What is SFT and How Does it Differ From NFT?

The blockchain ecosystem continues to evolve, giving rise to new technologies like semi-fungible tokens (SFTs) that expand the potential of digital assets. While non-fungible tokens (NFTs) have made headlines for their uniqueness and cultural impact, SFTs offer a blend of fungibility and individuality, unlocking versatile applications across industries. But what exactly are SFTs, and how do they differ from NFTs?

In this article, we’ll dive into the meaning of SFTs, their advantages, their differences from NFTs and their transformative potential in the tokenised economy.

Key takeaways

- SFTs start as fungible tokens but can evolve into unique NFTs, offering flexibility for dynamic use cases.

- Built on ERC-1155, SFTs reduce gas fees and simplify token management, which is ideal for bulk transactions.

- From gaming and ticketing to virtual assets and loyalty programs, SFTs are revolutionising industries by combining fungibility and individuality.

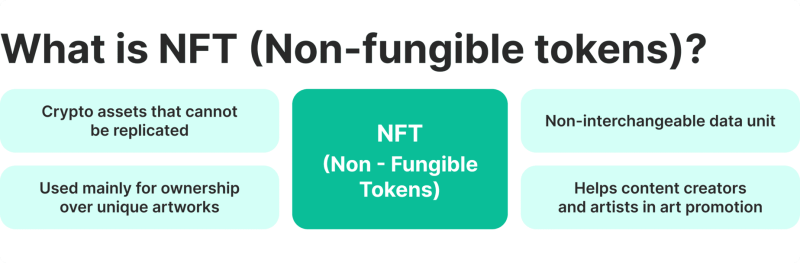

What is an NFT (Non-Fungible Token)?

An NFT (non-fungible token) is a unique digital asset stored on a blockchain that represents ownership or proof of authenticity for a specific item or content. Unlike cryptocurrencies such as Bitcoin or Ethereum, which are fungible (interchangeable and identical in value), NFTs are non-fungible, meaning each one is distinct and cannot be replaced or exchanged on a one-to-one basis. This uniqueness makes NFTs ideal for representing scarce digital items like art, music, videos, virtual real estate, and tweets.

The defining characteristic of NFTs is their uniqueness, achieved through metadata embedded in the blockchain. This metadata contains critical information such as the creator’s details, ownership history, and other attributes that distinguish the token from others.

