What is Trading API?

Articles

Today, the sphere of electronic trading is over-saturated with companies striving to create their own unique and valuable product that helps traders work comfortably in the financial markets. The trading application programming interface (API) was created in an effort to combine the advantages of different solutions and simplify the trading process.

This article will explain what a trading API is and how it works. You will also learn what the purposes of its use are and what the main types are. At the end of the article, you will discover the main advantages of using API in trading.

Key Takeaways

- Trading API is a set of commands and protocols that provide two-way integration of diverse systems and components that complement each other’s functionality.

- The main types of APIs are Web Service APIs, WebSocket APIs and Library Based APIs.

- The use of APIs is primarily aimed at achieving goals such as extending the functionality of third-party services, connecting systems, expanding customisation capabilities, and ensuring data security.

What is Trading API and How Does It Work?

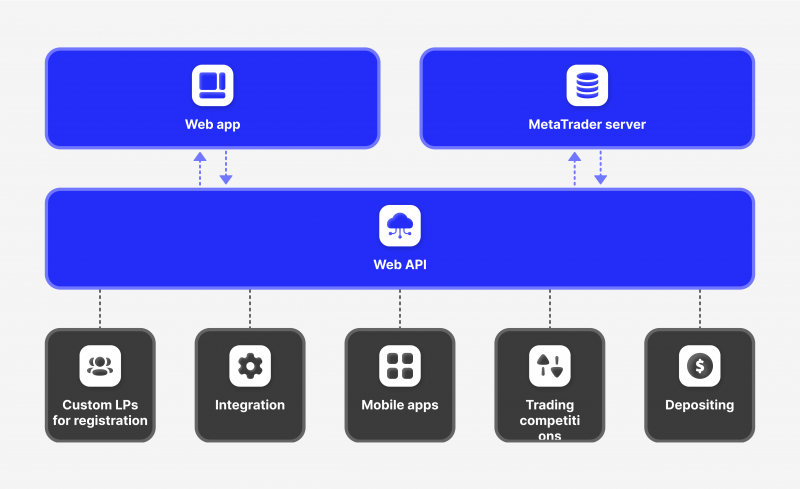

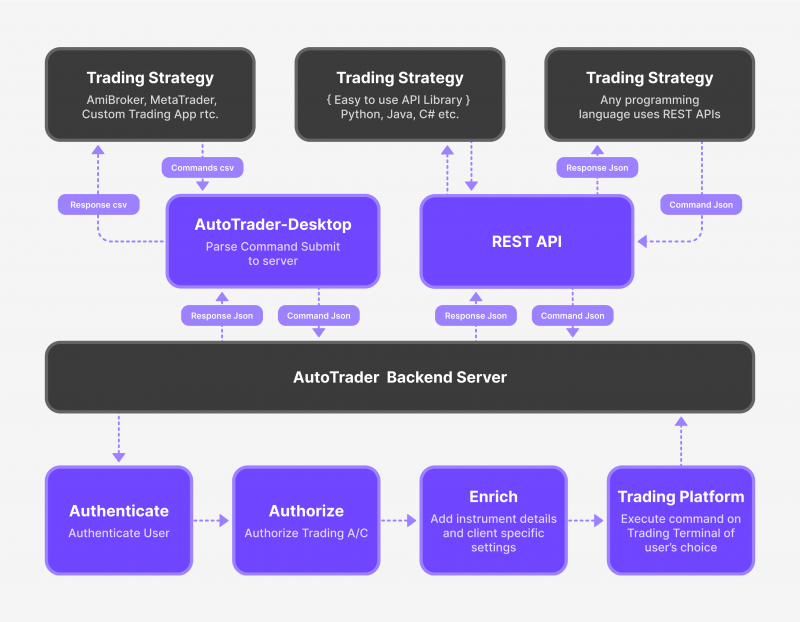

An API (Application Programming Interface) is a set of tools and functions as an interface to create new applications through which one program will interact with another. It allows developers to expand the functionality of their product and link it with other products. With an API, a program can ask another application for data or ask it to perform some operation. Considering the mechanism of work, this solution gained incredible popularity in the framework of electronic trading, allowing the linking of several products, thus increasing the flexibility of work in the ecosystem of different elements and providing access to the financial markets.

