How to Start an HFT Firm: Requirements, Costs, and Setup

The financial market offers many opportunities, and launching a high-frequency trading firm is a lucrative way to capitalize on increasing volume, significant price movements, and changing market volatility.

However, setting up an HFT platform comes with a technical challenge because it relies on automated, high-speed, high-volume order processing rather than discretionary decision-making. Therefore, you must focus on the infrastructure, capital, and compliance.

In this guide, we will discuss how brokerage founders, prop firm trading desks, and institutional trading platforms can launch an HFT trading arm. With fundamental checklists and legal overviews, you will understand capital requirements, operating models, team composition, technology decisions, regulatory readiness, and deployment strategy.

Key Takeaways

- Starting an HFT firm requires institutional-grade infrastructure, capital planning, and regulatory readiness from day one.

- Setup and operational costs vary widely depending on asset class, target market, server requirements, tech stack, and execution scope.

- Speed advantages come from end-to-end system design across execution, risk, and liquidity flow, not isolated optimizations.

- Partnering with established infrastructure providers can significantly reduce time-to-market and execution risk.

Have a Question About Your Brokerage Setup?

Our team is here to guide you — whether you're starting out or expanding.

What Is High-Frequency Trading, and How Does It Work?

High-frequency trading is an automated trading approach that uses advanced computing systems and platforms to execute large volumes of orders at extremely high speeds. As such, positions are typically held for very short periods, often less than a millisecond, and profitability is driven by small price movements captured frequently at a larger scale.

HFT platforms continuously process real-time market data from multiple exchanges and trading venues, analyzing order books, ongoing trades, and price movements to identify price discrepancies and execute rapidly. The process is far faster than humans can achieve.

Because these opportunities are so short-lived, execution speed and system consistency must be at a high level, which are vital components of an HFT trading system.

Latency plays a defining role in this environment. It represents the time it takes for market data to reach a trading system and for orders to be sent back to the exchange, measured in microseconds. Another core characteristic of HFT platforms is the high order-to-trade ratio, which measures the total orders (placed, modified, and cancelled) against the executed orders.

Furthermore, co-location services are a critical part of such trading systems, with trading servers physically located closer to exchange matching engines, delivering lower latency and ultra-fast execution.

The typical HFT trading infrastructure consists of the following components:

- Ultra-fast execution systems: Specialized hardware and software that process market data and execute trades in microseconds

- Sophisticated algorithms: Complex mathematical models that identify trading opportunities across multiple venues

- Direct market access: Connections that bypass traditional broker intermediaries for faster order placement

- Risk management: Real-time monitoring that prevents catastrophic losses from systemic algo errors

These components form a powerful end-to-end trading environment where speed, reliability, and control are inseparable, requiring the entire system to efficiently operate as a unified whole.

Deep, Reliable Liquidity Across 10 Major Asset Classes

FX, Crypto, Commodities, Indices & More from One Single Margin Account

Tight Spreads and Ultra-Low Latency Execution

Seamless API Integration with Your Trading Platform

Who Should Consider Starting an HFT Firm?

High-frequency trading is not suitable for every market participant. The barriers to entry are systematically high due to stringent capital, risk, infrastructure, and technical requirements.

Institutional brokerages and hedge funds are best positioned to launch an HFT arm. Even so, these firms still need to ensure optimal uptime for the execution server, matching engine, and other components.

Broker founders can pursue an HFT launch to internalize flow, expand proprietary trading, or diversify revenue streams beyond commissions.

Proprietary trading desks with existing quantitative expertise may see high-frequency trading as a natural path to more scalable, automated strategies.

Firms scaling systematic market-making or exploring arbitrage strategies are qualified to compete with algorithmic trading and low-latency systems.

Institutional teams with direct exchange access, balance-sheet strength, and operational maturity are also well positioned to operate an HFT platform.

In contrast, HFT strategies do not suit retail traders, discretionary traders, or individual quantitative developers without institutional access, as they lack the core components needed to compete in HFT environments.

Core Requirements Before Launching an HFT Operation

Before any trading activity begins, an HFT firm must assemble several foundational components that support continuous, high-speed operations under regulatory oversight.

Team and Expertise

An HFT firm is a multidisciplinary organization that requires the following roles:

- Quantitative developers and researchers: design and refine trading strategies, focusing on statistical modeling, optimization, and performance analysis.

- Systems and network engineers: ensure stable execution environments, low-latency deliveries, and a resilient platform under peak load conditions.

