What is a Limit Order Book?

Trading in the financial market involves multiple complexities the average investor might not know about. These little details facilitate the smooth working of financial markets across multiple exchanges, instruments, systems and databases.

The limit order book is an integral part of the investing world, ensuring that traders’ requests are accurately processed and their positions in the market are maintained.

The digitalisation of today’s investing platforms makes the limit order book dynamics even more accurate and streamlined. Let’s explain this concept in more detail.

Key Takeaways

- Limit order book stores all market orders with price and time limitations placed by traders.

- Market specialists or market makers used to maintain limit order books, but now it is more automated with modern digital platforms.

- Investors use limit order books to improve their trading strategies.

Limit Order Book Explained

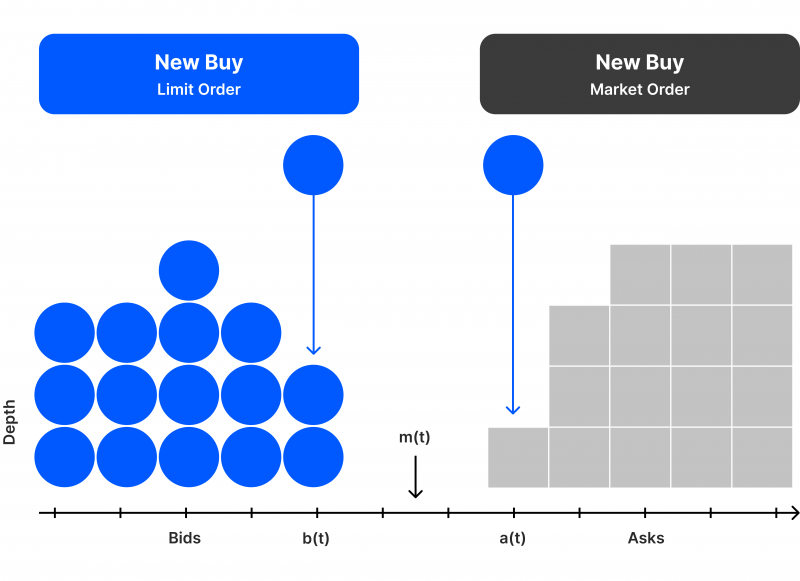

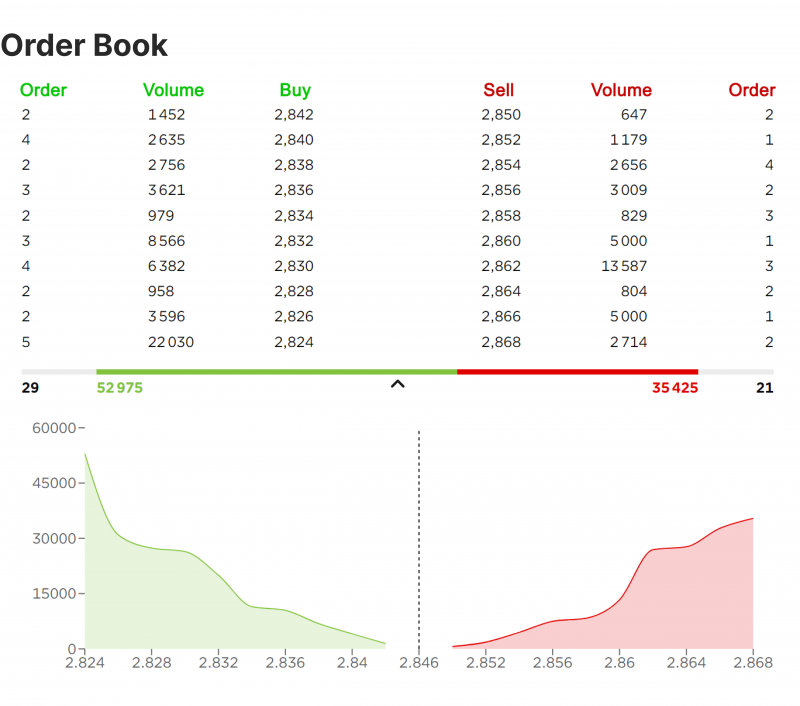

The limit order book records all the limit market orders placed by investors in the financial market. Exchanges or specialists keep track of these orders and ensure the timely execution of them according to the trader’s specified price-time priority.

Traders execute limit orders to buy or sell securities at a specified price or better. A buy limit order entails purchasing assets at a certain value or less, while a sell order limit means selling at a minimum price given or more.

When investors submit these market positions, they go through a market maker that makes a particular financial instrument available, which is traditionally manual. However, today’s electronic trading platforms use limit order book algorithms to execute trades faster and more accurately.

The limit order record keeper receives these requests and executes them on a priority basis when a matching order is found, ensuring that no other position is executed before the current one, avoiding slippage.

The limit book specialist earns a cut from the spread on every position they successfully execute, the difference between the ask and bid price.

Order Book Qualifiers

Qualifiers are criteria that determine how the trader wants the order to be executed. Without choosing the qualifiers, the order will be processed during the day or may not be executed.

For example, if a trader wants to buy 1,000 shares of company A at $30. This means their qualifier for a “long” order is to buy shares at $30 or better.

This qualifier is called “Good Till Cancelled”. GTC instructs the broker to locate and buy the specified stocks at $30 per share or less, regardless of how long it will take. Depending on the market liquidity, the order can be settled immediately or in batches. The broker might have to buy 100 shares at once until the trader cancels the order.

