Margin Trading Explained — How It Works

Thanks to the comprehensive development of electronic trading, it has become possible to enjoy the many benefits that different trading styles have, with their unique characteristics and features. One of such styles which has received incredible popularity thanks to the possibility to trade with use of borrowed funds of the broker or the exchange on the predetermined conditions – marginal trade.

This article will tell you what margin trading is and how it is organized. In addition, you will learn about this trading style’s main strengths and weaknesses. In the end, we will explain in detail several vital concepts intimately related to margin trading: margin call and position liquidation, as well as cross and isolation margin as the primary modes of margin usage.

Key Takeaways

- Margin trading is an instrument of capital multiplication using borrowed funds from the exchange.

- Even though margin trading offers high leverage to multiply the initial margin, it also proportionally increases the risks associated with the investment loss.

- There are two modes of margin trading: cross margin, where risk is spread across all assets in a portfolio, and isolated, where risk is concentrated in a single asset.

What is Margin Trading and How Does It Work?

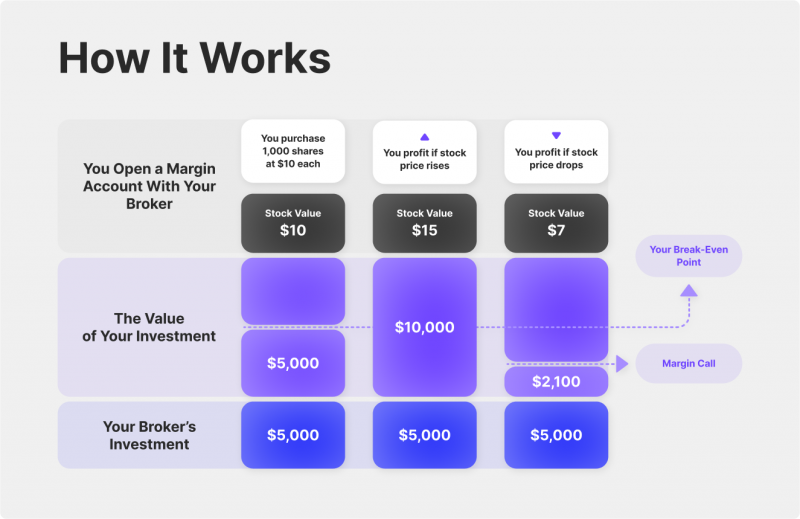

Margin trading is a type of speculation on the stock or cryptocurrency market, which involves the trader using borrowed funds (margin loan) provided by the exchange or its users (in rare cases) in his activity. As in any other credit loan situation, the user must provide collateral – in this case, to deposit an amount that guarantees repayment of the debt obligations according to the rules set by the exchange. The own funds allocated to open such a transaction are the margin (hence the name of this type of speculation). The own funds (initial margin) allocated to open such a transaction are the margin (hence the name of this type of speculation). Thanks to this possibility, under certain margin requirements, the user can make a profit many times greater than that which would be present when speculating solely with his own funds.

Positions that can be opened by the user on the exchange offering this service are conditionally divided into two types: long – when the user expects the growth of the asset, and short – when a bet is made on the price decline. When opening a long position (purchase), the broker grants the trader a certain credit (in accordance with the size of the leverage). In this case, a part of the funds is invested by the trader himself (the broker supplements the necessary volume to open the position). The same applies to such operations as a short position (sale).

If the asset price moves in the direction predicted by the trader, the income he can fix on the transaction increases in proportion to the selected leverage. When such a position is closed, the pledge body is returned to the creditor (the exchange) along with the commission fees, and the balance of the profit received is credited to the user’s account. Also, in addition to commissions for opening/closing trades, some exchanges may have so-called funding rates, which are paid to each other by holders of long and short trades, depending on the number of open positions of each type.

According to statistics, more than 80% of beginners using margin trading lose the invested capital due to inability to choose the right level of leverage.

Main Strengths and Weaknesses of Margin Trading

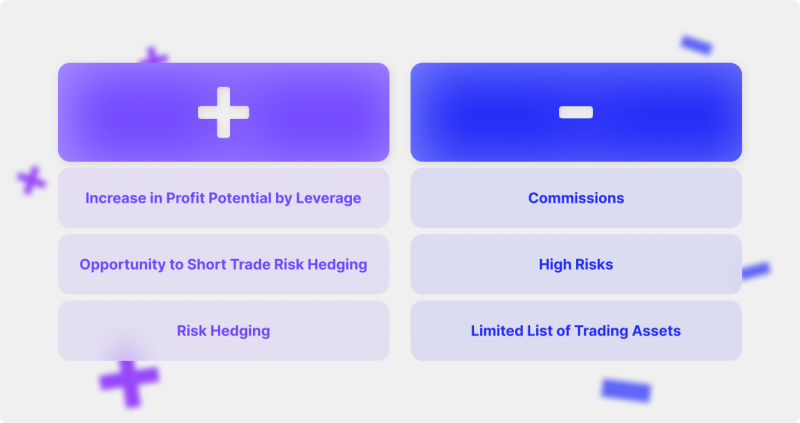

Margin trading, being one of the most popular trading styles today, had passed through many stages of development before it managed to become an advanced and mathematically complicated trading instrument in technical terms, which gives an opportunity to increase profit by using borrowed funds from a creditor (a broker or a stock exchange). With its unique specificity, this instrument has advantages and disadvantages, thus becoming the choice of many beginners and professional traders in different financial markets.

