Why Should You Backtest Your Portfolio?

Articles

Professional investors build their portfolios from experience. After years of participating in the financial market, a trader discovers flaws in their trade and tries to avoid repeating these mistakes.

Another way to create a robust trading strategy is to backtest it with a program that uses the market’s past performance and simulates your portfolio strategy.

Backtesting a portfolio is the process of assessing the effectiveness of a trading model using a market’s previous data. There are several tools and methods to implement this testing model, which we will explain in the article.

Key Takeaways

- Backtesting a portfolio uses historical market data to evaluate the effectiveness of a trader portfolio and trading model.

- Portfolio performance backtest simulates past market activity, usually done on trading platforms.

- Portfolio backtesting allows traders to find gaps, enhance their style exposures, and try their strategies without using real money.

- Backtesting relies on the concept that history repeats itself and that what happened in the market previously will occur in the future.

Programming a portfolio backtest is more flexible using Python, while C+ is used for A to Z development.

What Is Portfolio Backtesting?

Portfolio backtesting is assessing how good a trading strategy or model is by applying it to a previous market condition. Backtesting is done using software that the trader needs to program or use a ready-to-use testing platform.

The backtest results will display the strategy outcomes and risk characteristics and analyse related market data that the trader must take into account.

The notion of portfolio backtesting is that the market repeats itself, and what happened before is more likely to happen again. Thus, when a portfolio performs well in historical data, the chances are high to succeed in current market conditions as well.

Afterwards, the trader enhances the strategy according to the test outcomes and runs the backtest again to compare and optimise the strategy.

Importance Of Backtesting Trading Portfolio

Backtesting is vital to discover possible gaps in the portfolio strategy and how risky investing in a specific market is.

Portfolio managers use backtesting portfolio strategies to determine resource allocation and what markets respond to a given trading model. For example, some strategies work while trading cryptos, while others work better with stock trading.

Therefore, backtesting works like a risk management tool. Also, traders use it to evaluate a new trading strategy and how it would work before actually using it in real markets.

How To Conduct a Portfolio Backtest?

If a trader has sufficient knowledge of a programming language, then they can construct software to backtest their strategy. Backtesting portfolio with Python is widespread and relatively easy for developers to perform.

On the other hand, a trader may use trading platforms that offer backtesting options without writing any code. However, a trader must be aware of essential trading concepts, including:

- Backtesting relies on data to provide information. Therefore, it is crucial to use accurate data while performing portfolio backtests.

- Technical and fundamental analysis are essential concepts that every trader must know to analyse market sentiments and build performance forecasts for the market.

- Basic statistics understanding is useful, and concepts like mean, variance, and deviation can give helpful insights to the trader.

Portfolio Backtesting Tools

Some tools help the trader to make the most out of backtesting. Using The best tools for backtesting portfolios helps feed the platform with accurate data to optimise your investments.

Therefore, make sure your backtest platform provides the following tools.

- Portfolio Asset Allocation: This portfolio backtesting tool allows you to create multiple trading portfolios based on the selected markets and financial instruments. It also demonstrates the risk associated with these portfolios and the expected total return.

- Flexible Logic: The software needs to be flexible and consider more market factors like capital limits, leverage, and asset rebalance. This makes the backtest more reliable.

- Accurate historical prices: Portfolio backtesting uses historical values, including historical prices. Therefore, it is necessary to provide accurate prices, including volatility levels and stocks of bankrupt companies.

Steps For a Successful Portfolio Backtesting

A considerable portion of today’s trading activity is done using algorithms that trade on behalf of the trader. If you run an automated test for the first time, here is how to backtest a portfolio.

- Find a trading platform that offers backtesting.

- Select the trading model that you want to backtest.

- Determine the indicators and tools that you want to backtest with your portfolio.

- Decide the conditions and the proper course of action when conditions are met. For example, if the condition X is met, execute a buy order.

- Run the test over several markets, such as ETFs, stocks, mutual funds, and financial instruments.

Backtesting vs. Forward Testing

Opposite to backtesting, forward testing allows the trader to evaluate their trading strategies in a current market situation. This is usually done in a live market simulation, where the trader tests the effectiveness of their tools, methods, and models before using them in the actual market.

Advocates of forward testing consider it more effective since the backtesting uses old data, which might need to be updated and reliable.

Forward testing requires following the system’s logic and documenting this logic while executing trade orders. Thus, all entry and exit points are recorded diligently, without actually performing any real-life trade.

This way, traders can evaluate their portfolio strategy after executing it on a real-market simulation before taking their plans live.

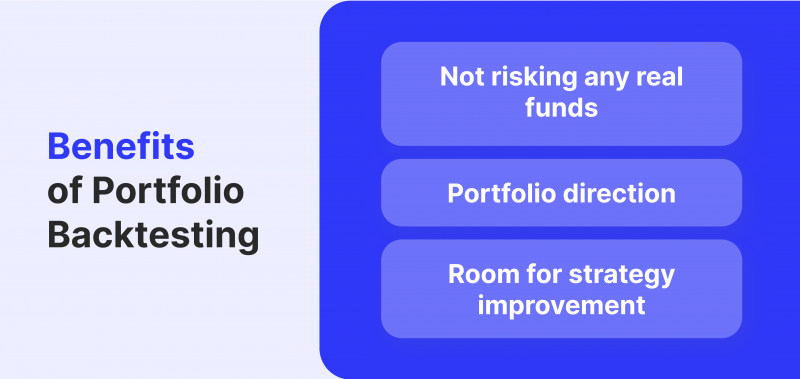

Benefits Of Portfolio Backtesting

Portfolio backtesting is crucial to discover if your strategy has any flaws or advantages before using it in the real market. Therefore, you can expect the following benefits when you automate your process.

- Not risking any real funds: Backtesting is done in a simulation that uses historical market data and price. Therefore, no actual trades are executed, and no real money is used.

- Portfolio direction: Backtest portfolio performance gives the trader directions about what assets they need to trade and strategies they can use.

- Room for improvement: Backtesting the portfolio enables traders to adjust and enhance their strategy according to the test result before applying it in the financial market.

Drawbacks Of Portfolio Backtesting

Although backtesting has several benefits, there are a few drawdowns to conducting a backtest, including:

- Potential bias: It is difficult to avoid bias while conducting backtesting. A trader may – unintentionally – manipulate input data in their best interest to get the best results.

- Cherry-picking: A trader may simultaneously conduct several tests using different variables and hypotheses and pick the one that brings the best results.

- Uncontrollable factors: Some variables cannot be included in the backtest, such as interest rates, market anomalies, and natural disasters, which highly affect trading activity and market sentiment.

Conclusion

Portfolio backtesting is essential to determine trading model strengths and shortcomings. Backtesting portfolio asset allocation helps traders choose the optimal industries and instruments and assess portfolio risks.

These tests use trading platforms that simulate historical market data and activities. The test data is computed and generated, giving the trader investment ideas and direction about what worked best and how to improve their strategies.

A portfolio backtester can combine the simulation with several tools that help the test become more efficient and generate adequate directions to enhance the trading portfolio.