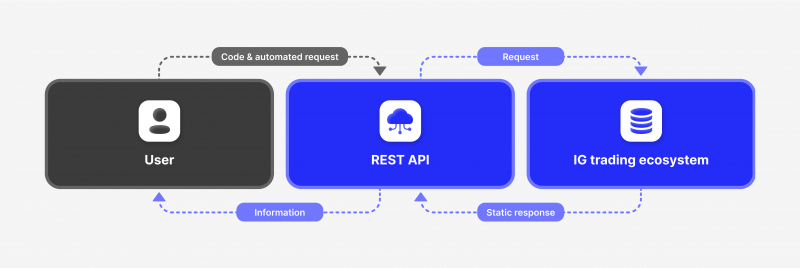

The principle of the Application Programming Interface is very simple. A client program makes a request to an API server to perform a certain operation. The interface receives the data and redirects the request to the application program, which implements the function. After that, the result of the request is returned to the client in the form of a certain action on the part of the user interface. If the operation fails or the request is invalid, the API generates an error message, which is subsequently corrected by the API technology provider.

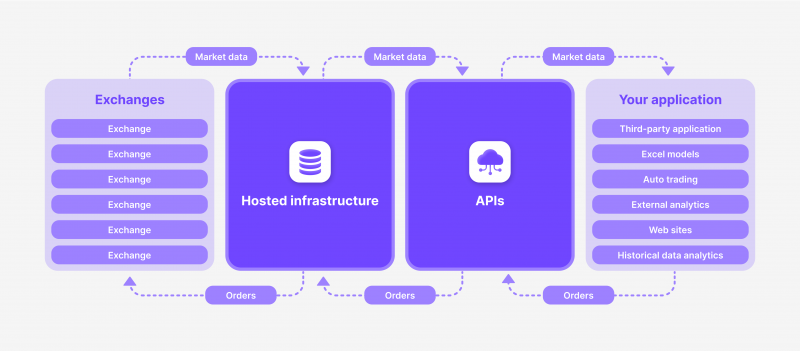

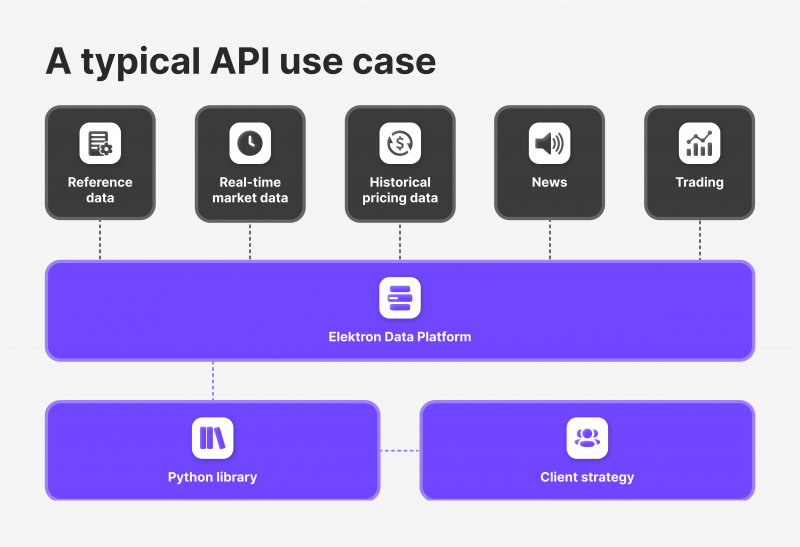

Within the framework of electronic trading, API technology plays an important role in providing the integration of various solutions and systems into a single ecosystem that provides a functional environment for using the advantages of one system (product, solution) within the framework of another. API technology is particularly practical in the infrastructure of cryptocurrency exchanges due to a high degree of integration with other crypto solutions, particularly solutions for storing crypto assets (crypto wallets), analytical platforms, crypto brokers, and algorithmic trading platforms using mathematical algorithms for high-frequency trading (bots). The API allows the instant pairing of different systems and supports their communication using algorithms and protocols based on integration and cloud computing power.

Major Types of API

Today, the rapid development of information technology has provided a high level of integration of web solutions in the process of electronic trading, allowing investors and traders to get the most out of the process of trading assets of all kinds. In the interaction and integration of different systems, the API interface has created a real furore; as a result, new types involve the interaction of different solutions of this or that category, depending on the complexity of their architecture. Consider below the main types of API.

Web Service APIs

The Web Service API (also Web API) is an application programming interface for a web server or web browser. It is a web development concept usually limited to the client side of a web application (including any web frameworks used) and, therefore, usually does not include web server or browser implementation details such as SAPI unless they are publicly available through a remote web application. In other words, a Web API is a software interface consisting of one or more publicly accessible endpoints for a particular request-response message system, frequently expressed in JSON or XML, that is made available over the Internet – most commonly through an HTTP Web server.

