The Pros and Cons of Cryptocurrency Margin Trading

The trading of cryptocurrencies can be conducted using a variety of methods. You might have heard of “shorting,” margin trading, leveraged crypto trading, etc. Since each of these terms refers to one concept, understanding how all of this works can be difficult.

However, margin trading with cryptocurrencies doesn’t have to be challenging. Yes, the crypto market is unpredictable and volatile, but if you gain enough experience in crypto margin trading, you can join a group of people who make money on the price swings in both bull and bear markets.

But what is margin trading, and how does it work? This article will show you how to start margin trading, as well as its pros and cons. In the end, we will share some tips to make your trading journey more enjoyable and successful.

First, let’s look at the theory of cryptocurrency margin trading.

What Is Cryptocurrency Margin Trading?

By borrowing money from other users or the exchange itself, traders can increase their engagement with a particular asset through crypto margin trading. Margin trading allows traders to increase the amount of capital with which they trade, unlike ordinary trading, which requires traders to execute transactions with their own funds, which is not always possible, especially for novices.

Cryptocurrency margin trading is usually referred to as “leverage trading” since it allows traders to increase their holdings by a certain amount. For instance, a margin trader using 50X leverage will have 50 times the risk and potential of the reward of a trade.

Many, especially newcomers, already may perceive margin trading as a big win and a way for traders to multiply their profits. Margin trading, however, has its drawbacks. You run a larger risk when you use leverage to increase your holdings in this type of trading. But is it possible to lose all your money?

Luckily for traders, there is no direct correlation between leverage and risk while trading cryptocurrency on margin. If you trade with 50X leverage, your losses won’t be multiplied by 50X because you almost never lose more money than you put into a deal. However, in certain circumstances, losses could exceed invested capital.

Margin trading is popular in slow and low volatility markets such as the Forex market or stocks. However, it found massive popularity in crypto markets too.

How Does Crypto Margin Trading Work?

Frankly speaking, trading with leverage is a pretty straightforward process. An exchange’s user borrows a specific amount of capital from an exchange and trades with it in the hope of achieving a significant return.

A trader must open a position with an upfront payment, also known as “initial margin,” and maintain the position with a set sum of money in their account (maintenance margin).

The funds you invest in initiating a margin trade with a cryptocurrency exchange are stored as collateral by the exchange. The limits of the exchange you trade on, and your initial margin determine how much leverage you can use.

In different cryptocurrency exchange software, leverage levels are expressed differently, such as 50X or 50:1. Every exchange can set its own amounts of leverage it will offer clients.

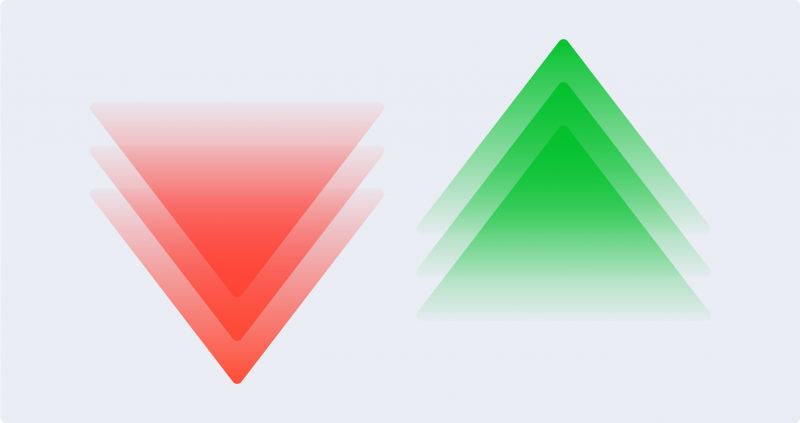

Margin trading gives users two options when opening positions: shorting or longing.

A trader anticipating an increase in the asset’s value will open a long position. On the contrary, traders are “shorting” if they expect a decrease in digital asset price.

However, if you lose money when trading on leverage, the exchange will immediately end your position and “liquidate” your transaction. This happens when the underlying asset’s price hits a predetermined level, which is referred to as the “liquidation price.”

Now, let’s take a closer look at what are the main advantages of cryptocurrency margin trading.

