Onshore vs Offshore Forex Broker License: Which One Is the Best?

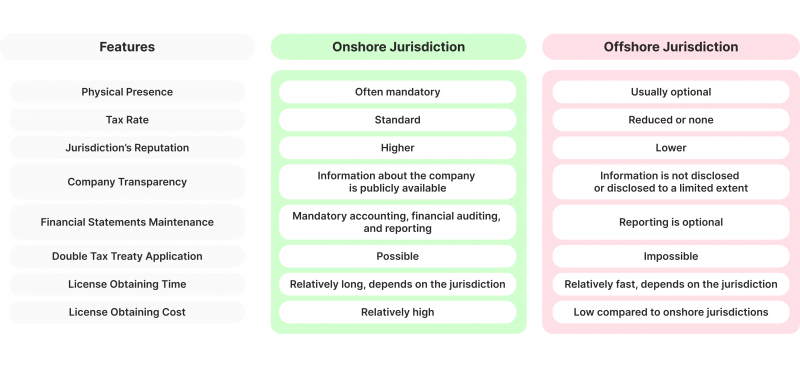

Every entrepreneur willing to start an FX brokerage has to decide on the jurisdiction of their license. The decision between onshore and offshore licensing can directly affect the company’s tax liabilities, regulatory requirements, and operational capabilities.

This article aims to comprehensively compare onshore and offshore Forex broker licenses, helping businesses select which jurisdiction is right for them.

Key Takeaways

- Onshore jurisdictions have stricter operating guidelines for FX brokers, including higher fees, longer processing times, and physical presence requirements.

- Offshore jurisdictions offer a more lenient regulatory environment with lower fees and faster processing times but also come with increased risks for traders.

- Countries such as the UK, Singapore, and Cyprus are examples of well-known onshore jurisdictions for online Forex broker licensing.

- Examples of offshore jurisdictions include Seychelles, Vanuatu, and Belize.

Overview of Onshore Licenses

Onshore jurisdictions refer to developed countries that adhere to international agreements and meet regulatory standards set by organisations such as the Financial Action Task Force (FATF) and the Organization for Economic Cooperation and Development (OECD).

These countries have established legal frameworks, robust financial systems, and strict industry oversight. Furthermore, they have a large domestic retail trading market, which means that companies operating in these jurisdictions are subject to protecting the interests of their domestic market.

Onshore regulators are known for imposing stringent requirements on Forex brokers seeking licenses. These requirements include meeting strict capital and financial obligations, long processing times, and high application, activation, and annual fees.

Additionally, an onshore regulatory body may also require proof of company existence, a clean criminal record, and current tax returns. These strict requirements are in place to ensure the credibility and stability of the FX market within their jurisdiction.

Moreover, onshore regulators often require companies to have a physical presence in their jurisdiction, with offices and staff located locally. This allows for closer supervision and control over the company’s operations. In some cases, only local residents can exercise certain rights, making it challenging for foreign companies to operate in these jurisdictions.

Examples of Onshore Jurisdictions

Some examples of well-known onshore jurisdictions for FX broker licensing include:

- United Kingdom

- Singapore

- Cyprus

- Hong Kong

- Germany

- Switzerland

- Lithuania

- Some US states

These countries have a highly regulated financial sector and are known for their strict regulatory requirements.

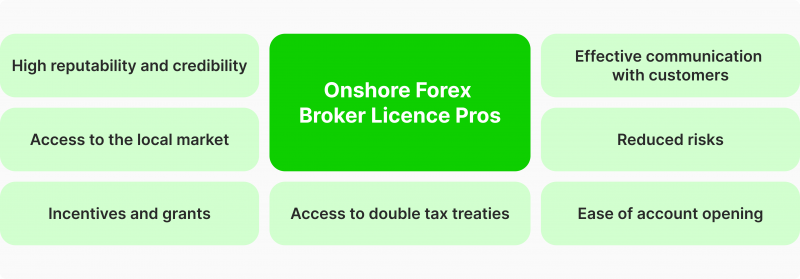

Pros of Obtaining an Onshore Forex Broker License

There are many benefits to obtaining an onshore FX broker license:

- High reputability and credibility: Onshore licensed companies are considered more trustworthy and reliable by traders and investors due to the strict requirements and oversight imposed by onshore regulators. This can lead to increased business opportunities and trust from clients.