The most popular and flexible Web API on the Internet is the REST API based on representative state transfer. The main feature of the REST API is that such transfer is performed without saving state, which means that servers do not save client data between requests. REST defines a set of functions, such as GET, PUT, DELETE, etc., that clients can use to access server data. Clients and servers exchange data using the HTTP protocol. The client sends requests to the server in the form of data. The server uses this client input to run internal functions and returns the output data to the client.

WebSocket APIs

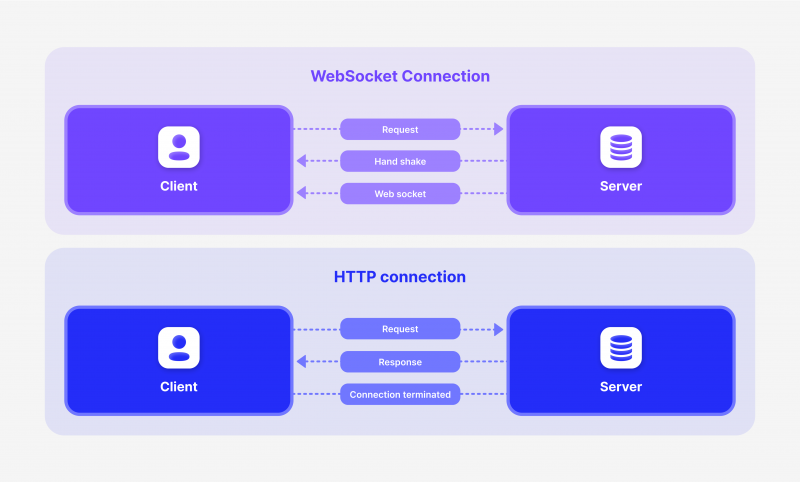

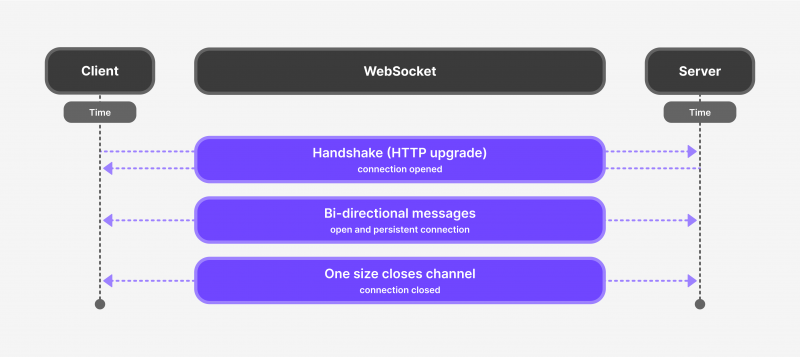

WebSocket API is an independent web protocol that creates an interactive connection between the server and the client (browser) and exchanges messages in real time. Unlike HTTP, WebSockets allow bidirectional market data flow, making the technology unique. However, like HTTP, web sockets send messages over a TCP (Transmission Control Protocol) connection. This standard ensures the reliable and predictable delivery of data sent in packets.

The WebSocket protocol makes it possible to make the connection bidirectional and persistent. The server can respond to the client’s request and independently transmit new information as it arrives. Data is exchanged within a single established connection in real time. Hence, considering that WS APIs are designed for interactive, dynamically updating services, web applications, and real-time devices, they find active, practical applications within stock exchanges (stock trading API) and other types of exchanges, trading floors, and other commercial services with rapidly changing quotes, prices, and other data.

Library Based APIs

Native library APIs are installed locally and compiled into the code as an additional library. The native library APIs consist of a set of classes or functions that extend the capabilities of an existing project. The APIs are entirely local and do not involve web communication.

Programmers can use classes, methods, or other functions available in the library. In addition, classes in native library APIs do not use the HTTP protocol, and requests and responses are not sent over the Internet. Therefore, library-based trading APIs are typically used primarily to access market quotes, orders, historical data, and historical data extraction.

The brief essence of how an API works is that it takes input or requests from one system, sends them to the target system, and returns a useful response or action.

For What Purposes Is the API Used in Trading?

The world of technology is at a stage where platforms need each other’s services to carry out their activities as efficiently as possible. For this, an API is created – a set of ready-made service functions for the needs of other services that want to cooperate with it or use its functionality. Electronic trading has become one of the first areas where APIs have been widely used to provide the following conditions.

1. Expanding the Functionality of the Services

API in trading is a multifunctional solution that helps to achieve increased efficiency of using different systems and services. For example, as part of a trading platform, an API solution can be used to extend its functionality by connecting third-party services to perform trading analytics and market analysis, study market sentiment and accumulate statistical and historical data as part of trading a particular asset. In addition, the API provides the basis for combining several groups of solutions for different purposes within the framework of the trading process, supplementing (making more practical) the basis of the system by implementing the functions of another system.

