What are Commodities, and How Do They Work?

Commodities are a crucial cornerstone of the world economy, providing an effortless way to invest in valuable resources. Through this blog post, we aim to inform new investors about the wonders and complexities of commodities trading. We will explore the definition of commodities, the mechanics of commodity pricing, the diverse array of commodities available today, how to invest in commodities and trade in commodities, and the potential risks and perils of trading and investing in these markets. Armed with this knowledge, you will be better equipped to make well-informed decisions about investment opportunities in these unpredictable markets.

What are Commodities?

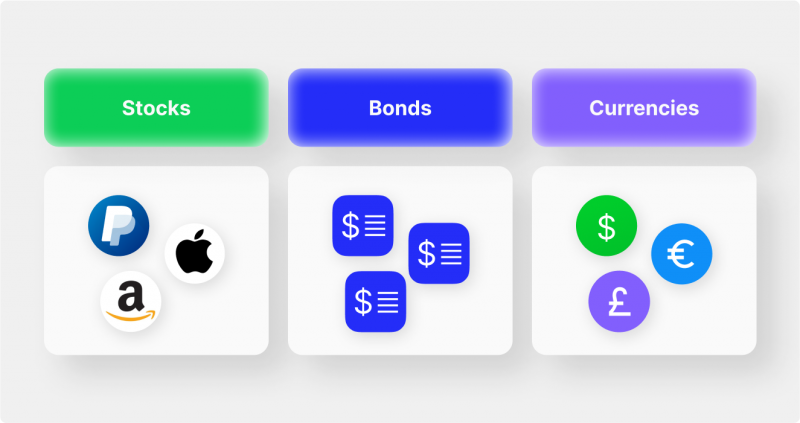

Natural resources like oil, natural gas, precious metals, and many others are vital in trading and investment activities and are known as commodities. While the term “commodities” often evokes images of raw materials or agricultural products, it is much more than that. It also includes currencies and financial instruments such as bonds and stocks.

For individuals engaged in commodities, vigilance in monitoring the ever-evolving global economy is vital, as prices tend to fluctuate in response to worldwide events and circumstances. These goods are typically traded on commodity exchanges, like the New York Mercantile Exchange or the Chicago Mercantile Exchange, where a wide array of buyers and sellers gather to negotiate based on current market values.

So, what determines commodity prices? The interplay of supply and demand is key, with prices soaring when demand spikes or a particular commodity becomes scarce. Moreover, the commodity market is inherently speculative, leading to dramatic price fluctuations due to sudden shifts in supply and demand. Consequently, investors must exercise caution, closely track market conditions, and be willing to accept certain risks to reap profits from their investments.

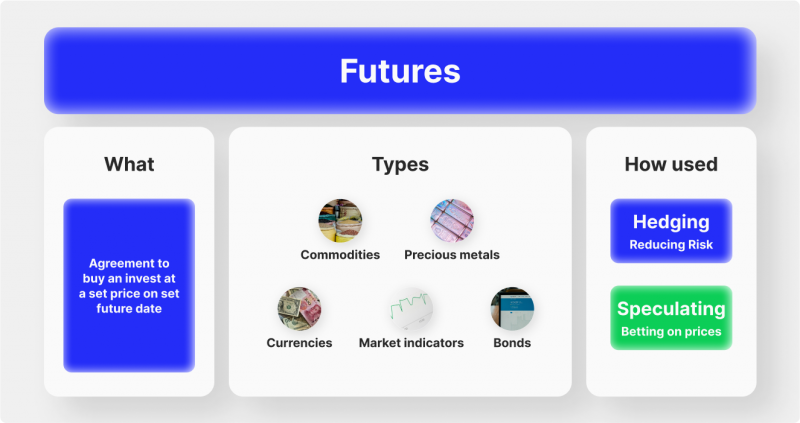

Trading commodities can be done through futures or options contracts, enabling buyers and sellers to settle on a fixed price for a future date. These arrangements shield commodity traders from short-term price volatility while allowing them to capitalize on potential long-term price growth. Additionally, commodities trading affords traders leverage advantage and the prospect of diversifying their portfolios.

