Top 10 Embedded Finance Providers

Today, many companies are trying to simplify daily routines and tasks for their end clients. Embedded finance enables customers to access financial services without ever leaving the site or app they’re presently using. Due to its ability to streamline multiple procedures, this strategy has become increasingly popular.

The importance of embedded finance organisations, startups, and providers increases as enterprises attempt to include financial products. In this article, we will showcase top embedded finance providers with their characteristics and niches.

Key Takeaways

- Embedded finance simplifies users’ daily experience of using financial services.

- Deposit accounts, lending, and payment solutions are three essential embedded finance items that streamline transactions.

- Businesses will need to be flexible as this concept might change business processes.

Types of Embedded Financial Products

Various financial products integrated into non-financial platforms that serve distinct purposes within the ecosystem are collectively referred to as embedded finance. Here’s a closer look at a few essential types:

Payment Solutions

One of the most popular types of embedded finance is payment solutions. Digital wallets, integrated payment gateways, and quick payment settlement options are a few of them. These enable companies to provide payment choices right on their platforms. An e-commerce website, for example, can incorporate a payment gateway so that users can finish transactions without ever leaving the website, simplifying the transaction process and improving user experience.

Lending and Credit Facilities

Through embedded lending solutions, consumers and businesses can obtain loans through non-financial platforms. One typical example is point-of-sale financing, which lets buyers finance items at the register. In a similar vein, accounting software can help small firms obtain loans, streamlining the application process and increasing accessibility to financing. These solutions offer adaptable payment plans to meet certain users’ requirements.

Deposit Accounts and Issuing Products

Through non-traditional channels like loyalty applications or e-commerce websites, consumers can create accounts or get debit cards with embedded deposit accounts and card-issuing items, increasing accessibility to banking.

Paid cards connected to these accounts provide more flexibility, particularly for gig economy workers who require instant access to their earnings. These services offer immediate access to financial institutions by integrating conventional banking services into regular digital encounters.

Investment Advice and Portfolio Management

Investment advice and portfolio management tools are being integrated into many trading platforms and brokerages. These tools can offer consumers specific suggestions based on their financial condition, investing objectives, and risk tolerance. Specific platforms might even provide services for automated portfolio management, in which algorithms are able to automatically rebalance portfolios according to certain standards.

Fintech enterprises can provide their consumers with a more comprehensive and value-added experience by directly integrating these services into the trading platform. This can help draw in and keep customers while generating income from other fee-based services.

The following are some advantages of this integrated portfolio management and investment advising feature:

- Users can avoid seeking outside guidance by managing their portfolios and accessing investment advice within the trading platform.

- Depending on the unique qualities of each investor, the tool can offer customised recommendations.

- Users can save time and effort by utilising automated portfolio management.

- Compared to typical financial consulting services, embedded services are frequently more affordable.

Even while embedded finance solutions have existed for many years, their mainstream use has risen recently, mostly due to technological breakthroughs like cloud computing and APIs.

Top 10 Embedded Finance Providers

Various suppliers make up the embedded finance industry, and they are all essential in helping organisations integrate their finances. Below, we present you with ten embedded finance providers that have significantly contributed to embedded finance.

Have a Question About Your Brokerage Setup?

Our team is here to guide you — whether you're starting out or expanding.

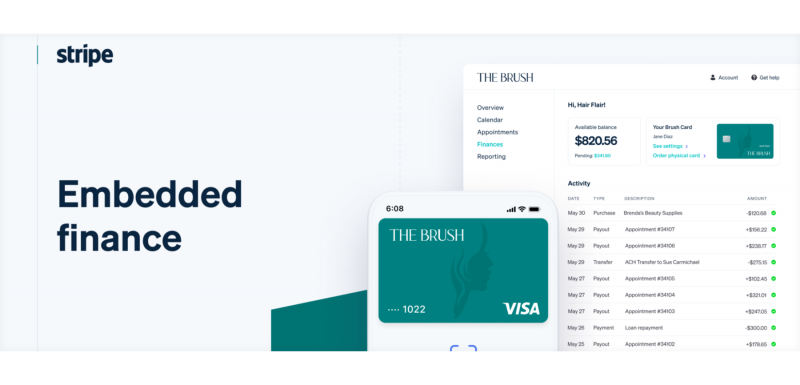

Stripe

A key player in the payment processing industry, Stripe is renowned for the depth of its embedded finance products. In collaboration with top financial institutions like Goldman Sachs, Stripe has created embedded financial services that enable marketplaces and platforms to incorporate an extensive array of financial instruments.

These services, which include lending solutions, accounts, and payments, let companies easily integrate financial services into their platforms to improve user experience and generate additional revenue.

Marqeta

With a focus on card issuing, Marqeta has established itself as a significant player among the embedded finance providers. By offering a flexible platform that integrates financial services like card issuance and money transfer, it enables businesses to provide personalised payment solutions.