Another qualifier is “All or None”. AON instructs the broker to execute the entire order size with 1,000 shares, in the above example, according to the mentioned price (or price range). In this case, the order is processed as a whole or is not executed at all. This order does not allow partial share purchasing like GTC.

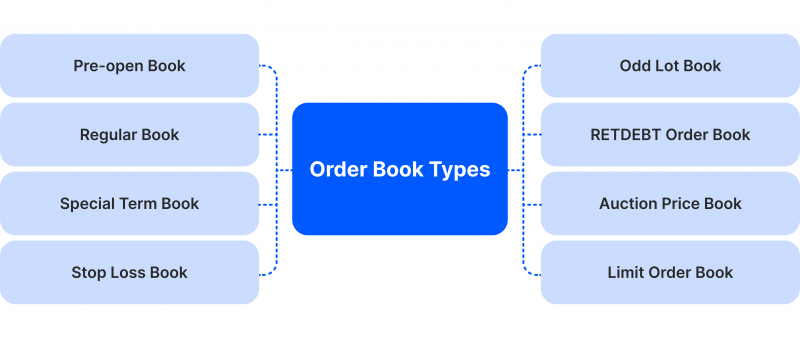

Order Book Types

As we explained, different market order types exist based on the trader’s strategy and market conditions. Accordingly, brokers use different order books to manage their trades.

Limit Order Book

The limit order book records all pending market orders that involve buying and selling price limits. As such, these requests imply executing a long position at a particular price or lower or executing a short position at a given price or higher.

Pre-open Book

Trades placed during the pre-market session are stored in the pre-open book. These requests are compiled on an entry-time basis. The orders are matched and executed by the end of the pre-trading hours.

These positions play a significant role in determining the opening price of the underlying asset.

Regular Book

Market orders that do not involve specific price and size limitations or any considerations use the regular lot book for execution. This book also keeps passive trades that have no match because they significantly differ from the current market price.

Companies can issue buyback orders to repurchase stocks and shares, processing them through this book.

Special Term Book

Trade orders that have specific attributes, such as unusual lot size or non-standard contract size, are recorded in the special term book. These orders require pre-confirmation before processing them in the market and are matched with the regular lot book.

Stop Loss Book

Stop loss trading orders are used for risk management, where the trader demands opening/closing a position when reaching a certain price level.

These orders are stored in the stop loss book until the target price triggers order execution and opens the requested position.

Odd Lot Book

Odd orders are trades that involve buying/selling an unusual number of assets for the broker. Every brokerage firm, clearinghouse and marketplace has its pre-set order size, and anything else is considered odd.

Executing these positions requires finding a matching one with the same odd share quantity.

RETDEBT Order Book

The Retail Debt market allows retail investors to buy and sell government securities and equities with other investors of the same type.

These orders are cross-matched within the same book to find a matching position. If there is no suitable order, they go through the passive book.

Auction Price Book

The auction trading model is rare, where exchanges offer positions for the highest paying participant. These auction-like market positions go through the auction price book, where the highest bid price owns the trade.

Limit Order Book Trading Strategy

Order books provide vast data for investors to use for their trading strategies. Though there is no specific approach to trading with order book knowledge, there is a wide range of information market participants can use from this in-depth insight.

The limit order book model supports trend trading strategies, where investors can view the price variation between the pending orders. This information gives insights into whether a particular asset spans more buy or sell requests.

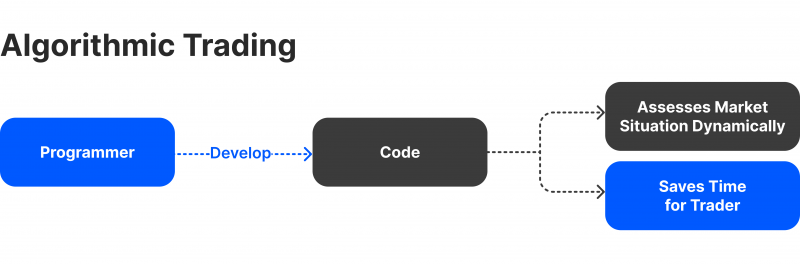

Algorithmic trading can utilise the limit order book data by integrating the order book and enabling the automatic trading machine to analyse pending orders and create the ideal strategy that suits your goals.

Explaining Central Limit Order Book

The Central Limit Order Book (CLOB) was created by the Securities and Exchange Commission in 2000 to use electronic bookkeeping systems to record pending orders.

This automated system makes order execution faster and more accurate, and the limit-order book data structure becomes more readable for other exchanges and brokers connected to the CLOB.

Brokerage firms use CLOB to process market positions based on given details, such as price, time limitations or other specifications.

The centralised CLOB runs on local exchanges or marketplaces, ensuring trade execution within the local server. On the other hand, the decentralised CLOB is more transparent, minimises conflicts of interest and makes the limit-order book more available.

Conclusion

The limit order book is the storage where limit buy/sell trading positions queue before processing. A limit order is when the trader puts special price and time priority requirements.

The CLOB emerged with the rise of electronic trading systems to make the operation more efficient and streamlined. A market specialist takes care of the correct execution of the stored orders. However, this role has become obsolete in the light of the systemised digital platform.

By clicking “Subscribe”, you agree to the Privacy Policy. The information you provide will not be disclosed or shared with others.

Our team will present the solution, demonstrate demo-cases, and provide a commercial offer