Now that we understand how the commodity market works let’s look at the different types of commodities that exist today and their respective uses.

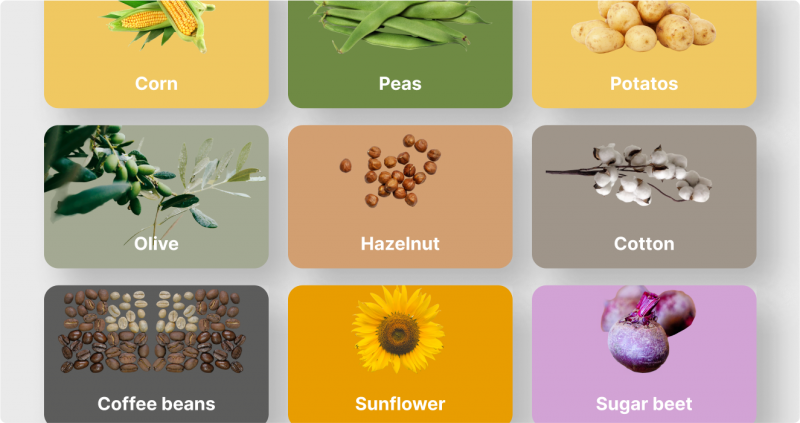

Agricultural Commodities

Agricultural commodities include various goods, from grains and livestock to vegetables and fruits. They are traded globally, with prices impacted by the always-changing supply and demand dynamics. These commodities hold immense importance for food production and other industries, such as biofuel manufacturing and pharmaceuticals.

Energy Commodities

Absolutely vital to modern living, energy commodities like oil and natural gas power our homes, vehicles, and enterprises. They also act as a significant revenue stream for many global producers. Despite their abundance, factors like geopolitical events and market conditions can cause the prices of these commodities to fluctuate considerably. The New York Mercantile Exchange mainly deals in energy, precious metals, and agricultural commodities.

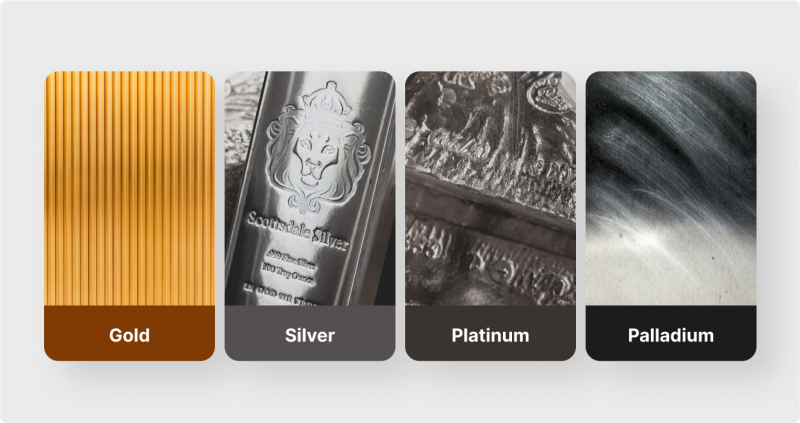

Metals Commodities

Historically used as currencies or the backing of currencies, metals like gold and silver now predominantly serve as investment assets. Their prices also fluctuate in response to global market supply and demand cycles. Investors often turn to metals as a store of value and alternative assets to diversify their portfolios and hedge against potential market turbulence or inflationary pressures. The London Metal Exchange is one of the most actively traded metals exchanges in the world.

Livestock Commodities

Meat, dairy, and other livestock-based products are essential for food production and economy’s health. Prices tend to be influenced by events such as weather or disease outbreaks, with supply and demand dynamics also playing a role. Additionally, food safety regulations and other market forces can significantly impact the prices of these commodities.

