Why Should You Start a Crypto Business in 2026?

The cryptocurrency industry quickly secured its position among top businesses for entrepreneurs and venture capitalists to grow their wealth and seek financial gain. Despite being relatively new, decentralised ecosystems and financial services now circulate billions of dollars in various startups, platforms, products and services.

Launching an exciting crypto project is more accessible than before due to the expansion of blockchain technology, diverse elements of the decentralised economy, and the increasing number of users.

Let’s discuss where the crypto market stands in 2026, what the forecasts are, and how profitable it is to start a crypto business in 2026.

Key Takeaways

- The crypto market has witnessed massive developments in 2024, including regulatory reforms, increased adoption and technological introductions.

- Adopting crypto assets in centralised financial institutions and banks spurs massive attention and potential to cryptocurrencies.

- The blockchain ecosystem is broad enough to find the best business inspirations in different aspects that interest you.

- Decentralised exchanges and brokerage platforms are the most common cryptocurrency business ideas that capitalise on the growing number of traders investing in growing digital currencies.

Crypto Market Overview

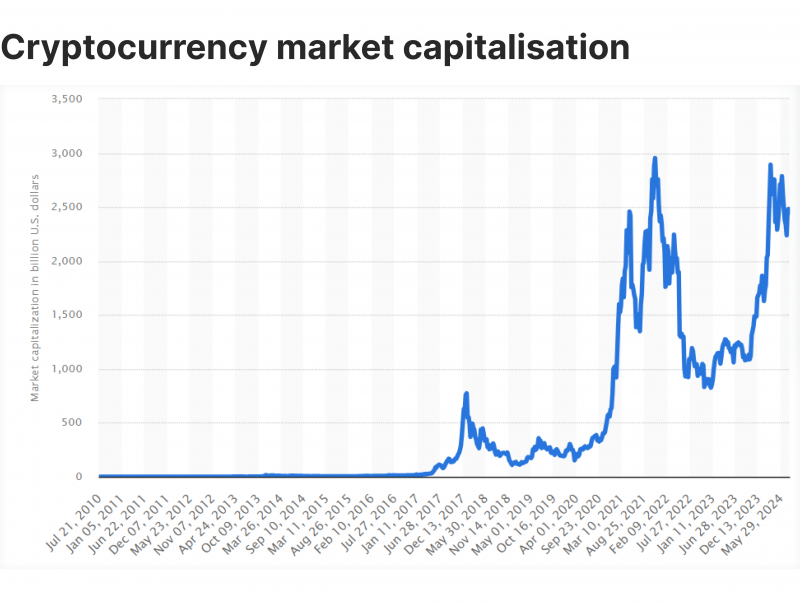

The past few years have been busy for the crypto world, with key events pertaining to cryptocurrency valuation, regulatory reforms, institutional adoption, and macroeconomic factors affecting the demand for digital assets and virtual coins.

The US political scene played a major role in these events, driving the regulations behind adopting Bitcoin and sanctioning exchange platforms. Bitcoin recorded a new all-time high price of $75,000 in March, way over its 2021 price record.

Institutional Adoption & Sustainability

Starting from the acceptance of Bitcoin spot ETF securities. This decision took the US Securities and Exchange Commission nine months before giving the green light for investment firms to list BTC ETFs for spot trading, boosting the coin’s growth and increasing the adoption rate among institutions and traditional investors.

The Bitcoin halving took place in April 2024, which cut the coin supply in half, reducing the overall supply and cutting the miner’s reward in half. This event drove BTC prices higher and boosted the coin’s sustainability.

Regulatory Reforms

In June, European financial regulators enforced the MiCA regulations – Title III and IV, raising the rules for developing and minting stablecoins. The new laws require issuers to back these coins with cash reserves denominated in Euros.

Developers must register as legal persons and financial institutions to follow the MiCA criteria with close monitoring from regulators.

Growing Stablecoins and Altcoins

Outside the Bitcoin network, other blockchain coins saw substantial growth, including Tether (USDT), which overtook Binance Coin (BNB), becoming the third-largest cryptocurrency in market capitalisation.

Circle’s USDC has also overtaken Ripple as the demand for USD-based stablecoins increased among businesses and exchanges.

Altcoin SOL has also seen a great performance, with more meme coins and crypto projects being developed on the Solana network.