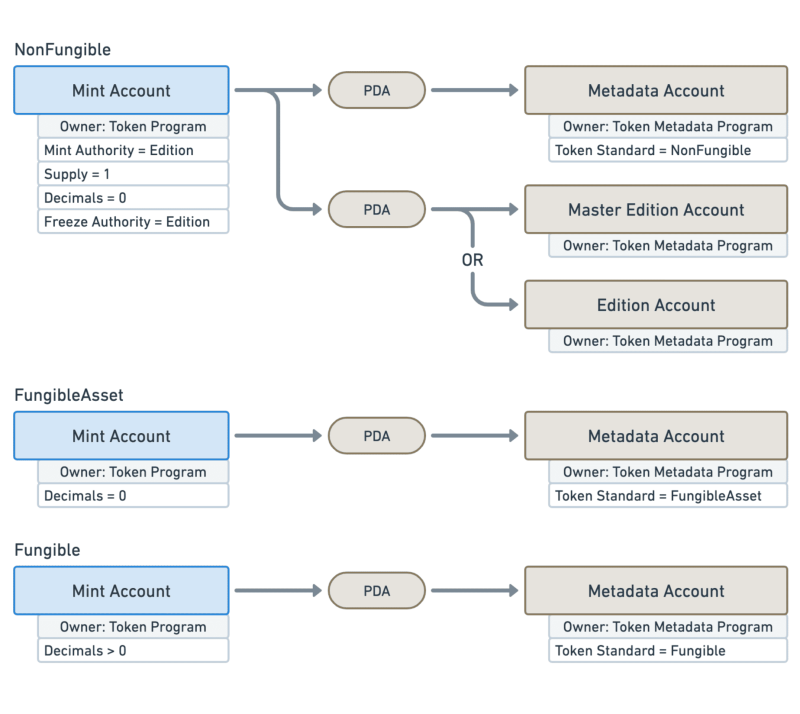

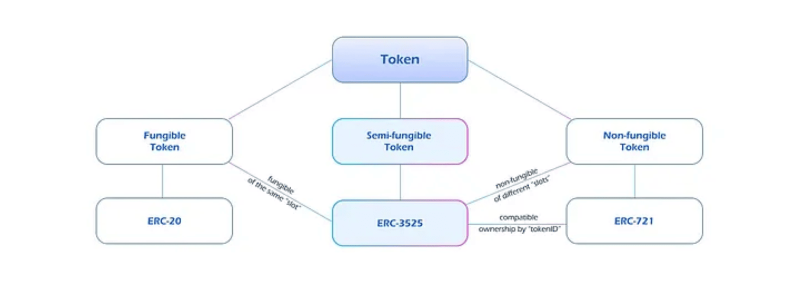

NFTs are often created using blockchain standards like ERC-721 or ERC-1155, primarily on the Ethereum blockchain. These standards ensure that the digital assets are verifiable, secure, and interoperable across various platforms.

Before the advent of NFTs, proving ownership or establishing scarcity in digital formats was nearly impossible, as files could be easily copied and distributed. NFTs solve this problem by linking a digital item to a blockchain, providing undeniable proof of authenticity.

For artists, musicians, and creators, this means a new way to monetise their work and maintain control over royalties, as NFTs can include smart contracts that automate payment terms whenever the token is resold.

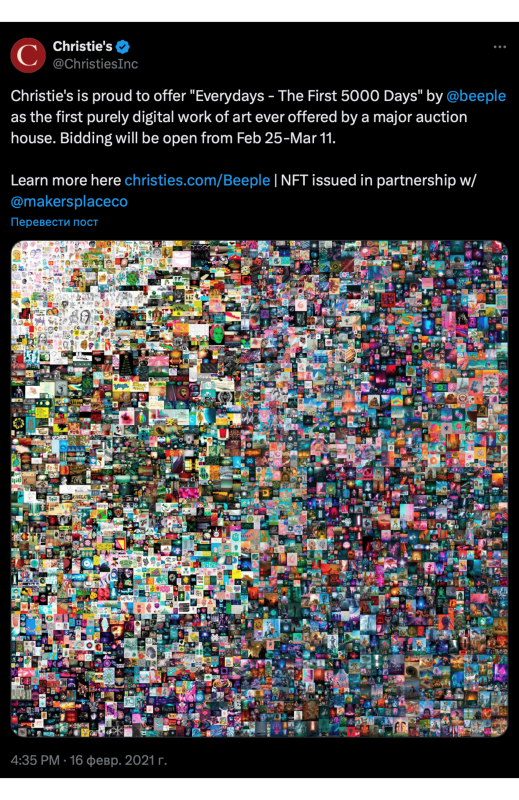

From digital art collections like Beeple’s $69 million “Everydays: The First 5000 Days” to virtual real estate in platforms like Decentraland, NFTs have opened up new economic possibilities. They allow creators to reach global audiences directly, bypassing traditional gatekeepers, while collectors gain access to provably rare and one-of-a-kind digital assets.

Fast Fact

What is an SFT (Semi-Fungible Token)?

A semi-fungible token (SFT) is a unique type of blockchain-based asset that combines the features of both fungible and non-fungible tokens. Initially, an SFT acts like a fungible token, meaning it is interchangeable with other tokens of the same kind and has a uniform value.

However, once a specific condition is met — such as being redeemed, used, or customised — it transforms into an NFT, becoming a unique asset with its own distinct identity.

This dual nature makes SFTs highly versatile and ideal for dynamic applications. For example, in gaming, a virtual item like a sword might be issued as an SFT, where all swords of the same type are identical and tradable. Over time, as a player uses the sword and adds upgrades or achieves milestones, the SFT transitions into a unique NFT that reflects its history and customised attributes.

Similarly, event tickets can be issued as SFTs, where they are interchangeable before the event but become unique collectables afterwards, serving as proof of attendance or memorabilia.

