Working Principles and Aspects of MT4 Copy Trading

Developed by MetaQuotes, MetaTrader is a multifaceted, professional trading ecosystem that has reinvented electronic trading across the capital markets through a perfect blend of design, technology, and functionality. This has made MT4/5 platforms an exemplary benchmark and industry leader, setting new trends.

Among a large number of trading modes offered by the platform, MT4 copy trading is especially popular, which gives the opportunity to use (copy) other people’s strategies as a basis for making money on price changes in certain assets.

This article will help you gain insight into the MT4 copy trading concept and its strengths. You will also learn about the challenges involved with using a MetaTrader 4 trade copier and what you need to do to start copying trades on this platform.

Key Takeaways

- Copy trading is one of the most common modes used when working on the MT4 platform.

- The key participants in copy-trading are signal providers who offer their trading strategies free of charge.

- The possibility to learn trading with the help of other people’s strategies is one of the important features of copy-trading.

What is the MT4 Copy Trading Concept?

MetaTrader 4 (MT4) is commonly used as a trading platform in the FX and CFD markets due to its user-friendly interface, robust charting features, and extensive analysis tools. The flexibility of the MT4 platform is well-known, as it enables traders to personalise indicators, develop automated trading strategies (expert advisors), and utilise various order processing options.

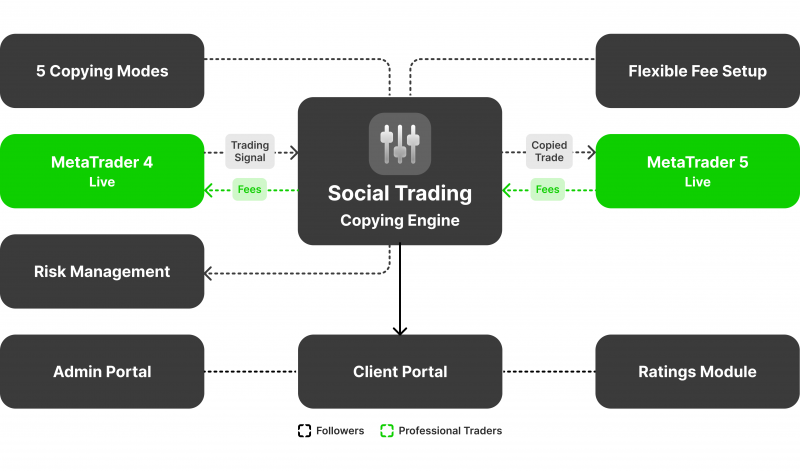

Copy trading is a feature built into the MT4 software that empowers traders to copy the trades of other experienced or successful traders proactively. This allows less experienced traders to leverage the competencies and trading methodologies of more proficient ones, potentially leading to improved trading performance.

The key aspects of copy trading on the MT4 platform include:

Signal Providers

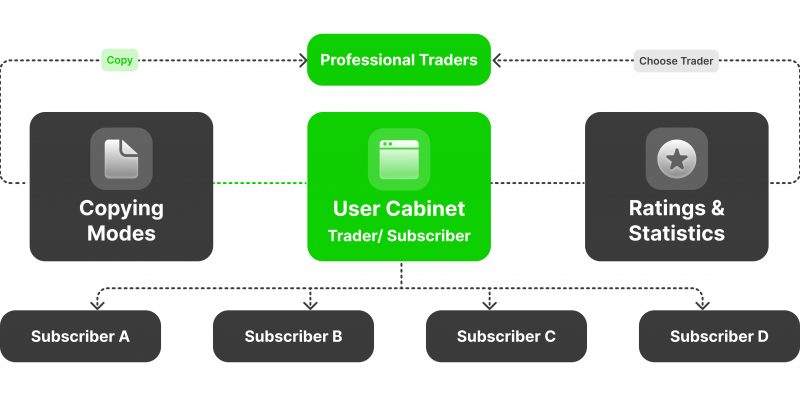

Signal providers on the MT4 platform are skilled traders who generously share their trading activities and strategies with others. They are typically experienced and successful individuals who are eager to pass on their knowledge and expertise to fellow traders.

Copying Traders

When traders opt to replicate the trades of signal providers, they are referred to as copying traders or followers. These individuals have the option to choose one or multiple signal providers to follow and then automatically mimic their trades.

