What is a Cryptocurrency Matching Engine, And How to Use it For Your Business?

Articles

The technological advancement significantly lowered the entry barriers for financial markets, and now almost anyone can trade in various industries using various instruments and securities.

This development is coupled with advanced solutions that ensure the market stays efficient in light of the increasing number of traders. The order-matching engine is one of those innovations used to execute market orders, and many traders may not know that it exists.

Today, we will talk about the cryptocurrency matching engine since it is one of the hottest markets, and we will explain what you need to know before you start a crypto business.

Key Takeaways

- Cryptocurrency matching engines connect buyers and sellers to execute trades within milliseconds.

- Matching engines deploy several algorithms to scan order books and find the best-matching orders.

- Pairing algorithms execute orders on a first-in, first-out priority, while other approaches prioritise the largest trading volume or the highest price.

- Matching engines can be centralised or decentralised based on your business needs. A centralised pairing system is faster, while a decentralised approach is safer.

Understanding The Cryptocurrency Matching Engine

The cryptocurrency exchange matching engine is software that decentralised exchanges and brokerage companies use to fulfil market orders. This software is the backbone of trading, serving different markets like stocks, commodities, ETFs, and cryptocurrencies.

This system works by finding a matching order request and settling it according to the market order requests by the trader. For example, if a trader wants to enter a market position by buying ten shares of Microsoft stock, the matching engine will find a buyer willing to sell ten shares of Microsoft at the market price.

Note that the buyer’s and seller’s prices do not 100% match because the seller wants to sell at the highest possible price, while the buyer wants to purchase at the lowest possible price. The difference between these two prices is called the spread.

The spread, or the difference between the “seller’s asking price” and the “buyer’s bidding price”, usually goes to the broker as transaction fees for every finalised position.

The same scenario applies to the cryptocurrency exchange order matching engine, where this solution looks for a trader willing to take the counterpart of the trade and execute it.

How Do Crypto Matching Engines Work?

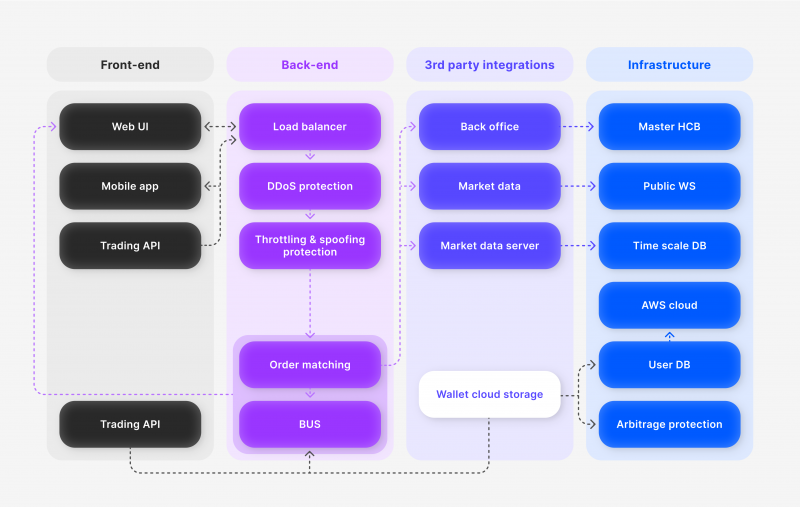

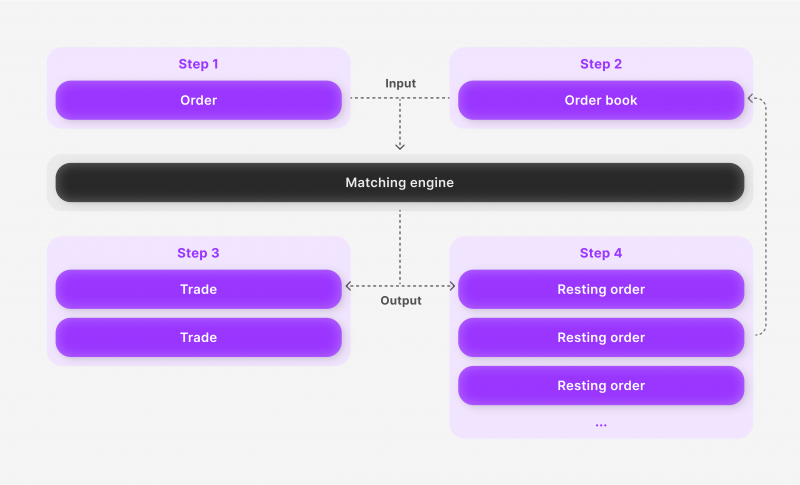

Matching engines deploy different algorithms that crawl the order book to find and settle suitable requested trades. The engine’s algorithm collects data from order books provided by different brokers and platforms to find both sides of the trade, a buyer and a seller of the same product and matches them together at the best possible price.

