A importância do copy trading para uma corretora forex

Artigos

A negociação forex, um empreendimento inerentemente arriscado, envolve comprar e vender moedas no mercado Forex, um mercado global que se encontra acessível tanto para novatos quanto para operadores de mercado profissionais. O papel da corretora Forex é fornecer acesso a este mercado e facilitar as suas decisões de negociação. Dado que este mercado continua a evoluir, as corretoras começaram a potenciar inovações como o copy trading para exponenciarem o seu alcance e melhorarem os seus serviços.

O copy trading, um subconjunto da negociação social, tem emergido rapidamente como uma tendência influente na negociação Forex. Este permite que os operadores de mercado espelhem as estratégias de negociação, bem como as decisões, dos operadores de mercado mais experientes e que as apliquem nas suas contas de negociação. Mas quais são as implicações disto para uma corretora Forex?

Este blogue aprofunda a importância do copy trading para uma corretora Forex, desde como beneficia as suas operações até aos desafios que pode apresentar.

Principais considerações

- A ascensão do copy trading oferece um efeito de democratização no mercado FX, tornando-o mais acessível e menos intimidatório para os iniciantes, enquanto fornece uma nova ferramenta estratégica aos veteranos.

- O sucesso do serviço de copy trading de uma corretora depende fortemente do fator “humano” – os operadores de mercado experientes escolhidos – sublinhando a necessidade de um processo de verificação rigoroso.

- À medida que a IA e a aprendizagem de máquina deixam a sua marca, o casamento da tecnologia e do copy trading poderão, potencialmente, revolucionar a abordagem à negociação Forex, tornando-a essencial para as corretoras permanecerem na linha da frente da inovação.

Compreender o copy trading

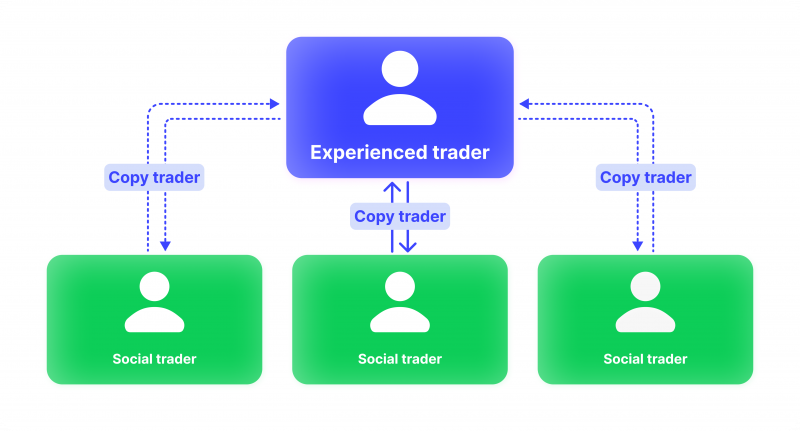

Na sua essência, o copy trading implica imitar as negociações dos operadores de mercado bem-sucedidos replicando automaticamente as suas ações de negociação na sua conta de negociação. Este método oferece muitas vantagens, particularmente para os operadores de mercado novatos com conhecimento de mercado limitado. As plataformas de copy trading servem como uma ponte, ligando os operadores de mercado menos experientes aos operadores de mercado mestres que têm um registo comprovado no mercado Forex. O melhor software de copy trading e plataformas de negociação social, tal como a MetaTrader 4, MetaTrader 5 e cTrader, facilitam esta ligação imaculada, reforçando a experiência de negociação em termos gerais.

O copy trading também permite diversificar as estratégias de negociação copiando negociações de vários operadores de mercado simultaneamente. Através das plataformas MAM e PAMM, pode alocar diferentes proporções do seu capital de negociação em diferentes estratégias de negociação executadas por diferentes operadores experientes. Esta estratégia de diversificação pode, potencialmente, levar a negociações mais bem-sucedidas, melhorando o desempenho geral da sua conta de negociação.

