Why is Tesla Stock Down? How Elon Musk’s Moves Are Impacting Tesla

Tesla’s stock has been facing severe pressure in recent months, with a dramatic 15% drop in a single trading day. Investors are increasingly concerned about multiple factors, including weakening demand, political controversies, and broader economic uncertainty.

As the electric vehicle (EV) pioneer continues to struggle, many are asking: Is Tesla a good stock to buy? And more importantly, will Tesla stock go up?

Tesla Stock News: The Numbers

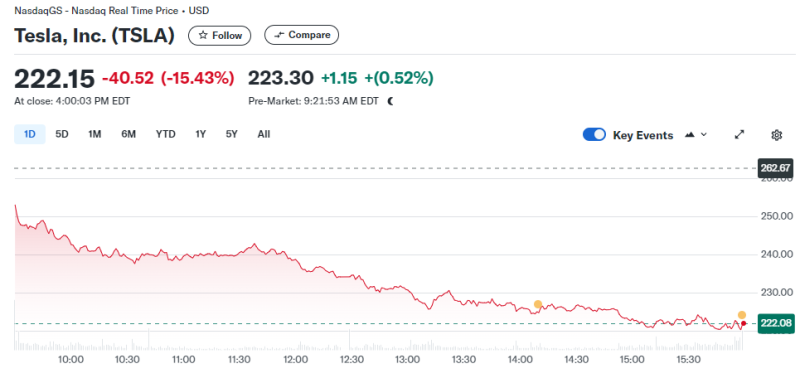

On Monday, Tesla’s stock price dropped to $222.15, its lowest point since late October. The decline wiped out the gains Tesla had made after the U.S. elections, bringing its valuation below pre-election levels. Over the past several weeks, Tesla’s stock has been on a downward trajectory, losing nearly 50% of its value since its peak in December.

Broader market trends have played a role in Tesla’s struggles. The S&P 500 saw a 2.7% decline, while the Nasdaq composite dropped 4% amid growing fears of an economic slowdown. Many attribute these swings to policy uncertainty, recent tariffs, and weakening economic indicators.

Sales Decline and Consumer Backlash

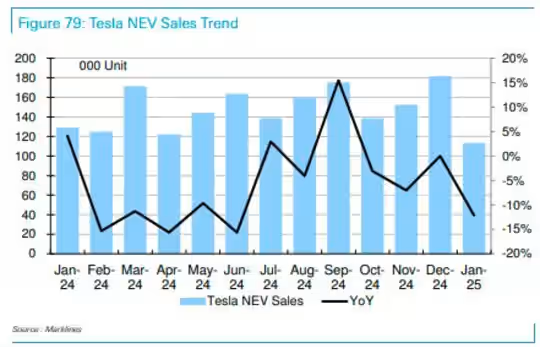

One of the primary drivers of Tesla’s stock drop is its disappointing sales performance. Recent data shows a significant decline in registrations and deliveries across key markets.

- In Germany, Tesla registrations fell by 60% in January and 76% in February, the biggest percentage drops for an automaker in the country.

- Other EU countries reported similar downward trends.

- China, a crucial market for Tesla, recorded an 11% drop in sales in January.

The reasons behind this drop extend beyond economic downturns. Tesla’s brand image has suffered due to Elon Musk’s increasingly controversial political statements. His close association with the Trump administration has alienated a portion of Tesla’s customer base, particularly climate-conscious consumers and left-leaning buyers.

Explore Deeper Industry Insights

Learn from experts shaping the future of financial services — get the latest strategies and trends.

Is Musk Spreading Himself Too Thin?

A major concern among investors is whether Elon Musk is dedicating enough time to Tesla. His involvement in multiple ventures—including X (formerly Twitter), SpaceX, The Boring Company, and Neuralink—raises questions about his leadership priorities.

Musk was also appointed by Trump to oversee the Department of Government Efficiency (DOGE). While some see it as a strategic advantage for Tesla, others worry that Musk’s attention is increasingly divided.

Economic Uncertainty and the Broader Market Impact

Tesla’s decline mirrors wider market worries. At Goldman Sachs, David Mericle revised his forecast for U.S. economic growth down to 1.7% from 2.2% for the end of 2025 compared to last year. The analyst foresees a possible recession, pointing to weak economic signals and decreased consumer confidence.

The Federal Reserve Bank of Atlanta’s real-time economic indicators suggest that the U.S. economy may already be contracting. While the job market remains stable for now, uncertainty surrounding tariffs, government spending cuts, and inflationary pressures are causing increased volatility in financial markets.

Will Tesla Stock Go Up?

Despite the challenges, some investors still see potential in Tesla’s future. Next month, the company will release its first-quarter earnings report, which will provide key insights into its financial health. If Tesla can demonstrate improved margins, strong demand, or innovations in EV technology, it may help stabilise investor confidence.

Additionally, Musk has hinted at upcoming product launches, including the Cybercab robotaxi and further expansions in AI-driven autonomous driving. However, competition in the EV industry is fiercer than ever, and Tesla’s ability to maintain its technological edge is uncertain.

Will Tesla Stock Go Up Again?

Despite the negative outlook, some investors remain optimistic about Tesla’s long-term prospects. The company continues to invest in artificial intelligence, autonomous driving, and robotics—fields that could redefine its future business model.

However, the short-term outlook remains bleak. UBS analyst Joseph Spak recently lowered his price target for Tesla from $259 to $225, citing concerns over declining deliveries and weak demand. The first-quarter earnings report, expected in early April, will be a key moment for investors looking to assess whether Tesla can recover.

Have a Question About Your Brokerage Setup?

Our team is here to guide you — whether you're starting out or expanding.

Conclusion: Is Tesla a Good Stock to Buy Now?

For investors considering Tesla, the current dip presents both a risk and an opportunity. On one hand, Tesla remains a leader in EV innovation, and its investments in AI, robotaxis, and energy solutions could drive long-term value.

On the other hand, declining sales, increased competition, and Musk’s political entanglements create significant volatility. Given the current uncertainties, Tesla remains a high-risk investment with unpredictable short-term performance.

Disclaimer: This article is for informational purposes only. It is not finance advice and should not be relied upon for investment decisions. Always do your own research and consult a financial advisor before investing.