Top 10 Investment Strategies and Recommendations for Beginners

Articles

Not long ago, being an investor was a luxury saved for select individuals across the globe. Only those with massive funds could enter this exciting landscape and try their luck with promising investment opportunities. In today’s world, investing in various commodities and instruments has become a near-necessity that amplifies the value of money and sets individuals up for long-term success. However, despite becoming mainstream and accessible, investing is still complex and often challenging. Many investors have lost massive funds due to a lack of diligence and sage investment strategies to secure their portfolios.

This article will delve into the fundamentals and crucial factors to consider in the investment landscape, highlighting their importance in the grand scheme of investment success. With these tips, suggestions and tactics, aspiring investors can maximise their chance of success in the long run.

Key Takeaways

- Investing is a highly lucrative venture, but it requires complete dedication and a firm grasp of fundamental concepts.

- Identifying and understanding your goals and aspirations is crucial to developing winning investment strategies.

- It is crucial to diversify investment portfolios, as this practice ensures minimal losses in worst-case scenarios.

- Other essential investment strategies include adopting risk mitigation practices, having ample cash reserves, and becoming familiar with different types of assets on the market.

Identify Your Specific Long-Term Investment Goals

First things first, before entering any investment market or adopting established investment strategies, it is essential to understand your own long-term goals and aspirations. Remember, investing is not an objective mission with a universally singular goal for every individual or company.

Investing is a game of preference, and everyone has their distinct endgame goal in this field. From short-term profits, negating inflation and economic uncertainty to building substantial portfolios and making potential-based purchases, every investor must have a firm grasp on why they entered this market in the first place.

Considerations should also involve the asset classes and types of markets the individuals or businesses are interested in. Numerous sectors present unique opportunities and benefits for aspiring investors, and it is crucial to understand if they match your specific needs in the short and long term.

Moreover, choosing an appropriate market is not just about returns and profits. Some investors prefer solid, timeless sectors like real estate, while others could prioritize technology or healthcare. After all, becoming an investor is about choosing the right commodity to support both financial income and intangible value.

Become Familiar with Stock Market Investment Strategies

After pinpointing and gauging their specific goals and aspirations, investors must fill their knowledge and experience gaps pertaining to the general science of investing. The best option here is to study and examine the stock market strategies, the most established and tested concepts in the investment landscape.

From relatively simple concepts like price-to-earnings ratios and Beta measures to increasingly complex mechanisms like derivatives and ETFs, aspiring investors must catch up on many technical details before making substantial purchases. While it is necessary to understand the fundamentals, there is no upper ceiling to how many individuals can learn about the stock market.

This industry is ever-changing and evolving, introducing new hybrid tactics and mechanisms annually. Therefore, continuous education and experience are important to enter the market and never get left behind the rigorous competition. Even expert investors actively monitor the frequent market updates and news, juxtaposing them with their existing strategies and considering potential modifications to their investment approach.

Thus, newcomer investors must dedicate their substantial time and energy to soaking every bit of stock market knowledge. This way, they will seamlessly avoid common pitfalls of the industry and start their investment journey confidently.

Analyae the Market Interest Rates Carefully

Interest rates, also known as market returns, are arguably the most essential metric in investing. Interest rates are usually the annual gains investors receive from various commodities like stocks and bonds. This metric determines the value of a given investment and incorporates potential risks tied to investing in it. Remember, the stock market always includes several inherent risks, including market volatility, inflation, liquidity, and general economic conditions in a given sector.

These risks must be accounted for with a corresponding reward to satisfy potential investors. After all, investment opportunities with higher risks must have higher potential returns. Interest rates are effectively the numerical representation of these added risks. However, it is naturally difficult to calculate the objective value of various risks associated with a given investment and then convert it into an unbiased interest rate figure.

Therefore, potential investors must have a firm grasp of how a given interest rate is calculated. Higher interest rates usually signal severely high risks for an investment opportunity. Therefore, it is advisable to understand the root cause of a higher interest rate and evaluate the potential earnings against the worst-case scenario. If a given asset is highly volatile or prone to inflation, even extraordinary interest rates might not be enough to negate these negative possibilities.

Consider Investing in Mutual Funds

For potential investors who wish to ease into the investment industry or simply avoid spending too much energy on it, mutual funds could be a perfect solution. Mutual funds are financial instruments that aggregate a variety of investment assets like stocks, bonds, or commodities. They are managed by industry experts with extensive experience and expertise in the investment world.

