Top 7 Best Copy Trading Platform Providers for Your Brokerage

Articles

Offering your clients the right copy trading platform is a must if you want to stay ahead in the competitive brokerage marketplace, whether it’s in Forex, crypto or any other financial market. However, the question is – what is the best copy trading platform provider for your brokerage?

Emerging from humble beginnings, where trading strategies were exchanged via newsletters, to the advent of virtual trading rooms, copy trading has significantly transformed over the years. It’s no longer an industry secret but a popular feature provided by online financial trading brokers aimed at helping novice traders reap the benefits of successful investors’ trading decisions, and it is widely popular among retail traders globally.

Key Takeaways

- The market has a variety of technology providers offering copy trading services.

- Copy trading attracts a wider audience, increases trading volume, and fosters client loyalty.

- Offering copy trading services requires adherence to all relevant financial regulations and compliance standards.

- Copy trading also includes risks that should be communicated clearly to clients, promoting informed decision-making and realistic investment expectations.

What is Copy Trading?

Copy trading is a form of social trading that enables individuals to mimic the trades of skilled and profitable investors. It allows novices to emulate the strategies of veteran traders, leveraging their knowledge to enhance their own performance.

The mechanism behind copy trading is straightforward yet technologically sophisticated. A copy trading platform acts as the intermediary, bringing together master traders, also known as signal providers and followers. Signal providers showcase their portfolios, including open positions and trading decisions, on the platform, providing transparency to potential followers.

Once a follower chooses a signal provider to follow, the copy trading platform seamlessly replicates every trade initiated by the master trader in the follower’s account, scaled to their available capital. This real-time replication ensures that followers can capitalise on the expertise of signal providers without actively managing their investments.

Best Copy Trading Software Providers for Brokers

If you’re running or planning to launch a brokerage, offering copy trading services to your clients will be essential to your success and competitiveness in the market. To help you out, here are the best social trading platform providers:

B2BROKER

B2BROKER is a global fintech solutions provider that caters to financial services enterprises of all sizes by providing them with competitive, reliable, and affordable liquidity solutions. As a global liquidity provider in numerous digital markets and jurisdictions, the company utilises a prime of prime (PoP) model, granting smaller firms access to the tier-1 liquidity pool of prime brokers and commercial banks.

B2BROKER’s portfolio of turnkey solutions consists of a range of products, including margin trading platforms, payment gateways, investment management systems, and Forex brokerage and crypto exchange WL solutions.

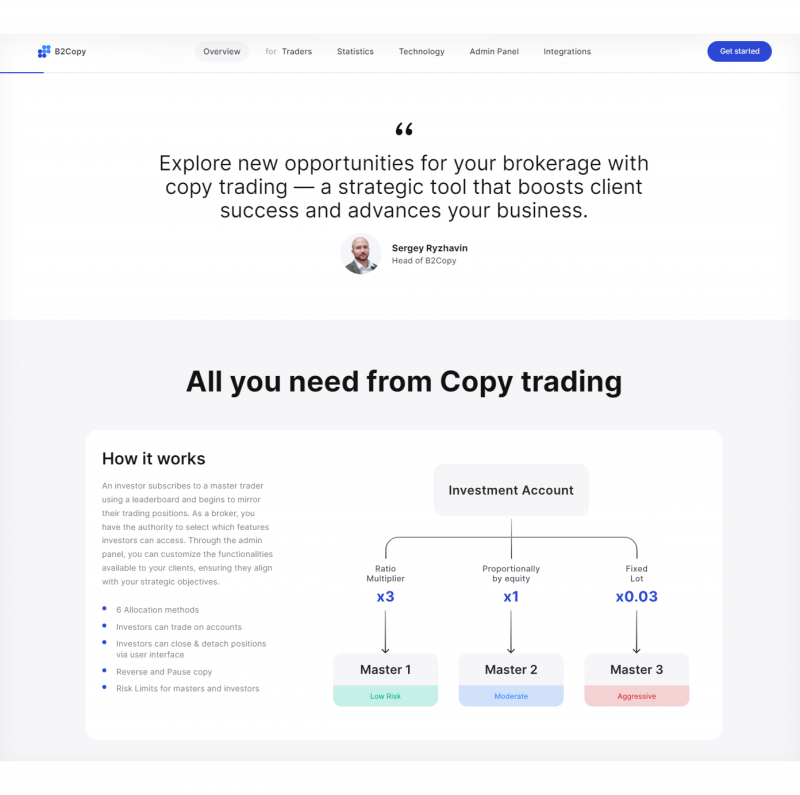

About B2BROKER’s Copy Trading Solution

B2BROKER’s copy trading solution, B2COPY, is a comprehensive and flexible money management platform that equips brokers with the tools to offer their clients an all-in-one social trading experience. Traders can subscribe to master traders through a leaderboard and mirror their positions in real-time.