Strengths of Margin Trading

To begin with, let us consider the most important advantages of using margin trading in trading practice.

Increase in Profit Potential by Leverage

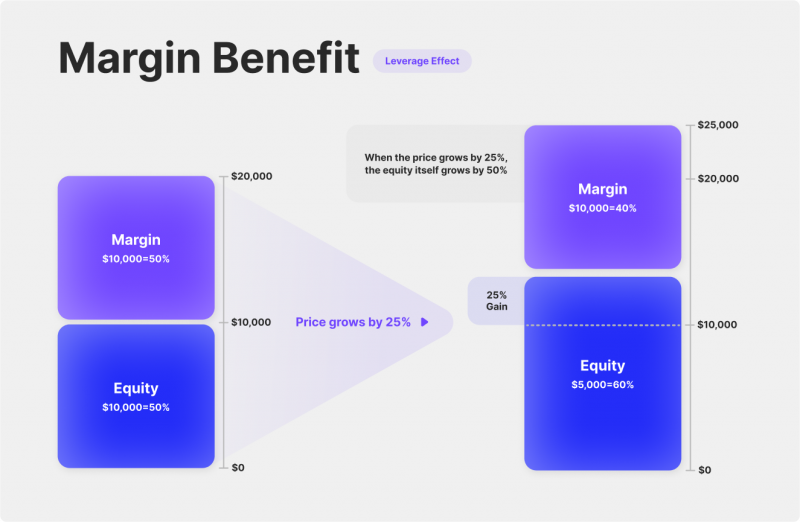

Trading on a margin account allows you to use leverage, which is a technical multiplier of income (or loss) that is directly proportional to the increase in initial margin, multiplied by its level. In other words, the higher the leverage, the higher is the potential profit, which is obtained with a correct forecast when trading long or short, or the loss with an incorrect forecast in both cases. As opposed to broker or exchange, the level of leverage is determined on the basis of individual conditions under which a trader trades. Such conditions, as a rule, mean the level of initial margin, volatility of the traded instrument and risk coefficient.

Have a Question About Your Brokerage Setup?

Our team is here to guide you — whether you're starting out or expanding.

Opportunity to Short Trade

Trading on margin accounts gives traders and investors an opportunity to profit from falling financial instruments quotations. As the market represents a cyclic pattern of movement, consisting of successive periods of rise and fall of any asset price in any market, the margin trading style allows receiving solid profit from the fall of markets, regardless of the reasons behind it. In fact, trading in short is the exact opposite of trading in long, helping to diversify the trading strategy and develop the skills of predicting market movements for additional profits on the volatility of certain trading assets.

Risk Hedging

Hedging is a widespread mechanism of classical financial markets aimed at minimizing potential losses in trading financial assets on any market. In simple terms, a hedge is an investment in an asset that has an inverse price correlation with the underlying investment asset (falls when the underlying asset rises and vice versa).

There are two most typical uses of hedging: to form a risk-neutral position and to protect against a catastrophic scenario, that is, one in which the amount of loss would be unacceptable to the investor. In the first case, to conduct a risk-free primary transaction and ensure the stability of margin levels, the investor is ready to give up a possible profit; in the second case, the investor implements the strategy of compliance with the risk limit.

Weaknesses of Margin Trading

Now let’s look at the main disadvantages that are inherent in the leveraged trading style.

Commissions

When borrowed money is used, the investor is obliged to return the borrowed sum to the exchange under the conditions set by the exchange. One of the conditions for using borrowed money from the broker is a certain amount paid by the investor during a specific period, called a commission. The commission is calculated individually for each trading asset and is payable at the expiration of a particular time. An ideal example, in this case, could be a standard bank loan, where the borrower has to pay interest for using credit.

High Risks

The specifics of margin trading imply high risks associated with a high probability of losing the initial margin. Since for the maintenance margin the exchange uses the algorithm of equalizing the balance of initially invested funds and funds that were lent to the trader, with the increase of the transaction risk ratio, the margin loan will be automatically repaid as a result of margin call, which appears at a critical deviation of the market price from the transaction entry price, which ultimately carries the risk of complete loss of initial capital, and in some cases, the appearance of debt to the exchange or brokerage firm.

Limited List of Trading Assets

Despite the opportunity to increase initial investment, trading on margin is a technically complex tool that requires careful handling and good financial knowledge. To prevent significant losses, primarily from inexperienced traders, many exchanges limit the assets available for trading with leverage, regardless of their class. This practice has worked well in both stock and cryptocurrency markets but still finds resistance from many professional market traders, especially in crypto trading, where leverage is much higher than others.

What is a Margin Call and Position Liquidation?

Margin call and position liquidation are terms used in financial markets, particularly in the stock and Forex markets, where traders cannot maintain an open position due to insufficient funds (initial margin) on the trading account.

