Prime Broker vs Executing Broker: How Do They Work in Financial Markets?

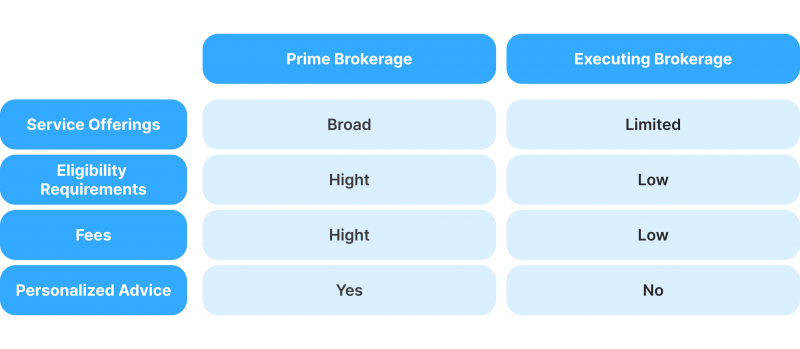

In short, the difference lies in the target market and functionalities. Prime brokers offer a range of services tailored to institutional investors, while trade execution services focus more on facilitating the actual buying and selling of assets. Let’s explore prime brokers and trade execution services in more detail.

Launching a financial service business is one lucrative way to make income, capitalising on the growing FinTech trends and technologies invested in this sphere. There are different types of brokerage services that you can operate, each with distinct features and objectives.

For example, an executing broker differs from a prime or clearing broker. So, what is the difference between them, and what is the profitability model for prime broker vs. executing broker?

Key Takeaways

- Prime brokers offer bundled services to institutional investors, such as order execution, risk management and asset optimisation.

- Executing brokers specialise in processing market orders, using liquidity pools and order books to settle trades quickly and safely.

- Execution is part of the prime brokerage services, which includes matching significant market positions for large market players.

What is a Prime Broker?

Despite the fact that financial brokerage is associated with performing trade orders on behalf of clients, the prime brokerage definition is slightly different. A prime broker is a financial service provider that works with corporate clients, such as hedge funds, investment firms and institutional investors.

They assist these entities in executing large trade orders, channelling liquidity from various sources and consolidating order books to process significant orders quickly and safely at the minimum slippage possible.

Thus, prime brokers (PBs) do not engage directly with retail traders or offer average buy-and-sell orders. Instead, they offer PB services in bundles in exchange for premium charges. Goldman Sachs and JPMorgan Chase are examples of banks that provide these services to top-tier institutional investors.

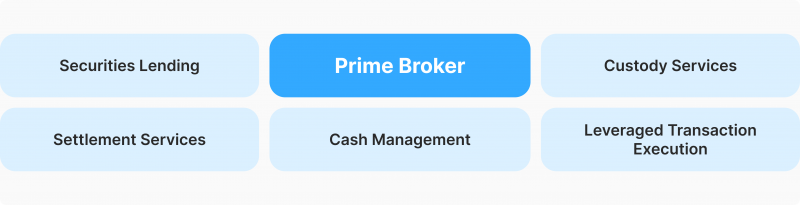

Prime Brokerage Services

A prime brokerage account offers comprehensive financial services that range from mere order execution to asset management and risk assessment. These services can extend to the following functions:

- Pooling market liquidity.

- Managing credit accounts through lending and margin financing.

- Holding and recording collaterals.

- Optimising corporate financial ratios and performance metrics.

- Financial consultancy and strategic planning.

- Settling transactions and managing accounts payable/receivable.

Large investment banking firms, financial insurance agencies, and hedge funds typically demand these services, which they outsource to experienced personnel or third-party contractors.

Morgan Stanley, Goldman Sachs and JP Morgan are key prime brokers, holding 60% of the prime brokerage market. Other competitors include Barclays Bank, Bank of America, Citigroup and BNP Paribas.

Advantages and Disadvantages of Prime Brokers

Prime brokerage is a great way to earn your share in the financial market. However, there are some pros and cons that corporate clients are aware of, which you need to consider before launching your own.

Have a Question About Your Brokerage Setup?

Our team is here to guide you — whether you're starting out or expanding.

Benefits

- Offering bundled financial services at premium prices can maximise your profits.

- Cooperating with tier-1 investors and hedge funds and expanding your network of industry professionals.

- Gaining market insights from working with policymakers, liquidity providers and the most advanced financial service providers.

Challenges

- Institutional investors are very selective, and it might take considerable time for your business to be distinguished.

- Significant capital investment must be made to secure the best liquidity sources, fast execution, and uninterrupted coverage.

How to Launch a Prime Brokerage Business

Offering a prime brokerage account requires significant investment and adequate connection with investment firms or a hedge fund, which differentiates prime brokers vs. executing brokers.

