Where and How to Register Forex Broker

Articles

The foreign exchange market is one of the most lucrative financial markets globally, attracting numerous entrepreneurs seeking to establish their own Forex brokerage companies. If you’re considering joining this competitive industry, understanding where and how to register Forex broker in today’s world is crucial.

This guide will provide comprehensive insights into the process, including the necessary steps, best jurisdictions, and essential tips to ensure your success.

Key Takeaways

- Registering as a Forex broker is not only a legal requirement but also a key factor in building trust and credibility with clients.

- Selecting the best place to register Forex broker business depends on various factors, including regulatory requirements, tax implications, and market access.

- Following a structured process for registration, from developing a Forex business plan to obtaining necessary Forex licenses, is essential for success.

Does a Forex Broker Need to Be Registered?

Registering a Forex company is not just a legal formality; it’s a vital step that ensures your business operates within the regulatory framework of the financial markets.

Regulatory bodies aim to protect traders by enforcing standards that promote transparency, fair trading account practices, and financial security. Therefore, having a registered Forex broker status enhances your firm’s credibility and trustworthiness, attracting more clients.

Operating without proper registration can lead to severe penalties, including hefty fines and legal actions. Registration ensures compliance with the laws of the jurisdiction where the broker operates, which helps in maintaining the integrity of the financial markets.

Best Place to Register Forex Broker

Choosing the proper jurisdiction is critical for the success of your Forex broker startup. Nowadays, several jurisdictions stand out for their favourable regulatory environments and robust financial infrastructures. Here are some of the top jurisdictions for Forex broker registration:

United States (NFA, CFTC)

The United States remains a prominent choice for Forex broker registration due to its stringent regulatory framework and high level of investor protection.

Brokers registered with the National Futures Association (NFA) and regulated by the Commodity Futures Trading Commission (CFTC) must adhere to strict standards, including high capital requirements and rigorous compliance checks. The benefits include enhanced credibility and access to a large market of potential clients.

United Kingdom (FCA)

The Financial Conduct Authority (FCA) in the United Kingdom is renowned for its comprehensive regulatory regime. Brokers under FCA regulation benefit from a strong reputation and high levels of consumer protection.

The FCA’s regulatory requirements include robust capital adequacy standards, segregation of client funds, and detailed reporting obligations. Despite Brexit, the UK remains a significant player in the global markets.

European Union (CySEC, ESMA)

The European Union, particularly Cyprus under the Cyprus Securities and Exchange Commission (CySEC), is a popular jurisdiction for Forex brokers. CySEC offers a balance of reasonable regulatory requirements and cost-effectiveness. Cyprus is known for its favourable tax regime. The process is relatively straightforward, making it ideal for startups looking for a balance between regulatory oversight and operational flexibility.

Brokers benefit from the European Securities and Markets Authority (ESMA) regulations, which provide harmonised rules across the EU, enhancing cross-border trading opportunities. The Markets in Financial Instruments Directive (MiFID II) ensures a high level of transparency and investor protection.

Australia (ASIC)

The Australian Securities and Investments Commission (ASIC) is known for its stringent regulatory standards and commitment to maintaining market integrity.

Forex brokers registered with ASIC must comply with rigorous financial requirements, client fund segregation, and regular audits. Australia’s stable economic environment and well-regulated financial market make it an attractive jurisdiction for Forex brokers seeking reliability and credibility.

Singapore (MAS)

The Monetary Authority of Singapore (MAS) is highly regarded for its robust regulatory framework and business-friendly environment. Forex brokers in Singapore benefit from a strategic location, advanced financial infrastructure, and a strong reputation for regulatory compliance.

MAS regulations include stringent capital requirements, comprehensive risk management protocols, and thorough compliance checks. Singapore’s status as a global financial hub enhances the attractiveness of this jurisdiction.

Offshore Jurisdictions (Belize, Seychelles…)

Offshore jurisdictions like Belize and Seychelles offer a more relaxed regulatory environment, often with lower capital requirements and fewer compliance obligations.

These jurisdictions can benefit brokers seeking a cost-effective and straightforward registration process. However, it is essential to consider the trade-offs, such as potentially lower credibility and increased scrutiny from clients and partners. Offshore registration may suit brokers targeting specific markets or those at the initial stages of their business.

Selecting the proper jurisdiction for Forex broker registration is a critical decision that can impact the success and reputation of the business. Each jurisdiction offers unique advantages and regulatory challenges. By carefully considering factors such as regulatory requirements, costs, and market access, prospective Forex brokers can choose a jurisdiction that aligns with their business goals and ensures compliance in the competitive Forex market.

Forex trading started in Amsterdam roughly 500 years ago and spread further throughout the whole world.

Steps to Register a Forex Broker

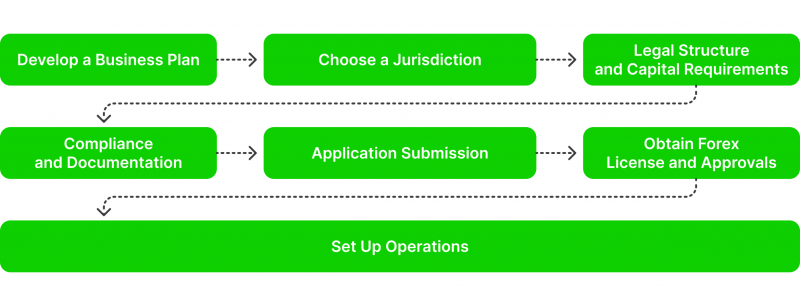

Registering a Forex broker involves a series of steps that ensure compliance with regulatory standards and the successful establishment of your brokerage firm. Here’s a detailed guide on the steps to register Forex broker:

Step 1: Develop a Business Plan

A comprehensive Forex broker business plan is the foundation of your startup. It should include your business model, target market, trading strategies, marketing strategies, financial projections, and risk management strategies. This plan is essential for both securing registration and attracting investors.

Step 2: Choose a Jurisdiction

Select a jurisdiction that aligns with your business goals. Consider factors such as regulatory requirements, tax implications, and the reputation of the regulatory body.

Step 3: Legal Structure and Capital Requirements

Determine the legal structure of your brokerage firm (e.g., sole proprietorship, partnership, corporation) and meet the minimum capital requirements set by the chosen jurisdiction. This step may involve depositing a specified amount of capital in a local corporate bank account.

Step 4: Compliance and Documentation

Prepare the necessary documentation, including proof of identity, proof of address, and a detailed business plan. Compliance with anti-money laundering (AML) and Know Your Customer (KYC) regulations is also crucial.

Step 5: Application Submission

Submit your application to the regulatory authority in the chosen jurisdiction. This process may include background checks, interviews, and the submission of additional documents as requested by the regulator.

Step 6: Obtain Forex License and Approvals

Once your application is approved, obtain the necessary Forex broker license and other approvals to operate as a registered Forex broker. This may include securing membership with financial associations or obtaining insurance coverage.

Step 7: Set Up Operations

Establish your operational infrastructure, including Forex trading platform, customer support, and back-office functions. Ensure compliance with ongoing regulatory requirements to maintain your registered status.

Conclusion

Starting a Forex brokerage company requires careful planning, adherence to regulatory requirements, and strategic execution. By understanding where and how to register Forex broker, you can set a solid foundation for a successful and reputable business in the dynamic Forex market.