What is Fixed Income? How to Invest in It?

Fixed-income assets attract investors who seek steady, predictable returns. These investments offer regular interest payments over a set period, making them ideal for reducing risk and generating consistent income.

So, what is fixed income as an asset class? This article will help you understand the concept.

Key Takeaways

- Fixed income assets are attractive for investors looking for capital preservation and predictable returns.

- Government, corporate, and municipal bonds are examples of fixed income asset categories, each with a unique risk profile.

- Even while fixed income investment provides security, investors should be mindful of the risks that could affect returns, such as inflation and credit risk.

What is Fixed Income?

A form of debt investment known as “fixed income” takes place when an investor lends money to a borrower—usually a government agency or business—in return for consistent interest payments. Bonds are a typical fixed income instrument. Investing in them is basically purchasing debt that the bond issuer has issued. Depending on the issuer, these could be corporate or government bonds.

For the duration of the bond, the investor will receive coupon payments, which are regular interest payments. For investors, these payments offer a consistent source of income. The issuer reimburses the initial investment principal when the bond matures. Because of this, fixed income investing appeals to people seeking steady, dependable returns.

Bonds and other fixed income securities differ from growth-oriented investments in that they prioritise interest-based income generation over capital gains.

Compared with higher-risk investments, fixed income investments frequently appeal to people looking to preserve capital and provide steady returns. Credit risk, interest rate risk, and other variables differ throughout fixed income product types, including municipal, investment-grade, and government bonds.

Investors can build a well-balanced investment portfolio that meets their objectives by solidly understanding fixed income.

How It Works

Let’s say you purchase a corporate bond from a sizable, respectable business to further clarify the concept. This bond has a $1,000 face value, a 4% coupon rate, and a 10-year maturity.

- Face value is the sum that you will get when the bond expires.

- The annual interest rate you will get on your investment is known as the coupon rate.

- The bond’s maturity is the time until the principal is paid back.

This is how it works:

Interest Payment Per Year: $40 is 4% of $1,000. For ten years, you will receive forty dollars annually.

Maturity Payment: The $1,000 face value of the bond will be paid to you after ten years.

Have a Question About Your Brokerage Setup?

Our team is here to guide you — whether you're starting out or expanding.

So, the total refund is:

$40 per year * 10 years = $400 is the interest earned.

Repayment of Principal: $1,000

$400 + $1,000 = $1,400 is the total return.

By purchasing this bond, you have guaranteed a return on your initial investment and a set income stream for ten years. This is a typical tactic investors use for steady, predictable returns, particularly during volatile market periods.

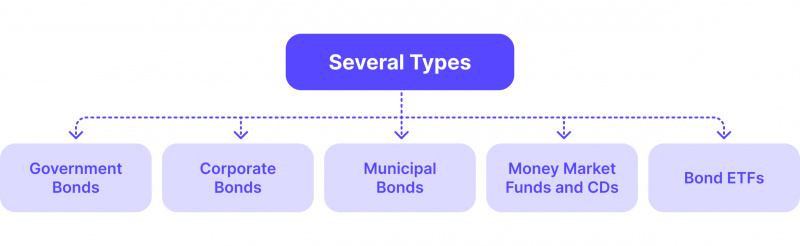

Types of Fixed Income

Now, after understanding the mechanics of fixed income, let’s discuss its types.

Government Bonds

Treasury bonds, notes, and bills issued by the federal government are government bonds. They are supported by the government’s full faith and credit and are renowned for offering stability. Investors frequently regard these as a low-risk choice, particularly when the market is volatile.

Corporate Bonds

Businesses issue them to raise money. They fall into the high-yield (junk) or investment-grade bond categories. Investment-grade bonds often have lower interest rates and a lower default risk. On the other hand, because of their increased credit risk, high-yield bonds are riskier but have higher potential yields.

Municipal Bonds

Issued by municipalities or local governments, they are appealing to investors looking for tax-efficient solutions because they frequently have tax-exempt status. They offer a consistent revenue stream with fewer tax ramifications and finance public initiatives.

Money Market Funds and Certificates of Deposit (CDs)

They are both regarded as secure investment options. Money market funds invest in short-term debt instruments, whereas certificates of deposit (CDs) pay interest over a certain period of time. They are appropriate for risk-averse investors seeking reliable solutions since they provide predictable returns.

Bond ETFs

Diversification and flexibility in investment are made possible by exchange-traded funds (ETFs) that concentrate on bonds. They expose investors to a range of instruments, facilitating portfolio management and allowing them to react to shifting market conditions. Bond ETFs can include a variety of corporate, municipal, and government bonds and track different indices.

Over time, fixed income product has changed dramatically, moving from conventional corporate and government bonds to cutting-edge products like junk bonds and mortgage-backed securities, giving investors a wide range of income-generating possibilities.

How to Invest in Fixed Income

A steady income stream and capital preservation are two benefits of investing. Below, we discuss some strategies and tips for successfully handling this process.

