The Nature, Benefits and Risks of Staking Crypto

Articles

Blockchain technology is well-known for its crafty nature, often introducing innovative ways to optimise the available resources. The staking practice is one of these inventive methods, facilitating the creation of new blockchain transactions with existing crypto assets.

First introduced in 2012, the staking method was a welcome addition to the blockchain ecosystem, letting users earn passive income by depositing their extra crypto assets on the respective network. This article will analyse how the staking process works and the factors users should consider before deciding to stake their digital assets.

Key Takeaways

- Crypto staking is a process that enables users to store crypto assets on the blockchain in return for interest rate returns.

- Crypto staking is the closest alternative to fiat bank deposits, presenting crypto’s most reliable passive income offerings.

- The staking process also allows a proof-of-stake algorithm to validate new blockchain transactions effectively and cheaply.

- Staking crypto has several significant risks, including market and liquidity risks tied to its profitability.

What is Crypto Staking?

The decentralised finance landscape has come a long way from its simple roots, increasing the DeFi tools and features progressively. Crypto staking has become one of the biggest offerings in the DeFi sector, letting users validate transactions and generate passive income simultaneously.

At its core, the staking approach functions similarly to the simple process of opening a deposit account in a bank. In both cases, users can deposit extra funds to receive rewards in the form of passive income. However, in the case of fiat deposits, users only receive monetary rewards, and the deposit itself mostly benefits the liquidity of respective banks.

Conversely, the staking process benefits the token holders in two significant ways – providing an opportunity to earn rewards and delivering a reliable way of validating blockchain transactions. After all, each blockchain network requires a dependable validation process, and the staking methodology is ready to satisfy the demand.

The staking is mainly utilised in the proof-of-stake consensus mechanism, which has become the second most popular validation mechanism in the crypto world. Industry giants like Ethereum have adopted this model to validate their robust transaction volumes successfully and efficiently. Thus, the staking model works effectively for all parties involved, giving users ample incentive to stake their assets and increase the validation efficiency on the entire network.

How Crypto Staking Makes the Proof-of-Stake Algorithm Possible?

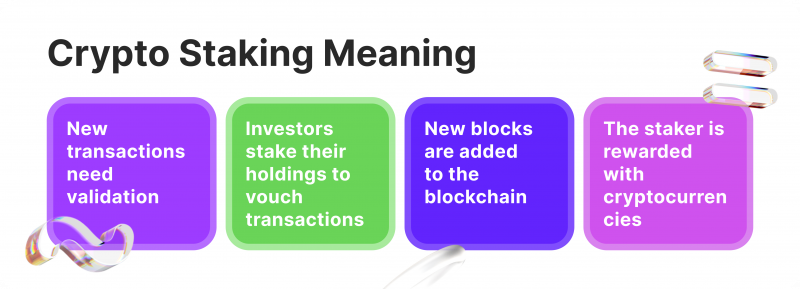

As discussed above, the staking model was conceived with a mission to facilitate a proof-of-stake (PoS) consensus algorithm. Without the staking process, the PoS algorithm would not be able to function, as it directly requires staking tokens in the validation process.

Here’s how the PoS algorithm works – members of a given blockchain network stake crypto assets as deposits, receiving a chance to validate the next transaction on the network. To ensure the integrity of the validation process, the blockchain network is equipped to penalise any parties with questionable motives.

For example, suppose the platform detects any signs of fraud, displacement or illegal activities. In that case, the respective users stand to lose a fraction or even the entirety of their staked assets. Thus, the staking participants have a solid incentive to stay honest and always validate proper transactions.

Thus, the staking process is a critical component of the proof-of-stake algorithm, as it motivates the involved parties to validate transactions without any security concerns. However, single parties only sometimes have to conduct the staking process. While it is possible for users to stake individual assets, most network validators utilise the staking pool approach, accumulating the staked assets from various participants and presenting an aggregated bid on validating transactions.

This way, validators have a higher chance to conduct the validation process and receive staking payouts. The staking pool participants receive their respective income shares as well. With this structure, each party received appropriate rewards for their contributions – the validators increased their chances of winning new transaction bids, and the staking parties earned crypto passive income without heavy involvement.

Benefits of the Staking

As analysed above, staking allows crypto users and blockchain networks to develop excellent synergy, simplifying the block validation process and letting users benefit from their network contributions all at once.