When the market has low liquidity, the algorithm only finds a handful of available orders and executes them at a higher price. In short, the algorithm cannot provide many options and alternatives that suit the seller/buyer.

Matching engine algorithms follow different execution models by prioritising first trade proposals or those with more significant volumes.

Types of Matching Engine Algorithms

Order pairing algorithms dictate how the system works and what conditions are required to execute orders, and here are some examples.

- FIFO: First-in, first-out is a delivery method that relies on serving orders by giving priority to those who arrived earlier and have been pending for the longest time. This approach is also called the time/price method, which gives priority to the oldest order with a matching price.

- Pro-rata: This approach is similar to the aforementioned “First-in, First-out”, but it prioritises market orders with larger volumes. Thus, if two trades are pending at the same time and price, the one with a larger traded quantity is executed first.

- Time-weighted pro-rate: This method follows the same pro-rata algorithm but prioritises those placed at a better price than the current market price. For example, if 1 BTC = $30,000, a trader willing to buy 1 BTC for $30,200 will have their trade request settled first.

Cryptocurrency matching engine algorithms can be centralised or decentralised. The centralised engine algorithm is faster and more common, using a local server to analyse order books of the same platform, inducing faster executions.

On the other hand, decentralised engines match orders from several books outside the local console and use a peer-to-peer network. This method is safer because no central server can be breached, but it might be slower.

The exchange matching engine software debuted in the early 1980s with the Chicago Stock Exchange’s launch of the first stock order book matching engine, designed to enable order execution with minimal human intervention.

Factors Affecting How a Crypto Matching Engine Works

Cryptocurrency matching engine algorithms are not unified for all brokers and exchanges, and each platform uses an engine that suits their requirements, budget, userbase and trading volume.

- Liquidity: The market liquidity or asset availability is a key factor in how a crypto matching engine works. The higher the liquidity is, the more potential trades are in pending status and the faster the execution. Large order books are usually associated with large liquidity providers, who supply the marketplace with tradable securities.

- Latency: How quickly orders are executed is crucial. Trade execution time is usually measured in milliseconds, and having lots of pending orders on the cryptocurrency gateway leads to increased latency.

Components of a Matching Engine

Matching engines work differently depending on your business requirements and expectations, and you may choose the one that suits you well. There are three crypto engine components that you must consider.

Speed

The matching engine speed is a crucial factor for your business, which refers to the speed at which market orders are executed. The engine’s speed may not be a big concern if you have a new crypto trading platform with few traders.

However, the matching speed is critical for large crypto exchanges offering massive digital assets and cryptocurrencies for multiple users and looking to provide high-frequency trading. Otherwise, market orders will be delayed, and the local server will be congested.

A centralised matching engine is usually faster because it operates on executing buy and sell orders in one server, while a decentralised matching engine is usually slower but safer.

Security

The safety and security of a matching engine are one of the most important key features of a trading platform. However, there is an important trade-off between a centralised and a decentralised engine.

Centralised engines are faster and provide faster order executions. However, they are less secure because they operate on one server, and attackers may target it and breach its infrastructure.

On the other hand, decentralised engines are safer because they provide direct network operations between sellers and buyers, but they are usually slower.

Therefore, you must find the balance between these two or use a centralised trading engine and ensure it has a robust security system.

Fees

The pricing policy is a core component because it determines the business model for exchange platforms. Brokerage companies and cryptocurrency exchanges usually charge a fixed or commission-based fee for every execution.

These prices are stemmed from multiple factors like the spread and resources required in the matching engine’s build.

Exchanges using centralised matching algorithms usually charge higher fees because they deploy more resources to keep their servers safe and fulfil and sell orders at a higher frequency. Decentralised ones that use a peer-to-peer network are usually less expensive.

Why Use A Crypto Matching Engine?

A cryptocurrency matching engine decides how you execute trades on your platform and how your business works. Major exchanges deploy one or more algorithms to find the best fit for their expectations and market conditions.

If a trader wants to buy $1,000 worth of ETH, it would be difficult for exchanges to manually search for sellers offering their cryptos at the same value, or the platform would have to sell from their holdings.

Therefore, most trading platforms now work on matching orders between buyers and sellers, and in the above example, the matching engine will search for another trade request to sell ETHs as close as possible to the asking price and execute it.

The searching, matching and execution process happens in milliseconds, and crypto exchanges use the best matching software to provide fast trading and this feature to lure traders to their platforms.

