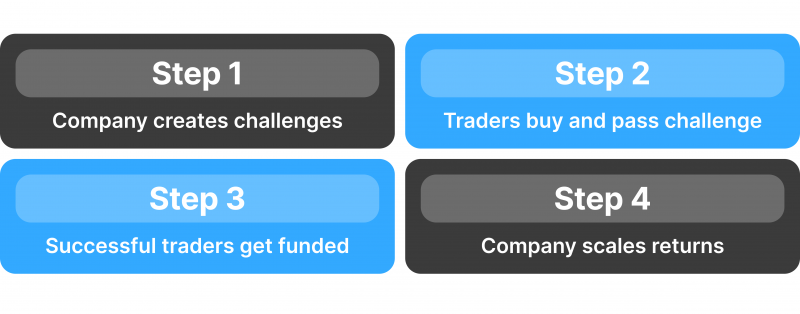

How Prop Trading Works

Proprietary trading firms set challenges for newly introduced investors to test their trading skills. Once they pass prop trading challenges, they are rewarded with a financed account with access to the company’s technology, risk portfolio, and trading capital.

These challenges instruct the candidates to trade in selected financial markets or securities and reach particular targets, such as profit targets, minimum losses, or a certain level of net income.

Prop trading platforms keep a percentage of the possible gains or losses that traders perceive during prop trading challenges. The proprietary trading firm earns from this income stream, which can change after succeeding in all the tasks and becoming an in-house prop trader.

Additionally, independent prop trading firms operate on a contract-based basis, where a group of investors serve other prop trading firms without being attached to one brokerage platform.

Have a Question About Your Brokerage Setup?

Our team is here to guide you — whether you're starting out or expanding.

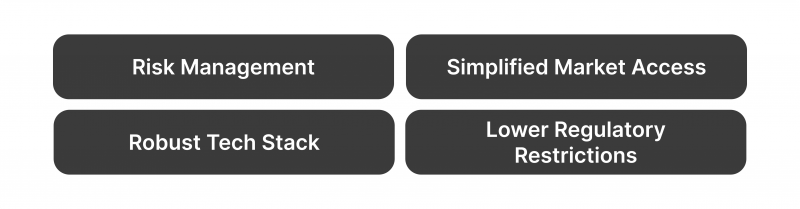

Features of Prop Trading

Companies can add prop trading software as they launch their startups from scratch or as an additional product line to their existing business. Here are some advantages of leveraging a prop brokerage platform.

Risk Management

Modern prop trading software comes with risk management tools that consider the changing market volatility and ensure traders take calculated steps. Prop trading companies guarantee that top-notch investors and professionals trade for them after passing all challenges.

On the other hand, prop traders minimise their risks by using the company’s resources and technologies to make informed decisions that do not expose the capital to significant dangers.

Simplified Market Access

Brokerage startups use proprietary trading software to quickly make it to the market and compete with existing firms. This innovative approach allows companies to engage from a new angle that challenges and awards professional traders before serving a broad market category.

This strategy is crucial in light of the increasing competition and the plethora of trading operators whose services can be identical.

Robust Tech Stack

Trading prop firms rely on the brokerage house’s technological setup and platforms to make the right decisions and investments. This includes extended trading plugins, analysis tools, algorithmic trading, managed accounts and back-office management.

Prop firm software connects the trader with broad liquidity pools and sources, especially when provided by top financial liquidity institutions that offer deep market accessibility and high trading volume.

Lower Regulatory Restrictions

The prop trading market is relatively new. Therefore, it is not heavily regulated like launching a Forex brokerage firm, which is subject to multiple regulatory jurisdictions and financial authorities.

This does not eliminate the need to comply with minimum security protocols, such as the Anti-Money Laundering (AML) Act and know-your-client (KYC) practices.

The first modern KYC procedures were introduced in the late 1990s by the Bank of England due to the increasing number of money laundering and illegal financial activities.