Financial Commodities

Encompassing stocks, bonds, and currencies, financial commodities are traded on commodity exchanges or over-the-counter markets, although not physical goods themselves. These instruments allow investors to capitalize on price shifts linked to economic or political developments. However, navigating these markets involves substantial risk, and it’s typically profitable for only seasoned traders with a comprehensive understanding of market dynamics to engage in such investments or trading.

The commodities markets are an ever-evolving and complex space. To better understand how commodities work, let’s take a closer look at the components of the market, various commodities trading styles and strategies, as well as methods used by commodities traders.

Key Takeaways

- A commodity is a basic, interchangeable good or raw material that is typically produced in large quantities by various suppliers.

- Several types of commodities exist, including agricultural products, energy sources, metals, and financial derivatives.

- Investors can access the commodities market through investment instruments such as ETFs, futures contracts, options, and mutual funds.

How Do Commodities Work?

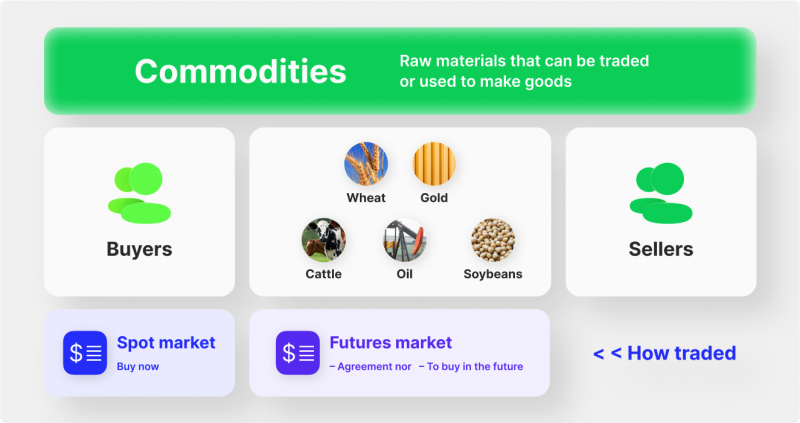

Commodity markets involve buyers and sellers exchanging goods in different forms, including physical delivery or financial contracts. The most common form of commodities trading is done through commodity futures contracts, which are agreements for the future delivery of a commodity at an agreed-upon price. Prices of commodities such as oil, gold, and wheat tend to fluctuate in response to supply and demand factors and global economic influences like political events or market conditions. A trader can buy (go long) or sell (go short) a particular contract to take advantage of potential price movements.

Have a Question About Your Brokerage Setup?

Our team is here to guide you — whether you're starting out or expanding.

Traders also have the option of using leverage when trading commodity markets. This typically involves borrowing financial instruments from brokers or other traders so that they can open larger positions with less capital. Leverage magnifies both gains and losses, thus making it imperative that traders exercise caution when entering into leveraged trades.

In addition to a commodity futures contract, traders can also purchase other derivative products such as options, forwards, and swaps. Options give traders the right to buy or sell a certain asset at a set price within a specific timeframe. Forwards are agreements for the physical delivery of an asset at an agreed-upon price on a future date. Swaps are contracts wherein parties agree to exchange different assets with predetermined payment streams based on their current commodity market prices.

Effect of Supply and Demand on Commodities

Commodity prices are predominantly influenced by supply and demand dynamics. When an asset’s demand increases while its supply remains constant, its price escalates. Conversely, prices generally decrease when an asset’s supply exceeds its demand. Furthermore, market speculation from traders can significantly impact prices. For instance, if traders anticipate an asset’s value to surge in the future due to factors like shifting weather patterns or new regulations, they might accumulate large quantities of it, driving its price up even before the influencing factors come into play.

