Key Features of Forex Back Office Software – How Do You Choose The Best One?

Articles

In FX trading, a solid reputation and a reliable trading system are crucial for achieving success. The service of back-office software and Forex CRM systems is important for the welfare of brokerage companies in the Forex business. Traders can utilise a secure online platform on the company’s website to conduct trades, process payments, and handle client documentation and identification requests.

This article will discuss the functionality of Forex Back Office Software, its advantages, and the top solutions available in the industry.

Key Takeaways

- FX Back Office Software streamlines brokerages’ operations and improves productivity.

- Back-office systems handle administrative tasks such as account and client information management or compliance with regulatory requirements.

- Efficient FX administration software includes essential features like real-time account monitoring, marketing and reporting instruments, trading platform integration, and more.

- Among the key advantages of using FX administrating systems are their cost efficiency, scalability and accessibility.

What Is Back Office Software For Forex?

Forex back-office software has been developed to streamline the operations of brokerages. Implementing this software into the FX business aims to improve its productivity to a great extent.

Forex back office system, developed as a comprehensive solution for FX brokers, offers specialised applications to optimise business operations. It streamlines execution and enhances productivity, improving customer satisfaction, increasing profit, and providing detailed reports. The software also offers integrated trading platforms for brokers to sell and buy without difficulties.

Forex trading involves a back-office system that manages administrative tasks behind the scenes. It handles account management, including opening and closing accounts, managing client information, and ensuring clients meet regulatory requirements. Back office systems allow staff to verify clients’ identities and access their account activity easily.

The back office Forex software aims to facilitate the business process improvement of your brokerage. This suggests that it will enhance work effectiveness and facilitate challenging tasks.

Having reliable Forex back office software is crucial for effectively operating your brokerage business and reaching your objectives since it can help monitor each stage of the sales process, generate detailed reports, and more.

Key Features of The Back Office Software

Efficient and reliable FX back office software is crucial for business success in the fast-paced FX trading world. It streamlines administrative tasks, allowing focus on trading and business growth. However, choosing the best software for your needs can take time and effort due to the wide range of available options. It would help to consider some core factors to make an informed decision.

Reporting Tools

Forex Back Office software should have simple reporting tools allowing easy data retrieval about administrators, partners, and clients. These tools should produce important reports on trading activities, earnings and losses, deposits, etc. These reports help identify the best market and keep existing clients engaged.

The software should also track and record the actions of partners and other admins, allowing for a better understanding of business progress.

Forex back office software should be straightforward and uncomplicated to help Forex brokers market and engage clients effectively.

Complete the KYC Verification Process

The Know Your Client (KYC) rules are the most common regulations enforced by financial authorities. The KYC feature is crucial in foreign exchange brokerages to prevent money laundering and comply with regulatory requirements. The back-office software should allow document uploading and storage to verify clients’ identities.

User Access Management

The back office software must include features for regulating and overseeing user permissions and access. This allows partners to personalise their back-office access, giving them total autonomy. Ensuring user permissions protects clients’ information and avoids potential issues. The Forex software designed for back office operations must have the capability to manage various user tasks, such as transferring funds for clients. When considering the purchase of a back-office tool, make sure to inquire about user roles in order to prevent errors and protect clients’ information.

Client Profile Management

The back office FX software should facilitate easy storage and maintenance of clients’ information, allowing users to create and update new profiles quickly. The user interface should be simple and clear, providing organised and easy access to clients’ trading experience, residency, and other information, enabling the recommendation of suitable products while adhering to regulations and laws.

Client Finances Management

The administrating software should be designed to track and manage the consolidated customer balances within the user’s financial administration. The software should also allow for transferring funds between multi-currency accounts, adding credits and rebates, and issuing refunds. This will enable the user to assist clients with queries regarding their balances. Overall, the back office software should be capable of providing comprehensive information to clients and customer transactions, ensuring they can easily manage their accounts.

FX Marketing Tools

Back-office FX software should include marketing tools for both clients and IBs. The software should allow for the identification of active and reduced trading activity, enabling targeted email campaigns and exclusive promotion links for tracking new leads. This allows for targeted marketing and efficient communication with clients, ensuring a successful trading experience.

Trading Platform Integrations

Forex brokerage back office software can function independently of the trading platform, but it is more efficient if integrated with MT4, MT5, or another platform. Users should be able to set up trading account groups that are linked to the platform using the software. Thus, fees, commissions, and discounts can be configured via the software. The use of software ensures that reports and payments are more precise as it can perform multiple trading functions. Linking the brokerage’s back office software with the preferred platform can enhance the firm’s operational efficiency and accuracy.

Partnership Programs and IB Management

Partnership programs effectively attract new clients and increase traded volumes on platforms. Forex firms that work with introducing brokers should have back office software that calculates and pays partners commissions and rebates, as well as provides partner tools for IBs to assist their clients. Direct access to the software will enable IBs to execute their obligations effectively, and when they receive the correct remuneration, they will be motivated to excel in their respective fields.