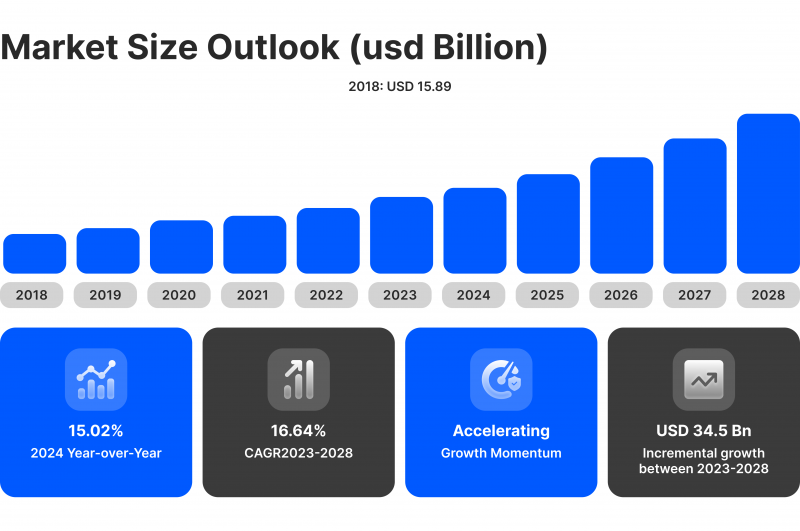

Is The Crypto Business Profitable?

Operating a crypto business entails offering relevant services and earning from commissions. As such, the more users engage in blockchain operations and crypto transitions, the more you earn.

Therefore, with the increasing number of blockchain companies, developers and users, you can find the best crypto business plan that suits your objectives and market demands.

However, it is crucial to keep in mind the changing regulatory requirements and the dynamic environment of cryptocurrencies and blockchain infrastructure.

How to Make Money in Blockchain?

Earning from commission is a typical crypto business model. You can operate an exchange or trading platform and charge fees on transactions or crypto brokerage services.

Have a Question About Your Brokerage Setup?

Our team is here to guide you — whether you're starting out or expanding.

Another way to make money is by offering crypto as a service, such as developing crypto wallet business integrations, programming smart contracts and minting platforms. You can create and replicate solutions that suit crypto entrepreneurs and businesses.

Starting a Crypto Business: Risks and Benefits

Despite the massive developments in the crypto ecosystem, many believe that they are still preliminary, and we can expect more in the future. Even if you find and launch the best crypto business ideas, you might multiply your returns in the coming years. Here are some advantages of launching a startup in this space.

- The potential of multiplying your returns as more technologies and innovations are presented.

- The increasing number of businesses and end-users prefer to pay, store funds, and use crypto wallet apps.

- The growing adoption rate in centralised entities and institutional investors leads to more prospective returns in the future.

- The ability to customise crypto solutions and services for users, boosting customer satisfaction and convenience.

On the other hand, this massive growth comes with various challenges that you must be aware of before launching your DeFi business.

- Frequent regulatory changes require financial commitment and reiteration to accommodate new rules and laws.

- The market is highly unpredictable and prone to speculations, making it challenging to cope with volatility and changing opinions.

- The competition is fierce, and multi-million corporations already operate in this space, requiring state-of-the-art innovations to generate traction for your business.

Crypto Businesses: Before and Now

When Bitcoin was introduced in 2009, most of the services in the following years focused on BTC-relevant functionalities, such as paying with BTC, Bitcoin ATMs, and Bitcoin/USD converters. The focus was on bridging the gap between traditional financial services and Bitcoin.

When Ethereum was introduced in 2015, it boosted the creation of altcoins and NFTs developed on the Ethereum network. During that time, most crypto businesses revolved around promoting the decentralised ecosystem’s internal infrastructure and systems, including smart contracts, NFT minting, and tokenisation.

However, in the last few years, most businesses have focused on delivering crypto tools to businesses, facilitating Bitcoin payment gateways, on-ramp exchanges, and crypto ownership using credit cards and Google/Apple Pay. Additionally, most projects today focus on customisation and flexibility to serve the increasing number of crypto users and operators.

In a nutshell, blockchain businesses used to focus on allowing users to buy, sell and trade cryptocurrencies. However, today, it focuses on user customisation and finding tailored solutions that suit businesses and individuals.

This approach may entail elevated expenses to develop the most innovative solutions and features, but they usually come with more lucrative returns as the demand for crypto solutions grows.