- Risk management and operations teams: oversee real-time exposure, incident response monitoring, and operational continuity.

- Compliance and regulatory specialists: ensure that trading activity aligns with applicable laws, exchange rules, and reporting obligations.

These functions cannot operate in isolation. HFT environments demand close coordination, clear escalation paths, and round-the-clock readiness.

Legal and Regulatory Foundation

Launching an HFT firm requires a strong legal and regulatory foundation that considers the following:

- Business entity formation: create a business structure aligned with applicable laws on brokerage firms and high-frequency transactions.

- Licensing and registration: get necessary licenses and brokerage registrations, which vary by jurisdiction, scope, and target market.

- Exchange and venue agreements: obtain access to key trading venues and exchanges for real-time prices, volatility, and liquidity.

- Reporting and audit readiness: prepare trade logs, audit trails, and record submissions to regulators in line with regulatory requirements.

Build Your HFT Infrastructure

Customize your own trading infrastructure with pre-integrated security systems, liquidity streams, and risk management models

Estimating Startup Costs and Capital Requirements

So, how much does it cost to start an HFT platform? In reality, the costs vary widely, and figures can be inaccurate without context. Let’s explain.

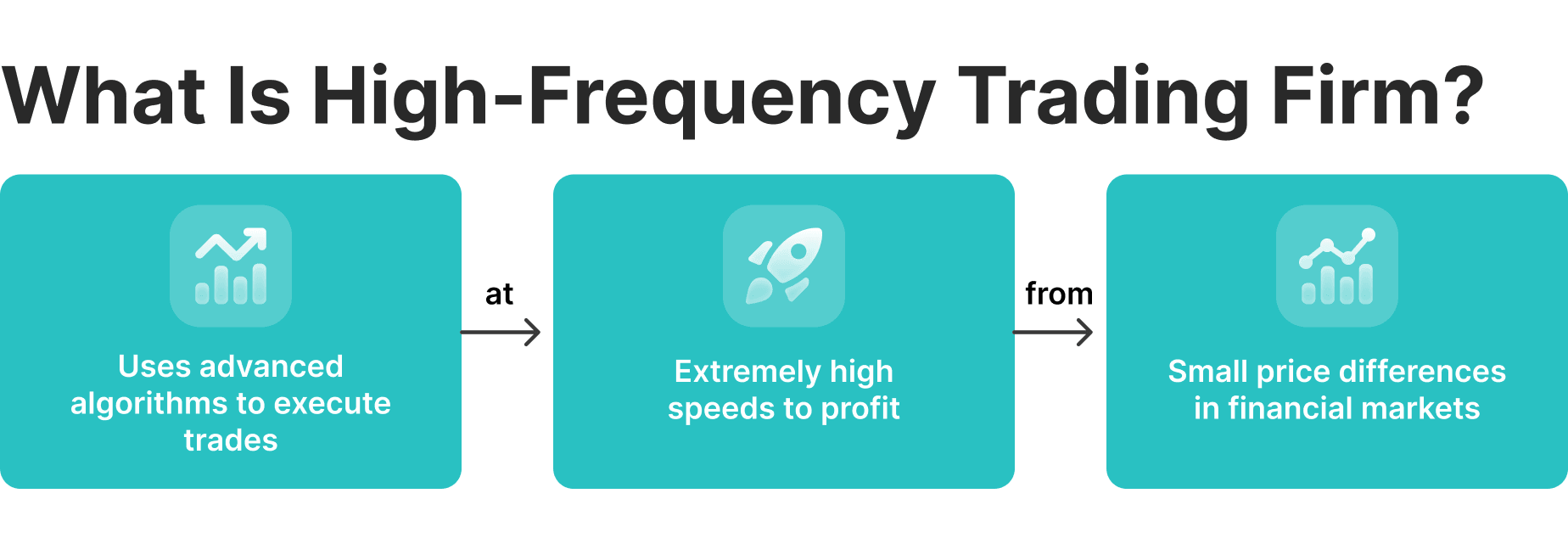

There are specific categories that determine the HFT platform cost:

- Infrastructure and connectivity: the number of connected trading venues, co-location hosting providers, and technical redundancy logic.

- Market data: the number of available asset classes, instruments, and the offerings’ complexity, including leverage, perpetuals, margin, and the costs associated with sourcing these feeds.

- Talent and operations: these sophisticated infrastructures need specialized engineers, trading experts, quant researchers, and compliance executives, usually requiring premium compensation.

