What is Crypto Liquidity, And How Does It Impact Market Stability?

The inception and development of globalised financial markets have completely transformed the balancing game of the economy. Numerous new variables are vital in keeping the global economy flowing smoothly and ensuring healthy growth. One such critical concept is liquidity, which has become increasingly crucial with the uprising of international commerce.

At first, liquidity might seem like a deceptively simple concept that doesn’t majorly affect the global economy. In practice, the changes in liquidity can impact entire countries and even international markets, as well as the crypto industry. So, it is vital to understand the nature, benefits and long-reaching impact of crypto liquidity if you plan to operate in this domain.

Key Takeaways

- The general liquidity concept measures how quickly someone can exchange or cash in tradable assets on the open market.

- Cryptocurrency liquidity refers to how swiftly traders can trade digital assets for fiat currency.

- This concept is arguably the most important for the crypto landscape, as it directly impacts price volatility and trading activity.

- Raising the liquidity levels will be challenging, as it demands tectonic shifts, including the increased inherent value and reclamation of the public trust.

Defining The Market Liquidity Concept

Liquidity is a straightforward concept – it measures the swiftness of converting tradable assets into cash. Suppose there is a single market for asset X and ten different investors. Investor A wishes to cash in on their asset X investments altogether. The market is highly liquid if they do it almost instantaneously and without significant price compromise.

Conversely, let’s imagine that investor A puts their assets up for a trade, and nobody responds for a considerable time. Investor A must either wait a while to cash in the asset or sacrifice their preferred price quote. This situation signals low liquidity in this particular market. Naturally, investor A is less likely to execute a deal in these circumstances, as they might be price-sensitive and risk-averse.

Thus, the liquidity metric assesses how simple it is to execute trades on the market. The simplicity depends on the number of market participants, the demand for particular assets and the overall cash supply. Additionally, numerous other factors dictate liquidity effects, including significant regulatory changes, economic downturns, political shifts and conflicts.

How to Assess The Liquidity Levels of Crypto Sectors

There is no simple formula for calculating the market liquidity ratio. However, if traders wish to quantify the levels of liquidity within a given sector, they can analyse the trading volume, bid-ask spreads and the overall turnover rate. With optimal liquidity, high trading volume tends to increase dramatically, showcasing the abundance of active traders and effortless price stability.

Bid-ask spreads are generally narrower in this case, as the sellers and buyers are plentiful in the sector, and it is much easier to match supply and demand in terms of prices. Finally, the turnover rate will also increase in high liquidity conditions, signalling that the same tradable assets exchange hands several times within a single trading period.

This activity increase signifies that the market is rich with players that employ different strategies actively and execute them without any roadblocks. Almost any industry will experience effortless and organic growth with these three metrics hitting higher levels.

Why is Liquidity a Key Factor in the Market?

As outlined above, liquidity levels determine financial and business market activity and health. But why is this metric so important regardless of the industry? Modern industries have become increasingly digital in one key area – trading. Almost every industry-leading company has put up their shares on stock exchange platforms.

Becoming a corporation and conducting an initial public offering is a go-to strategy to raise funds and acquire enough capital to grow exponentially quickly. Thus, trading markets have become more crucial than ever before. Stocks, treasury bills, forex and crypto exchange markets determine the success of practically every publicly traded company in the world, representing the majority of industries across the globe.

Since liquidity is a crucial concept for trading markets, it is arguably the most critical metric for the global economy. Let’s imagine a simplified scenario – the trading market for industry Y is experiencing liquidity problems due to various economic and political factors. Traders in this niche have decided to exit the industry due to its volatility and uncertainty.

Now, the trading market features half of the previous players, which has caused wider spreads, less turnover and volume of trades. As a result, corporations in this industry won’t be able to issue more shares or benefit from the existing ones. Their market price will probably go down and, in some instances, result in bankruptcies. Thus, the decrease in liquidity has far-reaching consequences in the trader’s room and the global economy.

Why is Liquidity Vital in the Crypto Landscape

As discussed, liquidity is a crucial metric for any trading sector globally. However, its importance varies from industry to industry, as some sectors are more liquid than others. For example, the forex market around popular and established currencies seldom experiences dramatic liquidity problems.

Currencies like the US dollar, Euro and British pound have dominated the market for decades, and their respective forex market has little to no problems with liquidity. Large financial institutions frequently act as market makers in this sector and supply the industry with narrow spreads and competitive prices. On the flip side, newer markets with less established leaders and market makers have much more trouble raising liquidity to optimal levels.

The crypto landscape is a perfect example of the latter, as the crypto market liquidity has been notoriously challenging since its very inception. While blockchain technology introduced numerous new and valuable concepts, its most popular product, cryptocurrency, has struggled to provide intrinsic value on the market.