Brokers can customise the features available to their clients through the admin panel, ensuring they align with their strategic objectives. B2COPY also offers six different allocation methods, allowing brokers to choose which one best suits their business model and risk management strategy.

The company also offers PAMM and MAM accounts platforms for brokers who wish to provide professional asset management services. The platform is equipped with advanced functionality for effective risk management, including stop loss and take profit features.

In terms of currency support, the B2BROKER platform leaves no stone unturned. It caters to accounts in fiat and cryptocurrencies, including but not limited to USD, JPY, BTC, USDT and EUR. These capabilities allow clients the flexibility to operate accounts in any currency, with all fees duly calculated and paid.

Leverate

Leverate, a prominent white label brokerage provider, brings over two decades of experience to the table in creating and managing advanced FinTech platforms. Its reputation is built upon delivering fully automated digital solutions that cater to both B2B and B2C financial markets, aimed at driving effective business results.

The company provides an extensive array of trading products and solutions, comprising liquidity options, trading platforms, CRM systems, and risk management instruments. Aimed at empowering brokers, these services are meticulously designed to elevate the quality of their offerings, ensuring superior performance.

About Leverate’s Copy Trading Solution

Leverate’s SIRIX Social is the company’s proprietary Forex social trading platform, offered as a part of its SIRIX trading suite. It boasts seamless connection with the trading system, offering traders cutting-edge technology and precision tools to elevate their experience, including advanced charting capabilities, risk management tools and social trading platforms integration.

Leverate’s SIRIX Social offers everything a robust Forex copy trading software needs: extensive customisation options, providing brokers with the ability to tailor the platform to their brand identity and trading philosophy, a dedicated dashboard for clients, showcasing master trader performance metrics and fostering a community of shared expertise, and more.

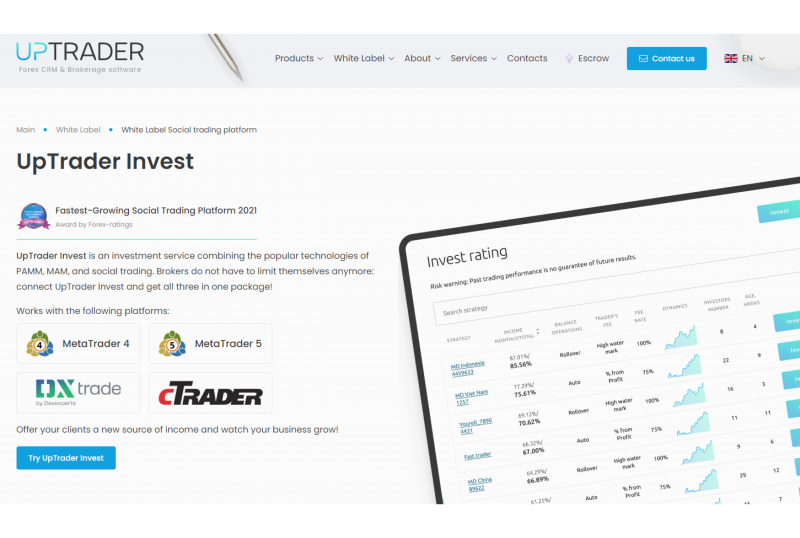

UpTrader

UpTrader has been a leading fintech software provider for over ten years, offering cutting-edge CRM for brokerage businesses. With outstanding technological expertise and professional support, the company has gained a reputation as one of the best copy trading software providers in the market.

One of UpTrader’s standout features is its cloud CRM system, which efficiently manages client relationships and allows brokers to track and analyse their customer base. Aside from that, UpTrader offers a comprehensive suite of products for brokers to choose from, including MT4/MT5 Terminal, copy trading management system, and liquidity provision services.

About UpTrader’s Copy Trading Solution

UpTrader’s copy trading solution – UpTrader Invest – is a combination of PAMM, MAM and social trading technologies, providing brokers with access to a variety of successful traders for their users to follow. The platform is compatible with popular trading platforms such as MT4, MT5, DXTrade, and cTrader copy trading.

UpTrader’s software has one major advantage, and that is its intuitive and user-friendly interface, making it easy for all parties involved to manage their accounts and investments. The service also offers a wide range of trading instruments, including currencies, cryptocurrencies, spot metals, CFDs on stocks, futures, bonds, and indices.

Match Trader

Match Trader is a well-established player in the trading platform market, with a history dating back to 2015. Their trading platform, a standalone system with its own backend infrastructure, was initially released as an institutional platform and has since evolved to cater to retail brokers with a white label option. It is also available for purchase as server licences, giving brokers the flexibility to choose the best model for their business.