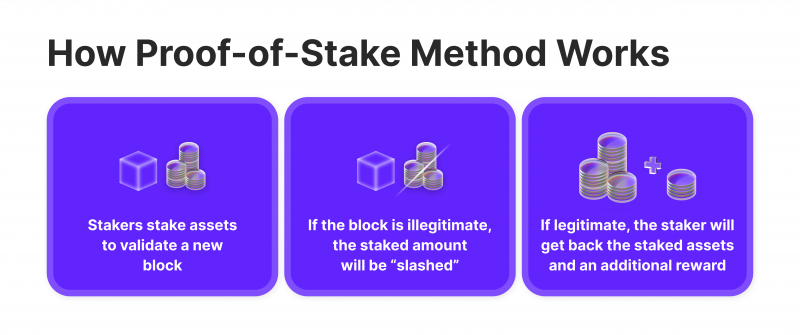

Passive Income Opportunity

A staking process is also an outstanding option for generating passive income in the crypto market. As discussed, staking closely resembles fiat deposit accounts, letting users receive interest income to exchange their monetary assets.

The staking process is the most reliable way to generate passive income from owning crypto assets. Moreover, with cryptocurrencies taking up a larger portion of the global trading market, numerous investors can own surplus crypto assets. Without staking, these assets would simply become idle or even cause losses due to price fluctuations.

Accessibility

The crypto landscape is notorious for its high degree of technical complexity. However, the last few years have witnessed a massive wave of accessible solutions entering the crypto market. From trading exchanges and digital wallets to NFT marketplaces and other blockchain tools, creators strive to make things as simple as possible for the target market.

The staking process is at the forefront of this movement, offering some of the most accessible interfaces to respective users. While the role of validators is quite complex and requires in-depth network knowledge, the staking itself is painstakingly similar to opening a deposit account. Thus, the staking process has almost no barriers to entry. With surface-level requirements, any person who owns a cryptocurrency with staking features will be able to open a crypto deposit in a matter of minutes.

Lower Energy Consumption

Compared to the energy-intensive proof-of-work (PoW) systems, like Bitcoin mining, staking is far more energy-efficient. PoS systems don’t require massive computational power, making them environmentally friendlier and more sustainable in the long run.

Increased Coin Value and Scarcity

As more users stake their coins, the circulating supply in the market decreases. This scarcity can lead to an appreciation of the coin’s value, benefiting long-term holders and stakers. Moreover, staking can indicate a strong belief in the project’s future, further increasing investor confidence.

Staking platforms frequently try to offset their liquidity and market volatility problems with high annual percentage yields. Thus, it is always important to look beyond the attractive return numbers.

The Potential Risks and Downsides of Crypto Staking

While the crypto staking process has been a much-needed breakthrough in DeFi, it comes with significant risks and shortcomings. Despite the lucrative possibilities of passive income and enhanced block validation, staking processes can lead to sizable losses. Thus, to avoid worst-case scenarios, users interested in utilising the staking approach must carefully analyse each of the following aspects:

Market-Related Risks

As with every other crypto-related investment, staking must be carefully examined in the context of market volatility. Despite many efforts to stabilise the market, the crypto industry remains unpredictable and susceptible to dramatic price variations. As a result, investors must be prudent and account for the worst-case scenarios when deciding to stake their digital assets.

To further visualise the market risks, let’s imagine the following scenario – Investor X is considering purchasing crypto A to stake it and earn 20% annual yields. Investor X buys a substantial amount of crypto A and puts it on a crypto staking platform. The staking period is three months for the following asset. In the second month of staking, crypto A experiences a sudden and massive price drop of 40%. As a result, investor X has a reported loss of almost half of its crypto A portfolio.

The following example is a simplified but effective representation of how market volatility impacts staking profits. While the annual staking returns could be substantial, the potential price drop could turn the entire process into a sunk cost. Thus, it is important to be mindful of the market risks and select crypto assets carefully.

Liquidity Concerns

Another ever-present factor in the DeFi field is the concept of liquidity, which dictates how swiftly the users can exchange their assets into liquid cash. Sufficient liquidity has been a problem for the majority of the crypto market, as only Bitcoin and USDT have managed to maintain appropriate liquidity levels. Thus, when considering to stake the crypto assets, users must evaluate the liquidity of underlying cryptocurrencies.

