What is MiCA Crypto Regulation and How Does It Affect Businesses?

The crypto industry has long been yearning for an all-encompassing regulatory framework to govern its activities and provide much-needed clarity. That wish has now been granted with landmark MiCA legislation, introduced by the European Union.

This article will explore the MiCA regulation summary, its potential impact on the crypto industry, and what it means for businesses operating within the EU.

Key Takeaways

- MiCA is intended to provide consumer protection, create a harmonised legal framework, and promote innovation in the crypto industry.

- It regulates three types of crypto-assets: EMTs, ARTs, and utility tokens while excluding NFTs, security tokens, and CBDCs.

- The implementation of MiCA in the EU presents both diverse opportunities and a number of challenges for businesses.

History of MiCA

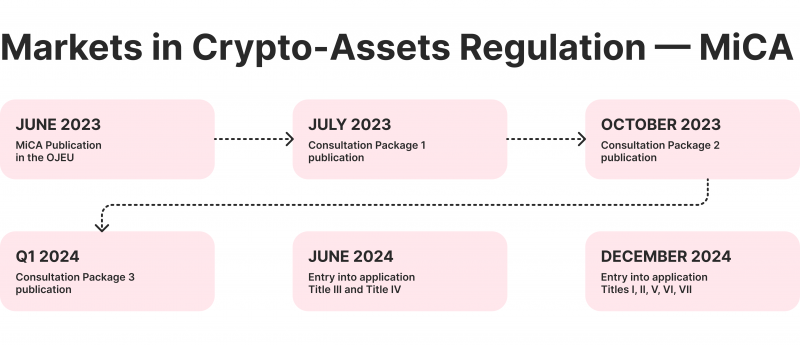

Markets in Crypto Assets (MiCA) was first introduced in 2022 and received overwhelming support from the Economic and Monetary Affairs Committee. The bill was then approved by the full European Parliament before finally entering into force in June 2023 after being signed off by national governments.

MiCA is the first EU-wide regulation specifically targeting the crypto asset market, and its implementation marks a significant milestone in the evolution of digital assets.

ESMA Consultations

While MiCA has already entered into force, many measures are still being developed. The European Securities and Markets Authority (ESMA) works closely with other regulatory bodies, namely the European Banking Authority (EBA), to consult with the broader public. These consultations, released in three packages, incorporate feedback from stakeholders such as investors and blockchain service providers.

The first consultation package was released shortly after MiCA came into effect, followed by two more packages in October 2023 and March 2024. The last package was opened for public feedback until June 25, 2024, allowing stakeholders to voice their opinions and suggestions on the proposed measures.

These EU crypto regulations are implemented in stages. Titles III and IV will be applicable by June 30, 2024, followed by Titles I, II, V, VI, and VII in December 2024. Here is the official MiCA regulation timeline provided by ESMA:

Scope and Objectives of MiCA

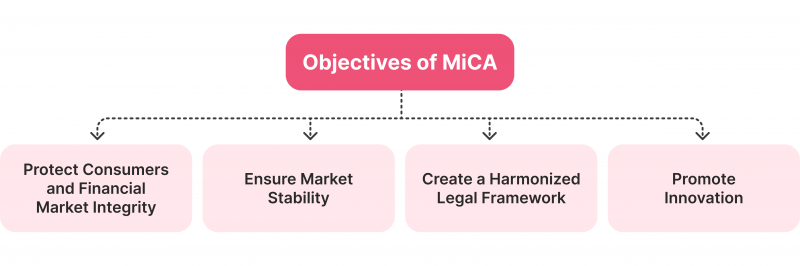

MiCA’s primary focus is governing the activities of two key entities within the crypto ecosystem: crypto asset service providers (CASPs) and crypto asset issuers. By establishing a consistent regulatory framework across all EU member states, MiCA aims to achieve four overarching objectives:

- Protecting Consumers and Financial Market Integrity: MiCA introduces stringent guidelines for digital currency businesses to safeguard investors and maintain the integrity of the financial markets.

- Ensuring Stable Virtual Asset Markets: The regulation seeks to foster a stable and resilient crypto market, mitigating the risks of volatility and potential systemic disruptions.

- Creating a Harmonized Legal Framework: MiCA provides a unified set of rules and guidelines for crypto assets within its scope, eliminating the need for individual member states to implement their own local laws.

- Promoting Innovation: Contrary to the common perception that regulation stifles innovation, MiCA is designed to empower crypto businesses to grow and innovate within clear and transparent guidelines.

Obligations for Crypto Asset Issuers

Under MiCA, entities wishing to issue crypto-assets within the EU must adhere to a set of strict obligations. These include:

Whitepaper Publication

Crypto asset issuers are required to publish a detailed whitepaper outlining the project, its technical specifications, and the associated risks for investors. No marketing communications relating to the cryptocurrency are allowed before the whitepaper is released.

Have a Question About Your Brokerage Setup?

Our team is here to guide you — whether you're starting out or expanding.

Liquidity Reserve

Issuers of EMTs and ARTs must maintain a liquidity reserve at least 1:1 to the value of the crypto assets in circulation, ensuring their ability to redeem tokens on demand.

Operational Requirements

Crypto asset issuers must meet specific operational requirements, such as robust governance structures, risk management frameworks, and disclosure policies, as outlined in the MiCA regulatory text.