- Access to the local market: As mentioned earlier, onshore companies can access local resources such as a skilled workforce, suppliers, and infrastructure, which can enhance operational efficiency and provide a competitive advantage.

- Incentives and grants: Onshore brokers may receive various forms of government support, such as tax incentives, grants, and other financial aid. This can foster growth and expansion opportunities for the company.

- Effective communication: Onshore companies share the same language and time zone with their customers, suppliers, and stakeholders, making communication more straightforward and streamlined.

- Reduced risk: Onshore companies operate in a stable economic environment provided by their home country, reducing exposure to political and regulatory risks.

- Ease of account opening: Onshore licensed companies can open accounts with any bank that provides relevant financial services, making it easier to manage funds and conduct business transactions.

- Access to double tax treaties: Companies operating onshore can apply for double tax treaties, which can help reduce their tax liability.

Cons of Obtaining an Onshore Forex Broker License

An onshore FX broker license can be a desirable option for many companies due to its perceived reputation and credibility. However, it also comes with some significant drawbacks that should be considered before making a decision:

- Limited flexibility in business operations: Onshore companies may have to adhere to strict regulations and limitations imposed by their home country, limiting their ability to expand or adapt their services according to market needs.

- Time-consuming application process: Obtaining an onshore FX broker license can be lengthy and complex, requiring extensive documentation and approvals from various governmental bodies. This can delay the company’s operations and hinder its growth.

- Higher capital requirements: Onshore jurisdictions may have higher minimum capital requirements for obtaining a FX broker license, which can be a significant financial burden for small or new companies.

- Political instability risks: Companies operating in onshore jurisdictions are vulnerable to political changes and instability, which can affect their business operations and profitability.

- Limited access to international clients: Due to their location, regulatory restrictions, or lack of market presence, onshore companies may face difficulties in attracting and retaining international clients.

- Increased compliance costs: Onshore businesses are often subject to strict compliance requirements and audits, which can result in higher operational costs and impact their bottom line.

Overview of Offshore Licenses

Offshore jurisdictions, or tax havens, offer companies a more lenient and flexible regulatory environment. These countries usually have lower tax rates or no taxation for non-resident companies, making them attractive business destinations.

Obtaining an offshore Forex broker license is relatively fast and less complicated than onshore jurisdictions. Most offshore regulators have fewer requirements, lower fees, and shorter processing times. In some cases, companies can obtain a license within months of application.

Offshore regulators have a profit-driven incentive to attract businesses to their jurisdiction, making it easier for FX brokers to enter the market. As a result, these offshore licenses have less strict capital and financial requirements, minimal administrative obligations, and no physical presence requirements for companies.

However, this lenient approach to regulation comes with its own set of risks. Offshore jurisdictions may have less comprehensive oversight and fewer protections for traders, leaving them vulnerable to fraud and scams.

Types of Offshoring

There are several types of offshoring:

- Business Offshoring: A company moves some or all of its operations to a foreign country to take advantage of lower labour costs and a more favourable tax environment.

- Investment Offshoring: This involves high-net-worth investors opening offshore investment accounts, which can offer substantial economic advantages, such as preferential tax status, asset protection, and secrecy.

Examples of Offshore Jurisdictions

A few of the most well-known offshore jurisdictions for FX broker licensing are as follows:

- Seychelles

- Vanuatu

- Nevis

- Isle of Man

- Curacao

- Comoros

- Belize

Pros of Obtaining an Offshore Forex Broker License

While both onshore and offshore jurisdictions offer advantages for obtaining a FX broker license, there are some specific benefits to choosing an offshore location. These include:

- Better tax conditions: One of the most significant advantages of obtaining an offshore FX license is the potential for tax benefits. Many offshore jurisdictions offer lower tax rates or even tax exemptions, allowing businesses to minimise their tax burden and retain more profits.

- Licenses are often more affordable: Obtaining a financial license in an offshore jurisdiction is often more affordable compared to onshore jurisdictions. This can be especially advantageous for new or smaller businesses with limited budgets, allowing them to enter the market at a lower cost and potentially increase profits in the long run.

- Higher level of confidentiality: Offshore jurisdictions often have strict privacy laws, providing a higher level of confidentiality for businesses and their owners, directors, and shareholders. This can especially benefit those who value privacy in their business operations.