Elements of Decentralised Ecosystems

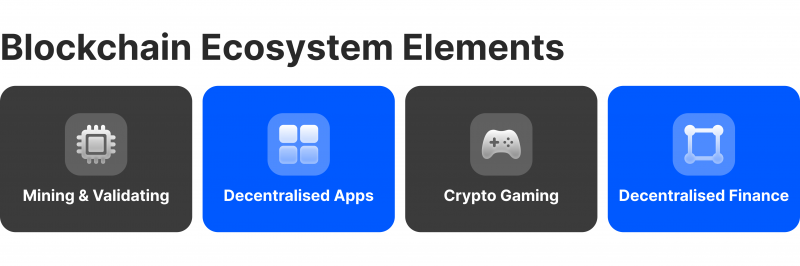

Unlike other business industries, the crypto space is broad and has a rich infrastructure. You can find the best cryptocurrency business ideas in each part of the decentralised ecosystem and offer products and services that the market demands.

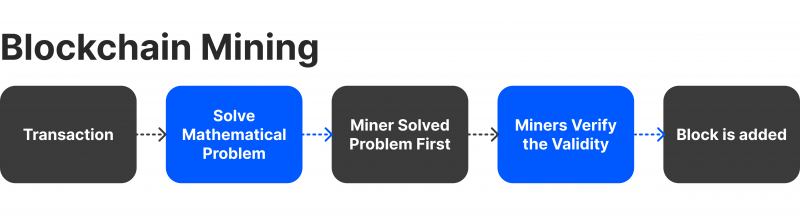

- Mining and validation are primary blockchain operations that require robust processing machines to receive, approve and register transactions on Bitcoin or Ethereum public ledgers.

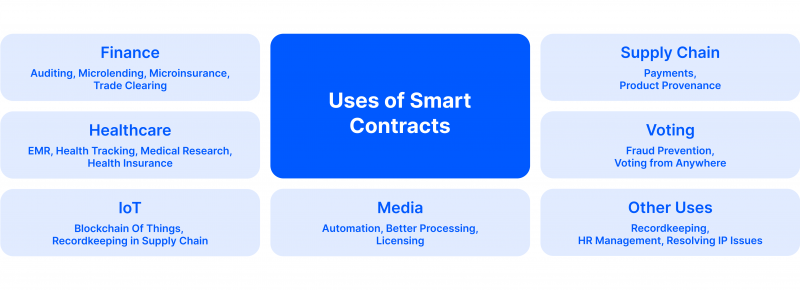

- Decentralised applications, smart contracts and scaling networks are key blockchain components that boost its functionality and allow users to transact, operate and develop crypto assets.

- Gaming is a growing aspect of the decentralised ecosystem that boosts the usage of utility tokens and helps develop a creator economy, giving more control tools for users than corporations.

- Decentralised financial services are core functions that deal with cryptocurrencies and value-based tokens. DeFi services facilitate the use of digital assets and tokens by businesses and individuals, which helps garner more attention and demand for crypto coins.

Finding Your Passion to Start the Best Crypto Business

The magic about having a crypto business is that you can choose and launch a project that aligns with your interests and aspirations. Whether you are into trading in financial markets, software development, cloud computing, e-gaming, or creative solutions, you can find your match and build the best crypto business.

DeFi Services Business Ideas

Decentralised finance services are the most common and best crypto business to start, serving many users looking to convert their fiat money into digital assets or store their funds in virtual storage or coins.

You can launch a centralised or decentralised crypto exchange, allowing users to connect their wallets and swap between different cryptocurrencies or exchange crypto and fiat money. This service can be strikingly lucrative as coin holders convert their assets according to market updates to seek crypto investments in trending coins.

Similarly, you can launch a Bitcoin brokerage platform, allowing investors to open and manage trading positions in multiple cryptocurrencies and capitalise on growing coins during bull runs and price momentum.

The profitability model of these businesses relies on charging brokerage services fees and commissions on traded lots and transactions.

The Costs

The cost of setting up a crypto exchange or trading platform depends on the features and integrations that are available. Additionally, developing the platform using internal resources is usually more expensive than finding ready-to-use white label exchange solutions.

In-house development can cost you over $50,000 in monthly salaries and hosting facilities that can stretch it up to $100,000. Conversely, plug-and-play turnkey solutions significantly reduce expenses to around $30,000 monthly for support, maintenance and hosting fees.

