What Is Stop Order and How Does it Work?

Articles

As an investor, you may have heard of a stop order, more commonly known throughout the crypto trading world as the stop-loss. This market order is used to limit your losses and protect your profits. But what exactly is a stop order, and how does it work?

In this article, we’ll cover everything you need to know about stop orders. You’ll learn exactly what they are, how they work, and why they’re important for you, the trader or investor who wants to manage risk to the best of their ability.

What is a Stop Order?

A stop order is an open market request to buy/sell an asset or a security once its price hits a certain point called a “stop price.”

Traders and investors use stop orders to mitigate risk by selling a given investment at a specific price. They do this to limit their potential losses or guarantee any profits they’ve made will be withdrawn at a certain price.

If you own a stock or a crypto asset but you’re worried its value might go down, a stop order can help you sell it at a specific price so you can (1) minimize your losses or (2) take out profits.

If you have stop orders active and the price of the asset falls to a specific price point, it will be sold automatically so your losses are limited.

On the other hand, let’s say you have a stock that’s going up in value. You might want to open a stop order at a certain price point if its value drops suddenly, you’ll automatically sell at that price point and capture guaranteed profits.

Stop orders allow traders and investors to buy and sell without having to watch and follow the market all the time. By using them in your trading strategy, you can go a long way toward automating your trading, avoiding mistakes, and limiting risks. If you’re not the type of trader who wants to constantly check the market or worry about when they have to buy/sell, your stop orders are the perfect tool to let you automate that process.

Whether you want to limit losses or secure profits, stop orders are exactly what your trading strategy needs.

How Does a Stop Order Work?

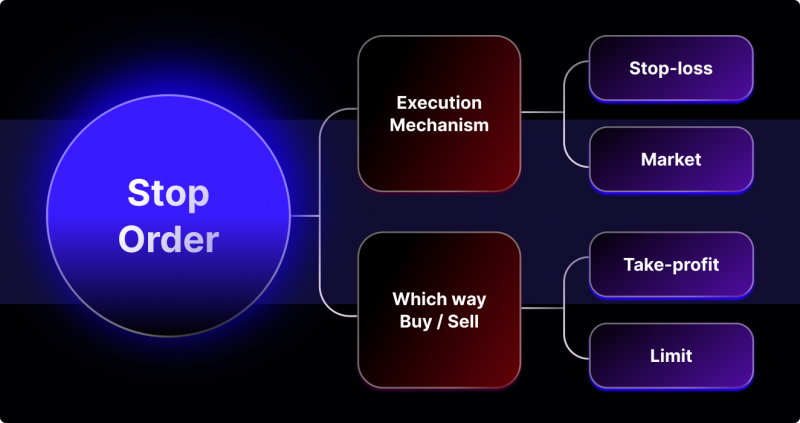

To set a stop order, you need to first have a target price in mind for a specific asset. The stop orders sets a trigger price that, when reached by the market, will activate the market or limit order.

- Market orders are fulfilled at the nearest available price.

- Limit orders are activated at a specific (or better) price.

For example, let’s say you own 1 Bitcoin that you bought at $20,000. It’s currently trading at $24,000, but you’re worried its price might drop.

You set a stop order at $22,000. If the price of Bitcoin falls to that $22,000 target price, your order will automatically fulfill and sell your Bitcoin at that price.

If the price drops incredibly quickly, the sale may happen at a lower price, but your stop order will basically guarantee you the profits you’ve made up until the target price.

If an individual holds 1 Bitcoin that was purchased for $20,000 and the current value is $18,000, they could implement a stop order to sell if the price falls to $17,000, thereby minimizing their losses if the market dips below that point. This strategy allows for the investor to limit their potential losses even if the value of Bitcoin drops suddenly.

What’s crucial to understand here is that the stop order cannot guarantee execution at the exact stop price that was established. Factors such as market liquidity and abrupt price changes may prevent the order from being fulfilled as initially planned.