About Match Trader’s Copy Trading Solution

Match Trader‘s social trading software is integrated into its proprietary platform, making it easily accessible and user-friendly for both brokers and traders. The feature allows beginner traders to follow the signals of experienced professionals, increasing retention rates for brokers.

Match Trader’s social trade copier is available through their MT4/5 Client Office mobile app, allowing traders to seamlessly switch between the desktop and mobile versions without any interruptions or need for separate profiles.

CAPFINEX

CAPFINEX is a provider of ready-made business solutions for financial companies, offering digital transformation and full-cycle development services. Their focus on leveraging cutting-edge technology and industry expertise enables them to offer faster trade execution, improved liquidity, and secure transactions to their clients.

This company’s portfolio includes turnkey broker solutions, multi-asset brokerage services, MT4/MT5 white label options, cryptocurrency market access, turnkey ICO launch assistance, NFT development capabilities, and crypto brokerage and exchange services.

About CAPFINEX’s Copy Trading Solution

CAPFINEX provides a comprehensive copy trading platform that merges MAM and social trading. Traders can choose from a pool of professional traders to copy their trades, rather than solely relying on automated strategies.

The platform provides advanced analytics, offering detailed statistics and performance data for each master account within the system. Trades are chosen based on profitability, drawdown levels, and other indicators, and there are even daily loss limits and a maximum number of orders to manage risk.

Furthermore, CAPFINEX’s copy trading solution includes a personal account feature, making it easy for users to manage their accounts and access all the necessary tools without the need for additional plugins.

Soft-FX

Soft-FX is a fintech development company that has been providing digital solutions for the FX and blockchain platforms since 2005. The company has established long-term partnerships with major players in the industry, including Forex brokers, digital currency platforms, and financial institutions, offering technological solutions to more than 500,000 end-users globally.

Soft-FX’s portfolio includes a wide range of products and services, including liquidity aggregation, risk management, and trading platforms for both traditional and digital assets. The company also offers bespoke solutions tailored to the specific needs of its clients.

About Soft-FX’s Copy Trading Solution

Soft-FX’s PAMM system is a sophisticated SaaS web portal that leverages the advanced capabilities of the proprietary TickTrader trading platform, designed to meet the diverse needs of trading enterprises. Its PAMM technology consolidates investors’ funds into a single managed account, enabling skilled traders to demonstrate their trading prowess to prospective followers.

TickTrader distinguishes itself with superior risk management tools and flexible reporting features, rendering it an all-encompassing solution for brokers who wish to provide copy trading services. Soft-FX ensures an unparalleled user experience by offering continuous technical support and regular product enhancements.

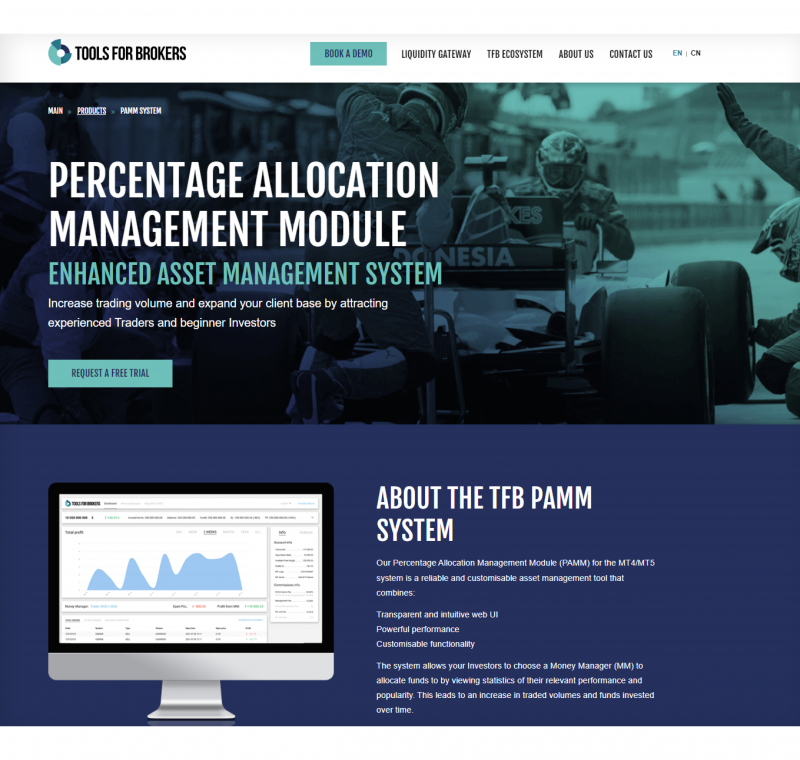

Tools for Brokers

Tools for Brokers is a leading technology provider offering solutions for retail brokers, hedge fund managers, and prop traders. Its ecosystem of products covers the most critical brokerage needs, with its trade processor – a liquidity bridge – being the cornerstone.

