What are Money Market Funds? Investor Guide

Investing in trust funds and ETF securities offers a wide array of opportunities that differ from common stocks, bonds and Forex markets.

Money market funds offer stability, longevity, and high liquidity, which any investor seeks. They are issued by top-notch institutions and are governed by national financial agencies, making them highly regulated and secure instruments.

So, what are money market funds, and what are their benefits? Let’s explain in this comprehensive guide.

Key Takeaways

- Money market funds (MMFs) are short-term, low-risk instruments managed by money experts.

- MMFs invest in government-based, federal, and corporate securities such as commercial papers, debt notes, and treasuries.

- MMFs maintain a net asset value (NAV) of $1, simplifying portfolio analysis, tracking and profitability.

- Money markets played a significant role in the 2008 financial crisis as many funds owned shares in banks, whose collapse triggered a chain reaction in the money market, leading to a liquidity crisis.

Understanding Money Market Funds

Money market funds are mutual funds that pool investors’ capital and allocate them to high-liquidity, short-term financial instruments. They focus on low-risk, moderate interest-bearing and stable investments like cash markets, government debts and high-credit-rating debt instruments.

Money market mutual funds carry little risk by investing in low-volatility securities, offering long-term money generation far from short-term fluctuations and price speculations.

They are often confused with money market accounts, which are savings accounts and bank-based investments that offer a stable interest rate.

Unlike these savings accounts, money funds are not governed by the Federal Deposit Insurance Corporation (FDIC). Instead, they are regulated by the SEC and ensured by the Securities Investor Protection Corporation (SIPC).

Market Overview

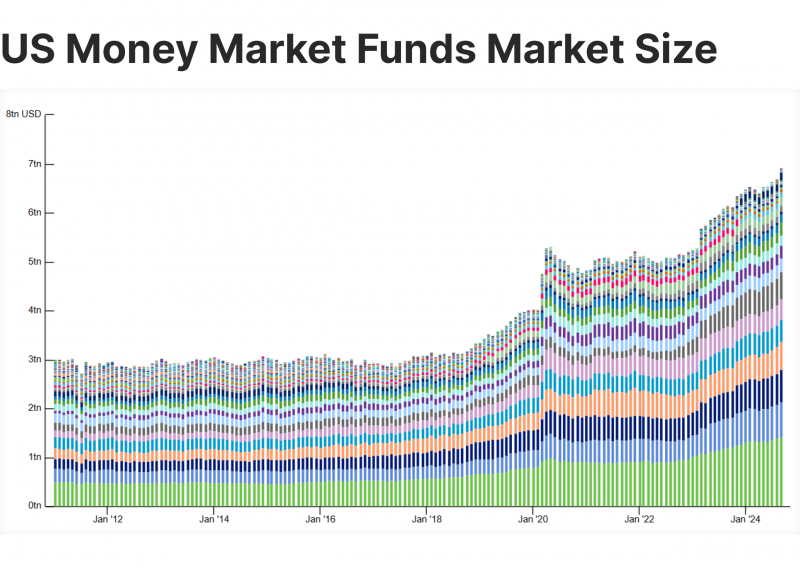

Money market funds (MMFs) were created in the early 1970s and gained popularity in the United States because they offered faster access to money pools that provide higher returns than those of banks.

Initially, these markets only included governmental bonds. However, commercial papers quickly entered and became more in demand because they offered higher yields and various risk characteristics.

In 2008, the MMF market played a major role in the financial crisis, as many funds held debt notes from commercial and investment banks, whose collapse affected the entire money market.

When the Lehman Brothers investment bank faced bankruptcy, the MMF “Reserve Primary Fund” lost value, causing panic in the market as stakeholders rushed to pull out their investments. This caused a liquidity crisis, affecting interconnected institutions and banks, causing money shortages and exacerbating the economic recession.