Types of Stop Orders

There are many different types of stop orders that traders employ depending on the situation. In the world of crypto trading, utilizing stop orders is easy due to the variety of popular cryptocurrency exchanges. Some of the most common ones include:

The Stop-Loss Order

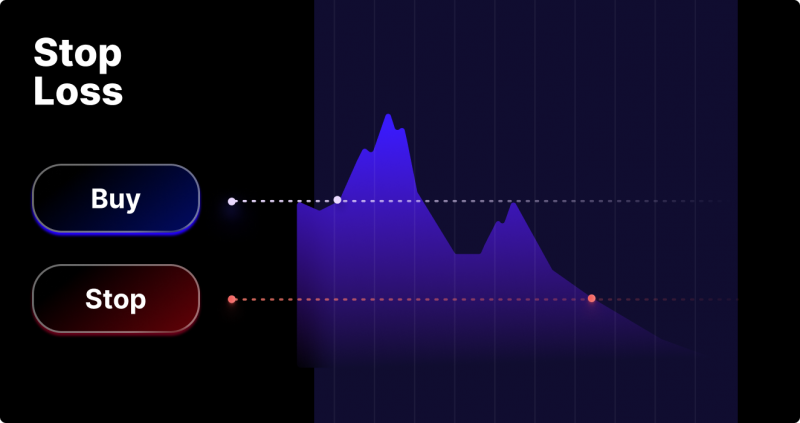

One of the most popular types of stop order is the stop loss order, which is a valuable tool for limiting losses when an investor is not actively monitoring the market. A trader would place this order at a price below the current market value of a specific security, and it will be triggered if the security’s price drops to a predetermined level.

The Stop-Limit Order

A stop-limit order is a hybrid order type that combines features of both limit and stop orders. When this type of order is triggered at a specific stop price, it will be activated if the price reaches the limit price, or possibly a better price than the limit price that was set.

The Trailing-Stop Order

A trailing stop order is a type of stop order that you use to lock in profits while the asset you’ve invested in is moving in the right direction. This type of order is opened at a percentage of the dollar amount below the current price, so naturally, if the stock rises, the stop price will adjust upwards to reflect the new market price.

The Sell-Stop Order

This type of order is often used to exit a long position on an asset. This type of order is also placed below the current market price, automatically triggering it if the asset price falls to a target price.

Why Are Stop Orders Important for Managing Risk?

One of the most important goals for any trader or investor is to mitigate, or at least better understand, the risk they’re taking.

Stop orders help you do exactly that – by helping you secure profits at certain price ranges and limit your losses if things go south, they can go a long way toward helping you become a more rational, level-headed investor who takes calculated risks.

Not to mention, a big part of the risk in trading comes with making decisions based on greed or fear.

With stop orders, you can take a lot of the emotion out of your decision-making, so you avoid making bad, impulsive decisions that lead to losses.

Potential risks of using a stop order in your trading and investing:

While you can use stop orders correctly and manage risk, sometimes, you might find yourself facing some potential risks that come inherent with opening a stop order. The main risk here is that your stop loss may be activated by a short-term fluctuation in price, resulting in potential losses.

For example, if the price of your stock drops and then rebounds rather quickly, your stop order might have triggered within that short timeframe, causing you to sell at a lower price than you would have initially liked.

The main potential issue with stop orders is that they’re not foolproof. Especially in chaotic, volatile markets like the crypto market, stop orders can sometimes be activated at a different price than the one you intended. This is also known as “slippage.”

Stop orders in action: how would a stop order look in practice?

To illustrate how a stop order could work in practice, here’s an example:

You own a share of a large corporation and it’s currently priced at $50 a share.

You set up a stop loss order at $40 a share. This means that if the price of this stock falls to $40 or lower, your order automatically triggers and sells your shares. This limits your losses and helps you avoid further declines in the price of the stock.

Alternatively, you might use a “buy” stop order and take advantage of the uptrends in your stock’s price. If you believe that the price of your stock will rise to $60, you might place a buy stop order at $60. If the asset’s price reaches $35, the order will be triggered, and you will automatically purchase shares. This can help you capitalize on price increases all while limiting the amount of risk you’re taking.

How Stop Orders Can Help Your Trading Journey

In conclusion, stop orders are a powerful tool in the arsenal of any trader or investors who wants to secure profits and mitigate risk. By using them to create specific price points at which you buy or sell your assets, you can pretty much automate your entire trading process and take emotion out of your decision-making entirely.

Stop orders come in many shapes and sizes, from stop-losses and stop-limit orders to trailing stop orders. By finding out what role each of them plays in your trading strategy, you can use them to achieve specific goals and maximize your efficiency as a trader or investor.

With that said, always remember that stop orders are not foolproof – they can be subject to slippage, market conditions, or lack of liquidity. Just like any other trading strategy out there, always make sure to do your own research before you start using stop orders in your trading.