Copying Mechanism

The MetaTrader 4 platform streamlines the copying process by synchronising the signal provider’s trades with the copying traders’ accounts. This guarantees that the copying traders execute identical trades, using the same lot sizes and entering or exiting the market at the same points as the signal provider. This enables the copying traders to replicate the signal provider’s trading actions precisely.

Risk Mitigation

Copy trading is a feature that provides a high level of customisation for risk management settings. This allows individuals who copy trades to have control over the level of exposure and leverage used when replicating the trades of other traders.

Compensation

Signal providers can choose to charge a fee or commission to the traders who copy their mt4 copy trading signals. This payment model incentivises signal providers to commune their trading ideas and expertise with the copying traders.

Proportional Allocation

When trades are copied, they are usually replicated in proportion to the available capital in the investor’s account compared to the capital of the signal provider. This means that the size of the copied trade is adjusted based on the investor’s available funds relative to the signal provider’s capital.

Social Trading Networks

A number of copy trading platforms serve as social trading networks, allowing users to engage with each other, exchange valuable insights, and track the trading activities of experienced traders.

By leveraging the copy trading feature on the MT4 platform, less sophisticated traders can conceivably take gain from the knowledge and strategies of more proficient traders, potentially enhancing their own trading performance and reducing the learning curve associated with Forex and CFD trading.

Copy trading evolved from mirror trading, which involves copying trading strategies rather than individual trades: developers share trading stories, and traders select and repeat the most profitable algorithms.

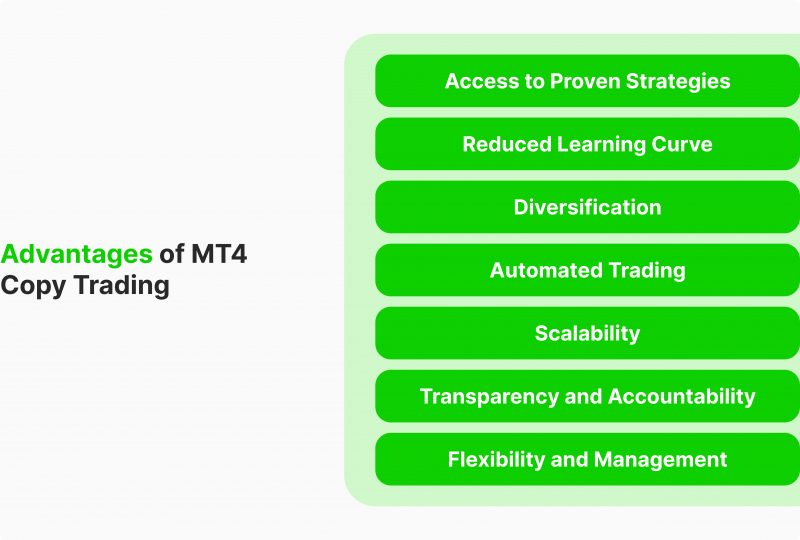

Advantages of MT4 Copy Trading

The copy trading Forex MT4 offers a modern set of all key tools and services, combining the latest developments and innovative technologies in the field of trading based on copy systems for working with any type of capital markets and trading assets.

Thus, among the main advantages of using copy trading software MT4 for both newcomers in the world of trading and advanced professionals are the following:

Have a Question About Your Brokerage Setup?

Our team is here to guide you — whether you're starting out or expanding.

Access to Proven Strategies

By copying traders, individuals can tap into the trading techniques and knowledge of accomplished signal providers without having to cultivate their own trading abilities from the ground up. This enables less experienced traders to potentially leverage the expertise and market perspectives of more skilled traders.

Reduced Learning Curve

When new traders engage in copy trading, they can greatly reduce the time it takes to learn, as they have the opportunity to observe and imitate the decision-making processes of seasoned signal providers. This, in turn, can expedite the advancement of their trading abilities and their comprehension of the market.

Diversification

Traders who copy others can expand their investment portfolios by following multiple signal providers, each with their own unique trading styles and approaches to managing risk. This expansion can help reduce the overall risk and fluctuations in the trader’s account.

Automated Trading

Copy trading on MT4 is a feature that automates the entire process of executing trades. It significantly simplifies the manual effort entailed by permitting users to duplicate the trades made by other experienced traders automatically.