It’s crucial to recognize that commodity prices are affected not only by supply and demand but also by additional factors such as government policies, technological advancements, and geopolitical events. For example, circumstances in prominent oil-producing countries like Iran or Russia can substantially impact crude oil prices. Similarly, financial crises and debt defaults may influence the value of currencies or bonds. Therefore, traders must consider these broader aspects before executing their trades.

Price Determination

Price determination in the commodities market depends on various factors, such as supply and demand dynamics (as mentioned above), geographic location of buyers and sellers, transportation costs, storage costs, quality, and grade of the commodity being traded. Furthermore, price movements depend largely on technological advancements that make delivering goods from one place to another easier. For instance, more efficient transportation methods may reduce transportation costs, affecting the prices of goods being transported.

Additionally, technology plays a significant role in today’s trading environment. Automated trading systems allow traders to enter orders quickly with minimal human intervention. This algorithmic trading type can significantly impact price movements due to its ability to generate large volumes of orders for specific assets rapidly.

Seasonal Patterns

Seasonal patterns in commodities trading refer to price movements that occur regularly throughout a given year. These patterns are often linked to production cycles and crop harvests. For instance, crop demand tends to increase during the harvest season, causing prices to rise accordingly. Similarly, traders tend to accumulate fuel products like crude oil before winter as temperatures drop, leading to higher prices of these assets. Seasonal patterns provide opportunities for speculators and hedgers alike by enabling them to anticipate potential price movements and plan their trades accordingly.

Seasonal patterns can also be used as a form of market analysis. By studying these patterns, traders can gain insight into how certain assets will perform in different seasons and develop strategies to capitalize on this knowledge. For instance, if a trader knows that the price of soybeans tends to increase during harvest season due to increased demand for their byproducts, they may enter long positions at the start of harvest in anticipation of higher prices. Similarly, seasonal trends provide valuable information to hedgers who use them to protect their portfolios from potential losses caused by volatile commodity prices.

Investing in commodities is an attractive opportunity for those looking to diversify their portfolio and benefit from the potential gains of a lucrative asset class. In this section, we will discuss how investors can gain exposure to the commodities market and how they can use risk management strategies to protect their investments.

Investing in Commodities

By investing in this market, investors can get exposure to numerous product categories, such as agricultural products, energy sources, and metals. In order to do so successfully, however, one must first understand how commodities work and be aware of the various factors that affect prices. Listed below are several reasons to invest in commodities:

Diversification

Investing in commodities allows investors to diversify their portfolios and reduce risk by allocating funds across different asset classes. By spreading out their investments, investors can minimize losses from any single investment sector while capturing other assets’ potential gains. In addition to providing a hedge against market downturns, investing in commodities also allows for greater returns when commodity markets are positive.

Liquidity

Commodities are typically very liquid as they can be traded easily on numerous exchanges worldwide. This benefits short-term traders who require liquidity to enter and exit positions quickly and long-term traders looking to benefit from price movements over time.

Risk Management

Commodities present an excellent opportunity for all to employ risk management techniques like hedging, stop-loss orders, and options contracts. These instruments allow traders to protect their investments from the volatility of the commodities market while still allowing for profit. By effectively utilizing these strategies, even inexperienced traders can capitalize on the opportunities offered by the commodities markets.