1. Direct Bond Investments

When investing directly in bonds, you can choose particular assets depending on their maturity and creditworthiness. Here’s how to go about it:

- Make a decision: To begin, decide the kinds of bonds you wish to purchase, such as corporate, municipal, or government bonds. Each has a unique profile of risk and reward. U.S. Treasury bonds, for example, are generally low risk, whereas high-yield ones are riskier but have larger potential rewards.

- Evaluate the quality of credit: To assess their creditworthiness, use credit rating agencies. The issuer’s ability to repay is indicated by ratings from organisations such as S&P or Moody’s. While non-investment grade (junk) bonds have higher returns but are riskier, investment-grade bonds are often safer.

- Examine maturity dates: Find out when the bonds you think about will mature. Bonds with shorter maturities are typically less susceptible to fluctuations in interest rates. In contrast, those with longer maturities may have higher yields and be more susceptible to interest rate fluctuations.

- Make your purchase: You can purchase the bonds using a brokerage account after you’ve made your selection. Bond prices are subject to change depending on the state of the market, so keep an eye on them. Keep an eye out for chances to buy bonds at a favourable price.

2. Bond Mutual Funds and ETFs

ETFs and bond mutual funds are good options if you want a more diversified strategy for income investing:

- Know the Structure: Bond mutual funds buy various assets by pooling the funds of several investors. ETFs function similarly to stocks, but they trade on stock exchanges. Both alternatives offer exposure to a wide variety of bonds.

- Assess the Performance of the Fund: Examine the management, fees, and past performance of the fund. Seek out funds that fit your risk tolerance and investing objectives.

- Choose Bond Funds: Select from various bond fund options, including corporate, municipal, and government bond funds. Each category offers customised exposure by concentrating on particular assets.

- Invest Through a Brokerage: A brokerage account can be used to purchase bond mutual funds or ETFs. Keep an eye out for advantageous entry points in the market. Putting money into these funds can lower the risk of individual bonds and provide diversification.

3. Strategies for Building a Portfolio

It takes careful preparation to build a balanced portfolio:

- Determine Your Tolerance for Risk: Based on your age, investment horizon, and financial objectives, ascertain your level of risk tolerance. While early retirement investors may want more stability, younger investors may prioritise growth.

- Put Bond Laddering into Practice: Investing in bonds with different maturity dates is known as bond laddering. This method can aid in managing interest rate risk by giving access to bonds that mature at various intervals and enabling reinvestment at current rates.

- Examine Yield Curves: The yield curve, which charts bond yields versus maturities, is worth examining. A regular upward-sloping curve indicates higher yields for longer maturities, whereas an inverted curve may indicate economic uncertainty. Make informed investing decisions by using this knowledge.

- Review and Modify Frequently: Make sure your bond portfolio aligns with your investing goals by regularly evaluating it. Rebalance as necessary, particularly if your financial circumstances alter or interest rates rise or fall.

4. Continuous Education and Adaptation

It’s important to stay aware of economic variables that impact bond prices, interest rate fluctuations, and market movements. Making wise investing choices can be aided by having a thorough understanding of the state of the economy.

Discover the Tools That Power 500+ Brokerages

Explore our complete ecosystem — from liquidity to CRM to trading infrastructure.

Contact a financial counsellor if you have questions about your investments or strategies. They can offer customised advice based on your objectives and financial status.

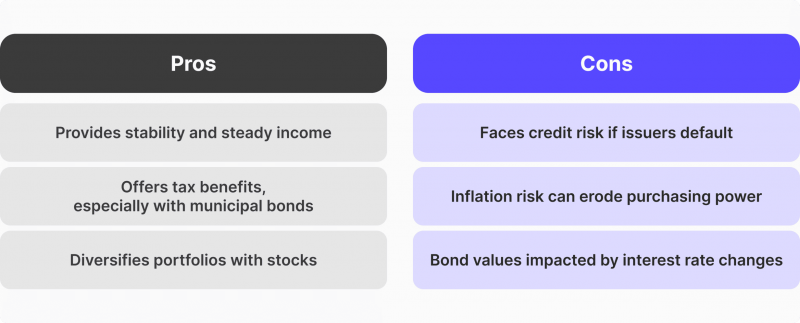

Risks and Benefits Associated

As you’ve seen, Investing has many advantages. It is a well-liked option for risk-averse investors since it offers stability and a steady income source. Tax benefits are a feature of many income instruments, especially municipal bonds, which increase total returns.

In addition, stocks and fixed income instruments usually have an inverse relationship, contributing to portfolio diversification.

There are risks associated with it, though. When the issuer fails to make interest payments, credit risk is created. Inflation risk could reduce purchasing power if returns fall short of price increases. Bond values are impacted by interest rate risk, particularly if rates increase after the purchase. Bond investors must be mindful of these possible drawbacks since market risk includes swings that may affect bond values.

You can choose their bond portfolios more wisely if you know the advantages and disadvantages of investments.

Conclusion

Long-term financial stability can be improved by including fixed income products. This strategy can reduce the downside risk connected with more volatile investments while producing revenue. All things considered, a thoughtful allocation can help achieve overall investing objectives, particularly during unstable markets.