This can be particularly beneficial for traders who have limited time to devote to monitoring the markets or for those who are new to trading and want to learn from seasoned investors.

Scalability

By leveraging the expertise and trading volume of signal providers, traders can potentially scale their positions and portfolios more easily. This can be particularly advantageous for traders with limited capital or those who are looking to grow their accounts, as it provides access to valuable insights and allows them to benefit from the success of more experienced market participants.

Transparency and Accountability

The MT4 platform offers robust performance tracking and reporting features for signal providers and copying traders. This level of transparency enables copying traders to thoroughly analyse performance data and make well-informed decisions.

Furthermore, it holds signal providers accountable for their trading activities by providing detailed reporting and analysis.

Flexibility and Management

When using the MT4 web platform, traders have the flexibility to personalise their risk management parameters, including setting the maximum lot size and leverage to suit their specific investment goals and risk characteristics. This high degree of customisation empowers copy traders to fine-tune the copy trading process according to their unique requirements.

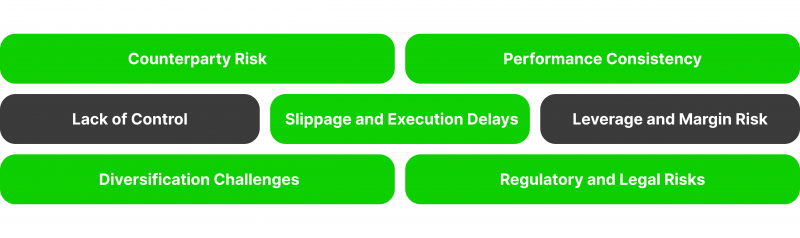

Risks Considering While Performing MT4 Copy Trading

The great popularity of the MT4 platform in the world of electronic trading has allowed it to grow and evolve, bringing improvements and innovations for its users. In particular, MetaTrader trade copier software has recently been in high demand due to its functionality, distinctive features and affordability.

However, despite the impressive positive qualities, this type of trading also has its disadvantages, expressed in the following risks:

Counterparty Risk

It’s important to be aware of the potential risks involved when you are copying a signal provider. Issues such as technical glitches, financial problems, or even fraudulent activities on the part of the signal provider can have a direct and negative impact on your trading outcomes. This emphasises the significance of conducting extensive research and due diligence to thoroughly assess the reliability and trustworthiness of signal providers before you decide to allocate your trading capital to them.

Performance Consistency

Signal providers’ historical trading results may not necessarily reflect their future success. This is because market conditions and the expertise of the signal providers can vary over time. Relying exclusively on past performance as an indicator of future success may not always be reliable.

Lack of Control

When you choose to engage in copy trading, it’s important to recognise that you are entrusting a portion of your trading autonomy and portfolio oversight to another individual. This entails a certain level of risk, as the trading methods and risk reduction techniques employed by the signal provider may not necessarily align with your individual preferences or risk threshold.

Slippage and Execution Delays

It is important to note that although we strive for accurate and timely execution of trades in your account based on the signal provider’s recommendations, there are scenarios where slippage or execution delays may occur. These factors can lead to variations in your trading results when compared to the signal provider’s reported performance.

Leverage and Margin Risk

When signal providers engage in trading, they often make use of high leverage or margin, enabling them to potentially increase both their profits and losses. Meanwhile, it’s paramount to be aware that excessive leverage has the potential to result in significant drawdowns within your trading account, particularly if the market moves against the signal provider’s positions.

Diversification Challenges

Depending too much on one signal provider can subject your portfolio to concentration risk, as their performance will significantly affect your overall trading outcomes.

Spreading your investments across various signal providers can reduce this risk, but it also means handling multiple copy trading relationships effectively.

Regulatory and Legal Risks

Confirming that the signal providers you choose to copy are operating within the relevant regulatory frameworks is crucial. Additionally, ensure that their activities comply with local laws and regulations. Neglecting to verify this information could lead to potential legal or regulatory consequences for you.