- Ability to access global markets: A Forex broker offshore typically has better access to international markets, providing new opportunities for growth and reducing dependence on their home market.

- Asset protection: By locating assets in offshore jurisdictions with strong legal protection, businesses can safeguard their assets from potential legal judgments and lawsuits. This can provide peace of mind for businesses operating in potentially high-risk environments.

- Lower regulatory requirements: In some cases, offshore jurisdictions may have fewer regulations than onshore jurisdictions, making it easier for businesses to operate and reducing compliance costs. This can be especially beneficial for small businesses with limited resources.

Cons of Obtaining an Offshore Forex Broker License

While obtaining an offshore FX broker license may seem appealing for some, several cons should be carefully considered before making a decision. These drawbacks can significantly impact the success and reputation of an offshore company.

- Risks associated with different regulatory frameworks: Offshore brokers are subject to the laws and regulations of a foreign jurisdiction, which may differ greatly from those in their home country. This can lead to confusion and potential legal issues for the company.

- Negative public perception: The public may view offshore companies negatively due to the common misconception that they engage in tax avoidance or evasion. This negative perception can also affect the company’s reputation and brand image.

- Limited access to local resources: Offshore regulated brokers may face difficulties in accessing local resources such as a skilled workforce, suppliers, and infrastructure. This can impede their operations and growth potential.

- Mandatory annual fees: Many offshore jurisdictions require brokers to remit annual fees to renew their financial licenses, which can increase the overall cost of operating an offshore company.

- Restrictions on local business operations: Some offshore jurisdictions prohibit companies from conducting business within the country of registration. This can limit the company’s potential market and growth opportunities.

Choosing the Right Jurisdiction for Your Business

So, which jurisdiction is best for your Forex business? The answer depends on various factors, including your company’s size, budget, and target market.

Onshore jurisdictions may be more suitable for established companies with a larger budget and a focus on serving the domestic market. These licenses offer credibility and trustworthiness to potential clients, which can attract a larger customer base.

In contrast, offshore jurisdictions may be a more attractive option for smaller companies with a limited budget and a global target market. These licenses offer flexibility and convenience, allowing businesses to enter the market quickly and at a lower cost.

Final Thoughts

It’s important to remember that both types of licenses require compliance with certain legal and regulatory standards. Therefore, it’s crucial to do your due diligence and understand all the implications before making a decision.

You should also seek guidance from professionals experienced in obtaining offshore and onshore financial licenses. They can help you choose the most suitable jurisdictions, considering your business requirements.

FAQ

How do I get a Forex license?

To obtain an FX license, you must follow the specific regulations and requirements of the country or jurisdiction where you plan to operate. These requirements may vary depending on your location, but generally include:

- Registering your business with the appropriate government agency.

- Providing detailed information about your company, including its structure, shareholders, and directors.

- Demonstrating sufficient capitalisation to cover potential risks and liabilities.

- Obtaining the necessary permits and licenses for operating a financial services business.

- Complying with AML and KYC regulations.

How long does it take to get a license?

The time it takes to obtain a license can vary greatly for onshore and offshore brokers. In general, an onshore FX license may take longer to acquire due to stricter regulations and more extensive application processes. On the other hand, offshore licenses may be obtained more quickly depending on the jurisdiction’s specific requirements.

What are the typical costs associated with obtaining a license?

The costs associated with obtaining a Forex license can vary greatly depending on the country or jurisdiction where you plan to operate. Generally, the license can cost anywhere from $30,000 to $60,000. Additionally, there may be other fees and expenses, such as legal and consulting fees, background checks, application fees, and more.

What are offshore forex brokers and how do they operate?

Offshore forex brokers operate in jurisdictions with lenient regulations, lower fees, and faster licensing processes, allowing them to provide global trading opportunities with minimal operational costs.

What are the advantages of choosing offshore forex brokers?

Offshore forex brokers offer benefits such as lower tax rates, affordable licensing, greater confidentiality, and quicker market entry, making them ideal for smaller businesses and startups.

Recommended articles

By clicking “Subscribe”, you agree to the Privacy Policy. The information you provide will not be disclosed or shared with others.

Our team will present the solution, demonstrate demo-cases, and provide a commercial offer