No entanto, como qualquer abordagem de negociação, o copy trading também tem os seus contratempos. Por um lado, nem sempre garante que é rentável. Até os operadores de mercado experientes podem ter negociações em perda e, por extensão, os operadores de mercado que os copiem também podem experienciar perdas. Além disso, pode desencorajar novos operadores de mercado de desenvolverem as suas respetivas estratégias de negociação e de compreenderem as condições do mercado, dado que ficam demasiado dependentes das decisões dos operadores de mercado experientes que estão a copiar.

O copy trading evoluiu da negociação espelhada em 2005 onde, inicialmente, os operadores de mercado imitavam algoritmos mas, posteriormente, trocaram para a replicação das ações de operadores de mercado individuais.

A função de uma corretora forex no copy trading

As corretoras forex desempenham um papel central nForex brokers play a pivotal role in copy trading. They provide the platforms where the copy trading process unfolds and help traders access the resources they need to succeed. To illustrate, the MetaTrader copy trading service, available on both MetaTrader 4 and MetaTrader 5, is facilitated by brokers who provide these platforms to their clients.

A Forex broker’s role is integral to a copy trader’s success. The broker’s platform determines which experienced traders you can copy, directly influencing your trading decisions and outcomes. They are the gatekeepers of quality, as they control the selection of experienced traders on their platform. Hence, they are crucial in ensuring clients connect with successful traders with solid trading histories.

The Benefits of Copy Trading

Integrating copy trading into Forex brokerage services can bring about several significant benefits. It has transformed traditional trading operations and can offer a new dynamic to the Forex broker’s business model. Here are some in-depth details about these advantages.

Increased Trading Volumes

Copy trading inherently involves the execution of additional trades. A new trade is initiated each time a novice trader decides to follow and copy an experienced trader. This directly results in increased trading volumes, which benefits brokers as their revenues are often derived from commissions based on the volume of trades executed. Therefore, the higher the trading volume, the higher the potential revenue for the broker.

Diversification of Client Base

Copy trading also significantly broadens the scope of potential clientele for Forex brokers. The very nature of copy trading, which allows less experienced traders to mirror the strategies of professionals, opens the door to individuals who may have previously felt that the Forex market was beyond their comprehension. This includes novices looking for a simplified trading experience, as well as more advanced traders seeking to diversify their strategies or mitigate risk. As a result, brokers can attract a more diverse range of clients, increasing their market share and enhancing their brand reputation.

Improved Client Retention

Brokers can improve client retention by offering comprehensive and efficient copy trading services. The benefits of copy trading, such as the ability to leverage the expertise of professional traders, are attractive to both new and experienced traders. As traders continue to perceive value in these services, they are likelier to remain loyal to a broker that provides a robust, transparent, and user-friendly copy trading service. In addition to attracting new clients, this increased customer loyalty can improve brokers’ long-term profitability.

Challenges Forex Brokers Encounter with Copy Trading

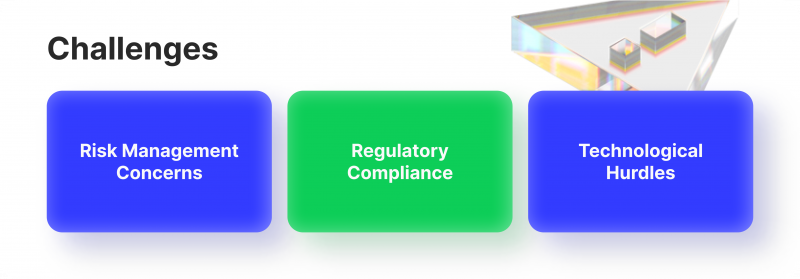

While copy trading offers significant advantages, it’s also associated with some unique challenges that Forex brokers must be prepared to address.

Risk Management Concerns

Copy trading can potentially magnify risks because when an inexperienced trader copies a losing trade, the losses are duplicated across multiple accounts. Brokers must address this challenge by not only educating their clients about these risks but also providing tools and features to manage them effectively. This might include offering risk management tools like stop-loss orders and risk diversification options, such as allowing users to copy trades from multiple traders.