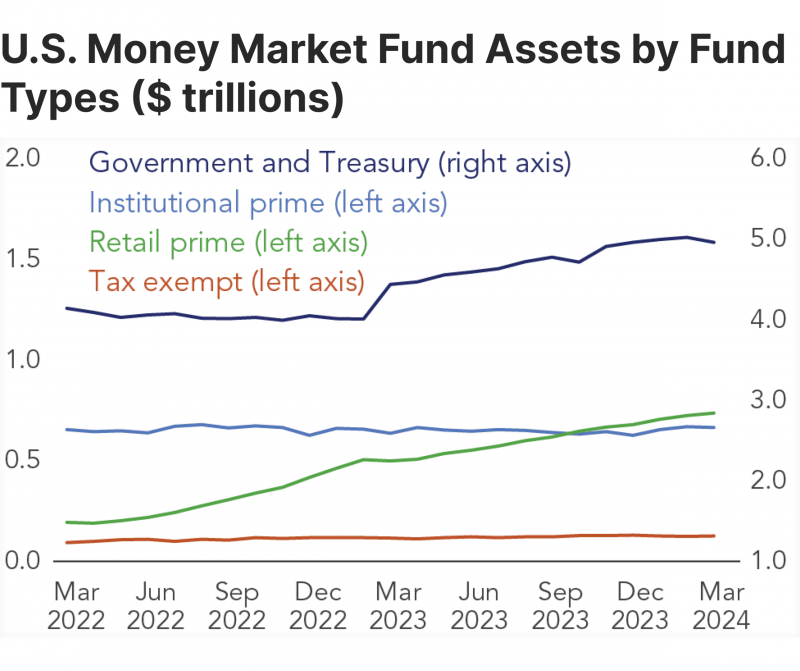

Today, the MMF is one of the largest and fastest-growing sectors in the US. In 2024, the market was just shy of $7 trillion by Q4, with key players like Fidelity, JP Morgan and Vanguard money market funds.

During the first quarter of 2024, the market inflow was estimated at over $90 billion, with retail and government funds leading most of the net flow.

Processes and Key Aspects

MMFs work like a typical mutual fund, pooling investor’s capital for a collection of stocks, units and various financial instruments. These baskets reflect real-time market dynamics and price changes and enable traders to change their shares or withdraw according to given rules.

Most money funds are invested in four main categories:

- US Treasuries: Short-term debts issued by the government.

- Commercial Paper: Company’s short-term unsecured debt notes.

- Certificate of Deposit: Short-term bank-based savings certificate.

- Repurchase Agreement: Repurchased government securities.

- Banker’s Acceptance: short-term debt instruments guaranteed by commercial banks.

Returns on these assets depend on market and economic conditions, including interest rates, government investments and consumer trusts.

MMFs are excellent alternatives to common investments like ETFs, high-yield savings and government/corporate bonds. However, they have two distinctive characteristics.

The Net-Asset Value Standard

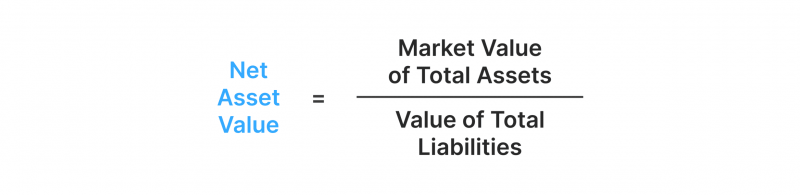

A money market fund must maintain its net value asset (NAV) at $1 to underline stability and simplify performance analysis. When the fund exceeds $1, earnings are distributed to shareholders as dividends. On the other hand, if the NAV is below $1, the issuing company may seek external investments or governmental support to maintain its value.

This peg simplifies tracking and portfolio analysis. Despite the lack of price valuation, shareholders earn from underlying assets (savings – bonds – stocks) yields receivables, coupon payments and dividends.

Have a Question About Your Brokerage Setup?

Our team is here to guide you — whether you're starting out or expanding.

Breaking The Buck

Breaking the buck happens when the portfolio’s NAV drops below $1. This means that the liability (taxes, losses and overheads) exceeds its revenue (trading gains, dividends and yields).

The money mutual fund may decrease due to market dynamics and underlying securities’ underperformance. In such instances, the money manager undertakes various investment and trading decisions to regain the net value. Additionally, regulators may intervene with subsidiaries or liquidations to maintain the market and avoid an economic collapse.

However, if NAV continues breaking the buck, investors switch to other instruments. This situation may be aggravated if a domino effect occurs, many shareholders sell their holdings, and the issuer lacks liquidity to pay back.

Benefits of Investing Money Market Mutual Funds

Investing in MMFs offers stability and liquidity, allowing you to generate stable income with less hassle, especially since the money market funds rates are usually higher than classic savings and money accounts. Here’s what you can expect.

Portfolio Diversification

MMFs allow you to improve your portfolio balance with short-term instruments that carry little risk and moderate income-generating possibilities.

These instruments pool investors’ capital in a combination of assets, reducing the risk of relying on a single stock or security and minimising the exposure risk.

Stable Net Asset Value

Money market mutual funds maintain a NAV of $1, making it easier to track your investment and analyse portfolio performance and market action. This approach helps preserve value and minimise price volatility.

Additionally, they are insured by the SIPC, which provides a safety net in case of insolvency or broker’s bankruptcy.

High Interest Rates

These money funds combine multiple short-term, high-interest government, treasury bills and corporate notes, offering higher interest rates than bank-based savings and high-yield checking accounts.

