Open Banking vs Embedded Finance: Discussing The Differences

Any company that deals with finances has gone a long way and transformed itself throughout the years because of innovations and advancements. This shift is driven by fintech companies, which provide new channels for businesses to get and supply financial services.

Through protected APIs, open banking gives third-party providers access to consumer data, allowing companies to create more specialised financial products. By seamlessly integrating financial services into non-financial platforms, embedded finance provides users with a seamless banking experience within applications or services they already use.

In this article, we discuss the main distinctions between open banking vs embedded finance, emphasising how businesses can pick the model of their choice.

Key Takeaways

- Open banking allows the exchange of client information, resulting in more individualised financial services and products.

- Embedded finance allows smooth in-app transactions and services by integrating financial services into non-financial platforms.

- While embedded finance develops new revenue streams and improves consumer experiences, open banking promotes the development of new financial services through data sharing.

Open Banking Meaning

Through safe APIs, open banking enables financial institutions to share consumer data with outside businesses. Because of this data sharing, financial service providers can give more individualised financial goods and services. PSD2 (Payment Services Directive 2), which requires traditional banks to grant access to financial data to regulated third-party providers, is one of the rules that drive open banking.

Increased access to individualised services like account aggregation, open banking payments, and budgeting apps is one way customers profit from open banking. Additionally, the system fosters competition and openness, which supports financial solutions that better meet the demands of each individual.

Open banking apps allow users to enjoy customised services based on their past financial behaviour and spending patterns and manage numerous bank accounts in one location.

In other words, open banking permits many applications to obtain access to your bank account details. Consider using some kind of taxi or ride app. Without requiring you to enter your card information explicitly, the app could use open banking to automatically verify your bank account balance and ensure you have enough cash for a ride. This is but one illustration of how open banking may improve the convenience and customisation of financial services.

By giving third-party businesses access to your financial information, you can access a number of innovative services that are specialised to your particular needs. A travel insurance provider might provide customised coverage based on your past trip experiences, while a budgeting tool might examine your spending patterns to assist you in saving money.

The inception of open banking dates back to 1980, when the German Federal Post Office used external computers for a screen test. It gave 2,000 private customers access to an early version of online banking under the tagline “My bank in the living room.”

Open Banking vs Embedded Finance

After clarifying both concepts, let’s dig deeper into the embedded finance vs open banking distinctions.

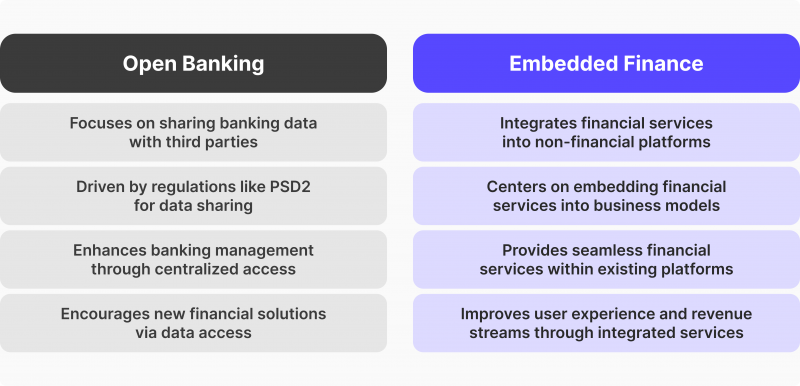

Scope of Application

The traditional financial institutions’ banking data is the main focus of open banking. Through approved APIs, it simplifies sharing this customer data with other businesses. The financial services sector is still the main emphasis, with banks and other financial organisations granting access to their data to create new banking products or enhance already-existing banking services.

Embedded finance, on the other hand, functions outside of the financial industry. It enables businesses to provide banking services like account creation, payments, and lending within their core activities by integrating financial products and services onto the platforms of non-financial organisations.

Have a Question About Your Brokerage Setup?

Our team is here to guide you — whether you're starting out or expanding.

For example, an embedded banking function like in-app payments can be integrated into an e-commerce platform, saving consumers from dealing with traditional banks. This wide range makes it possible for non-financial businesses to embrace seamless financial services that are incorporated into daily operations.

Regulation vs. Business Model

PSD2 and other regulatory frameworks are significant drivers of open banking. These laws guarantee that financial institutions abide by data-sharing guidelines and grant outside businesses access to banking infrastructure and data. In addition to giving customers more options and individualised financial solutions, the objective is to promote competition between banks and other entities.

However, embedded finance focuses on integrating financial services into non-financial company models rather than conforming to regulations. This idea goes beyond regulation and concentrates on facilitating access to financial services to generate new sources of income. Businesses provide financial products using embedded banking solutions as a core competency.

By directly integrating financial services into their customer experiences, companies can introduce new financial solutions without depending on conventional banks.

End-User Experience

Improving conventional banking procedures is the main focus of open banking’s customer experience. These models provide enhanced digital services that let consumers manage all their bank accounts in one location.

Better money management, increased accessibility to individualised financial data, and more competitive offers from financial service providers are the outcomes. Nevertheless, the financial process is still connected to established traditional financial institutions.