Regulatory Compliance

Navigating regulatory issues is another challenge. Forex brokers must ensure that their copy trading services comply with the financial regulations of the jurisdictions in which they operate. This requirement can be particularly demanding in regions with rigorous financial regulation and may necessitate allocating extra resources for regulatory compliance.

Technological Hurdles

Finally, technological challenges are an integral part of providing copy trading services. Forex brokers must develop and maintain robust technical infrastructure to support real-time trade copying, guarantee platform stability, and deliver a seamless and intuitive user interface. Ensuring these requirements necessitates significant technological investment and may require collaboration with technology experts. In addition, the constant evolution of technology necessitates regular updates and adaptations to keep the platform current and efficient. Despite these challenges, a strong technological foundation is crucial for delivering an effective and reliable copy trading service.

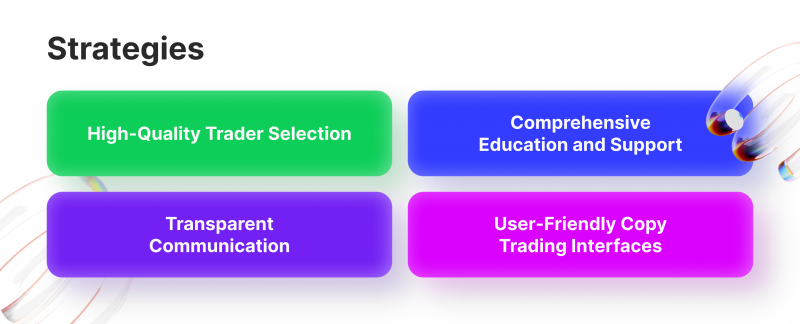

Strategies for Forex Brokers to Enhance Copy Trading Experience

Forex brokers have the potential to enhance their copy trading services by adopting an array of strategic measures. The aim is to ensure maximum value to their clientele, which encompasses newbie traders looking for a jump-start, as well as experienced traders seeking diversification. Here are some in-depth approaches.

1. High-Quality Trader Selection

The first and arguably most critical step in the ladder to successful copy trading is the careful selection of experienced traders. It’s essential to understand that the success of a newbie trader and the broker’s reputation significantly depends on the selected master traders’ performance. The presence of proficient, successful traders on the platform encourages new and existing clients to engage more with copy trading.

Brokers should follow a stringent vetting process to identify these traders. Criteria should include thoroughly reviewing the trader’s trading history to determine their consistency and profitability. Examining their risk management practices is equally important. An experienced trader adept in risk mitigation strategies ensures safer trading outcomes for those copying them. Only traders with a consistent, proven track record should be featured, thus maintaining the integrity of the copy trading platform and enhancing its appeal to potential traders.

2. Comprehensive Education and Support

Secondly, the importance of comprehensive education and support cannot be overstated. The domain of Forex trading, more so copy trading, can be intricate for novice traders. Therefore, brokers should invest in developing a well-structured and easily accessible education program to equip traders with the necessary tools to navigate the copy trading landscape successfully.

Educational content should cover a broad spectrum, ranging from basics like the mechanics of copy trading, selecting a suitably experienced trader to copy, and understanding the parameters within a trader’s strategy to advanced concepts such as deciphering market conditions and how they affect different trading strategies.

Forex brokers should also ensure round-the-clock customer support to promptly address queries and resolve issues. Quick response times and effective problem resolution can significantly enhance the trader’s experience on the platform, increasing their likelihood of staying engaged.

3. Transparent Communication

Maintaining clear, regular, and transparent communication is the key to building trust. Forex brokers must adhere to a policy of complete transparency when it comes to the performance and trading strategies of the available experienced traders for copying. An intuitive and easy-to-navigate performance dashboard displaying critical metrics like success rate, risk level, and trading frequency can be highly effective.

Transparency also ensures that traders are well informed about the potential risks and rewards of copy trading. Brokers should clarify that while copy trading can potentially amplify profits by leveraging the skills of successful traders, it can also boost losses when the copied trader’s strategy doesn’t pan out as expected.

