STP vs ECN Forex Brokers: What’s The Difference?

The world of Forex trading has become increasingly mainstream, inviting smaller businesses and individuals to trade alongside industry leaders. Unlike in the past, Forex trading is accessible and often profitable for investors with limited budgets. Despite the decreased financial barriers to entry, the issue of knowledge and experience persists in the Forex trading market.

Aspiring traders must have a firm grasp on a variety of essential concepts in the Forex field, starting with brokers and their subtypes. This article will delve into the nature of Forex brokers, their respective subtypes, and how to decide between these distinct options.

Key Takeaways

- Forex brokers assist traders in executing Forex transactions in exchange for commission fees and spread income.

- ECN and STP brokers are both no-deal desk brokers, providing customers with direct access to the Forex market.

- ECN brokers offer more speed and transparency but demand substantially higher commission fees.

- STP brokers have inconsistent processing times and reduced order routing transparency but generally offer favorable pricing.

- Deciding between these two options depends on the specific requirements of a given trading business or individual.

Who Are Forex Brokers and Why Do They Matter?

For individuals and businesses aiming to enter the Forex industry, it is crucial to understand the Forex broker concept. Forex brokers act as practical intermediaries between traders and the Forex market. With their assistance, traders can swiftly find matching sellers or buyers and execute their preferred Forex deals. Forex brokers also partner with liquidity providers to raise the liquidity levels on the Forex market, facilitating more active trading and increased supply of currencies.

Forex Brokers also provide traders with convenient and highly functional platforms that contain currency prices, trading mechanisms, analytical tools, and many other helpful features. Their involvement and rendered services make the Forex trading landscape much more accessible for beginner and experienced traders alike.

For their contributions, Forex brokers earn their profits with transaction fees and differences between bid and ask prices. The difference between bid and ask prices presented by forex brokers is called the spread. Although this means that forex brokers slightly alter the market prices to generate spread revenue, their overall benefits to the forex market greatly outweigh the costs.

Thus, Forex brokers play a vital role both directly and indirectly in simplifying the Forex trading process for professional traders. Forex brokers come in various types and facilitate trader efforts in different ways. Therefore, it is crucial to understand which type of Forex broker is best for a specific trading practice.

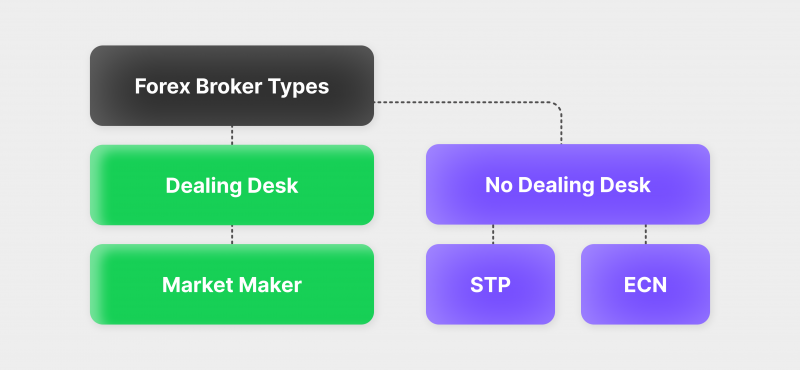

Dealing Desk Brokers (DD) vs. No Dealing Desk Brokers (NDD)

DD model Forex broker effectively serves as a market maker in the Forex industry. They execute orders in two ways: matching traders with buyers or sellers on an open market, or acting as counterparties themselves. The choice between these trade execution types depends on the current market conditions and preferences of dealing desk brokers.

On one side, dealing desk brokers provide fixed spreads and ensure that traders’ desired transactions are always executed. However, the terms might not always be favorable, as their spreads tend to be wider compared to the open Forex market. Additionally, as dealing desk brokers take up the opposite end of a particular transaction, this could lead to specific conflicts of interest with brokers only choosing favorable sides and potentially competing with their respective customers.

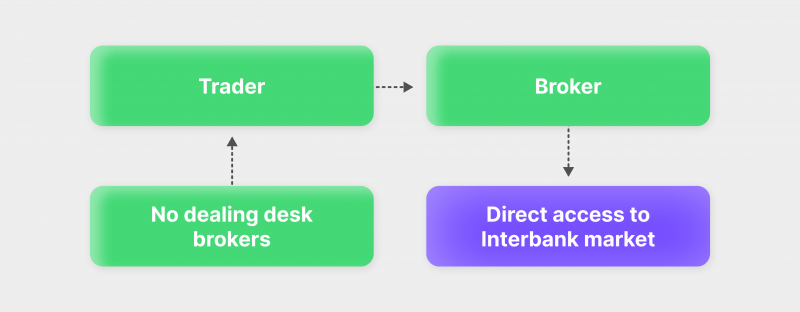

On the other hand, NDD model brokers only act as intermediaries, providing direct market access to Forex traders. As the name implies, no dealing desks are involved in this case, as NDD Forex brokers do not conduct any transactions on their behalf. They connect traders to the Forex market with the help of liquidity providers, large financial institutions and similar entities. NDD brokers have two respective subtypes – ECN brokers and STP brokers.