Extended Revenue Streams

Prop trading firms can potentially expand their sources of income by trading independently, earning commissions from serving their clients, and receiving a percentage of prop traders’ activities.

Moreover, Forex prop firms require challengers to pay certain fees to participate. If they do not fulfil their tasks, they will have to pay again to pass the prop trading challenge, which creates recurring revenue for the broker.

How to Start a Prop Trading Firm

Venturing into the prop trading business model comes with certain risks, just like any other company. However, the challenges provided by prop firms’ software increase the possibility of hiring top investors.

Firstly, you must acquaint yourself with the applicable laws and regulations regarding offering financial services in your region or your target market’s territory. Check out any licensing requirements you must pass before acquiring a permit.

Then, find a prop trading platform provider who can equip you with the technological and financial means to start your prop brokerage business.

Set challenges and entry fees to attract investors to start trading for you. Arrange an appropriate reward system to ensure prop traders stay on your platform and continue providing you with revenue streams.

Integrating Prop Trading Software

Finding the right prop software for your business is crucial because changing the supplier every now and then is costly, time-consuming and unsatisfactory for your traders.

Therefore, there are the top 7 qualifications of prop trading software that you must look for.

- Regulated financial activities and appropriate reputation to gain traders’ trust and engage with communities.

- Accessibility to facilitate executing high-value trading positions and margin accounts to amplify potential gains.

- Competitive setup and launch fees that consider your budget limitations or scalability requirements.

- Advanced tech stack to ensure the proper working of the trading software and seamless integration with third-party suppliers.

- Integration possibilities to elevate your platform with swift payment methods, liquidity sources, price updates and newsfeeds.

- Adequate training and onboarding mechanism to ensure simplified accessibility for new prop traders.

- Appropriate prop trading challenges with dashboards that accurately and transparently track and analyse traders’ activities.

B2Prop: Groundbreaking Prop Trading Software

B2Prop is a newly launched proprietary trading software powered with technologies and functionalities that meet and exceed brokers’ needs.

Discover the Tools That Power 500+ Brokerages

Explore our complete ecosystem — from liquidity to CRM to trading infrastructure.

Introduced by the leading financial solution provider, B2BROKER, and backed by its advanced ecosystem, the new B2PROP ensures seamless integration of a prop trading platform to boost your business potential.

B2PROP is supported by B2Broker’s expansive liquidity sources and connections, which provide accessibility to the widest range of trading instruments and markets. B2PROP also supports crypto payments due to its compatibility with B2BINPAY blockchain and cryptocurrency support.

Launching your prop trading platform with B2PROP is seamless thanks to its simplified onboarding, low fees and customised approach, enabling you to hand-pick the features and functionalities your business requires.

Conclusion

Prop trading refers to brokerage firms that engage in financial trading for personal gains in addition to offering investment services to their clients.

Brokerage firms integrate prop trading software to expand their range of services, attracting the most elite trading professionals to become in-house prop traders after passing specific challenges.

Entering the world of proprietary trading can be very lucrative if done well. Therefore, you must find a reliable prop trading software provider who equips you with technological and financial support to expand your revenue streams and grow your business.

FAQ

What is prop trading software and how does it benefit brokerage firms?

Prop trading software enables brokerage firms to manage proprietary trading activities efficiently. This prop firm software provides tools for risk management, trading automation, and performance tracking, helping firms attract elite traders and boost their revenue streams.

What features should I look for in prop firm technology?

When selecting prop firm technology, consider features such as advanced risk management, seamless integration with trading platforms, real-time analytics, user-friendly interfaces, and robust security measures. These features ensure effective trading operations and enhance the overall performance of the prop trading software.

How can I choose the right prop trading software for my business?

To choose the right prop trading software, evaluate providers based on their technology stack, customization options, scalability, customer support, and compliance with regulations. Selecting reliable prop firm software that aligns with your business goals will help you efficiently manage proprietary trading and attract top traders.