- Compliance and legal: licensing, advisory services, and ongoing regulatory requirements vary widely across jurisdictions, regional trading laws, and anti-financial crime obligations.

- Ongoing maintenance and upgrades: continuous maintenance, system patches, and performance optimization require additional workforce, monitoring systems, and software licensing.

As such, the actual cost of setting up a high-frequency trading system includes multiple variables. For example, getting liquidity across multiple assets increases data and connectivity expenses, and strategies with extreme latency sensitivity come at hefty infrastructure investments.

As shown above, the cost of starting an HFT platform starts at $850,000, with multi-venue, ultra-low latency infrastructures costing over $4 million.

Choosing Your HFT Operating Model

When launching an HFT platform, firms must determine the operating model—whether to pursue proprietary trading, where the firm trades its own capital, or a brokerage model, where trades are executed on behalf of clients in exchange for commissions. This decision also influences governance, risk controls, and performance metrics across the platform.

You must also determine the product range—whether you are focusing on a single asset or pursuing a multi-asset strategy from the outset. A narrow scope comes with deeper liquidity insight and tighter execution logic, while a multi-asset approach prioritizes diversification, cross-market opportunities, and broader market coverage; however, at a higher cost.

Similarly, determine the strategy orientation between market-making or arbitrage-led, each implying a different competitive advantage. Market making aligns with consistent liquidity provision and inventory management, whereas arbitrage prioritizes speed, pricing inefficiencies, and opportunistic capital use.

Finally, firms must determine the execution architecture: centralized or distributed. Centralized models favor control and simplicity, while distributed setups align with global market access and competitive speed.

These choices align strategically to ensure the platform’s structure supports its long-term commercial and competitive objectives.

Technology and Infrastructure Decisions (Founder-Level View)

Technology is the backbone of any HFT operation. While implementation details and business structure are complex, technical infrastructure is key for platform security, risk management, and optimal execution.

Execution Architecture and Latency Considerations

HFT firms prioritize co-location because physical proximity to exchanges reduces network delay and improves execution predictability. Therefore, direct market access is important to ensure orders reach venues without intermediary delays.

Redundancy is equally critical because in a latency-sensitive environment, every millisecond matters. Hardware failures, network disruptions, or software bugs can lead to significant losses if not contained immediately.

Well-designed systems include failover mechanisms and real-time health monitoring, enabling admins to oversee performance metrics and implement fixes without interrupting the user experience.

Build vs. Buy vs. Partner

When developing a high-frequency trading platform, founders have three options:

- Fully proprietary development: maximum control but significant time, capital, and operational concentration.

- Hybrid models: sufficient control over strategy logic while outsourcing technical infrastructure components.

- Partnering with institutional infrastructure providers: faster deployment and lower execution risk, especially for new entrants.

White label, outsourcing, custom development, and source code are four main ways to make your entry into the financial market. Here’s how they differ.

12.08.24

Risk Management and Compliance at High Speed

In high-frequency environments, profits and losses can scale rapidly. Therefore, risk management systems must operate at the same speed as execution engines, with minimum reliance on manual intervention.

