What is a VASP License? How to Apply for it?

Articles

Working with crypto assets is becoming increasingly common among technology and financial companies. After being deemed a risky asset, cryptocurrencies have become a competitive advantage for growing a successful business.

However, with this facilitated access, more regulations are coming into force to set the rules of the game and ensure economic integration and investor protection. Just like the Forex trading license that brokers must acquire, the VASP license is essential to provide financial services involving blockchain-based currencies.

So, what is a VASP license? Are there any benefits to acquiring it? Let’s explore.

Key Takeaways

- The VASP license allows businesses to offer crypto services legally in different jurisdictions.

- Decentralised exchanges, blockchain wallets and crypto brokerage firms must obtain a VASP license to operate legally.

- Applying for a VASP permit requires thorough documentation, regulatory compliance, financing and auditing preparation.

Understanding the VASP License

The Virtual Asset Service Provider License is a financial permit for service providers who offer payment, monetary and custodial services using cryptocurrencies and other blockchain-based coins.

Cryptocurrencies have become an integral part of the global payment and financial industry. Nowadays, many companies accept Bitcoin payments and use crypto wallets to accommodate recent trends and deliver an exceptional customer experience.

Moreover, the adoption of Bitcoin trading and Ethereum ETF instruments by the US financial regulator facilitated the inflow of many investors exposed to crypto market dynamics. This increased exposure comes with distinct manipulation risk and scam activities.

Therefore, to avoid compromising financial security, regulators around the world started implementing the VASP requirements to safeguard their investors and promote the healthy growth of digital assets.

Who Needs a VASP?

A VASP license approves that a particular crypto service provider is legitimate and follows the set rules. However, not every electronic financial service requires a VASP. For example, digital money wallets and consultant services that are not directly involved in trading and exchanging cryptos can go by without obtaining a VASP permit.

However, you definitely need a virtual asset license if you are:

- A crypto exchange offering spot and CFD coin trade/sale.

- Offering decentralised wallets to store crypto and digital assets.

- Conducting an initial coin offering (ICO) for a new token/coin.

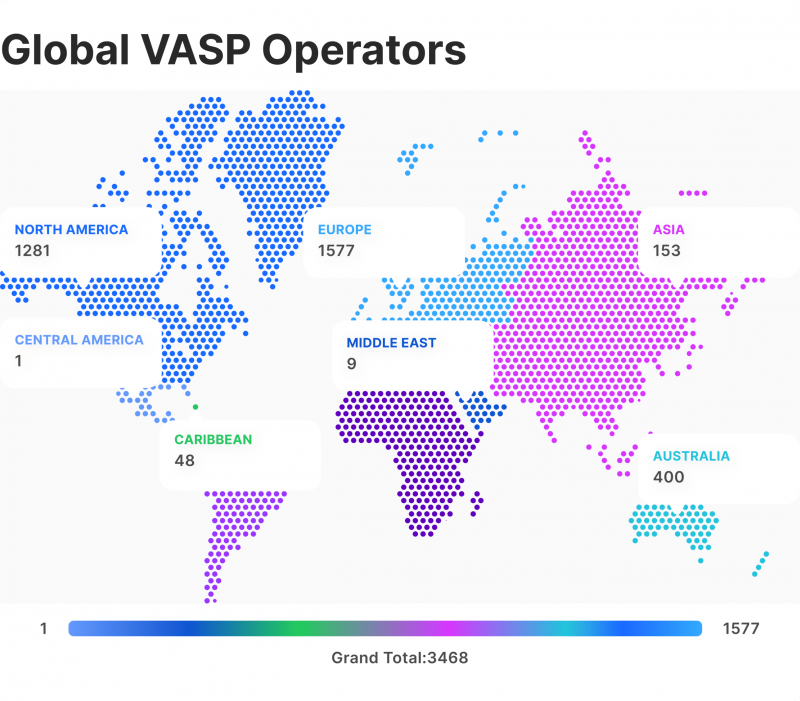

Europe has the highest number of registered VASPs, with over 1,500 operators in 2023, followed by North America, with 1,200+ companies.

VASP License Requirements

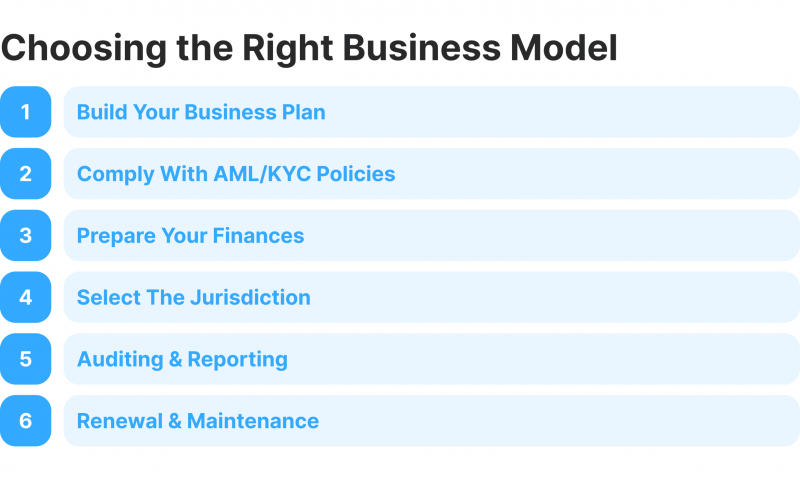

The VASP crypto license conditions and regulatory requirements differ between countries. Therefore, it is crucial to familiarise yourself with local laws and inquire about the VASP license price and guidelines. However, there is a general practice for VASP applications that can be applicable in your jurisdiction.