The Adverse Effects of Crypto’s Speculative Nature

Fourteen years after the invention of Bitcoin, the most popular cryptocurrencies in the world are still largely speculative, failing to offer sturdy technological or practical value to stabilise market prices. Therefore, the market is still primarily dictated and influenced by speculative customer demand.

This means that the increased attention from the buyers can cause swift price spikes, but the spontaneous decrease in demand can cause significant economic downturns. The worst part is that nothing can effectively negate the massive price variations on the market, as the value of cryptocurrencies is highly dependent on public perception.

Thus, liquidity has an elevated importance in the crypto sector. If it goes down and the industry experiences a significant trader outflow, even the flagship currencies are not safe from massive repercussions. Moreover, crypto liquidity solutions are less abundant than fiat, stocks and other sectors.

Currently, most central banks are not interested in providing liquidity to crypto markets, meaning non-bank liquidity providers have to bear the brunt of supplying ample funds. While the prime broker and market maker industries are flourishing, it is still challenging to depend on relatively smaller companies to provide optimal liquidity.

So, to summarise – this sector struggles to keep abundant liquidity due to inherent volatility and value problems. Simply put, the crypto industry can’t afford to neglect to monitor the liquidity levels in various sectors, as they could swiftly ripple into major financial downturns.

Liquid Crypto Market vs Illiquid Market

While the previous section analysed the importance of liquidity in crypto, it might still be tricky to visualise how liquidity affects this industry. So, let’s imagine two separate scenarios revolving around cryptocurrency X. In the first scenario, crypto X has ample liquidity. In the second one, crypto X’s liquidity levels are decreasing rapidly. So, what would be the difference between the two conditions?

What Happens When Liquidity Is Sufficient?

In the first scenario, the market would have plenty of active traders, liquidity providers, trading volumes and new projects that build their business around crypto X. In the second scenario, everything would be in reverse. First, the large number of traders helps the market stabilise the price effortlessly and without market manipulation. Spreads, in this case, are narrow, which means that more deals will go through, motivating traders to devise more strategies on the open market.

Secondly, mid-sized liquidity providers are more drawn to a highly liquid market because they have no problems creating liquidity pools by convincing various investors to supply funds. Finally, more businesses would adopt crypto X as their payment option or even construct product offerings focusing on this currency, knowing that this digital asset is dependable in the long run.

The Effects of Diminished Liquidity

None of these benefits would be on the market in the low liquidity scenario. On the contrary, even the existing traders would leave the sector due to increased risks and fewer price matches. Businesses generally avoid this sector, and investors would not finance a cryptocurrency liquidity provider to supply this niche. Thus, lower liquidity causes an adverse chain reaction, where everything gets exponentially worse with time.

So, it is not an overstatement to say that low liquidity might be a terminal sentence for crypto markets, causing companies to go bankrupt, traders to exit the market and currency to lose all of its market value.

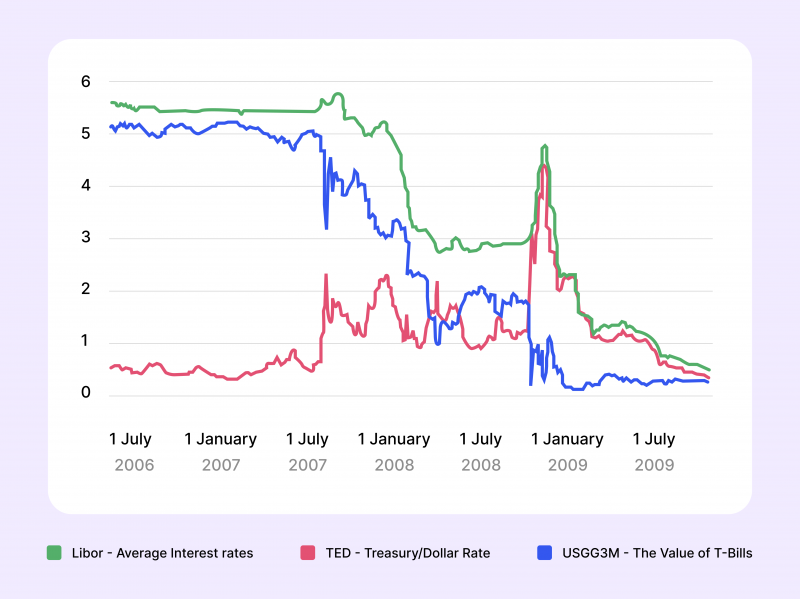

The 2008 housing crisis was the worst recession in the USA since the Second World War, causing millions to lose their jobs.

What Happens During A Liquidity Crisis?