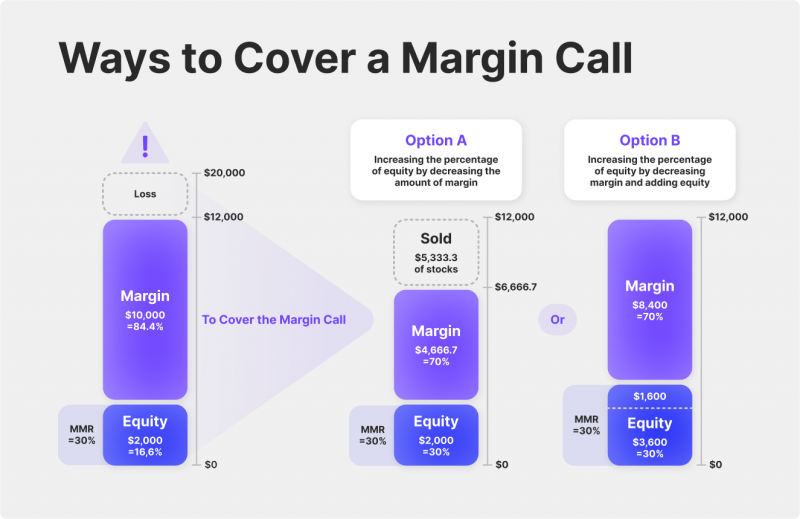

When an investor pays to buy and sell securities using a combination of his own funds and money borrowed from his broker, this is called buying on margin. An investor’s equity in an investment is equal to the market value of the securities minus the amount of money borrowed from their broker. A margin call is triggered when an investor’s equity as a percentage of the total market value of the securities falls below a certain percentage requirement (maintenance margin). Suppose the investor cannot afford to pay the amount needed to bring the value of his portfolio up to the account’s maintenance margin balance. In that case, the broker may be forced to liquidate the securities in the account.

The use of margin trading will be appropriate for transactions of short duration. Particularly with scalping or multiple trades over a short period of time, the use of margin positions is common. In other cases, the costs and risks of holding a position increase dramatically. The higher the leverage, the higher the cost of error. While 1 to 3 will not cause severe losses, a leverage of 1 to 10 will result in a 30% loss on equity. However, with a positive trend in the position, a 3% increase or decrease in the price of an asset with a leverage of 1 to 10 will bring a 30% profit. That’s why many bidders are starting to use margin positions when implementing their strategies.

On the other hand, position liquidation is a process whereby a broker or exchange automatically closes the trader’s position due to a lack of funds in his trading account as a result of exceeding the allowable level of deviation of the asset’s market price from the opening price of a deal in both long and short positions. This situation occurs when the trader does not replenish his account after receiving a margin call or if the trader can not maintain an open position at a sharp drop in the asset price on which it trades.

In general, margin call and position liquidation are mechanisms that protect the broker and the trader from losses. When a trader receives a margin call, it means that he must react quickly and deposit funds to avoid liquidating a position. If the trader fails to comply with this requirement, his position will be automatically closed, and he will lose money. Therefore, monitoring the margin level in your trading account and replenishing it in time to avoid margin calls and position liquidation is imperative.

What are Cross Margin and Isolated Margin?

Cross-margin is a margin allocated to an open position using the total funds in the available balance, reducing the risk of liquidating a losing position. Any realized PNL (profit and losses) from other positions can help add margin to a losing position. In cross-margin mode, all positions are guaranteed by total margin and account balance. That is, the loss on a single position may be greater than the margin on that position. When unprofitable positions reach the liquidation point, all positions are simultaneously forcibly liquidated, and the trader loses all invested funds.

Discover the Tools That Power 500+ Brokerages

Explore our complete ecosystem — from liquidity to CRM to trading infrastructure.

In the cross-margin mode, a margin is reserved for the position in the amount of the initial margin according to the minimum set requirements. For example, on the ETHUSD contract, only 1% is reserved as the initial margin for entry into the position. However, if a negative movement occurs in such a position, the trader’s entire balance (of the relevant coin) will be automatically drawn to cover losses. In other words, the maximum cross-margin loss is calculated as the sum of the initial margin and the balance of the available account balance. Since an open cross-margin position can reduce the entire available balance to 0, the preset level of leverage makes no sense. Effective cross-margin leverage is determined by the position’s value and the user’s available balance.

An isolated margin is a tool that isolates the margin securing some trades from the margin of other trades. The simplest example of implementing this feature is trading on two or more independent of each other trading accounts within one user account. Thus, the margin between accounts will be isolated; that is, a loss on one account will not lead to a change in the balance of another account. Thus, this method of margin has a higher liquidation risk, but the loss is limited to a fixed amount of collateral, not the entire account.

It is worth noting that isolated margin can be used for speculative positions. One can limit losses on the initial margin set using this margin strategy. This helps day traders and short-term investors reduce their exposure if a trade does not go as expected.

Conclusion

The style of trading using margin loans has become a popular tool for multiplying capital in various financial markets. Offering high leverage and a wide variety of trading assets available for speculation, this trading strategy holds great promise for development, capable of seriously changing the idea of making money in the future.