Obligations for Crypto Asset Service Providers

Under the MiCA crypto regulation, companies that provide crypto-asset services—including trading platforms, exchanges, and wallets—must secure authorisation to operate within the EU. This entails thorough vetting and adherence to stringent criteria set by regulatory authorities.

Upon receiving authorisation, these providers must comply with new regulations to ensure asset liquidity and enforce robust corporate governance practices. These measures are designed to promote market stability, uphold integrity, and safeguard investors against potential risks associated with these services.

Major providers of crypto assets services are already taking steps to comply with the upcoming regulations. One such example is Binance, the world’s leading cryptocurrency exchange, which recently announced plans to restrict access to unregulated stablecoins for users within the European Economic Area (EEA).

Classification of Crypto Assets under MiCA

One of the fundamental challenges in crypto regulation has been the lack of clear asset classifications. MiCA addresses this by defining three distinct categories of crypto-assets that fall within its purview:

- Electronic Money Tokens (EMTs): E-money tokens whose value is pegged to a single fiat currency, such as the Euro or US Dollar, to maintain stable value (stablecoins).

- Asset Referenced Tokens (ARTs): ARTs are crypto-assets whose value is tied to a basket of underlying assets, including fiat currencies, physical commodities, or even other crypto assets.

- Utility Tokens: This category encompasses cryptocurrencies and tokens that provide access to a platform or enable the achievement of a specific purpose but do not fall under the EMT or ART classifications.

Notably, MiCA excludes certain crypto-related assets, such as non-fungible tokens (NFTs), security tokens, and Central Bank Digital Currencies (CBDCs), from its regulatory scope. This decision reflects the ongoing debate around classifying and treating these emerging asset types.

The targeted approach allows MiCA to focus on the specific crypto asset categories that require a harmonised regulatory framework while leaving the governance of other digital assets to existing or future specialised regulations.

MiCA’s Positive Impact on Crypto Businesses

As with any new regulation, MiCA is expected to offer businesses operating in the European digital currency market diverse opportunities and certain challenges.

More Institutional Participation in Crypto

The stringent regulatory framework put in place by MiCA is expected to attract more institutional investors to the crypto market. This influx of traditional players can provide significant capital and expertise, fostering the industry’s growth and maturity and promoting the wider adoption of digital financial instruments across the EU.

Confidence in Regulatory Policy

Prior to MiCA, the absence of a unified regulatory framework for crypto assets in the EU created an ambiguous and often perplexing environment for businesses. With MiCA’s clear and comprehensive guidelines, companies now have a consistent framework to follow, instilling greater confidence in their operations and decision-making.

Legitimisation of the Crypto Space

One of MiCA’s most profound impacts is the legitimacy it confers on the entire crypto ecosystem. By standardising regulations, MiCA may encourage governments and policymakers to view digital assets more favourably, potentially leading to increased support for the industry and its businesses.

Security for Investors

MiCA’s rigorous disclosure rules, liquidity guarantees, and corporate governance standards offer essential safeguards for crypto investors. This enhanced protection can attract more mainstream market participants, resulting in a more diverse and resilient investor base.

Potential Challenges of MiCA for Businesses

While MiCA offers many advantages to companies in the crypto sphere, it also presents some challenges that companies in the sphere need to take into account:

Increased Compliance Costs

MiCA’s strict obligations could increase operational costs, particularly affecting smaller firms and startups, which may struggle to allocate sufficient resources to meet these stringent obligations. The added financial burden could deter new entrants into the market and stifle the entrepreneurial spirit that drives the industry.

Limits for Privacy-Focused Projects

MiCA’s strict AML and Know Your Customer (KYC) requirements could significantly limit anonymity for certain market players. Companies have to implement detailed identification and verification processes, which might deter privacy-conscious individuals and firms from participating in the EU’s crypto market.

Increased Regulatory Burden for Startups

The complexity of MiCA’s legal requirements could limit competition within the market, particularly for smaller businesses and startups, which may struggle to comply with the extensive legal demands. Regulatory requirements create entry barriers that can disproportionately benefit larger companies with abundant resources, potentially leading to a less dynamic and competitive industry overall.

Discover the Tools That Power 500+ Brokerages

Explore our complete ecosystem — from liquidity to CRM to trading infrastructure.

Debates Around MiCA

While MiCA represents a significant step forward for crypto regulation, there are still a number of unresolved questions remaining.

One of the primary concerns revolves around the core principles of distributed ledger technology, such as decentralisation and peer-to-peer transactions. These fundamental aspects of crypto might clash with the nature of government regulation, which traditionally relies on centralised oversight and control. How regulators will reconcile these differences remains an open question.

Furthermore, the global nature of the crypto industry adds another layer of complexity. Cryptocurrency transactions and platforms operate across borders, making it challenging to enforce regulations uniformly. Different jurisdictions may have varying regulatory approaches, leading to inconsistencies and potential regulatory arbitrage.

Despite all the challenges, MiCA news marks a significant milestone for the crypto industry and sets the stage for establishing broader global transparent regulations.

Closing Thoughts

The adoption of MiCA in the EU has significant implications beyond its borders. As the first regulation of this scale in the digital asset industry, MiCA can serve as a reference for other nations. Its success in standardising crypto assets regulation could inspire global harmonisation, reducing legal fragmentation.

Developing economies and emerging markets may use MiCA as a blueprint for their own regulations, fostering a secure and thriving crypto ecosystem, potentially could pressure countries slow to address crypto regulation, risking their exclusion from the industry’s growth and innovation.