Because of Marqeta’s modular API framework, companies may customise their embedded finance solutions to match the unique demands of their clients, increasing user engagement and loyalty and expediting payment procedures.

The Cross River Bank

Cross River Bank provides a full range of integrated financial services and is a balance sheet and technology supplier. Through the use of their platform, companies can integrate a range of financial services, such as banking, lending, and payments, into their daily operations.

Cross River Bank ensures that companies can offer smooth financial services to their clients by fusing cutting-edge technology with banking knowledge. This increases customer satisfaction and opens up new revenue streams for businesses.

B2BINPAY

With B2BINPAY’s secure crypto processing solution, businesses can easily include cryptocurrency payment capabilities into their digital ecosystems by integrating it with incorporated finance platforms.

B2BINPAY is a B2B embedded finance provider that enables business customers to streamline payment flows and improve user experience by allowing embedded payments within their applications.

This integration streamlines online transactions by enabling non-financial businesses to include financial services in their purchasing procedures and lessen the need for traditional banking channels.

Companies may use B2BINPAY to integrate payment automation and access financial services like receiving, storing, swapping, and sending cryptocurrency without the hassles of conventional financial accounts.

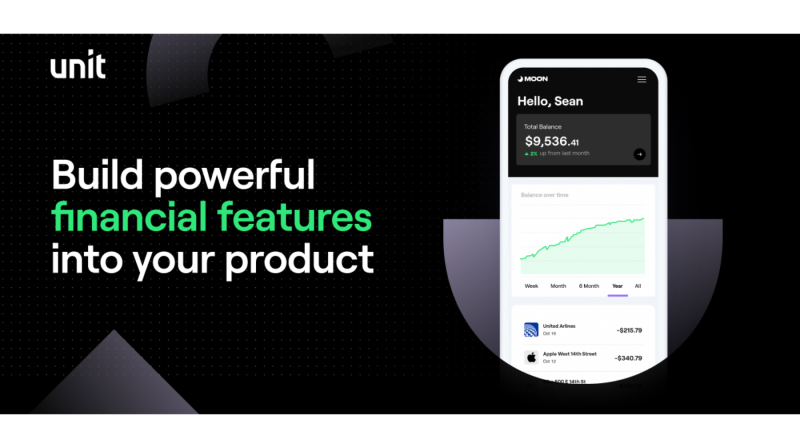

Unit

To help companies include financial services, including accounts, cards, payments, and lending straight into their products, Unit provides a robust embedded finance platform. Focused on security, scalability, and compliance, Unit offers a dependable infrastructure that helps fast-growing businesses effectively integrate financial services.

As one of the leading embedded finance providers, Unit’s adaptable solutions enable companies to design distinctive financial experiences for their clientele, increasing engagement and opening up fresh sources of income.

Bond

Bond is a platform that enables companies to integrate financial services into their current workflows. It provides various tools and APIs for rapid and effective integration, allowing businesses to offer their clients with customised credit products, including virtual and actual credit cards.

Businesses may improve client experience and streamline financial processes by implementing Bond’s solutions, allowing them to effortlessly integrate financial services without needing extensive fintech experience.

Alviere

Alviere provides a thorough embedded finance solution to a range of business sectors. Numerous financial services, such as account administration, payments, and international money transfers, are supported by their HIVE platform.

With Alviere’s embedded finance services, companies may provide their clients with branded financial goods like wallets and debit cards. Businesses may increase revenue, streamline financial operations, and improve customer loyalty by using Alviere’s platform to integrate financial tools seamlessly.

Finix

One of the popular embedded finance providers is Finix, which allows companies to build their own payment infrastructure and embed payments. Because of its various financing choices, businesses can manage and grow their payment processing.

Discover the Tools That Power 500+ Brokerages

Explore our complete ecosystem — from liquidity to CRM to trading infrastructure.

Businesses may improve the overall customer experience by managing payment acceptance, customer transactions, and other financial services directly within their platforms with the help of this embedded finance solution.

Railsr

Businesses can incorporate financial services like credit, debit, and banking products into their offers by utilising Railsr’s global platform. It guarantees seamless integration and regulatory assistance while streamlining non-financial businesses’ banking product offering process.

The infrastructure of Railsr facilitates a range of business models and dynamic marketplaces, allowing companies to effectively integrate financial services while lowering the regulatory burden that comes with using traditional banking systems.

Galileo Financial Technologies

APIs are provided by Galileo Financial Technologies to make it easier for digital platforms to incorporate financial services such as lending, account management, and payment processing. This makes it possible for companies to include banking as a service straight into their products, resulting in seamless customer experiences.

Through embedded finance systems, Galileo helps organisations increase revenue, improve customer loyalty, and automate company operations by providing digital banking services and adaptable financial instruments.

Last Remarks

Embedded finance providers significantly contribute to the transformation of the industry. As a result, user interactions are simple, and client relationships are strengthened. Integrating financial services will continue to change business procedures as market trends change and evolve.