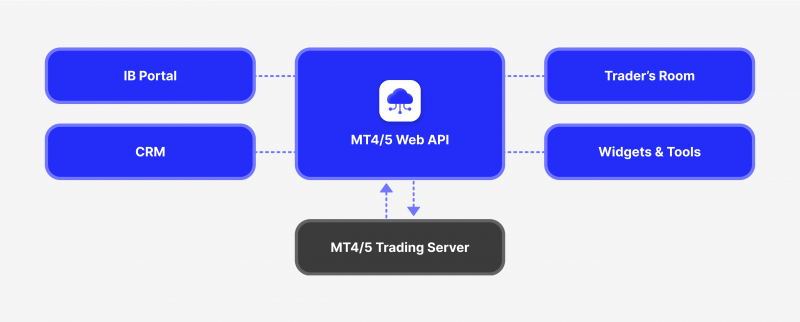

2. Linking Systems

Integration or pairing of different systems is the essence of any API, but within the framework of electronic trading, such solutions have much wider opportunities. First of all, APIs allows making a complex connection between large systems, such as trading system and smaller solutions, such as widgets and plug-ins, in the form of indicators used for analysing price charts of financial assets. On the other hand, it’s possible to connect different trading systems using the API key. A good example of that is connecting different crypto exchanges to the resource that provides automated trading, which gives a complete picture of the movement of funds in each account of any connected exchange.

3. Ensuring Data Security

Security is the quintessence of any transaction taking place within the financial markets. Of paramount importance in trading any asset class, the interconnection of systems through APIs implies advanced technologies in cybersecurity and financial protection. Combining products to symbiosis and increasing their overall performance and functionality, API interfaces, regardless of type and purpose, provide a high level of encryption of incoming and outgoing data between servers of different systems and clients.

4. Wide Customisation Possibilities

When using the trading API, the most useful and practical point is that the user interface can be customised according to the needs of traders. Thus, the trading API can be used at the discretion, using the necessary elements of the system. Customisation, in this case, implies a flexible workspace configuration. For example, the flexibility of the system can be expressed in the connection between the trading API website and the clients (traders) through small data packets consisting only of the information that it is told to accept, eliminating the possibility of false requests.

Main Benefits of Using the API for Trading

The API solutions market continues to expand, proportionally increasing the volume of created projects to support the process of integration of certain systems into other systems in response to the increasing demand from customers represented by Forex brokers, cryptocurrency exchanges and other parties involved in business relationships in various financial markets. The use of the trading API has become a vital need for business that strives to keep up with the development of innovations in the field of electronic trading. This is due to the many benefits that are inherent in API interfaces.

Ease of Use

The use of API in trading is a simple and clear process for beginners as well as for experienced and advanced traders and investors who are well-versed in the intricacies of these solutions. The specifics of their work are implemented to allow you to interactively view information about the methods of the open program interface and send requests about the status of the trading process types. This is achieved through a highly informative support service that provides all the required information for comfortable and effective work with API of any type and purpose.

Functionality

Any method of trading, especially its automated type, implies the active involvement of many services and systems which, on the one hand, are directly involved in supporting the trading process and, on the other hand, play a secondary role by connecting on demand and when necessary. Since a broker’s automated trading system is a complex set of interrelated elements providing trading automation, APIs are designed to provide access to the widest range of third-party trading tools to implement any trading strategy.

Universality

APIs of any type are considered a universal means of ensuring interaction between different systems and services whose communication is carried out through the Internet protocol (both on the PC and on other types of devices), which in turn provides the ability to create trading and information applications in any programming language and on a device with any operating system.

This is especially practical in situations requiring connecting products with different architectures to ensure full compatibility (interfacing) and stability. An ideal example of this is any cryptocurrency exchange whose architecture was built, for example, on the Python programming language, which implies using an analytical platform written in the C++ programming language through the API, which means absolutely different features and integration models.

Stability

Any API solution is a complex, multi-component tool, the stable operation of which determines the overall efficiency of trading or investment activities. Therefore, all suppliers of such solutions pay special attention to the technical component that can ensure the uninterrupted functioning of trading applications even during peak loads so that customers can be confident in the stable operation of the software, as well as always be able to count on prompt helpdesk support in case something goes wrong.

Conclusion

Trading API is an important component of the ecosystem of many companies providing various services related to trading on financial markets. By providing two-way integration of different types and functionality systems and components, the API creates powerful tools for effective and profitable investment activities, allowing one to take a fresh look at the process of making money in the financial markets.