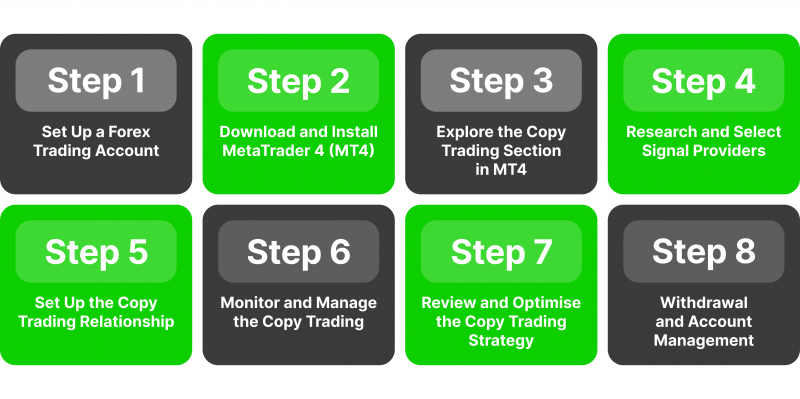

How to Perform MT4 Copy Trading?

Copy trading using the MT4 platform is a powerful tool for copying trades, providing access to a myriad of analytical, statistical and risk management resources, and is therefore very popular today.

To get started, you must go through several steps to familiarise yourself with and install the software. These steps include:

Discover the Tools That Power 500+ Brokerages

Explore our complete ecosystem — from liquidity to CRM to trading infrastructure.

1. Set Up a Forex Trading Account

Open a trading account with a broker that offers the MT4 platform and copy trading functions. Assure the account is suitable for your investment goals and risk tolerance.

2. Download and Install MetaTrader 4

Download the MT4 platform from your broker’s website or the official MetaTrader website. Install the MT4 software on your computer or mobile device.

3. Explore the Copy Trading Section in MT4

Locate the copy trading section within the MT4 platform, usually found under the “Tools” or “Navigator” menus. Familiarise yourself with the available features and settings for copy trading.

4. Research and Select Signal Providers

Explore the list of available signal providers, also known as “traders” or “experts.” Analyse their trading history, performance metrics, risk management practices, and trading styles to identify suitable providers. Consider factors such as drawdowns, win rates, and consistency of performance.

5. Set Up the Copy Trading Relationship

Choose the signal provider(s) you want to copy and initiate the copy trading connection. Adjust the copy trading settings, such as the maximum lot size, risk limits, and leverage, to align with your risk aversion providers, which can optimise your risk tolerance and investment objectives.

6. Monitor and Manage the Copy Trading

Consistently monitor the trading activity of the signal provider(s) you are copying. Observe the implications on your account, reckoning realised profits/losses and overall portfolio performance. Adjust the copy trading settings or pause/stop the copying process if necessary, based on your ongoing risk assessment.

7. Review and Optimise the Copy Trading Strategy

Regularly review the performance of the signal providers you are copying. Evaluate the consistency of their trading results and consider adding or removing providers to build up your copy trading portfolio. Fine-tune your copy trading settings and risk management parameters as needed.

8. Withdrawal and Account Management

Maintain a disciplined approach to withdrawing profits and managing your trading capital. Ensure you have a withdrawal strategy that aligns with your financial goals and risk tolerance.

Conclusion

MT4 copy trading opens up new opportunities for capital growth thanks to the availability of a wide range of professional software focused on providing optimal working conditions with the process of copying trades, which in turn allows providing the best experience in copy trading on the basis of the most sought-after trading platform in the world MetaTrader.

FAQ

What is MT4 copy trading?

MT4 copy trading is a feature within the MT4 trading environment that encourages traders to autonomously copy the trades of other experienced traders, known as “signal providers” or “traders.”

How does the copying process work in MT4?

The copying trader selects one or more signal providers to follow. The MT4 platform then automatically replicates the signal provider’s trades in the copying trader’s account, considering the trade size, entry and exit points, and timing.

What are the benefits of MT4 copy trading?

Key benefits include the ability to leverage the resources of advanced traders, diversify your trading profile, and potentially improve your trading results without needing to set up your own trading algorithms.

How do I choose a suitable signal provider to copy?

When selecting signal providers, consider factors such as their trading history, risk mitigation approach, consistency of outcomes, and alignment with your investment objectives and risk preferences.

Can I copy multiple signal providers simultaneously?

Yes, you can copy trades from multiple signal providers simultaneously to enrich your copy trading profile and potentially ameliorate overall risk.

What are the risks involved in MT4 copy trading?

Key risks include counterparty risk (depending on the signal provider’s reliability), performance consistency, lack of oversight, and the prospect of slippage or execution delays.