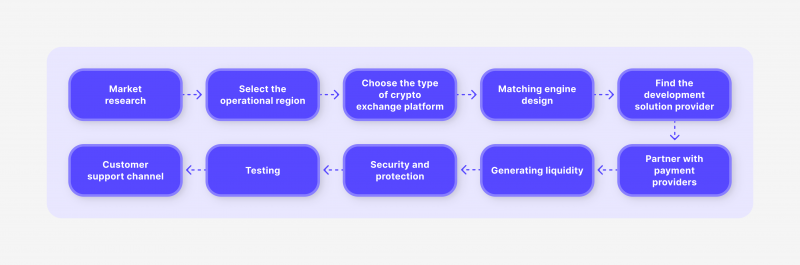

Choosing a Crypto Matching Engine For Your Business

If you are operating a crypto exchange platform, understanding matching engine types and the difference between them is crucial.

Not every trader is aware of these concepts because they work in the background of every trade, and only exchange operators are involved in how these engines work and which one to choose.

How To Find The Right Matching?

To understand what types of engine algorithms you must use, you need to find out which ones affect your users’ experience. Traders look to execute their orders quickly, ensure their stop limit orders are settled accurately and have the tightest spread levels.

Therefore, the ability to provide real-time data and your choice of algorithm are important factors in choosing the right matching engine.

Find a first-serve algorithm to match buy orders as soon as possible, minimising the waiting time for every transaction and improving the user’s experience.

Moreover, crypto exchanges deploy big data and rely on providing information quickly and accurately. Therefore, find a matching engine that powers trading desks with quick data exchange and uses fast servers.

Criteria To Consider When Choosing a Matching Engine

Besides the fast and efficient characteristics of an engine, there are other features that you can explore to expand the functionality and usability of your platform.

- API integrations: The engine’s capability to integrate with different applications and service providers using multiple APIs to provide a better service like fast data exchange, secure connection and more.

- Uptime: Ensuring the matching engine does not face downtime or gets disconnected from its server frequently, which affects how your crypto exchange works.

- User interface: It is important for the matching process to be easy to understand for traders and CRM owners alike. This helps developers address issues when they arise and interact swiftly with them.

- Scalability: The matching engine’s ability to provide for a larger user base when your business grows without having to change the entire engine.

You may also discover white label solutions that help you develop a customised trading platform that suits your preferences and business needs. These solution providers apply their experience in developing similar software, using the above-mentioned criteria and more to shorten the time you need to find a crypto trading CRM or build it on your own.

Advantages And Disadvantages of Crypto Matching Engines

After understanding what crypto pairing engines are and how they work, let’s go through their advantages and disadvantages. Analysing pros and cons helps you make your own crypto exchange more efficient and fitting for your business model.

Benefits

- A faster and more cost-effective way to execute trades, eliminating the need for intermediaries and market makers to find counterpart trades. The engines will scan and find suitable orders in milliseconds.

- Access to higher liquidity pools using decentralised algorithms that connect traders across different order books. This way, orders are matched through a broader market directly between traders.

- Safer environment using decentralised matching engine algorithms that use peer-to-peer networks without relying on a central server and making it difficult for hackers to trace transactions and breach them.

- Matching algorithms are scalable, and you can choose the one that suits your business needs and preferences. Moreover, discovering its integrations and usability across a larger user base.

Challenges

- Security trade-off with performance. Matching systems with better performance are usually prone to beaches and attacks, while safer networks can be slower, leading to more waiting time.

- Maintaining the engine’s uptime during peak market activity when a huge number of traders is being requested, and the platform is experiencing increasing traffic. If the engine fails to maintain its speed, trade can be delayed with more pending transactions.

- Cryptocurrencies are unregulated. Matching systems are not subject to laws, and significant market players can use them to manipulate the market or apply unfair conditions.

Conclusion

A cryptocurrency matching engine is a system that matches bid orders with sellers, connecting market traders to execute trades in milliseconds. These engines deploy different algorithms to fulfil orders using various approaches like first-in, first-out, or giving priority to order requests at higher volumes or prices.

Choosing the right algorithm and engine is crucial if you own a crypto platform and want to provide quick execution for your users. Therefore, find software that provides safe and fast trading by accessing larger liquidity pools.

FAQ

What is a crypto matching engine?

A cryptocurrency matching engine is a system that scans order books and connects crypto buyers with sellers. For example, if a trader wants to sell 1 BTC, the matching engine will search for a buyer willing to pay a close price to purchase the offered 1 BTC price.

How does an exchange matching engine work?

Pairing engines scan through multiple order books and find an order with the closest match involving the same asset with the nearest price possible.

What is the difference between a matching engine and an order book?

The order book is the log that lists all market order requests when a trader wants to open/close a position. The matching engine scans through the order book to pair buyers with sellers.

What is the algorithm for matching buyers and sellers?

There are different approaches for pairing algorithms, such as FIFO (First-in, First-out), serving the oldest transaction on a priority list. Other ways include pro-rata and weighted volume, which give priority to the highest price or volume, respectively.