High Liquidity

The US market capitalisation reached almost $7 trillion in September 2024, making it a volume-dense and active market. Therefore, participants can quickly acquire shares, withdraw funds or access cash.

Low Risks

These funds invest in high-rated instruments, including government and commercial papers, which are highly regulated and carry little default risks.

Additionally, fixing the fund’s net value to $1 underlines stability and ensures that money market fund managers only make decisions that benefit shareholders.

Money Market Fund vs Money Market Account

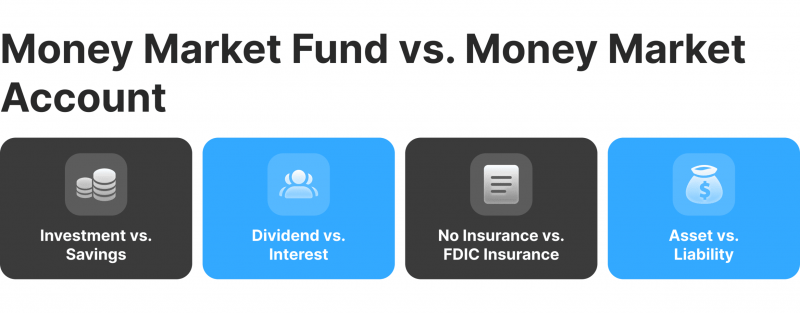

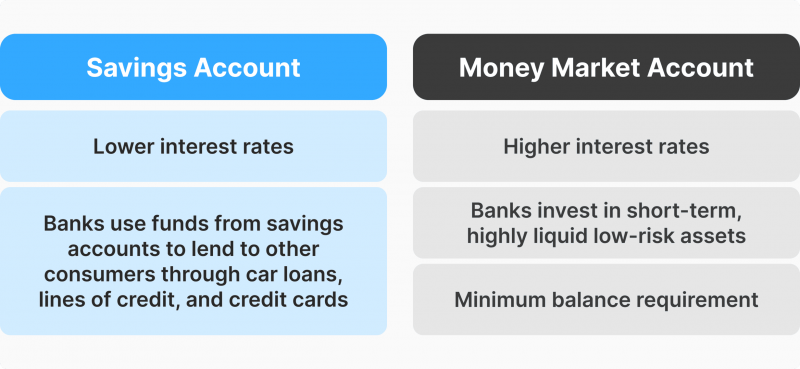

MMFs and MMAs can be similar in terms of low-risk characteristics and almost stability. However, they differ in various areas.

Money market accounts are bank-backed securities, including term savings, saving accounts and interest-bearing checking accounts. They are ensured by the FDIC, making them highly secure instruments for fixed-income generation. However, they provide low-to-medium interest payments.

On the other hand, money funds are short-term instruments that stem from government and corporate debt notes and certificates of deposits. They offer higher yields than money accounts and are fixed to $1 NAV to ensure profitability. MMF shareholders earn from the underlying assets’ high interest rates and dividends.

Money market deposit accounts are more regulated and insured, offering higher security, while MMFs are similarly regulated and can fluctuate but provide higher returns.

Money Market Funds vs High-Yield Savings

High-yield savings accounts are typical banking instruments that allow users to deposit and lock their money for a predetermined period of time for a given interest rate. They are well-ensured by governmental and banking institutions and offer sufficient returns.

However, they limit withdrawals and can be affected by economic factors like inflation, which, in some cases, offsets the accumulated interest.

Money funds are also insured against insolvency. Moreover, they cope with market fluctuations without going below the fixed NAV, allowing shareholders to earn from interests and dividend distributions.

As such, the main difference is the investment term, as money funds are short-term instruments and offer higher returns, while high-yield saving accounts can extend to one or more years at fixed rates.

Money Market Types

MMFs offer diversified investments in various short-term instruments, including corporate certificates and government bonds. However, their maturity dates, underlying assets and income-generating models vary widely. Let’s revise these types of mutual funds.

Prime Funds

A prime money fund, also known as a taxable money market fund, invests in corporate and government securities and debt notes with floating rates. This flexibility may offer higher yields per share, which are subject to applicable taxes.

Treasury Funds

These markets invest mainly in US treasury security, such as bills, notes and bonds, offering high insurance and credit guarantees by the government. Therefore, they are highly liquid and considered highly safe from insolvency and default risks.

However, their returns can be moderate due to the type of associated securities, allowing investors to earn savings-like returns that are safe and sustainable.

Government Funds

These funds focus the vast majority of its total assets on government debts, repurchase agreements, and cash markets that are entirely collateralised with cash or non-cash government securities.

These funds may also include treasury funds and US treasury-issued debt notes, like treasury bonds, T-bills, and treasury notes. This sector is the largest and most profit-generating category in the market, reaching $5 trillion in Q1 2024.