However, many investors could fall into the trap of high staking returns and forget to consider the liquidity risks. It is essential to remember that high staking returns are often employed to offset some inherent risks related to a particular crypto asset. In many cases, high staking yields could mean the crypto asset has low liquidity. Thus, the returns might be lucrative, but investors won’t be able to exchange them into stablecoins or fiat anytime soon.

Lengthy Lockup Duration

Certain crypto staking options employ a lockup period protocol, which effectively freezes the staked assets for a predetermined amount of time. While inconvenient to users, this process enhances the security and stability of blockchain networks. Despite its positive impact on the blockchain ecosystem, lockup periods could cause significant losses to investors if the underlying crypto asset dips in value.

For example, if the lockup period is two months and crypto A is expected to drop the following month, the investment must be ignored even with the lucrative yield possibilities. As discussed above, the crypto landscape is still highly volatile, and the lockup periods increase the chance of portfolio losses.

Thus, seeking a crypto-staking platform that does not force the lockup process onto its users is highly recommended. Lockup-free platforms let users withdraw the staked assets at any given time, letting them minimise the potential losses related to price drops. While the returns on such platforms are generally lower, it is still a worthwhile investment, enabling users to mitigate price variation risks.

Inconsistent Staking Rewards

As with lockup periods, the payout intervals for staking rewards can also be extremely lengthy. In some cases, staking rewards are distributed only once in six months or even once per year. Such cases might not be a problem for long-term investors who wish to earn passive income and nothing else.

But for investors and traders who wish to re-invest or conduct other transactions with their generated profits, the lengthy payout periods could be a significant roadblock. Thus, it is recommended to seek out crypto staking options with frequent payout periods, letting traders utilise the earned passive income at their own convenience.

Income vs Costs

Lastly, it is important to note that crypto staking is not a free process. Whether users decide to become validators themselves or delegate validation to third parties, both scenarios require certain expenses. In the first instance, users will have to purchase appropriate equipment and pay for the hefty electricity bills coming from the validation process. In the second instance, staking pools typically charge a percentage share for their rendered services.

In some cases, bloated third-party commissions or excessive equipment needs might severely decrease the net staking profits. Thus, investors who consider staking must compare the potential returns with the corresponding costs. If the net profits are still lucrative, then the investment can still be worthwhile despite the hefty expenses.

How To Stake Cryptos?

As mentioned above, the staking process is one of the most accessible crypto-related activities on the market. Users can enjoy a simplified staking structure despite the complex inner workings of block validation. First, users must choose a staking platform of their preference. When deciding between staking platforms, it is important to consider the network security, reputation and staking yield percentages.

Remember, with minuscule staking returns, earning a passive income of substantial amounts might become impossible. Next, users must decide on the cryptocurrency of their choice. As outlined above, crypto market risk and liquidity risk are the main factors to consider. After that, users simply select the staking amount of their preference and send the order to the staking platform.

Users sometimes must connect their digital wallets and transfer the funds through this channel. In other instances, the staking platforms may offer built-in possibilities to purchase and store cryptocurrency. Now, users have their own crypto savings accounts. All that’s left is to sit tight and wait for the periodic return payouts. However, users should not forget to monitor the crypto prices regularly and re-examine whether they should continue their investment or withdraw the staked tokens.

Final Takeaways

The staking has taken the DeFi landscape by storm from the first introduction. This inventive protocol enhances the security and stability of blockchain networks while enabling users to generate reliable passive income from their extra crypto funds.

However, the staking process is not absolved from usual crypto pitfalls like market and liquidity risks. Additional concerns include lengthy lockup periods, bloated payout intervals and excessive commissions. Users who account for these risks and choose their staking options wisely stand to earn substantial passive income in the long run.

FAQ

How does the staking process work?

Users deposit their preferred crypto assets on a staking platform, which effectively locks up the mentioned assets for a certain period. In return, users receive periodical percentage yields on their deposited assets.

What are the benefits of staking?

Staking is the closest equivalent to fiat money deposits in traditional banks. Therefore, staking is an excellent opportunity to generate passive income if users possess extra crypto funds. Staking also enhances the security and validation capabilities of the given blockchain network, which is great for all parties involved.

What are the biggest risks related to staking?

Since the staking process is tied to cryptocurrency value, users must carefully consider the market volatility and liquidity risks that prevail in the crypto industry.