SFTs are typically built using the ERC-1155 token standard, which supports fungible and non-fungible tokens within a single smart contract. This standard is more efficient than traditional NFT standards like ERC-721, particularly for bulk issuance and trading scenarios. It allows developers to reduce transaction costs and simplify token management while maintaining the flexibility to support complex use cases.

The concept of SFTs has opened up new possibilities in industries such as gaming, ticketing, and loyalty programs. By offering the benefits of fungibility and non-fungibility in a single token, SFTs provide greater utility, reduce gas fees, and enhance user experiences.

Whether it’s enabling gamers to trade items seamlessly, creating collectable digital event passes, or facilitating innovative reward systems, SFTs represent a significant evolution in the token economy. As blockchain technology evolves, SFTs will likely play a crucial role in bridging the gap between fungible and non-fungible digital assets.

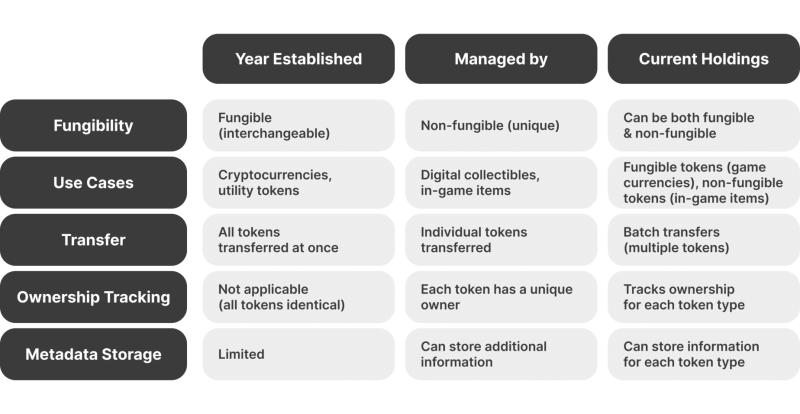

Key Differences Between NFTs and SFTs

While NFTs and SFTs operate on blockchain technology and represent digital assets, their fundamental nature, use cases, and functionality differ significantly. Understanding these differences is essential for identifying the right token type for specific applications.

Nature and Uniqueness

NFTs are inherently unique, meaning no two tokens are the same. Each NFT is linked to specific metadata that makes it one-of-a-kind, whether it represents a digital artwork, a piece of music, or a virtual asset. This uniqueness is the core of their value, as NFTs are not interchangeable one-to-one. For example, a digital painting stored as an NFT is distinct from any other, even if it belongs to the same collection.

Have a Question About Your Brokerage Setup?

Our team is here to guide you — whether you're starting out or expanding.

On the other hand, SFTs begin as fungible tokens. In this phase, multiple tokens of the same type are indistinguishable and interchangeable, much like traditional cryptocurrencies or event tickets. However, when specific conditions are met — such as redemption, use, or modification — the SFT transitions into a unique, non-fungible state, making it distinguishable from others. This dual nature allows SFTs to serve broader purposes, especially in dynamic environments like gaming or event management.

Use Cases

NFTs excel in scenarios where individuality and scarcity are paramount. They are commonly used for digital art, virtual real estate, rare collectables, and intellectual property rights. For example, a collector might purchase an NFT of a famous artwork to prove ownership and display it in a virtual gallery.

SFTs, in contrast, are designed for more flexible applications. They are particularly useful in cases where assets initially share identical properties but later require individual identification. In gaming, for instance, a weapon or item might start as a fungible SFT, allowing players to trade it freely.

Over time, as the item gains experience or upgrades, it evolves into a unique token, reflecting its history and characteristics. Similarly, event tickets can be issued as interchangeable SFTs before an event and converted into unique mementoes afterwards.

Blockchain Standards

NFTs are typically created using standards like ERC-721, tailored for non-fungible tokens. This standard ensures that each token is unique and includes metadata to verify its authenticity.

SFTs, however, leverage the ERC-1155 standard, which supports fungible and non-fungible tokens within a single smart contract. This dual functionality reduces the need for multiple contracts, making ERC-1155 more efficient for applications requiring a mix of token types.