Mutual funds enable various investors to invest in portions of a large, steady and profitable portfolio. There are numerous types of mutual funds, including bond funds, money market funds, index funds, stock funds and even a combination of different types. Each mutual fund comes with a prospectus explaining a given portfolio’s underlying strategies, goals, and structure. With digital innovations paving the way, most mutual funds can be accessed and purchased digitally, either through their manager firms or a simple brokerage account.

With these benefits and advantages, investing in mutual funds is an excellent strategy for newcomer and seasoned investors. They provide a steady stream of income without the hassle of research, daily asset management and relentless strategizing. However, mutual funds could be an expensive endeavor for interested investors, as they charge annual fees or commissions.

In some cases, the costs tied to mutual funds could severely decrease the net profits from the entire investment, rendering the asset ownership obsolete. Thus, investors must carefully analyze the potential profits against the corresponding fees from mutual funds and make an educated purchasing decision.

Have Ample Cash Reserves Via High Yield Savings Accounts

While the world of investment is exciting and rewarding, it is always essential to have a plan B if the initial investment strategies don’t work out. Full-time investors must have sufficient cash reserves for a variety of crucial needs. From adjusting investment strategies and expanding risk mitigation practices to having financial freedom, cash reserves can liberate investors and let them do business confidently.

Keeping and expanding cash reserves can be achieved with a variety of strategies. For example, investors can put some of their resources into purchasing dividend stock assets. Dividend stocks are virtually the same as standard stocks, but with a single crucial distinction – they pay dividends to shareholders. Therefore, investors can generate additional cash income without actually shrinking their portfolios.

However, keeping healthy cash reserves does not necessarily mean that investors should simply put their money in a dormant account. On the contrary, many investors put their liquid assets into a high-yield savings account, which generates higher-than-usual interest rate returns.

However, investors should remember that high-yield savings accounts have variable interest rates, which might sometimes fall below industry standards. It is advisable to monitor the Federal Reserve interest rates to have firm expectations on how these interest rates might change over time and affect cash reserve gains.

Regardless of the preferred investment strategies, investors have a wealth of options to either accumulate or keep a healthy amount of cash reserves at all times. With this approach, investors will be free to take certain investment risks, purchase assets with potential instead of immediate income and much more.

Diversify the Investment Portfolio

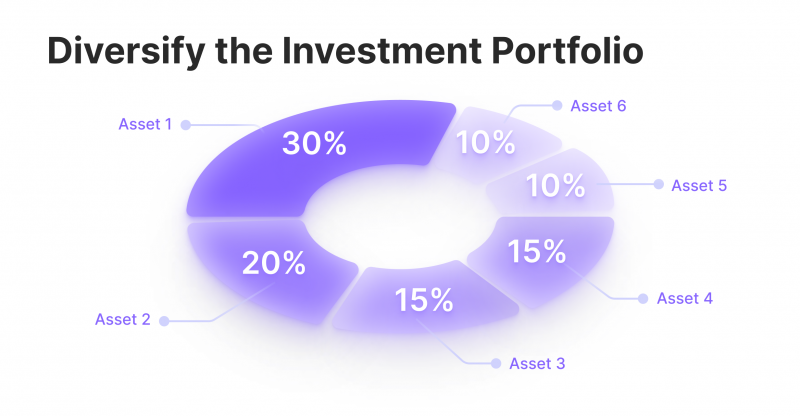

It goes without saying that investment is a risky endeavor in almost every case. Interested individuals and businesses must understand that investing in virtually any asset includes negative scenarios. Thus, it is always essential to have a reasonably diversified portfolio. While the extent of diversification depends on specific circumstances, asset allocation has become a necessity in the modern world of investing.

Without diversification, it is almost impossible to control and manage all the possible risks in the market. As the world has seen many times before, even the sturdiest sectors, like real estate investment trusts, can become unstable in months. While there are numerous risk mitigation practices, diversifying an investment portfolio is the tried and true method that can offset a variety of negative scenarios.

In simple terms, diversified portfolios have fewer inherent risks like volatility, inflation and general economic or political events. With this approach, if a single industry or a niche experiences price variation or other turbulent events, this will only affect a small portion of a given portfolio. Thus, it is advisable to diversify as far and wide as practically possible. This way, the ripple effect of a specific failing market will have a smaller chance of reaching other assets in the portfolio.

