How do You Integrate Liquidity API inside Your Crypto Exchange?

Articles

Crypto trading has evolved into a global marketplace, driving growth every year and expanding its horizons rapidly. After the turbulent first decade, the crypto market is slowly maturing.

Since 2020, the crypto trading landscape has increased steadily and impressively. So, it has never been a better time to enter the crypto exchange market and capitalise on the current growth trends.

However, there are several challenges on the road to entering the crypto exchange market and obtaining a proper liquidity API is often the primary concern.

This article will discuss the role of APIs in building a functional crypto exchange and the necessary steps to integrate this mechanism into your ecosystem thoroughly.

Key Takeaways

- Liquidity APIs allow crypto exchanges to access larger liquidity pools of more popular exchanges or market makers.

- High-quality APIs can facilitate price stability, narrow spread margins, and extend the variety of available currency pairs.

- To acquire a proper API, you must choose a reliable provider, set up security measures, test the platform before deployment and conduct regular optimisation checks afterwards.

Significance of Exchanges in the Blockchain Landscape

Crypto exchanges serve as bridges between buyers and sellers in the virtual currency market. While it is technically possible to conduct direct crypto exchanges using various mechanisms, like swaps, crypto exchange software is much more convenient and accessible for average users.

Instead of dealing with highly technical blockchain ecosystems, traders can enter exchange platforms with intuitive UI, simple menus and numerous additional features.

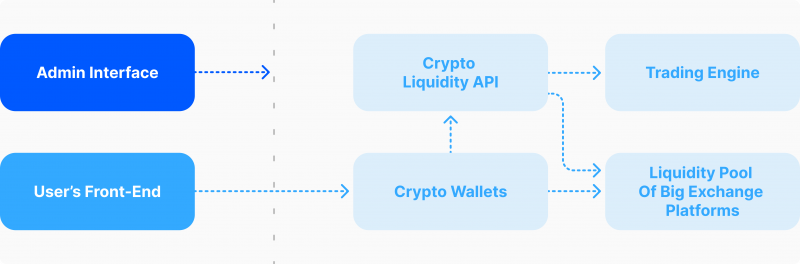

On a technical level, crypto exchanges create or source liquidity pools and develop a trading engine that processes buy and sell orders. As a result, traders can seamlessly place orders and execute deals in minutes or seconds. In recent years, the influx of crypto exchange startups has further polished the cryptocurrency exchange software, producing digital hubs with excellent functionality and lightning-fast execution.

Most crypto exchanges offer data analytics, live data feeds, educational resources and complex trading mechanisms in addition to simple order processing, allowing traders to conduct their daily business without leaving the platform.

Understanding the Crypto Liquidity Provider API

Liquidity APIs play a crucial role in running a successful cryptocurrency exchange. The integrated liquidity API ensures that the exchange platform has sufficient liquidity at all times, allowing the platform to execute deals without delays or slippage for its users.

In simple terms, liquidity APIs bridge the digital platforms with fund pools and order books, giving the exchange software access to broader market liquidity. As a result, placed orders can be executed in seconds since trading pairs are readily available through the API connection.

Usually, popular exchanges serve as the primary source of liquidity since they possess massive proprietary fund pools. However, exchange platforms can add a secondary source of liquidity, like market makers, to extend their currency pair offerings.

This practice is primarily helpful if exchange startups wish to diversify their currency pairs, as popular exchanges frequently offer only mainstream virtual coins.

Advantages of Integrating Crypto Liquidity API in Your Exchange

Utilising APIs has numerous benefits for exchange startups, allowing them to hit the ground running in this fiercely competitive market. APIs have lowered the entry barriers for exchange startups since they no longer have to accumulate funds independently.

Previously, exchange startups had to go through a challenging process of finding investors or borrowing massive funds from financial organisations.

Acquiring funds in this manner would accumulate considerable interest rates, further slimming down the company’s profit margins. With liquidity APIs, accessing fund pools became more accessible and more efficient for all parties involved.

Additionally, APIs allow exchanges to serve clients swiftly and present more trading options. Having a direct link to fund pools will enable platforms to execute transactions swiftly and offer trading pairs that would be hard to fund independently.