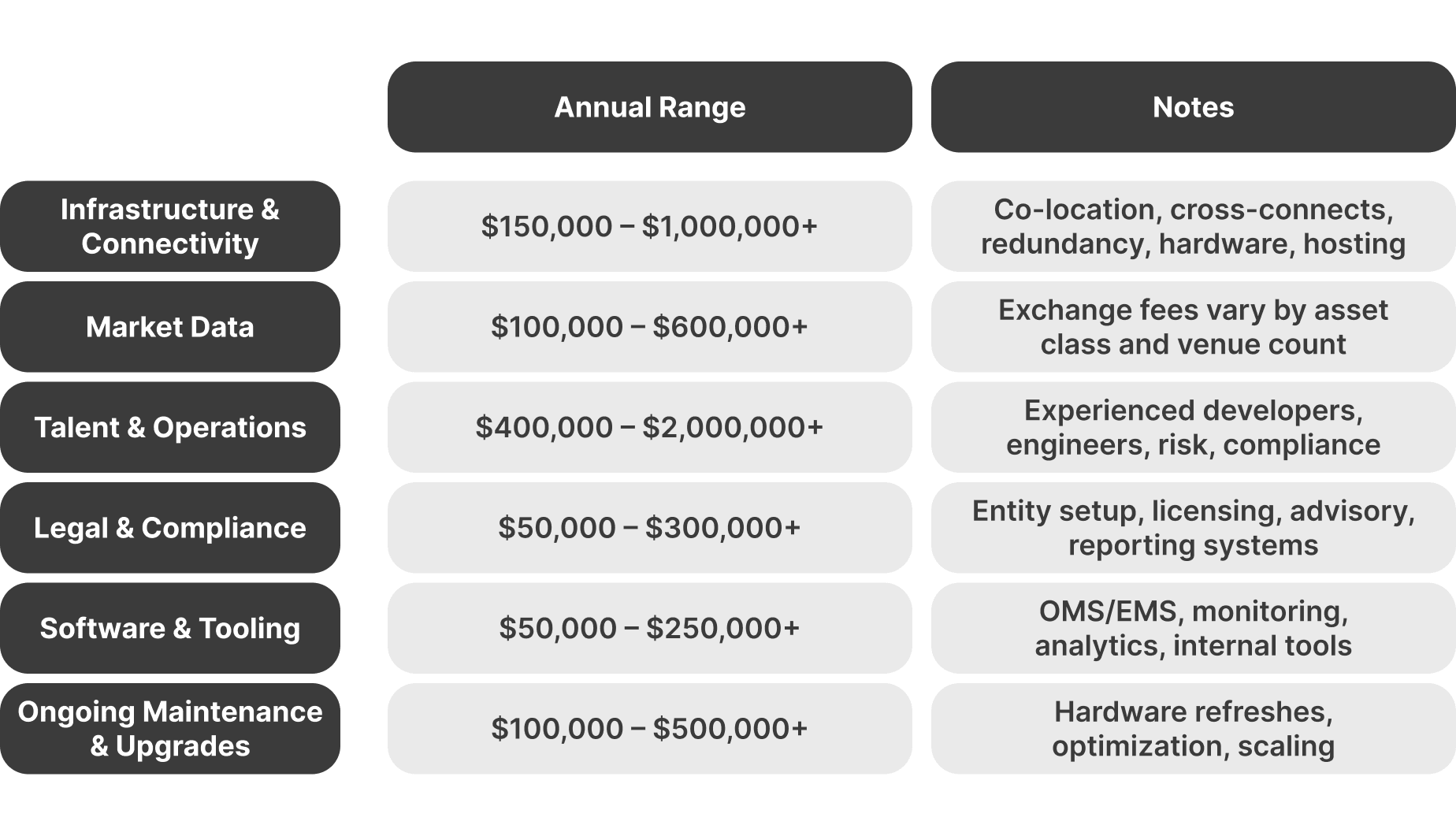

Pre-Trade and Real-Time Risk Controls

Building an effective HFT risk management relies on layered, automated controls that operate at machine speed. You need to ensure core safeguards on pre-trade positions and exposure limits, preventing strategies from exceeding defined risk thresholds set by the broker.

You can also configure automated kill switches and strategy-level halts to stop any abnormal behavior, triggered by market conditions or internal system faults.

Risk controls must incorporate real-time checks on order size, frequency, and price bands to continuously monitor latency, fill ratios, and execution patterns, allowing firms to detect anomalies early and intervene promptly before small issues escalate into material losses or market disruptions.

Ongoing Compliance and Audit Readiness

Beyond real-time controls, HFT founders must maintain continuous compliance and audit readiness as an operational discipline. This includes accurate trade and transaction reporting, comprehensive record retention, and a detailed log of incidents, system changes, and corrective actions.

Jurisdictions have different requirements, but most regulators expect firms to ensure proactive measures and compliance systems capable of capturing, analyzing, and escalating at the same pace as trading activity.

A transparent regulator relationship is critical for business longevity, ensuring the firm can respond quickly and confidently to inquiries, audits, or regulatory reviews.

Step-by-Step Roadmap to Launch

Let’s discuss a detailed timeline on building a high-frequency trading brokerage, covering from early strategic decisions to live deployments. It is worth noting that exact steps may differ by jurisdiction, but the typical approach consists of the following six steps:

Step 1: Define Scope and Target Markets

Firstly, firms must define the initial scope of their HFT operation. Founders must make decisions on target exchanges, liquidity venues, geographic coverage, trading hours, and asset classes (Forex, equities, crypto, derivatives).

These directions shape infrastructure requirements, regulatory exposure, and ongoing operating costs. For example, a tightly defined scope allows firms to align technology, compliance, and capital efficiently, whereas attempting to support multiple markets or strategies at launch often leads to higher complexity and lower focus.