Crypto Mining Startups

Crypto mining entails using robust machines, including graphic video cards and processing units, to act as network nodes and participate in payment verification and registration.

Blockchain miners earn 3.25 BTC for every block of transactions they validate and register, compensating for the high mining costs. However, each operation can take from 10 minutes to several days, depending on network congestion and hardware capabilities. Therefore, you must invest significantly in your mining “rig” to ensure sustainable passive income from this business.

Alternatively, you can lease the mining capabilities through cloud mining. This approach allows other users and entities to use the machine at your premise to start their mining operations while you earn rent payables.

The Costs

Making a cryptocurrency mining grid requires multiple robust GPUs, a motherboard to support all these video cards, an advanced CPU, significantly large RAM to store enormous blockchain data and a reliable power supply.

These costs can climb up to over $10,000. Note that the more you invest in your mining machine, the faster the validation process and your returns are. You must also include hefty electricity bills from powering the mining rig and cooling systems to minimise hardware damage.

Blockchain Services Ideas

Blockchain services creation is for software developers and innovative creators who want to introduce cutting-edge services and utilities for other crypto platforms and businesses.

This includes minting tokens, creating decentralised applications, issuing meme coins and no-code building platforms. These functionalities facilitate blockchain access to non-tech-savvy individuals and companies and allow them to integrate their websites with crypto tools seamlessly.

Smart contract development has significant potential for usage outside the context of crypto transactions. You can create smart contracts to execute various tasks, such as hotel booking confirmations, healthcare record registration, certificate authentication and ticket validation.

The Costs

Developing smart contracts comes with different utilities and complexities, which determine the required capital. If your smart contract executes a simple function, you can expect to pay up to $30,000 for salaries, external code auditing and development platforms.

Discover the Tools That Power 500+ Brokerages

Explore our complete ecosystem — from liquidity to CRM to trading infrastructure.

However, more complicated smart contract functionalities will raise the costs to over $50,000 because the code becomes more complex to develop, audit and test.

Gaming Startup Ideas

Crypto gaming has grown exceptionally, driving massive attention to the advanced ideation and gamification of Web 3.0 platforms and utilities.

Blockchain games differ from traditional video games in that they put the user at the heart of the system, allowing them to customise the experience to their preferences. Players can contribute to game creation and monetisation, designing new challenges, building new levels, and integrating a creator economy that relies on crypto tokens.

The rise of the metaverse and play-to-earn concepts grew significantly along with the blockchain developments, allowing creators to embed utility tokens and crypto payments, collect NFTs and engage in P2P trades for rate items and gaming elements.

As a crypto game owner, you earn money from advertisement placement, transaction commissions, and in-game marketplaces.

The Costs

The costs of developing a crypto game depend on the complexity, embedded functionalities and in-game experiences. The expenses can range from $50,000 to $100,000, especially if you want to add AI capabilities, payment gateways or even develop the game’s native token.

Conclusion

Launching a business in the blockchain sector can be profitable, given the advanced technologies poured into this space and the increasing number of individual users and companies requiring cutting-edge solutions.

Although thousands of projects exist today in decentralised ecosystems, you can find a blockchain element that suits you to launch the best crypto business, capitalising on market infancy and massive potential.

Finding the best crypto business idea inspiration depends on your interest, expertise and market demand. However, you must be resilient to regulatory requirements and changing market dynamics to remain competitive.

FAQ

Is crypto mining a profitable business in 2025?

Yes. The rising Bitcoin prices and increasing number of users mean that BTC transactions are growing, and the demand for validators and miners has increased despite the lowered mining rewards after the BTC halving.

What is the best crypto to buy now?

After growing massively over the years, Bitcoin has historically been the best digital currency, reaching record highs in March 2024 (at $75k) and dominating most crypto exchanges, payments and trading utilities.

What is the best crypto business idea in 2025?

Crypto brokerage firms and decentralised exchanges have proven their importance in DeFi systems. As more users try to own virtual coins, trade in crypto markets and invest in various blockchain opportunities, you can explore multiple business models that charge fees and commissions from traders’ and users’ activities.

How to make passive income from crypto?

Generative passive income from cryptocurrencies requires finding products and services that users demand, whether investing in Bitcoin, storing funds virtually or developing applications for other businesses. Then, you can create revenue streams from transaction fees in exchange for providing your services.