Proof of Reserves: Who is Still Hiding Something?

Cryptocurrency is a revolutionary technology that has the potential to change how we transact and view our finances, yet for many users, there are still lingering doubts about its security. One of the biggest concerns people have regarding crypto is whether or not their funds are genuinely safe. Does real value in reserve actually back projects? Using proof-of-reserve auditing has become an increasingly popular method in the industry of showing that crypto firms have funds backing up the tokens they sell — who’s doing this, and who still needs to prove they are following best practices? We’ll explore these issues in depth and provide clarity on this critical topic.

Understanding Proof of Reserves

Proof of Reserves (PoR) is an auditing process used to assess the legitimacy of a cryptocurrency project. It involves verifying that the amount of tokens a project sells is backed by tangible assets held in reserve. In simpler terms, it’s a way for users and investors to know that their funds are safe and will not be subject to potential losses due to mismanagement.

To issue proof of reserves audits, projects need to provide proof that they have enough assets held in reserve to back up the number of tokens they have issued. This proof must be transparent and verifiable for people to trust its validity. Auditors can then verify the accuracy of these claims by examining bank documents, the balance sheet, and other records. If a project passes the audit, it indicates that the funds are held securely and can be accessed in case of emergency. This gives investors peace of mind when trusting companies with their money, knowing they won’t face a situation where their investments are at risk due to mismanagement or financial insolvency.

Who is Auditing?

Proof-of-reserve audits have become increasingly popular within the industry as a way for cryptocurrency projects to show users and investors that their funds are safe. Several audit firms specialize in providing these services. These audit firms use specialized software to analyze data and verify the accuracy of claims made by projects.

In addition to these services, there are also self-auditing measures that some cryptocurrency projects have implemented. These protocols allow users to easily verify the accuracy of a project’s claims without relying on third parties. Ethereum is one such project that has implemented its own proof-of-reserve protocol called Merkle tree verification. This system allows users to promptly confirm the amount of ETH held in reserve, eliminating the need to wait for an external audit.

Why is Proof of Reserves Necessary?

Proof of reserves is an integral part of maintaining trust and transparency in the crypto space. Without proof-of-reserve audits, users cannot know if their funds are safe, which can lead to losses due to mismanagement or financial insolvency. By utilizing audit firm oversight and self-auditing protocols, projects can ensure that customer assets are secure and that investors feel comfortable trusting them with their investments. This section will explore why these measures are necessary and how they help protect user funds.

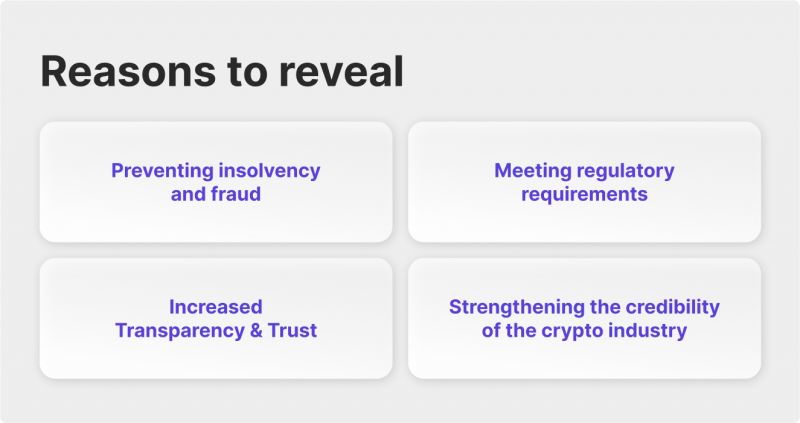

Preventing insolvency and fraud

This is the primary reason why proof of reserves is essential. Without an audit, there’s no way to tell if a project is cooking its books – and in turn, users have no idea what’s happening behind the scenes. By conducting regular audits and verifying that the project holds the amount of funds it claims to hold on the balance sheet, users can feel better assured that their money is safe from financial mismanagement.

Furthermore, having third-party audit firms evaluate a project’s finances allows for more accurate reporting of user balances and transactions. This helps avoid discrepancies between reported figures and actual ones, preventing potential problems before they arise. Additionally, external auditors provide impartial insight into how well projects are using the all the assets – allowing them to be managed in the most secure and efficient way possible.

Increased Transparency & Trust

Proof of reserves also helps to build trust among customers and investors, as they can see that their funds aren’t going to disappear without warning. With regular audits, projects can demonstrate that they’re being honest about their financials and taking the necessary steps to protect user assets. This reassures users that their money is safe, which can help encourage more people to invest in a project or use its services.