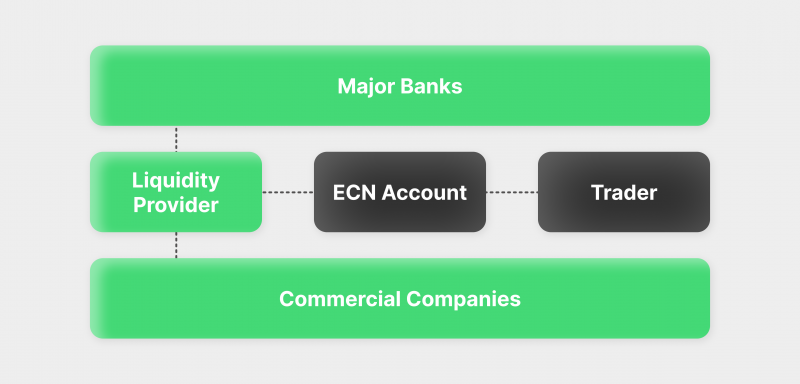

Electronic Communication Networks (ECNs) were invented to aggregate price quotes in forex worldwide and present the best-possible prices to traders.

ECN Brokers Explained

ECN brokers utilize electronic communication networks to create a digital bridge between customers and the Forex trading market. With ECN capabilities, brokers develop platforms with instant access to real-time Forex databases, accumulating market prices continuously. As a result, ECN brokers can provide narrow spreads, as they are not limited by geography or a local Forex market.

Have a Question About Your Brokerage Setup?

Our team is here to guide you — whether you're starting out or expanding.

Before the invention of ECNs, the Forex landscape was substantially different, as market prices could often be dictated by their geographical locations. Traders did not have a reliable way to identify and compare different prices across the globe. With ECNs, even individual traders with drastically limited capabilities can instantly receive the most competitive market worldwide.

This makes ECN highly attractive to traders, as they always get the best spreads available on the market. However, ECN brokers charge various commission fees for their rendered services, which might be higher compared to standard brokers. Thus, it is vital to consider the potential volume of trades and compare the spread decrease to increased commission expenses.

Moreover, ECN brokers are available 24/7 and enable continued trading practices, letting traders fulfill their full-time strategies without significant delays. ECN trading is also unbiased toward traders, as ECN brokers do not trade against their customers, providing fewer risks related to conflict of interest.

STP brokers have a larger pool of partners compared to ECN, which means that some of the STP transactions could end up with DD brokers.

Understanding The STP Brokers

NDD model brokers that execute Forex transactions without using trading desks or acting as direct counterparties to their clients are straight-through processing (STP) brokers. They provide narrow spreads via aggregating market prices and accommodate customers with direct access to the Forex market.

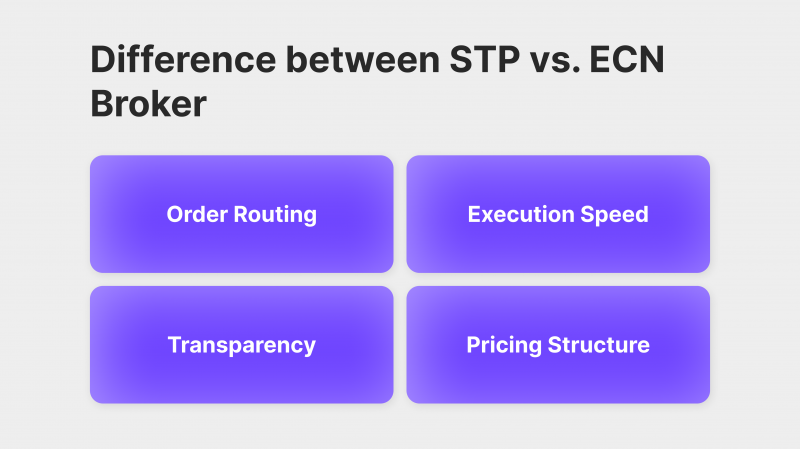

While STP Forex brokers share many similarities with their ECN counterparts, they differ in several crucial ways. First of all, STP brokers approach trade execution differently. Unlike ECNs, STPs do not connect customers with an interbank market.

Instead, they have diverse partners, ranging from market makers, other brokerage firms, or even similar STP brokers. This means that transactions processed by STPs can be executed through different channels with varying speeds and efficiency.

Additionally, STP brokers have different pricing structures. Whereas ECN brokers mostly benefit from a commission on every trade, STP brokers also earn their income through spreads. Therefore, utilizing STP brokers might prove more expensive for traders with high transaction volumes.