Stay Calm Even If The Market Panics

As a general rule of thumb, many industry experts advise exercising patience and perseverance when investing. Many investors make the mistake of responding instantly to certain market changes and downturns. In some cases, that might be the correct approach, but investors must stay patient and trust the overall process in many others.

While certain market downturns are crippling, most price variations and volatility concerns are temporary and often precede lucrative appreciation. Therefore, it is crucial to see the bigger picture and have outstanding patience, not sell the stock when the market appears to be in chaos. Patience has served numerous investors very well empirically, and it continues to do so recently.

Numerous industries that experienced temporary downturns have subsequently rewarded loyal investors with elevated returns. While it is not advisable to always wait without taking action, this strategy simply highlights the importance of not making hasty decisions. While the investment markets can be relentless and fast-paced, there is almost always time to consider investment options before making a decision.

Consider a Growth Investing Strategy

While the endgame of investing is almost always making substantial profits, sometimes it is best to play the long game, prioritizing assets with growth potential instead of immediate income. Growth investing is one of the most promising alternative investments on the market. Usually, growth investing involves purchasing growth stocks from startups and other companies that are expected to grow tremendously in the future. As a result, investors can multiply their initial invested value in the long term.

Growth investing is highly attractive to most investors, as it can potentially provide massive returns on limited investments. However, it is also a risky endeavor since most of the subject companies still need to be established or really tested. Therefore, many potentially lucrative growth stocks could become busts, not even delivering on their initial value. However, many investors are still ready to take this risk, considering the potential rewards if everything works out.

Mostly, investors look for growth stocks in rapidly expanding markets, like the technology sector. The subject companies that issue stocks are usually newcomers with massive potential and a strong foundation. Selecting a profitable growth stock depends on various factors, including the competency, experience, and professionalism of a stock issuer company. Naturally, a bit of luck is always involved, as the companies mentioned above might be affected positively or negatively by various economic, political and social factors worldwide.

Understand the Tax Implications

As with every other industry, taxation is the key element in the field of investing. Different investment markets, countries, and even geographical regions have varying tax rates that must be paid on time. Taxes effectively decrease the gross profits on an investment portfolio and therefore play a significant role in determining future investments.

Investors must be mindful of tax rates before entering a given asset market, as they can heavily influence the net income remaining after all costs have been deducted. Different countries and sovereign entities have various types of taxation related to investment commodities. Taxation also depends on the type of assets purchased and held. For example, dividend stocks have a higher rate of taxation, as the investor actually receives the liquid profits. Conversely, growth stocks and other assets that prioritize appreciation can be taxed very lightly.

Thus, taxation is important when considering the next investment opportunity. In many cases, it can be a deciding factor between purchasing or holding out on a given asset. Regardless of preference, investors must always be mindful of the tax implications and always examine the tax rates when considering a fresh investment option.

Master the Risk Mitigation Practices

Last, but certainly not least, investors must always think about minimizing risks related to their portfolios. The risk mitigation practices can include the above-discussed diversification investment strategies, risk hedging, lowering the portfolio volatility and more. There are no objective ways to ensure minimal risk, as specific investment circumstances require distinct risk management practices.

It is up to investors to analyze their respective portfolios and see what could be improved in terms of minimizing risks. It is generally advisable to keep portfolios diverse, free of volatility, and reevaluate the established investment strategies regularly. There are numerous other strategies to increase risk tolerance for a given portfolio, but everything depends on the specific conditions and the investor’s unique goals.

Therefore, there are no right or wrong answers when it comes to managing risks. The rule of thumb is carefully monitoring the portfolio status and investing with a margin of safety, avoiding risky decisions altogether. Managing risk sometimes comes down to patience and diligence, as investors can often fall victim to seemingly exciting opportunities. It is important to remember that investing is a long-term endeavor, and every investment requires a careful examination instead of impulse-based decisions.

Final Takeaways

Becoming an investor is a challenging yet rewarding undertaking for individuals and businesses alike. Investing provides asset growth, reliable income and security against inflation. However, investing can also be a highly risky endeavor that leads to sizable losses. For aspiring investors, it is crucial to study the basics, become familiar with investment strategies and stay diligent every step of the way.

Thus, for individuals and businesses aspiring to create a profitable investment portfolio, it is essential to get acquainted with fundamental concepts and understand the risks involved. While investing can be a highly profitable career, it demands dedication, energy, and time. Those willing to provide all three have a strong chance to succeed in the short and long term.