Step 2: Establish Legal, Regulatory, and Banking Foundations

Next, you must start legal and regulatory processing, including incorporating the legal entity, selecting an appropriate jurisdiction, obtaining necessary licences or registrations, and establishing compliant banking, custody, and payment relationships.

Since regulatory obligations differ significantly across regions and asset classes, early engagement with legal and compliance advisers helps prevent approval delays, forced restructures, or restricted market access later in the process.

Step 3: Secure Market Access and Liquidity Relationships

After securing the legal and business entity, you must plan your platform. Strategize market access and liquidity relationships with exchanges, prime brokers, clearing firms, and liquidity providers. Each of these participants plays a role in execution, margining, settlement, and operational continuity.

When selecting liquidity partners, firms must evaluate them based on execution quality, latency stability, fee transparency, credit terms, and operational strength. These factors directly impact performance and scalability.

Institutional-Class Liquidity

Access deep liquidity covering 10 asset classes and 1,500+ instruments from a single connector

Step 4: Deploy Infrastructure and Integrate Systems

At this stage, firms assemble and connect execution engines, risk controls, data feeds, and monitoring systems into a cohesive trading environment.

Founders must focus on system integration, resilience, and operational readiness. Platforms must ensure that redundancy systems, failover mechanisms, and end-to-end operations are tested and ready.

Infrastructure is a key component of your HFT platform, and partnering with an industry-focused provider is the best way to ensure operational stability, accelerate deployment, reduce operational risk, and avoid rebuilding.

Step 5: Test Extensively Before Going Live

Extensive testing is essential to prevent severe financial losses and regulatory breaches when going live. This includes historical backtesting, simulated trading, and stress testing under extreme market conditions.

This stage must evaluate strategy logic, system behavior, latency spikes, feed disruptions, and risk-control activation. Moreover, kill switches must be validated, incident response procedures defined, and baseline performance metrics established, ensuring issues can be detected and contained immediately once live trading begins.

Step 6: Launch Gradually and Monitor Continuously

Finally, the deployment stage must be treated carefully. The go-live phase should be treated as a controlled rollout rather than a full-scale launch.

You can begin with limited capital, conservative risk limits, and heightened real-time monitoring to validate performance under live market conditions. When everything goes flawlessly, you can increase breadth to full capacity while tracking metrics at every stage.

Furthermore, you must ensure continuous oversight of execution quality, latency, system stability, and compliance reporting. Scaling should only occur once systems demonstrate consistent performance under increasing demand.

Starting Faster With an Institutional Infrastructure Partner

While launching an HFT firm independently is possible, partnering with an established infrastructure provider can dramatically reduce time-to-market and operational risk. Pre-built technology ecosystems eliminate months of development while providing proven execution, risk, and compliance frameworks.

B2BROKER’s turnkey infrastructure offers regulatory guidance, institutional-grade liquidity access, and ongoing technical support as operations scale. This empowers new and expanding HFT firms with pre-integrated solutions, security modules, superior matching engines, and complete back-office systems to track every bit of your HFT platform.

Frequently Asked Questions about HFT Platforms

- How much capital do I need to start a high-frequency trading firm?

Most HFT startups require $1–5 million in initial capital to cover technology infrastructure, regulatory compliance, and operating expenses for the first year. The exact amount depends on your target markets, strategy complexity, jurisdiction requirements, and whether you plan to build or buy your trading systems.

- Can individuals engage in high-frequency trading without forming a company?

While technically possible, individual traders face significant disadvantages, including higher costs for market access, limited credit facilities, and regulatory restrictions. Most successful HFT operations require the legal structure and institutional relationships that come with forming a registered trading firm.

- What programming languages are essential for high-frequency trading software?

C++ dominates HFT development due to its speed and hardware control, while Python handles research and backtesting. Java serves middle-tier applications, and specialized languages like FPGA programming provide ultimate performance for specific components.

- How long does it take to become profitable in high-frequency trading?

Successful HFT firms typically achieve profitability within 6–12 months of live trading, though this assumes proper capitalization, proven strategies, and stable technology. Many firms operate at a loss during initial development and testing phases.

- What are the main differences between HFT in Forex versus equities?

Forex HFT operates in decentralized markets with multiple liquidity providers, requiring aggregation strategies and relationships with prime brokers. Equity HFT focuses on centralized exchanges with standardized rules but faces more intense competition for speed advantages.