Real-Time Account Monitoring

Integrating back office software with FX trading should allow the platform to monitor all accounts in real time, obtaining information such as margin, profit and loss, position sizes for client orders, etc. This information enables timely margin calls and risk advice and helps control exposure, which is particularly beneficial for firms operating as dealing desk brokerages.

Payment Processor Integrations

Clients often face difficulties depositing money due to a lengthy process for funding their accounts. Connecting back-office software to external payment systems like credit card processors, SEPA transfers, crypto wallets, and bank transfers can reduce the time it takes for deposits to be credited. Multiple payment integrations allow customers to choose their preferred methods of withdrawals and deposits, increasing traded volumes for businesses.

The main goal of a Forex brokerage is to cater to the needs of its clients. The success of a brokerage relies heavily on its capacity to attract new customers and retain existing ones.

The Advantages of Using Back Office Systems in The FX Industry

Each back-office software provider has its advantages and disadvantages. Before selecting a back-office software provider, it’s crucial to consider your goals and objectives to determine the best fit. However, there are some key features that you can benefit from when using FX back-office systems:

- Accessibility – The specialised software equips foreign exchange business owners with robust back office and report instruments to effectively oversee their accounts, monitor investments, and receive expert guidance.

- Flexibility and scalability – Back office technologies can quickly adjust to complex data management demands in foreign currency markets, allowing firms to stay cost-efficient while smoothly managing complex processes like deposits and settlements. The software can also adapt to growing trading volumes and client bases by adding new functionalities, integrating additional platforms or liquidity providers, and customising workflows. This scalability ensures that Forex’s back-office operations can keep up with the demands of a growing trading business.

- Cost efficiency – Back office software for stock brokers is valuable for brokers to enhance profits and decrease operational costs by automating manual processes like customer service, account administration, and order execution, thereby promoting long-term cost efficiency.

- Easy Management – Foreign exchange back office software is fundamental for brokers and traders, enabling efficient resource management across various business aspects like customer service, accounting, payments, and risk analysis.

How to Choose Forex Back Office Solution

Choosing the right Forex platform back office is vital for your FX business to grow and maximise its potential. Here are some tips you might find helpful while selecting a suitable solution:

Do Thorough Research

Market research is crucial for understanding systems and operations. Utilising a trusted network outside the organisation as a first-layer filter can help narrow down the options and provide insight into different platforms’ features, capabilities, and limitations. This approach helps in identifying the most suitable solutions for a specific problem.

Set a Budget That Is Right for You

The company should ensure its technology investment budget aligns with its financial strategy, avoiding strain on resources like licensing, hardware, or staff.

Review Technology Offerings and Security Features

Functional requirements involve understanding the platform’s features, challenges, and daily usage. Performance and security are also crucial. Security is a significant concern if the solution accesses private, personal, or financial data, which is the most valuable asset for a broker.

Test the Chosen Solutions

To make the best decision, observe solutions in action, preferably within the company’s IT environment, request demos or trials from vendors, and create a scorecard to evaluate their ability to meet requirements and align with your business objectives. This will make it easier to compare vendors and make informed decisions.

Top 3 Forex Back Office Solutions

Back-office trading software providers offer comprehensive services for online trading, saving time and money. Choosing the best Forex back office trading software provider can be overwhelming. Here are the three best providers you can consider as an option.

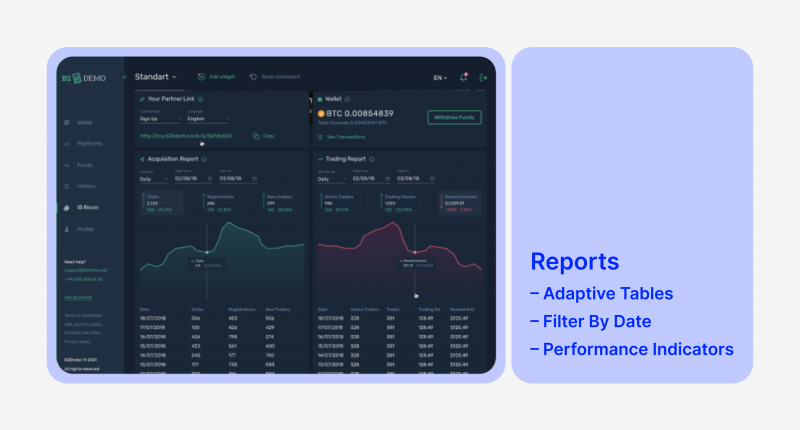

B2Core

B2Core is a market-leading CRM solution for Forex businesses.

B2Core’s proprietary platform meets client demand and provides functionalities like multi-currency wallets, PAMM, IB module, and Leaderboard. It is a multifunctional system that supports Android, iOS, Windows, and MacOS platforms. Its top-level support team enhances the user experience. The system is reported to have a high level of security. The main components of B2CORE include a trader’s room, a back office with client management and support, and a CRM system for automating customer interactions, making it one of the most versatile tools available.