Market Behaviour and Value

In the market, NFTs are valued based on their rarity, uniqueness, and cultural significance. The value of an NFT is often subjective and depends on factors like the creator’s reputation, the story behind the token, and market demand.

SFTs, on the other hand, start with uniform value during their fungible phase. Their market behaviour is similar to that of traditional tokens, where they can be traded in bulk. Their value becomes individualised once they transition to non-fungibility, reflecting their unique attributes or history. This shift offers more versatility and utility compared to NFTs.

Efficiency and Cost

Because SFTs use the ERC-1155 standard, they are generally more efficient regarding gas fees and transaction costs, especially when issuing or managing large numbers of tokens. In contrast, NFTs created using ERC-721 can become costly and inefficient for bulk operations, as each token requires a separate transaction.

Advantages of SFTs

SFTs combine the best features of fungible and non-fungible tokens, offering unique advantages that make them valuable across a wide range of industries. Their hybrid nature allows them to start as interchangeable assets and later become unique, unlocking numerous possibilities and addressing specific challenges faced by traditional token models.

Dual Nature for Versatility

SFTs provide a flexible solution by beginning as fungible tokens and transitioning into non-fungible tokens when required. This dual functionality allows developers to create assets that adapt to evolving use cases, such as event tickets that become collectables or gaming items that gain individuality after usage.

Cost-Effectiveness

SFTs are typically implemented using the ERC-1155 standard, which supports multiple token types in a single smart contract. This reduces the contracts needed, lowering gas fees and overall transaction costs. For projects requiring bulk token issuance, such as games or ticketing platforms, SFTs offer significant cost savings compared to NFTs created with ERC-721.

Efficiency in Bulk Transactions

Unlike NFTs, where each token requires a separate transaction, SFTs can handle multiple assets in one transaction. This bulk-transfer capability is ideal for platforms that need to distribute or manage large numbers of identical items efficiently.

Improved User Experience

SFTs streamline user interaction by offering fungible functionality for common scenarios (e.g., trading identical items) while retaining the option for uniqueness when necessary. This enhances user engagement, as players, collectors, or attendees experience seamless transitions between token states.

Enhanced Market Liquidity

Since SFTs begin as fungible assets, they are easier to trade in bulk, creating more liquidity in the market. Once their purpose changes, their transformation into unique tokens adds a layer of exclusivity, further increasing their value.

Broader Use Cases

By bridging the gap between fungibility and non-fungibility, SFTs can be applied to a wider range of industries than purely fungible or non-fungible tokens.

Applications of SFTs

The versatility of SFTs makes them applicable across a wide range of industries, offering innovative solutions for challenges that require a blend of fungibility and uniqueness. Here’s an exploration of how SFTs are being used and their potential for transforming industries.

Gaming Industry

The gaming sector is one of the most prominent adopters of SFTs. In many games, players acquire items like weapons, skins, or consumables that are identical when issued (fungible phase). As players use or upgrade these items, they transition into unique assets (non-fungible phase), reflecting individual histories, achievements, or customisations.

SFTs also allow for efficient trading of identical items within the game economy, reducing transaction fees and enhancing gameplay dynamics.

Event Ticketing

SFTs solve many challenges in event ticketing. Tickets issued as fungible tokens can be traded easily before the event. Once redeemed, they transform into unique tokens that serve as proof of attendance or digital souvenirs. This approach also minimises counterfeiting, as blockchain records ensure authenticity.

Loyalty Programs and Rewards

SFTs are ideal for loyalty programs where rewards initially need to be interchangeable (fungible phase) but later evolve into personalised incentives or experiences (non-fungible phase). This allows companies to offer customised benefits without managing separate token systems.

Virtual Real Estate and Assets

SFTs can be used for virtual real estate or resources in metaverse environments. Land parcels, for instance, might start as fungible assets during allocation phases. Over time, as users develop their land or add unique features, the SFTs evolve into distinctive NFTs.

Redeemable Vouchers and Coupons

SFTs can be used to issue redeemable vouchers or discount coupons. These tokens are fungible while remaining unredeemed but become unique once used or tied to a specific customer.