The Pros Of Crypto Margin Trading

A) The possibility of leveraging a crypto asset

Buying crypto assets on margin allows you to boost the amount of your transaction by leveraging the value of assets you already own. If your investments’ value grows, you can expand your earnings.

For illustration, a cryptocurrency exchange allows investors to borrow up to 50X of the cost of acquisition of crypto assets on margin. Hence, if you wanted to buy a crypto asset worth $20,000, you could put $10,000 of the money you invested upfront and borrow an extra $10,000 to buy the rest. This would make your total investment $20,000.

Have a Question About Your Brokerage Setup?

Our team is here to guide you — whether you're starting out or expanding.

B) Improved profitability in current market trends

However, traders, mainly novices, must be advised that such an investing plan is suitable mainly for full-time professional traders. Experienced traders use a margin account to borrow significant sums to invest because they have the expertise and confidence to multiply their returns.

Margin investing may be highly beneficial in bullish markets, especially if you are at your computer each day, have tight loss limits, with a proper trading mindset. However, traders should only do it if they expect the market to continue rising and should always set loss limitations because, otherwise, significant losses are unavoidable. The same applies to bear markets, though. The main difference here is that traders anticipate that the price will fall while following their trading plan according to the current trend.

C) Diversification of a portfolio

You can place too many “eggs in one basket” if your portfolio represents a considerable portion of one crypto asset. However, with a margin account, you might be able to use those assets as security for a margin loan. You can broaden your portfolio using the loan proceeds without being required to sell your underlying assets. This method may be beneficial if you have a sizable unrealized investment income and desire to keep it.

Cryptocurrency margin trading has its drawbacks too, and it is vital to keep them in mind.

The Cons Of Crypto Margin Trading

Margin trading might be advantageous and attractive, but there is danger involved. Borrowing on margin entails all the risks associated with debt, such as interest payments and decreased flexibility for future revenue. Margin call risk, extra expenses, and the chance of losing your whole account balance in a short period of time are the main risks associated with trading on margin. Just as dramatically as it might increase returns, margin can wipe out your account in a matter of minutes.

A) Risk of margin call

A specific amount, known as the maintenance margin, must be maintained in your account’s balance. The cryptocurrency exchange software will automatically initiate a margin call if an account suffers too many losses due to poor performance, requiring you to make more deposits and sell some or even all of your account holdings to repay the margin loan.

Note that your brokerage or exchange may liquidate your account without seeking your agreement if markets fall together with your opened positions. That presents a significant risk for a trader.

Even supporters of margin acquisitions, who are aware of the risk, warn that doing so could multiply losses and make it necessary to generate a return higher than the margin loan rate.

Therefore, crypto margin trading is for experts familiar with its fundamentals, certainly not for occasional speculators.

B) Additional costs & risk of loss of capital

Cryptocurrency margin trading can significantly increase your losses, much like margin trading of other asset classes. You should be aware of the possibility of losing your entire capital before considering margin trading. Traders are always obligated to keep a certain amount of equity in their account, at least 20 to 30% of the open position, by exchanges and financial institutions.

It is also essential to remember that borrowing money to finance a margin trade is not free. The borrowed funds will be subject to interest, and you will have to repay the loan. The platform’s additional trading costs are a thing you should be aware of.

Next, let’s explore what you need to do in order to participate in margin trading.

How To Get Started With Crypto Margin Trading

The first step to getting started with cryptocurrency margin trading is to open margin accounts that give traders leverage to boost their experience in the financial markets. Based on whether you believe the price of an asset will rise or fall, you can initiate a buy or sell position with a margin account. For those who don’t want to buy and hold assets for a long time, the possibility to engage in short selling when asset values decline is a desirable feature of margin trading.

Follow the steps below to get engaged in crypto margin trading:

A) Sign up for a profile and make an initial deposit

Doing this will instantly grant you access to a free demo account, allowing you to practice trading with “fake” money without taking any risks. If you’re ready to start trading with real money, you can add capital to your account. Every serious cryptocurrency exchange software should have a demo account to let their clients have a first experience to see how they will like it.

B) Choose between trading CFDs or spread betting

It is critical to understand more about the taxation of these two trading products, the websites where they are available, how profit and loss are calculated, and any extra costs in the spread betting vs. CFDs comparison guide provided by a particular company.