CurrentDesk

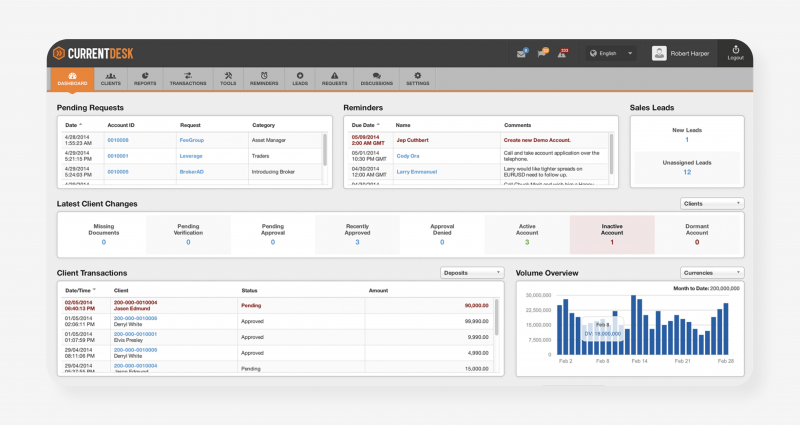

CurrentDesk is another popular software solution for brokerage firms and financial institutions, focusing on the international foreign exchange market. It streamlines client relationship management, administrative hub, multi-asset management, and internal processes to increase the visibility of key data and support business growth. CurrentDesk CRM offers self-registration, complete commission control, and multi-tier IB trees for managing partner networks.

It streamlines KYC processing and account opening and sends auto-reminders to chase incomplete document uploads. The software also tracks leads, increases trader engagement, automates back-office operations, speeds up compliance processes, and connects to multiple MetaTrader 4/5 servers.

UpTrader

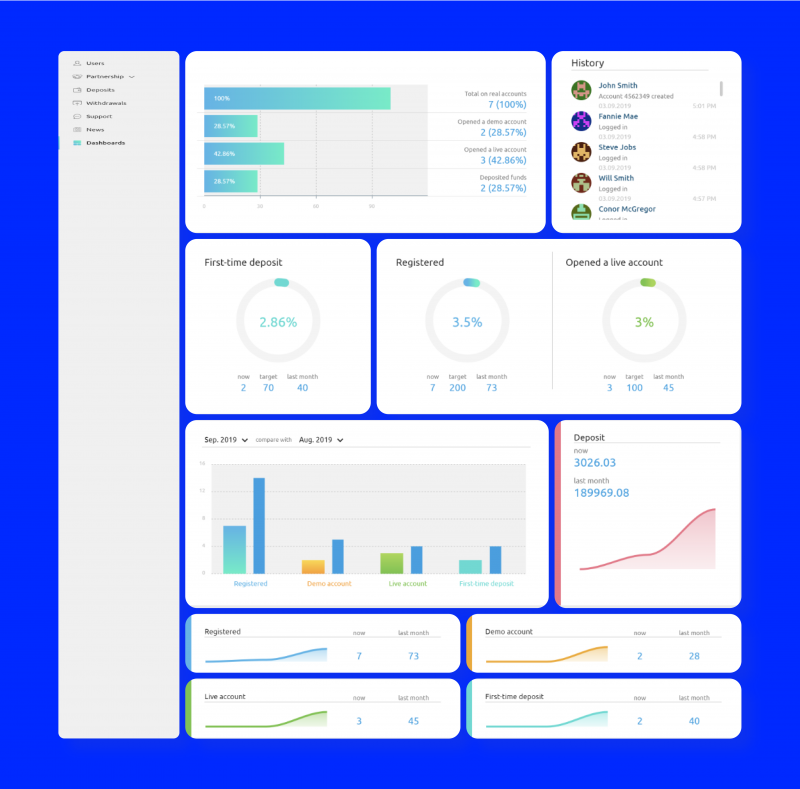

UpTrader Forex CRM is a dedicated CRM provider that offers a unique ecosystem adapted for brokerage companies. The company’s design is intuitive and modern, focusing on addressing the needs of financial mediators. UpTrader’s exceptional client support portal and advanced Sales Funnel set it apart from competitors. The company also offers a multilevel partnership program with advanced partnership reports, allowing for custom partnership details calculation.

UpTrader offers four bonus programs and an integrated Power BI for deep analytics. Its extensive CRM ecosystem includes modules like the Partnership Program, CopyTrading Platform, Sales Interface, Traders Room, Back Office, and Admin.

Final Takeaways

Investing in Forex Back Office Software requires both money and time. The right software should include features for managing IBs or money managers and for expanding into new regions. Investing in this software can increase operational efficiency and improve risk management and customer experience. As the FX market evolves, having reliable and professional software is essential for long-term success in the trading industry.

FAQ

Is There Free Back Office Software?

Such software is provided by a third party. Usually, a provider charges a fee for utilising its product.

What Functions Does Back Office Perform In FX?

In the FX market, the back office handles operational and administrative responsibilities such as trade confirmation, settlement, accounting, compliance with regulatory requirements, and risk handling.

What Is CRM?

CRM is a system a brokerage firm uses to handle client communication, adopting a unique approach to customer experience management.