Tax-Exempts

Also known as “Minus” or “Municipal” funds, they offer interest-bearing returns that are free from US Fed tax or state-specific taxes. Due to their nature, state funds are exempt from the federal income tax for residents of that specific state.

Some examples include municipal bonds, debt securities and state bonds. They attract institutional capital on the higher end of the minimum investment amount. Therefore, they have limited payouts, offering tax benefits for investors in high tax brackets.

Institutional Funds

Retail money market funds suit multinational corporations and institutional investors, such as hedge funds, pension funds and government entities, because they have high investment requirements.

Institutional money market funds offer a floating NAV that fluctuates with the market value of the underlying securities, offering real-time price tracking. They invest in a combination of commercial papers, certificates of deposit, and high-grade short-term instruments.

Therefore, these funds provide stability and longevity with high liquidity, offering an excellent option for financial institutions to manage cash reserves and earn competitive returns.

Regulations and Governance

The MMF markets are regulated by the SEC, which defines the rules and regulations, allows investments, and specifies instruments’ characteristics and other specifications, ensuring stability, liquidity, and transparency.

Discover the Tools That Power 500+ Brokerages

Explore our complete ecosystem — from liquidity to CRM to trading infrastructure.

In 2008, after the financial collapse of banks and financial institutions, the SEC introduced new regulations to manage these markets better. These reforms include the following:

- Liquidity requirements: MMFs must hold at least 10% daily liquid assets and 30% weekly liquid assets to satisfy withdrawals.

- Reduced maturity: The maturity dates of these instruments were lowered from 90 to 60 days to reduce the interest rate risk.

- Credit standard: Only highly rated, short-term investment-grade assets were allowed, with more restrictions on below AA ratings.

- Transparent reporting: Monthly portfolio holding disclosures, including NAV fluctuations, are required for better transparency.

The Securities Investor Protection Corporation plays an insurance role in these markets to safeguard investors if brokers default and fail to meet redemption demands.

It helps recover cash or securities up to $500,000 per customer’s account, including up to $250,000 in cash. However, it does not protect investors when they lose money from natural market dynamics or NAV fluctuations.

Top Money Market Funds

Top financial institutions and brokerage firms offer investments in these money markets, including some of the highest-yielding money market funds. Therefore, you must research, find the instruments that suit you, analyse the associated risks and assets, and buy some shares.

Charles Schwab Money Market Funds

Charles Schwab provides a variety of low-cost ratios and secure instruments like US T-bills, notes, and government-based securities. It integrates low fees and flexible account management for all users.

These offers ensure stability, low risk and moderate yield for conservative investors. It also offers prime money market funds for higher interest rates, including high-quality corporate debt notes, certificates of deposit, and commercial papers, attracting those who prefer higher returns at an elevated risk.

Vanguard Money Market Funds

Vanguard offers high-quality MMF instruments focusing on stability and maximum yields, including Federal funds that entail low risk and high liquidity. It provides investments in prime funds, combining high-grade corporate bonds, commercial papers, and certificates of deposit.

These offerings ensure cost efficiency and strict portfolio management, making it a perfect balance between income generation and high security.

Fidelity Money Market Funds

Fidelity provides a broad range of flexible and benefit-rich MMFs. It offers government money market funds and treasury funds like US treasuries and agency securities for maximum security and liquidity.

Its offerings include commercial papers, corporate debt notes and certificates of deposit, as well as tax-exempt money fund instruments and municipal bonds that offer tax benefits.

Conclusion

Money market funds invest in short-term, high-rated securities that include cash, non-cash securities, government and corporate instruments. These are highly sophisticated markets with a valuation near $7 trillion, involving significant money pools from wealthy investors, governments, and multi-million dollar corporations.

They offer a combination of assets that suit different risk profiles, diversified yield preferences and multiple high-class instruments. Professional and institutional investors utilise these markets to optimise their portfolio balance and tap into highly secured assets.

FAQ

What are money market funds?

MMFs are money pools invested in short-term, low-risk instruments like bonds, debt notes and other mutual funds. They offer diversified risk characteristics at a relatively high rate of return.

Is investing in money market funds a good idea?

Yes. MMFs suit investors who want to balance their investment portfolios and explore low-risk options that generate adequate returns.

Are money markets good for beginners?

Yes. Despite their difference from traditional stocks, currencies and commodities. Money market instruments are high-quality, short-term money pools managed by financial experts. They incorporate a fixed net asset value to simplify share ownership for new traders.

What is the best money market fund provider?

Vanguard offers some of the best money market funds that integrate low risk and low cost at a high interest rate ranging around 5%.