STP vs. ECN Broker – A Direct Comparison

As discussed, STP and ECN models share many positive features like providing competitive spreads, never trading against their customers and giving access to global interbank markets. However, STP and ECN models have several fundamental differences in their approach to executing transactions, which are essential to consider and understand for aspiring traders.

Liquidity and Commission Fees

ECN brokers also offer abundant liquidity levels to their customers, having access to large liquidity provider institutions. This, in turn, translates to faster transaction times and efficiency. On the contrary, STP brokers generally do not have access to ample liquidity pools, as they accommodate traders with smaller transactional needs. As a result, their processed transactions might be susceptible to slippage and fail to process orders swiftly.

Thus far, ECN has appeared superior to STP brokers in direct comparison. While the ECN model holds various advantages over STP, it also comes with a considerably large price tag. Most ECN brokers charge substantial commissions for their services, accumulating massive total fees in case of high-volume transactions.

Transaction Processing

Arguably the most essential difference is the underlying order routing process. In the case of ECNs, trader orders are transferred to the interbank market without a threat of third-party intervention or changing spreads. This process is completely transparent and anonymous for involved traders. While STP order routing also accommodates anonymity, it lacks transparency and consistency.

As a result, order processing might vary in length and efficiency and contain risks related to conflicts of interest. Since STP transactions lack transparency, they might get forwarded to dealing desk brokers, who, in turn, could decide to keep the transaction in-house. Customers have no effective means to prevent this from happening, as it is a fundamental methodology of order matching for STP brokers.

Things to Consider When Choosing Between STP and ECN

Despite their differences, both ECN and STP broker types are excellent choices for traders with different needs and requirements. Both types provide direct access to Forex markets and narrow spreads but benefit specific traders differently. Thus, deciding between the two options is more dependent on the distinct circumstances of a given trader individual or business:

Analyze the Pricing Plan

While the structural and processing needs are important for traders, the budgets might often dictate the decision to choose a broker. In this case, an ECN broker is the most expensive option, as it charges substantial commission fees for processed transactions. However, they generally operate solely on commission fees, while STP brokers also take a share of spreads alongside transaction charges. While STP costs might seem bigger, it highly depends on the transaction size and overall trading frequencies.

Traders with smaller-scale needs might confidently cover the combined STP broker costs while having trouble with generally higher ECN rates. Thus, each trader must analyze their transactional needs in short and long terms and calculate rough estimates of possible commissions and spreads associated with both broker types.

However, it is also essential to understand that pricing preferences might change over time for certain traders and their respective trading needs. For example, traders with recently increased transaction volumes and sizes might encounter unreasonable commission fees with certain broker partners. In this case, it is best to re-enter the broker market and search for more favorable pricing packages.

Discover the Tools That Power 500+ Brokerages

Explore our complete ecosystem — from liquidity to CRM to trading infrastructure.

Examine the Liquidity Providers behind the Selected Broker

The matter of sufficient liquidity is a constantly present issue in the field of Forex. Liquidity dictates and affects practically every facet of the Forex market, determining whether the industry is active and thriving at any given moment. The same is true for individual Forex brokers and their respective partnerships with liquidity providers.

In general, ECN firms have a distinct advantage over STP when it comes to providing ample liquidity sources. However, the liquidity capabilities of both broker types must be weighed against their respective values. For example, while STP brokers might offer lower costs, their lackluster liquidity pools might offset the negative impact of decreased trading commissions. Thus, the correct approach is to weigh the positives and negatives of each offering and consider if the corresponding liquidity pools are deep enough for specific trading needs.

Understand Your Trading Goals and Needs

Before committing to a final decision, traders must carefully analyze their specific requirements and long-term aspirations. For example, if a given trader has a limited trading budget and seeks a lower volume of transactions, STP brokers might be the best choice. STP brokers offer smaller fees while maintaining relatively tight spreads and competitive Forex prices. However, traders that go with the STP brokers must consider the potential risks associated with lower transparency and unpredictability of the STP model.

On the other hand, traders with massive transactional requirements and high volumes would do best to partner with ECN brokers, since they offer the narrowest spreads possible on the market. They also provide transparency, eliminating potential conflicts of interest from trading against their own customers. However, ECN brokers are quite expensive, which could be a deterrent for some large-scale traders.

As illustrated above, it is best to identify specific trading needs and aspirations before partnering with a particular broker. This way, individuals and companies will have a firm grasp on their trading priorities and then decide which type suits their needs optimally.

Final Takeaways

ECN and STP brokers are two of the sturdiest choices on the broker market, offering a variety of improvements over established broker practices. Their involvement made the Forex trading landscape more efficient and accessible to the general trading public. However, deciding between the two options might prove challenging, as numerous factors and variables must be considered.

Recommended articles

Recent news