Ultimately, proof-of-reserve audits serve an essential purpose in cryptocurrency – providing an extra layer of protection for users’ funds and enabling greater transparency in project finances. By verifying reserve balances on a regular basis, projects can ensure that users’ funds are safe and sound, helping to boost trust in the space overall.

Have a Question About Your Brokerage Setup?

Our team is here to guide you — whether you're starting out or expanding.

Meeting regulatory requirements

In addition to providing greater trust and transparency, proof of reserves can also help projects meet certain regulatory requirements. For example, some countries require custodial institutions holding billions – such as banks and other traditional financial institutions – to regularly audit their reserve balances to remain compliant with local laws. By ensuring that their funds are properly accounted for and tracked, these firms can ensure that they operate within legal bounds. Moreover, crypto companies may also need to submit proof-of-reserve audits to obtain financial authorities’ licenses.

Strengthening the credibility of the crypto industry

Aside from protecting users’ funds, proof-of-reserve audits are also important for strengthening the credibility of the cryptocurrency industry as a whole. By demonstrating that projects are properly accounting for their reserves and taking steps to ensure user safety, these audits can help make crypto appear more legitimate in the eyes of regulators, investors, and other stakeholders. This can lead to increased trust in the space, which could ultimately pave the way for the wider adoption of digital assets.

To sum up, proof-of-reserve audits serve a variety of purposes – from protecting user funds to meeting regulatory requirements and boosting overall trust in the sector. By implementing regular audit processes and legal and contractual structuring, crypto exchanges can verify hidden liabilities and increase transparency – helping protect users and strengthen the cryptocurrency industry as a whole.

Protecting Client Assets – Crypto Exchanges and Their PoRs

With the increasing importance of proof-of-reserve audits for verifying crypto assets and liabilities, more crypto exchanges are revealing their proof of reserves figures. However, there are still many that remain secretive about this information. Let’s take a look at which crypto exchanges have disclosed their PoR figures and which ones have yet to make this information public.

Crypto Companies With Revealed PoRs

- Binance

- Kraken

- BitMex

- OKX

- Crypto.com

- KuCoin

- Gemini

- Coinbase

It should be noted, in the case of Coinbase, as they are a publicly-traded company, they are obligated to submit their financials to an external auditor for quarterly review. Furthermore, they must file annually audited financial statements with the SEC.

Binance, Kraken, BitMex, OKX, Crypto.com, KuCoin, and Gemini have all taken steps to demonstrate their commitment to protecting client assets and eliminating uncertainty about asset holdings and liabilities by supporting PoR. These crypto exchanges have set an example for the industry by exhibiting transparency and trustworthiness by publicly disclosing their proof-of-reserve figures. This helps reassure all that customer holdings are secure and handled professionally.

Crypto Companies With Hidden PoRs

- eToro

- BitStamp(preparing PoR)

- Poloniex – (preparing PoR)

Certain major exchanges, such as eToro, BitStamp, and Poloniex, are yet to disclose their proof-of-reserve figures publicly. Customers of these crypto exchanges must stay aware of the situation and confirm that their crypto holdings are being handled properly. Additionally, it is in the best interest of these companies to be transparent and forthcoming with this information to protect their reputation as reliable service providers.

Therefore, customers should hold them accountable until they release their PoRs or provide assurances regarding asset holdings and liabilities. This will help give users peace of mind knowing their assets are safe.

Challenges and Shortcomings of Proof of Reserves

Despite the many benefits that proof of reserves audits bring to the cryptocurrency industry, they still have some challenges and shortcomings. In this section, we’ll explore some of these issues.

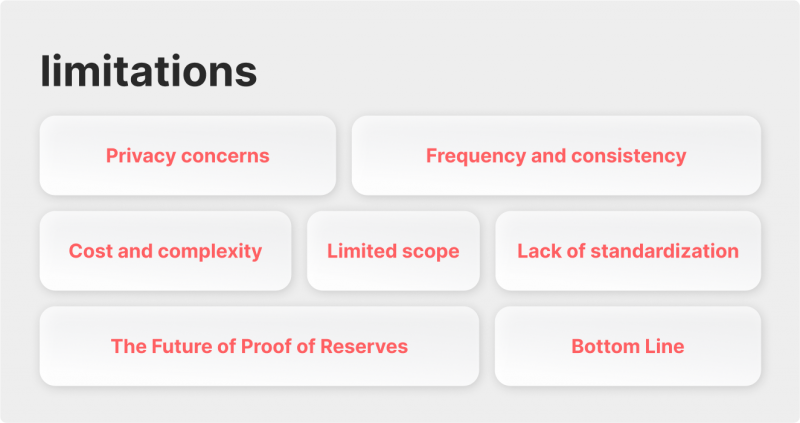

Privacy concerns

One of the primary concerns with proof of reserves audits is that they can potentially compromise user privacy. Although regulations require certain information to be made public, such as total asset holdings and liabilities, exchanges can disclose more information than necessary. This could lead to users’ personal data being exposed, which is a significant privacy concern in the cryptocurrency space.