C) Know the dangers associated with leverage and margin

As you already know, margin transactions can significantly enhance earnings, but they can also substantially increase losses as well. If you want to know more, an exchange should provide further details on preventing capital loss in their risk-management handbooks.

D) Participate in volume markets

The quantity of assets traded between buyers and sellers in a specific time period is known as the trading volume, which measures price movements.

Existing high-volume trading pairings usually show less extreme price volatility since they have greater liquidity. It is worth being aware that unexpected pumps and dumps in margin trading can rapidly lead to margin calls and order liquidations.

Finding high-volume trading pairings could turn out to be highly beneficial if you wish to trade with leverage.

E) Set your emotions aside

Last but not least, if you want to participate and keep trading on margin for some time, you must keep emotions aside. Although leverage is a beautiful idea, forced liquidations are often the case. Many novice traders are unaware of the correlation between liquidation price and leverage.

The capacity to trade with 10X or 25X leverage can inspire fantasies of getting rich overnight. The dissociation from reality leads to being broken for many over-leveraged traders.

Remember that if everything were that simple, everyone would be wealthy already.

Tips For Crypto Margin Traders

Several tactics can be used while trading cryptocurrencies on margin and with leverage. Here are a few to think about that are worth applying:

A) Risk management

The best advice you’ll ever hear about margin trading in cryptocurrencies is to set strict risk management rules.

Every margin trading method essentially revolves around careful risk management. Trading on margin carries risk by itself. To succeed, you must grasp when and how to take calculated risks and how to eliminate them.

B) Don’t add fuel to the fire

It’s frequently tempting to hold on to a falling position. You might believe that there will eventually be a reversal that will enable you to get it all back in one trade as the red candle grows.

There are times when everything appears to be going well and according to plan, but most of the time, the market beats you. Do not chase losing positions into a bottomless pit in order to return your lost money.

Instead, think about exiting losing positions earlier because cryptocurrencies are incredibly volatile and subject to the tremendous downside as well as the upside.

C) Avoid dogmatic attitudes and market assumptions

Every investor has his own prediction of the direction the market will take. However, there is a difference between a belief about the direction of the market and stubborn adherence to that belief if you decide to buy an asset because, having done the necessary technical analysis, you are confident that the asset will retreat from a significant support level.

Discover the Tools That Power 500+ Brokerages

Explore our complete ecosystem — from liquidity to CRM to trading infrastructure.

The bounce might arrive, but it does so with low volume and swiftly deteriorates. A savvy and adaptable trader would be aware of this and think about selling their long position for a tiny profit to wait and watch the price move further.

Impatient traders steadfastly committed to a bull trend would ignore indicators and stick to their bull thesis. As it turns out, a long position quickly becomes a blown-out trade — something that may be avoided if the trader remains “neutral.”

That said, be ready and expect all possibilities. Since anything can happen, you should be prepared for any outcome.

D) Remember that the trend is your friend

Say the market is headed in one direction, but you want to follow other traders by getting on board. By doing so, you go against the trend to “counter-trade” the market.

But, when the market is bullish, it is bullish. The same goes for the bear market. During periods of extreme rallies, changing direction can be fatal.

Remember that it is the best and simplest way to go with the flow when the market shows a strong push in one direction. Since intense evidence cycles are uncommon, you should take advantage of them.

E) Never Go All In

Lastly, remember that going all-in is the greatest mistake in the world of risk management.

Please, write it down and pin it to a wall above where you have your trading setup. Never invest everything, especially what you can’t afford.

Going all in is the easiest way to lose all your trading capital, have no more money to even trade without margin, and have your experience in trading cryptocurrencies completely ruined. Remember that persistence is the key element of a successful crypto trader.

Bottom Line

Cryptocurrency margin trading can significantly boost your income if you trust your knowledge of the crypto market and consistently predict price changes successfully. However, opening the incorrect position at the wrong time can drastically damage your financial status. Thus, always be sure about what you are doing and never invest more than you can afford to lose.

Disclaimer:

NO FINANCIAL ADVICE – The information in this article is provided for education and informational purposes only, without any express or implied warranty of any kind, including warranties of accuracy, completeness, or fitness for any particular purpose.

You should not make any decision, financial investment, trading or otherwise, based on any of the information presented in this article without undertaking independent due diligence and consultation with a professional broker or financial advisory.