Firstly, you need to craft a business plan, including your business type and the service you are offering in relation to virtual assets. You must also state your marketing strategy, target audience, financial capital, and profit and loss projections.

After incorporating your business in the local registry, you must fill in a formal VASP application form and sign it by the owner or shareholder(s).

You might be required to submit a background check and professional record of board members, top managers and owner(s) to verify business reputation and avoid registering financial criminals.

Legal compliance papers must be prepared and submitted according to local laws, ensuring anti-money laundering and financial activities.

Applying for The VASP Crypto License

Getting a VASP license can boost your chances of attracting more users and growing a successful business while dealing with cryptocurrencies, such as exchange platforms, crypto/fiat on/off-ramp converters and crypto token swaps. Here’s how you can apply for a VASP license.

Develop Your Business Model

Determining the objective of your crypto business is essential as it decides the initial capital requirements and other financial insurance schemes that you must adhere to.

The VASP is applicable if you are launching a crypto exchange platform, crypto wallet storage or a spot/CFD crypto brokerage. The organisation structure, duties and responsibilities must be clearly defined in your business plan and submitted to the VASP licenses issuer.

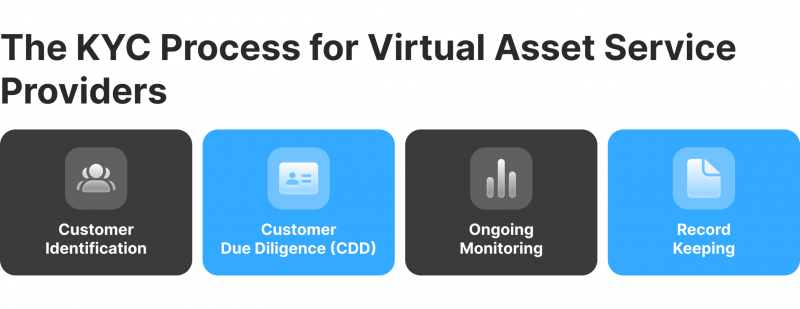

Create AML and KYC Compliance Protocol

The Know Your Client and Anti-Monetary Laundering are standard protocols for financial service providers, whether with crypto or traditional payments. Thus, you must demonstrate adequate KYC procedures to collect and analyse user information, ensuring no financial criminals and blacklisted personnel register on your platform.

Additionally, the AML policies require setting transaction standards that analyse outgoing and incoming payments and track any anomalies. The AML strategy would also include a mitigation plan and course of action.

Prepare Your Finances

Obtaining a VASP license requires a financial commitment, and different jurisdictions have their own investment requirements that applicants must showcase before issuing the permit.

Proof of funds must be submitted according to the local regulatory framework. For example, in Spain, you must prove to have 40,000 Eur in your bank account, while in Estonia, it goes up to 100,000 Eur.

Additionally, you must prepare financial documents to demonstrate your projected performance. This includes financial statements to verify your economic health and accuracy, capital rations to assess your capabilities and liquidity levels to ensure your ability to meet cashflow obligations.

Jurisdiction Selection

Choosing your VASP jurisdiction depends on your location, target market and licensing procedures. As mentioned earlier, each virtual asset regulatory authority has different requirements, assessment protocols and VASP license costs.

Therefore, you may choose a VASP issuer based on your business needs or the processing speed, complexity and predictability of outcomes.

Auditing and Reporting Requirements

Becoming a licensed VASP company entails having a sophisticated in-house auditing and reporting mechanism. This includes internal auditing, financial ratio analysis, system assessment and quality assurance.

These protocols help you keep up with market dynamics, continuously improve your offerings and comply with applicable laws.

Renewal and Maintenance

Regulated VASPs are subject to crypto and digital asset laws, which can change according to market conditions and policymakers. We saw the recent introduction of MiCA in Europe, the restructuring of stablecoins creation and minting, and the adoption of crypto ETFs in the US.

These changing dynamics mean that virtual asset service providers must keep track of market developments and law changes and adapt promptly.

Where Can You Apply For The VASP License?

Each jurisdiction has unique application requirements and prelims. For example, The Central Bank of Ireland conducts pre-registration meetings with applicants to testify and verify certain information, while in Austria, the application process is fully automated on an online portal.

Nevertheless, some third-party intermediaries offer legal services to register and obtain your VASP license. Be careful of these operators, as some do not operate legally, while reliable ones can significantly help incorporate and register your crypto business.

Conclusion

The VASP license is a legal requirement for businesses offering crypto services, including coin exchanges, brokerage services, and Web3 wallet storage. Acquiring a virtual asset service provider permit can boost your potential, allowing you to attract more investors, capitalise on growing market opportunities and improve your financial position.

However, VASP licensing is unique to each jurisdiction, and becoming a legal crypto provider is different across European regulatory authorities and between other regions in America and Asia.