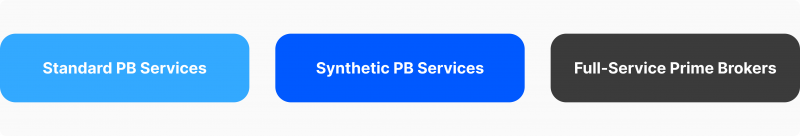

There are three types of brokers that you can operate:

- Standard Services: This includes managing assets and lending funds using typical financial instruments, like stocks and bonds.

- Synthetic PB Services: This extends the PB functionality to more securities, such as derivatives, ETFs and other instruments to optimise the client’s asset management and financial performance.

- Full-service Prime Brokerage: This bundled service goes beyond the sole function of executing orders and managing funds to provide liquidity pools, financial advisory, and risk assessment.

What is an Executing Broker?

As the name indicates, an executing broker is a financial service provider that works on matching trading orders and processing market positions put in by the retail or institutional investor.

Trade execution services are usually offered as part of the prime brokerage functions, where an executing broker is concerned with finding a counterpart order for the trader’s requested market position. Thus, finding a buy order (buying trader) for a sell order, and vice versa.

Opposite to PBs, who work primarily with institutional investors, execution-only brokers also cooperate with retail brokers, processing their market orders at a low price slippage and tight spread ranges.

Executive Brokerage Services

These brokers offer trading and execution services in exchange for bid-ask spread commissions and other managerial and handling fees.

Executing brokers offer the technological means to interact with trading markets, whether through market makers, OTC exchanges or ECN trading capabilities to consolidate broader order books.

For example, these entities may work through a brokerage firm or platform, where traders sign up and submit trading requests, which are processed and analysed carefully.

Once the demanded trade is approved based on the given criteria, it is executed by matching it with relevant security and finally passed to a clearing corporation to settle the transaction.

Prime Broker vs Executing Broker

Prime and executing brokers complement each other, offering a dynamic infrastructure for trading and execution services. PBs offer a broader range of financial services that range from settling market positions to asset management, while executing brokers specialise in processing market orders.

Order execution can be offered as a part of the prime brokerage account, where PBs connect institutional investors to financial markets, processing significant orders and multi-million dollar investments.

At the same time, execution brokers can work independently with retail traders who invest for themselves or on behalf of their clients.

In a nutshell, the difference between prime brokers and executing brokers is the target market. PBs serve corporate clients and offer bundled services at premium rates, while execution brokers focus on matching and settling trade orders at low spread and slippage rates.

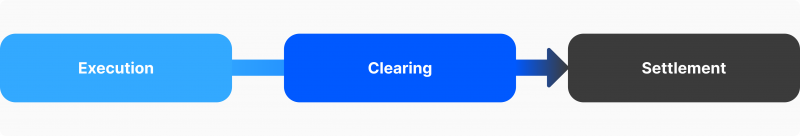

Executing Broker vs Clearing Broker

It is important to note the difference between clearing and executing brokers. In fact, most investors and traders overlook the role of clearing agencies.

When an investor puts its an order to buy 100 shares of Microsoft stock, the executing broker will receive the request and inspect it to ensure its legitimacy and validity. This also includes background checks on the trader to clear out any suspicious activities.

Discover the Tools That Power 500+ Brokerages

Explore our complete ecosystem — from liquidity to CRM to trading infrastructure.

Once the transaction is through, the clearing broker will receive the order actually to settle the trade. This includes recording the assets involved by buyers and sellers and receiving the invested amount in exchange for the requested shares.

In other words, the execution broker works as a middleman between investors and clearing brokers, while the clearing broker connects the executing broker and the marketplace.

Conclusion

Prime and executing brokers are two intermediaries that facilitate the work of financial markets. Understanding the works of prime brokers vs executing brokers is essential before launching a business in this industry.

Prime brokers offer a comprehensive bundle of financial services, from order execution to account management and asset optimisation. On the other hand, execution brokers focus on finding matching orders and processing trades at tight spread ranges and low price divergence.

FAQ

What is a prime broker?

A prime broker is a financial institution that provides a range of services to institutional clients, such as hedge funds and asset managers. These services often include trade execution, custody, financing, and securities lending.

How does a prime broker assist hedge funds?

Prime brokers offer hedge funds services like clearing and settlement of trades, access to leverage, and risk management tools. This helps hedge funds manage their operations more efficiently and focus on investment strategies.

Why do institutional investors need a prime broker?

Institutional investors rely on prime brokers for streamlined trading, access to capital, and support with complex transactions. A prime broker can also provide research, technology, and regulatory reporting, which are crucial for managing large-scale investments.