Sports and Collectibles

Sports organisations can use SFTs to distribute identical memorabilia, such as player cards or team badges. Over time, these tokens can transition into unique collectables based on player performance or specific match milestones.

Education and Certification

SFTs can streamline digital certification processes. Academic or training institutions could issue interchangeable completion certificates. Once a student graduates or completes a specific course, the certificate transitions into a unique NFT containing their details and achievements.

The Future of SFTs in the Tokenised Economy

The rise of SFTs is poised to transform the tokenised economy by bridging the gap between fungibility and non-fungibility. Their hybrid nature offers unparalleled versatility, enabling innovative use cases across industries.

As blockchain technology evolves and decentralised systems gain traction, SFTs are expected to play a central role in shaping the future of digital assets.

Discover the Tools That Power 500+ Brokerages

Explore our complete ecosystem — from liquidity to CRM to trading infrastructure.

Here’s a detailed exploration of what the future holds for SFTs.

Enhanced Efficiency in Token Management

SFTs use the ERC-1155 standard, enabling multiple token types in one contract. This reduces gas fees, simplifies token issuance, and lowers entry barriers for smaller projects. As blockchain technology scales, SFTs will benefit from reduced costs and faster transactions, further appealing to businesses.

Driving Interoperability and Cross-Platform Use

SFTs enable assets to move seamlessly across blockchain platforms. For example, an SFT issued in one game can be traded or used in another compatible game or metaverse. Emerging interoperable blockchain networks like Polkadot and Cosmos will enhance these cross-platform capabilities.

Expansion of the Metaverse Economy

In the metaverse, SFTs support the evolution of virtual assets like real estate or clothing. These start as fungible tokens for easy trading and later become unique as users personalise or customise them, aligning with the metaverse’s focus on digital identity and ownership.

Advanced Tokenisation Models

SFTs will enable dynamic tokens, fractional ownership, and hybrid asset models. Tokens can evolve based on user engagement, represent fractional shares in real-world assets, or combine physical and digital ownership, such as luxury items transitioning from a batch to unique ownership.

Real-World Asset Integration

SFTs can tokenise real-world assets like real estate or commodities. A property can be issued as fungible shares and later transition into unique ownership certificates. Similarly, precious metals can evolve into unique tokens reflecting serial numbers or provenance.

Regulatory and Compliance Advancements

SFTs are ideal for regulated industries like identity verification or intellectual property. Their adaptability allows compliance with local laws while remaining interoperable globally, making them suitable for supply chains and secure transactions.

Innovation in Creator Economies

Creators can issue SFTs that evolve over time, offering dynamic ownership experiences. For example, an artist can release fungible tokens for an album, which transform into unique collectables tied to events, exclusive content, or personalised merchandise, fostering deeper fan engagement.

Conclusion

SFTs represent a significant step forward in the blockchain and digital asset landscape. By blending fungibility with the uniqueness of NFTs, SFTs are well-positioned to transform industries such as gaming, ticketing, and beyond by offering flexibility, cost efficiency, and dynamic applications.

As blockchain technology evolves, SFTs will likely bridge the gap between traditional tokens and NFTs, creating new possibilities for innovation and user engagement. Whether you’re a developer, investor, or enthusiast, understanding SFTs is essential for navigating the future of the tokenised economy.

FAQ

What is SFT?

SFT stands for a semi-fungible token, a blockchain-based asset that starts as interchangeable and becomes unique when specific conditions are met.

How is SFT different from NFT?

While NFTs are always unique, SFTs begin as fungible assets (identical and interchangeable) and later transform into unique tokens.

What are semi-fungible tokens used for?

SFTs are used in gaming, ticketing, loyalty programs, and more, offering flexibility by starting as tradable assets and later evolving into unique items.

What blockchain standard supports SFTs?

SFTs are primarily built using the ERC-1155 standard, enabling both fungible and non-fungible functionalities in a single smart contract.

Why are SFTs important?

SFTs offer versatility, cost savings, and scalability, making them ideal for industries needing both fungibility and unique asset management.