Understanding the After-Hours Trading

The after-hours trading practice refers to exchanging various assets after the official market hours are over. Usually, trading markets have four distinct periods – the premarket and regular premarket hours, market hours and, finally, after-hours periods.

This article will focus on the after-hours period and how it can benefit potential investors to get ahead of the competition.

Key Takeaways

- After-hours trading times last from 4 PM to 8 PM, after regular market hours.

- Many corporations issue business updates and other crucial information during this period, which presents great opportunities.

- Investors can utilise this period to purchase or sell stocks before the market makes a price adjustment.

What Does After-Hours Trading Mean?

As outlined above, after-hours represents the trading period after the open market. Different markets and regions have varying trading hours, but it is almost always conducted from 9:30 AM to 4 PM. But how is this period different from the standard trading period? The answer is quite simple but ingenious.

Corporations tend to release company-related updates during pre or after-trading hours to facilitate healthy trading volumes. These updates range from simple earnings-per-share statements to major news, like company restructuring and the departure or hiring of top management. Thus, in some cases, the provided updates could strongly influence the trading decisions in a given market.

With this approach, companies ensure that most traders are not caught off guard by sudden company news and decide to make hasty investment decisions. Investors closely monitoring these updates can make swift investment decisions based on the newly acquired information. Therefore, after-hours trading is a unique opportunity for diligent and motivated traders to distinguish themselves from the general public.

In the past, this period was only accessible to big players, like corporate investors and massive individual traders. Average traders had no effective ways to reach the market after the regular hours were finished. However, technological advancements make after-hours accessible to the general public. Moreover, it is highly encouraged, as investors can react instantly to high-profile company changes and stay ahead of the curve.

How Does Trading After-Hours Work?

While similar to a standard trading period, after-hours trading has several distinctions. Most notably, investors can’t trade in this period using popular trading platforms like Nasdaq. Instead, the orders are processed by electronic communication networks (ECNs), automated alternatives to conventional trading platforms.

Have a Question About Your Brokerage Setup?

Our team is here to guide you — whether you're starting out or expanding.

While this change-up is not inherently detrimental, it presents a massive constraint with limit orders. First, limit orders expire after a single session. This means that investors must execute their order within a single session, or the order will simply become invalid during the next open session. Secondly, limit orders restrict prices, mostly forcing individuals to purchase assets at a predetermined maximum price. Naturally, this limitation forbids investors to carry out complex strategies and capitalise on newly acquired information from corporations.

Individuals must have a brokerage account connected to an ECN network. If so, users can simply place limit orders and wait for the potential execution. However, the limit order price might not match any other pairing. If the ECN protocol struggles to find a suitable trading pair, the deal will not go through and become void.

A Practical Use Case

After-hours could be an excellent opportunity to capitalise on tectonic shifts or smaller but significant changes in the trading landscape. Let’s imagine a case where Google announces their new branch development. This branch has a lot of potential to become a cash cow for Google and increase the company’s valuation in the long term.

You can buy Google’s stocks with a roughly current share price to reap long-term profits from the newly announced branch opening. While this example is trivial, it precisely showcases the power of after-hours, as investors can get ahead of the competition and buy or sell shares before the market takes notice. That is why most traders are active and paying attention even after regular trading hours, trying not to miss out on potential portfolio-altering opportunities.