Forex brokers should also communicate clearly about any fees or charges associated with copy trading. Traders should know upfront about any costs they may incur, which helps create a transparent relationship between the broker and the trader, fostering trust and boosting user engagement.

4. User-Friendly Copy Trading Interfaces

Lastly, a crucial but often overlooked aspect is the user interface of the copy trading platform. A platform that’s easy to navigate, fast, and responsive can significantly improve the trading experience. Brokers should strive to ensure their platforms are intuitive and user-friendly, enabling traders to easily search for and select experienced traders, monitor their portfolios, and manage their settings per their preferences.

Innovative Approaches to Copy Trading Platforms

Brokers continuously innovate and enhance their services to maintain relevance in the fast-paced Forex market. They are rethinking their approaches to copy trading, experimenting with new features and tools, and even reinventing their business models to accommodate the changing needs of traders better.

Many Forex brokers are experimenting with novel features and refining existing ones to improve their copy trading services. For instance, some brokers have introduced advanced filtering options that allow traders to identify and select signal providers that align with their specific risk tolerance and investment objectives. This granular level of control enables traders to personalise their copy trading experiences, and at the same time, it makes the brokers’ platforms more attractive and competitive.

Alongside introducing new features, there’s been an increase in the development and integration of sophisticated, technology-driven tools to make copy trading more efficient, flexible, and user-friendly. A prominent example of this is the implementation of customisable stop-loss orders for individual copied trades. This innovation gives traders greater control over their risk exposure, allowing them to dictate the terms at which they would like their copied trades to close in the event of a market downturn. By offering these advanced tools, brokers can increase their platforms’ appeal, ensuring they remain attractive to both new and seasoned traders.

The implications of these innovative practices are far-reaching. They don’t just enhance the trading experience for individual traders; they also offer strategic benefits for brokers themselves. By providing an optimised copy trading service, brokers can attract a broader spectrum of traders, increase client satisfaction and loyalty, and potentially amplify trading volumes.

Innovation also fosters a competitive edge. In an industry where traders have many options, unique and effective features can make a platform stand out. Brokers who successfully innovate their copy trading offerings are more likely to differentiate themselves from their competitors, potentially boosting their market share and improving their overall profitability.

Evolving Trends and Challenges in Copy Trading

Copy trading is not a static phenomenon but constantly evolves, influenced by broader market trends, technological innovations, and shifting trader preferences.

Automation is becoming increasingly prevalent in copy trading, with automated copy trading systems gaining traction. These systems use advanced algorithms to automatically select and copy trades from successful traders based on pre-set parameters, further simplifying the process for traders.

Another emerging trend is integrating artificial intelligence and machine learning into copy trading. These technologies can potentially improve the selection of signal providers by analysing vast amounts of data and identifying patterns that humans may overlook.

Forex brokers must stay abreast of these trends to maintain their competitive edge. This involves continuous investment in technology and a commitment to innovation. Additionally, brokers should prioritise transparency, user education, and customer support to ensure a high-quality service as copy trading evolves.

Conclusion

The future of copy trading looks promising. With continued technological advancements and evolving market trends, it’s set to become an even more integral part of the Forex trading landscape. As such, Forex brokers must continue to invest in and optimise their copy trading offerings to cater to this growing demand and stay ahead in the competitive Forex market.

FAQ

Is copy trading easy?

Copy trading is designed to be user-friendly, especially for beginners. It allows individuals to automatically copy the trades of experienced traders, reducing the need for extensive market knowledge. However, it’s essential to understand the risks and choose the right traders to follow.

Can you lose money in copy trading?

Yes, while copy trading can simplify the trading process, it doesn’t eliminate the inherent risks of investing. Just as you can profit from successful trades, you can also incur losses from unsuccessful ones.

Can copy trading make you a millionaire?

Copy trading can be profitable, but becoming a millionaire largely depends on the amount invested, the performance of the copied traders, and market conditions. It’s not a guaranteed path to wealth, and one should approach it with realistic expectations and caution.

Procurando respostas ou conselhos?

Compartilhe suas dúvidas no formulário para obter assistência personalizada

Contate-Nos