Frequency and consistency

Another issue with proof-of-reserve audits is the frequency and consistency with which they occur. While some exchanges may conduct regular auditing, others may not adhere to a set schedule or standardize the process. As such, customers might not get an accurate picture of a company’s current financial state, leading to confusion and uncertainty about asset holdings and user liabilities. Additionally, even when exchanges do perform regular audits, they might not be conducted by qualified third-party auditors who can provide reliable results.

Cost and complexity

In addition to the above mentioned challenges, proof-of-reserve audits can also be expensive and complex to implement. Exchanges may incur high costs associated with hiring a qualified auditor, as well as the time required to complete the process. Furthermore, these audits often require specialized knowledge and experience that not all exchanges can access. As a result, some may find it difficult or costly to comply with audit standards.

Limited scope

Also, proof-of-reserve audits are limited in scope and may not provide a comprehensive picture of an exchange’s real financial state. Financial statement audits typically only assess a company’s holdings and liabilities at a given time. This means that customers cannot be sure if the exchange is financially sound over a longer period of time or during crypto market downturns. Therefore, exchanges need to provide additional information, such as liquidity ratios, so that users can make more informed investment decisions.

Lack of standardization

Finally, there is currently no standard or unified approach to proof-of-reserve audits. Different exchanges may adhere to different standards and procedures, making it difficult for customers to compare the results of various audits. This lack of uniformity can make it difficult for users to trust the results they receive from an exchange.

Although PoR faces challenges, it is crucial to increase transparency and trust in the cryptocurrency industry. There are ongoing efforts to improve PoR and make it more effective in protecting users’ assets.

Discover the Tools That Power 500+ Brokerages

Explore our complete ecosystem — from liquidity to CRM to trading infrastructure.

The Future of Proof of Reserves

The adoption of proof-of-reserve audits is growing in the cryptocurrency industry. With increasing regulation and public pressure, more and more exchanges are turning to PoR to provide assurances about their asset holdings and liabilities. In addition, many third-party auditing firms that specialize in delivering reliable audit reports for exchanges have emerged. Finally, some exchanges are even taking proactive steps by releasing regular financial statements or periodic liquidity reports to give customers a better understanding of their current financial situation.

Regulatory developments related to PoR have been emerging in recent years. Regulatory bodies are encouraging exchanges to comply with audit standards, and authorities in some jurisdictions even require certain companies to undergo regular audits. In addition, regulators are working to create unified standards for PoR, as well as PoR legislation, that can be applied across different countries and regions. This will ensure that customers receive the same level of assurance and protection regardless of where they trade or invest. By increasing transparency and trust in the cryptocurrency industry, regulators hope to attract more investors and promote further adoption of cryptocurrencies worldwide. Regulatory bodies also recognize the importance of protecting user privacy during PoR audits. They are pushing for better safeguards that limit what information can be disclosed by exchanges while still providing users with the assurance they need. Overall, these regulatory developments are helping to make PoR more reliable and trustworthy than ever before.

The implementation of PoR has the potential to improve trust and transparency within the cryptocurrency industry drastically. By providing customers with reliable assurance of asset ownership, PoR can create a safer and more secure environment for trading digital assets. This can help foster greater confidence in institutional investors and individual users, which is critical for driving further growth and adoption of cryptocurrency.

Bottom Line

The crypto market is still emerging, but its potential to revolutionize finance and beyond is undeniable. As the industry grows, tools like Proof of Reserves will become increasingly important for providing users with assurance about their assets. With proper regulation to protect customer privacy, PoR can help create a more secure environment for trading digital assets and bring much-needed trust and transparency to the cryptocurrency space.

By continuing to develop improved standards and procedures, regulatory bodies can ensure that PoR audits are conducted reliably and accurately so that customers can confidently invest in cryptocurrencies, knowing that their funds are safe. Ultimately, by improving trust, transparency, and security within the cryptocurrency industry, PoR can help drive the adoption of cryptocurrencies and pave the way for a more secure and prosperous future.