Thus far, previous sections have described the impact of liquidity levels in theory. In practice, liquidity crises have happened more often than one would think, both in crypto and conventional trading markets. The most notorious liquidity crisis occurred during the 2008 housing bubble in the USA.

At first glance, it might be logical to presume that a single-market crisis confined within a single country should not have global ripple effects. However, the US housing crisis can be felt globally even today, after 15 years.

This massive downturn was caused by the simple rule change in the US banking sector, where banks could sell collateralised debt obligations to the general public. In 2008, the country realised these investments consisted of risky assets that would swiftly turn into liabilities.

The Ripple Effects Of The 2008 Crisis

As a result, most financial institutions in the USA had to declare their losses related to CDOs, meaning they no longer had a substantial portion of their cash reserves. Moreover, the banks could no longer honour the cash deposits of customers, which led to one of the most extensive liquidity crises in the history of international banking.

The US government stepped in to remedy this issue and bail out key banking players, but many financial institutions simply went bankrupt, causing significant layoffs. To help the remaining banks, the US had to take on massive debt and work closely with these organisations to stabilise the economy. The situation is not wholly remedied even to this day!

The cautionary tale of the 2008 housing crisis signifies the importance of liquidity. The housing market slowly became illiquid, filled with assets that were not quickly tradable but disguised as highly liquid instruments. It was too late once the market realised that these assets were not nearly as valuable as the prices suggested.

Thus, the concept of liquidity is not as clear-cut as it seems in theory. Many markets experience it without any signs or red flags, which further increases the importance of transparency and honesty. The banking organisations in the USA neglected liquidity problems to maximise profits but ultimately lost everything due to this concept. In simple terms, no market can stay healthy if they don’t carefully monitor this vital metric.

Essential Measures to Prevent Liquidity Crises in Crypto

While there are no specific guidelines for maintaining a healthy liquidity balance in crypto, the empirical evidence shows us several successful strategies that could apply to this sector. Let’s explore:

Organic Market Growth To Facilitate Trading Volume

First and foremost, no strategy is more effective than a straightforward, natural market growth that invites more investors and active players to the crypto market. As discussed above, the growth in this industry depends on its ability to avoid volatility by introducing more intrinsic value and increasing user adoption for global payments.

If the current trends continue, the crypto landscape is on track to do just that, with numerous new projects prioritising the utility of smart contracts and cross-border payments using crypto assets. Barring any unforeseen events that could slow down this development, this field is heading toward a less volatile state, significantly increasing the liquidity levels across the board.

Reclaiming The Trust of The Public

Secondly, the crypto landscape is in a tricky place in 2023. With the second crypto winter only a year behind, the public is still showing bearish patterns of investment activity. While the industry is heading in the right direction with new and promising projects, regaining the initial public trust is still a ways off.

Due to the scope of downturns and the dishonest behaviour that has populated the market for years, it will be a long and challenging journey to reclaim the initial popularity of crypto. However, this change is essential for the industry, as liquidity levels desperately require new market entrants to increase the trading volumes and the general turnover.

While there are numerous other mechanisms to bail out low liquidity crypto sectors superficially, their effectiveness will not be consistent, and it will not save the industry from another downturn. Temporary liquidity spikes, institutional bailouts and other activities will be a band-aid to the above-outlined fundamental issues.

Currently, the highest liquidity in crypto is possessed by Bitcoin. But even this flagship digital asset struggles to maintain healthy price levels and incentivise investors outside the crypto sector. This is an unmistakable signal that the industry must change its outlook and strive to utilise groundbreaking blockchain technology with more practicality in mind. Otherwise, liquidity problems will persist in the future, causing more recessions and an eventual collapse of the entire market.

Final Remarks

Liquidity is a critical concept in crypto, even more important than other conventional industries. This metric can single-handedly decide the success or failure of the crypto market in the long-term future. Thus, it is vitally important to keep the current trends in the industry and prioritise intrinsic value over hype. It will be fascinating to see whether the crypto field can overcome liquidity troubles and establish itself as a dominant presence in global commerce.

FAQ

What Does The Crypto Liquidity Metric Measure?

Crypto liquidity measures how easy it is to convert crypto assets into cash at favourable exchange rates and in due time.

What’s The Difference Between High and Low Liquidity?

High liquidity facilitates more active trading and allows traders to find matching orders faster and with fair market exchange rates. It also invites new players to the market and generally stabilises the pricing in the crypto industry.

How To Prevent A Crypto Liquidity Crisis?

In the case of the crypto market, it is all about driving natural growth, introducing more tangible crypto utilities and clearing up the tainted reputation in the eyes of the global public.

Recommended articles

By clicking “Subscribe”, you agree to the Privacy Policy. The information you provide will not be disclosed or shared with others.

Our team will present the solution, demonstrate demo-cases, and provide a commercial offer