Advantages and Disadvantages of After-Hours

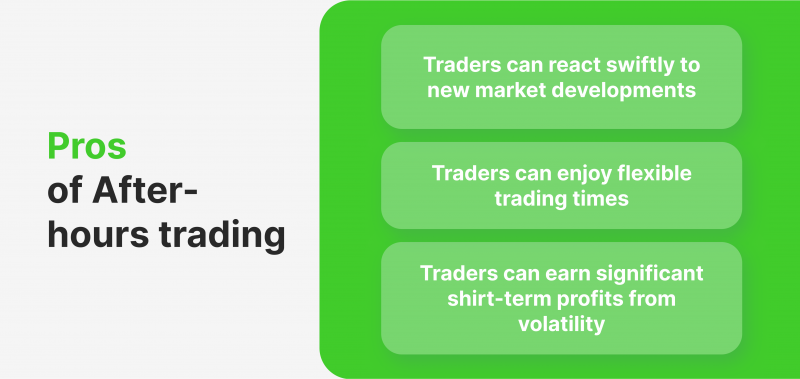

As discussed above, after-hours is an excellent time for opportunistic investors to make swift decisions and get a head start on their peers. However, utilising this period to your advantage is easier said than done. Let’s discuss its pros and cons further:

Seizing the Opportunity

The most significant advantage of after-hours is the opportunity to make swift and flexible trading decisions before the competition. As outlined above, traders can devise clever strategies and utilise their newly acquired knowledge to purchase or sell various tradable assets.

While their choices might be limited in pricing and order execution, this period provides a unique chance to analyse the market in real time. After all, the stock market is all about anticipation and reaction to industry news and developments.

Utilising the Volatility

While volatility is mainly considered a negative concept in the trading landscape, it is also an excellent opportunity for profit in some instances. Traders can utilise the price variance produced by market volatility for their benefit, buying low and selling high within the same trading sessions.

Since after-hours trading mostly has lower volumes, asset prices tend to fluctuate more significantly, which creates ample opportunities for immediate trading profits. However, it is essential to note that this unstable trading strategy is only recommended to highly experienced investors.

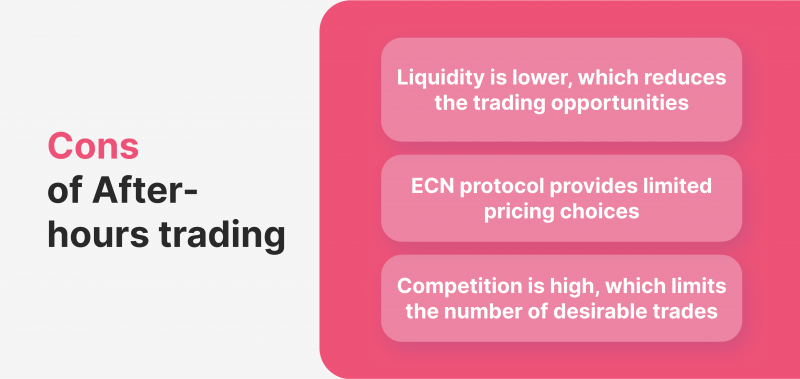

Low Liquidity and Price Uncertainty

While the volatility of the after-hours market could be lucrative for some investors, it also poses liquidity risks. As discussed above, after-hours trading has lower volumes, which implies inferior market liquidity in this period. Thus, traders might not be able to carry out their desired deals.

Discover the Tools That Power 500+ Brokerages

Explore our complete ecosystem — from liquidity to CRM to trading infrastructure.

For example, suppose trader X bought asset Y at a favourable price to sell it immediately. Due to reduced liquidity, trader X might not execute the second part of its strategy, leaving him with an asset purchased solely for immediate gains. In this case, trader X will most likely suffer losses, as asset Y will be sold for less during regular trading hours.

Additionally, the prices themselves could be pretty uncertain since traders do not receive an aggregate of the best numbers on the market. Instead, they receive the prices identified by the ECN protocol. So, even if traders identify an excellent opportunity to harness this period for their profits, they may not find the desired price on the market.

Final Takeaways

After-hours trading is an excellent tactic for experienced and knowledgeable traders in any market. This period presents unique opportunities to capitalise on fresh developments in the various industries. Traders acquire or sell stocks at favourable prices before the market can adjust.

However, this trading technique is also risky, as the market has lower volumes in this period, presenting liquidity issues. The utilisation of ECN also causes price uncertainty. Thus, traders must be careful when trading in these hours, as lucrative opportunities might turn into sunk costs in a matter of hours.