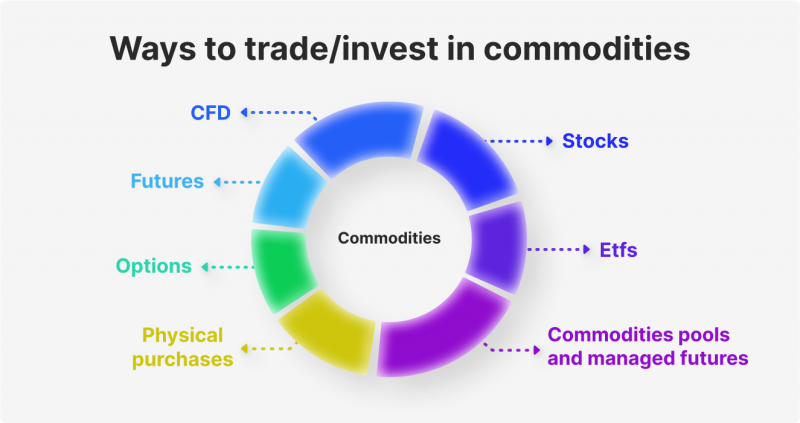

Types of Commodities Investments

The commodities market offers investors the access to multiple financial instruments, such as investing in physical assets, futures contracts, options on futures, or exchange-traded funds (ETFs). Each option comes with its own distinct risks and rewards, so comprehending the differences between these investment types is crucial before making a decision.

Physical Assets

The most widely used method of investing in commodities is purchasing physical assets like gold bars or agricultural products. This approach enables investors to personally manage their investments and profit from any price appreciation of the underlying asset. Although, this strategy can be expensive and necessitates the storage and upkeep of the actual commodity.

Futures Contracts

A futures contract represents an agreement between two parties in which one party commits to buying or selling a commodity at a specific price and time in the future. A futures contract offers investors exposure to commodities without needing to physically possess them, as they can be traded on exchanges like the Chicago Mercantile Exchange (CME).

Options on Futures

Options on futures are financial instruments that allow traders to speculate on commodity movements without actually owning or purchasing any physical assets. These instruments grant investors greater adaptability than futures contracts, as they can be employed for both bullish and bearish tactics.

Exchange-Traded Funds (ETFs)

Exchange-traded funds (ETFs) are investment vehicles that follow an underlying collection of commodities. ETFs afford investors a convenient way to gain exposure to commodities markets while reducing their risks.

Commodity trading is another favored approach for investors to take advantage of price shifts and diversify their portfolios. In the subsequent section, we’ll examine what it takes to succeed in commodity trading.

How to Trade Commodities

Venturing into commodity trading can be rewarding, but comprehending how the markets function is crucial before diving into this trading sphere. Here are some essential tips to bear in mind when trading commodities:

Discover the Tools That Power 500+ Brokerages

Explore our complete ecosystem — from liquidity to CRM to trading infrastructure.

Understand Market Conditions

Prior to investing in any commodity, thoroughly research the current market conditions and price movements. Understanding how various commodities are influenced by macroeconomic factors like currency fluctuations and geopolitical events can aid traders in making well-informed decisions.

Establish Goals

Setting goals before entering the market is vital for success. These objectives should encompass both short-term and long-term targets, as well as the level of risk one is prepared to assume.

Employ Risk Management Strategies

To optimize returns and minimize losses, traders should utilize risk management techniques such as stop-loss orders and options contracts to shield their investments from the commodities market’s volatility.

Keep Track of Market Activity

Staying current on the latest news and price movements is essential for any successful trader. By monitoring market activity, traders can remain informed about emerging trends and seize potential opportunities before they vanish.

Leverage Trading Platforms

Modern traders have access to many trading platforms that can assist them in executing trades swiftly and effectively. From mobile apps to desktop software to automatic trading bots, these tools supply investors with the resources required to make real-time, informed decisions.

By adhering to these guidelines, traders can significantly boost their chances of success in the commodities market. With a touch of knowledge, research, and discipline, achieving substantial returns from commodity trading is possible.

Bottom Line

Commodities represent a valuable asset class that can be integrated into an investor’s portfolio. Commodities are always evolving, and it is each individual’s responsibility to fully understand the nature of these markets to achieve a successful trading and investing experience. As a prospective commodity trader, you should carefully weigh all the discussed factors and conduct thorough research before participating in any investment. Knowledge is vital, so make an effort to stay updated on the market, whether daily or weekly, to consistently and proactively manage your positions. Lastly, always continue to learn about emerging strategies, trends, and insights to become an effective investor in this sector.

Recommended articles

Recent news