The firm’s suite of solutions includes advanced monitoring and reporting capabilities, a money management system, and a selection of plugins and applications targeting specific pains.

About Tools for Brokers’ Copy Trading Solution

Aside from liquidity solutions, Tools for Brokers also offers a state-of-the-art PAMM module on MT4 and MT5, designed for brokers and money managers looking to maximise their earnings. The company’s PAMM module offers a transparent and intuitive web user interface, powerful performance, and customisable functionality.

Brokerages can easily manage data visibility for investors and money managers, set individual view parameters for each client, and have regular reports on open positions and equity. With access to the system on mobile and tablet devices 24/7, brokers can track changes and updates in real time.

The Pros of Copy-Trading Services for Forex Brokers

Integrating copy trading into the services offered by Forex brokers can bring numerous benefits for both the brokers and their clients. Let’s explore some of the advantages of incorporating copy trading:

Attracting a Wider Audience

Copy trading has become increasingly popular among traders in recent years, creating a demand for brokers who offer this service. Incorporating copy trading into Forex brokers’ services can attract a wider audience of potential clients.

Increasing Trading Volume

Copy trading allows for a seamless and efficient way for traders to execute trades, which can lead to an increase in trading volume, which is beneficial for brokers as it can result in higher commissions and profits.

Building Client Loyalty

Financial companies offering copy trading services can develop more meaningful relationships with their clients, giving them a convenient and user-friendly platform on which to trade, which leads to increased client retention and loyalty.

What to Consider Before Offering Copy Trading Services to Traders

While the addition of the copy-trading service into a brokerage’s operations offers significant advantages, it’s crucial to approach it with diligence.

Compliance with Regulations

Ensuring that all relevant financial regulations and compliance standards are adhered to when offering copy trading is of utmost importance for brokerage firms. You must guarantee that their operation meets all legal prerequisites to safeguard your clientele.

Technology Infrastructure

Investing in a robust and secure technological infrastructure is vital for smooth copy trading execution. The platform should handle real-time replication of trades effectively and securely, ensuring the precision and reliability of copied trades.

Reliable Money Managers

The performance and reliability of trading signals offered to clients depend heavily on the broker’s choice of signal providers. Thorough vetting of these providers is necessary to uphold the integrity of the copy trading platform.

Risk Notification

Although copy trading provides opportunities for better trading outcomes, it also comes with its own set of risks. You need to make sure clients comprehend the potential for losses when emulating the trades of signal providers. Clear risk notification promotes informed decision-making and aids clients in setting realistic investment expectations.

Conclusion

Offering copy trading services can bring significant benefits to Forex brokers and their clients. However, it’s crucial to approach this innovation with diligence by ensuring compliance with regulations, investing in a reliable technology infrastructure, vetting signal providers thoroughly. With the right approach, copy trading can be a valuable addition to any brokerage, driving client retention and business growth.

FAQ

What should I look for in a copy trading platform for my brokerage?

To select a platform for your brokerage, focus on its features and functionalities. Opt for a user-friendly interface that’s simple for you and your clients to navigate. Prioritise security, ensuring the platform uses advanced encryption technologies and contains multiple security layers. Consider whether the platform supports a variety of assets that match your brokerage’s offerings and can be integrated seamlessly with existing systems. Lastly, check the reputation of the platform as well as the reviews it has received to gauge its dependability.

Do copy traders make money?

Yes, copy trading can indeed be profitable. As evidenced by Bitget’s 2023 report, 93% of futures copy traders made profits on the crypto platform.

Is copy trading illegal?

Copy trading is categorically legal as long as it’s conducted through a regulated broker or trading platform. In the U.S., the Securities and Exchange Commission (SEC) oversees securities trading, ensuring its legality. The same practice is generally followed in most countries around the globe.

Can traders lose in copy trading?

Yes, traders can indeed incur losses in copy trading. This is because copying trades, like all financial market activity, necessitates risking a portion of a trader’s capital. Potential market risks may lead to a decrease in that capital if the copied trader’s transactions do not yield the desired results.

What features define the top copy trading platforms?

Top copy trading platforms should offer user-friendly interfaces, robust copy trading tools, and support for multiple asset classes, such as Forex and cryptocurrencies. These platforms must provide real-time trade replication, ensure high security, and integrate seamlessly with brokers’ existing systems to deliver a reliable and efficient trading experience.

How do copy trading tools benefit brokerage firms?

Copy trading tools help brokerage firms attract a broader audience by offering accessible trading options for novice investors. They enhance client loyalty by providing a seamless, user-friendly platform and increase trading volume, leading to higher revenue and competitive positioning in the marketplace.