Embedded finance attempts to completely change the financial experience by including financial services in customers’ platforms. These platforms may be anything from smartphone apps to physical businesses.

Embedded finance offers a seamless, integrated user experience by integrating these services into non-financial products, eliminating the need for customers to interact with different financial providers.

For instance, consumers can apply for credit straight from the shopping platform without leaving it if an online retailer offers financing choices during checkout. The seamless integration of financial services into the purchasing process improves total consumer involvement.

Drivers of Innovation

Though in different ways, open banking and embedded finance are both catalysts for innovation. Open banking encourages innovation by providing third-party developers and fintechs access to critical financial data from banks, allowing them to design customised financial services and solutions.

As a result of platform data sharing, new apps and services that assist individuals and companies in managing their financial circumstances are created. Using this data access, fintechs can make the financial services arena more competitive.

While dealing with an embedded finance ecosystem, non-financial businesses can streamline their clients’ experiences by offering banking tools, including loans, insurance, and payment processing.

By eliminating the need for direct bank partnerships, these embedded banking solutions improve the client experience and open new revenue streams for businesses.

Financial services are becoming a part of routine activities like buying travel insurance, paying for transport, or even using an app to apply for a loan. Non-financial products can provide better user experiences thanks to this degree of integration, which is consistent with current embedded finance trends in digital transformation.

Industry Choices

Embedded finance and open banking benefit different sectors depending on their structure and clientele. Let’s examine each model’s specific fit.

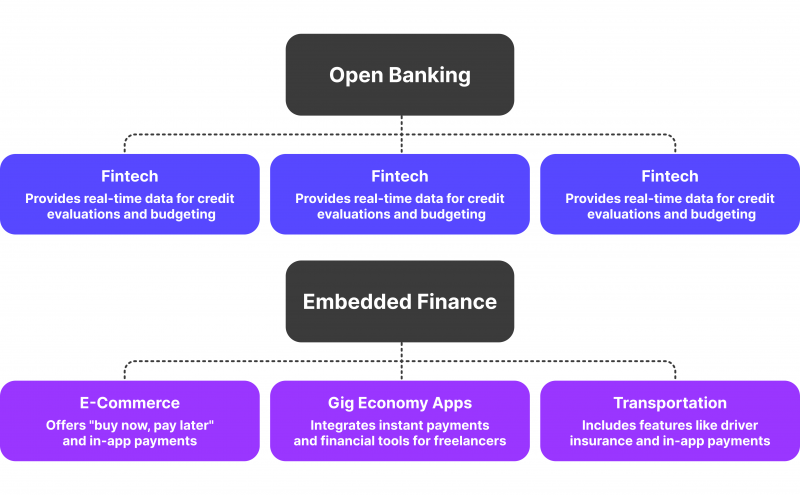

Open Banking

Fintech – Through APIs, fintech companies can obtain banking data from financial institutions by using open banking. This allows them to provide services like credit evaluations, account aggregation, and loan comparisons. Fintech apps can give users real-time financial position data by linking with banks. This enables users to manage various accounts better, track spending patterns, and create budgets.

Insurance – By examining financial history, open banking data enables insurance companies to evaluate client risk more precisely. This data makes personalised insurance quotes and offers possible, which expedites business procedures for both the client and the insurer.

Discover the Tools That Power 500+ Brokerages

Explore our complete ecosystem — from liquidity to CRM to trading infrastructure.

Personal Finance Management (PFM) Tools – By establishing a direct connection with users’ bank accounts, open banking simplifies the usage of apps such as account aggregators and budgeting applications. Users may now quickly gather and analyse financial data, which improves their understanding of their financial situation. Users can track their financial objectives, make educated decisions, and access all their accounts in one location.

Embedded Finance

E-commerce Platforms – Online retailers may offer financing choices like “buy now, pay later” and in-app payment solutions directly within their platforms, thanks to embedded finance. As a result, users are no longer dependent on outside financial institutions to handle their payments. Financial services like financing and instalment payment options can be integrated by e-commerce businesses to provide clients with greater flexibility and increase sales.

Apps for the Gig Economy – Organisations that depend on freelancers or delivery services can incorporate banking services straight into their applications. Instant payments, tools for financial planning, and even insurance possibilities can all be integrated so that employees can manage their income without utilising third-party banks or traversing between apps.

Transportation – Embedded financial features like driver insurance and in-app payments can be included in ride-sharing or delivery services. This streamlines the overall service experience by simplifying financial communication between clients and drivers. For instance, drivers don’t need to rely on conventional financial institutions for payouts because they can get paid right away after finishing a route.

To put it briefly, open banking is more appropriate for sectors that depend on the exchange of financial data and access controlled by regulations. In contrast, embedded finance is more suitable for companies wishing to include financial functions in their current operations.

Final Thoughts

As we’ve seen, the application and purpose of embedded finance and open banking are different. The demands of the industry and the particular company model will determine whether open banking or embedded finance is best. Each provides special advantages catered to various clientele and industries, guaranteeing easier access to smooth financial services.