Finally, APIs let exchange platforms provide competitive market prices, giving their customers precise market quotes and preventing users from experiencing any slippage in their trading activities.

Liquidity APIs are not only prevalent in the crypto sector. For FX liquidity providers, API serves a similarly vital role in maintaining stable fiat prices across the forex market.

A Guide to Integrating Liquidity API in Your System

While liquidity APIs are essential, setting up this tool is challenging and multi-faceted. Let’s explore the necessary steps you have to take in order to integrate this API tool without any complications or shortcomings.

Choose a Reliable LP

Selecting a dependable LP is the first and most critical step in this process. The correct choices will help your exchange increase its market depth and avoid causing significant price fluctuations for your customers. Additionally, a consistent LP will ensure your long-term operational success, improving your fund pool access in line with your growing demands.

To select a perfect LP for your needs, you must analyse their technology, features and pricing packages. Not all liquidity APIs are compatible with various crypto exchange liquidity systems; if they are, not all offer in-depth functionality and high quality. Pricing is also essential, as some LPs might charge significant monthly fees for their rendered liquidity API services.

It is also crucial to conduct background research and due diligence. The market is filled with companies that provide liquidity APIs, but not all are trustworthy. So, it is prudent to analyse their track records, check their history and evaluate their compliance with relevant regulations.

It is also essential to check whether the selected LP has sufficient funds to continue business indefinitely.

Implement Robust Cybersecurity Mechanisms

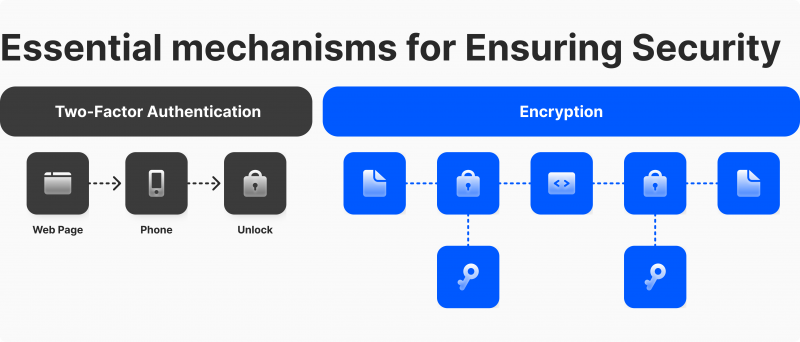

Liquidity APIs are some of the most targeted digital tools in crypto, as they could give attackers direct access to massive fund pools. So, setting up several security layers in your system is crucial. Tools like two-factor authentication and encryption are mandatory at this point, protecting your loyal customers from various cyber threats.

Conducting systematic audits and inspections to identify potential liquidity connect threats is also prudent. As a result, your system will not fall into the hands of malicious attackers anytime soon.

Thoroughly Test the Integration

While API integration has become much easier in recent years, it still takes considerable time and resources for exchange companies. After the integration process, there are many potential areas where liquidity API could be improperly set up, leading to delays, system errors or platform outages.

So, it’s crucial to test the API integration thoroughly before deployment. Most companies create staging environments of their platform to run a demo version of their exchange. This way, you can ensure everything works as intended before deploying your exchange in the market.

Assess the System Performance

Once everything is set up, your liquidity API will serve as a reliable bridge, allowing your customers to enjoy market stability through your crypto exchange. However, to maintain this functionality, you must continuously monitor the performance of your API.

APIs can often lead to inefficient order routing, which can be optimised by analysing the order process and identifying the bottlenecks.

The liquidity API providers might also dip in quality, providing access to inferior fund pools.

So, it is vital to monitor the quality of your partners and switch to a different one if your current LP is no longer up to the task. Maintaining high-quality liquidity APIs is a continuous process that can prove challenging in specific cases, but it is worth it in the long run.

Final Thoughts

Integrating liquidity API into your crypto exchange is necessary to become competitive in the current market. This mechanism allows smaller exchanges to level the playing field and offer the same prices and spreads as the market-leading exchange platforms.

So, it goes without saying that choosing a proper API can set up your exchange business for long-term success. Therefore, it is advisable to spend time, money and resources on acquiring the best possible liquidity API tool for your business needs.

Seeking answers or advice?

Share your queries in the form for personalized assistance