How to Create Forex Brokerage? – Step by Step Guide

In this article, we’ll explore the primary business models used by Forex brokers and the unique aspects of this industry. You’ll also discover how Forex brokers leverage various technologies in their operations. Finally, we provide a step-by-step guide to help you create Forex brokerage of your own.

Forex is an international financial market founded in 1970, where currencies are exchanged. It is considered the most liquid market in the world, with a daily turnover of more than 5 trillion dollars. This market is unique in its kind and has a number of features in terms of the trading process. The Forex market is vital for the proper functioning of the world economy and ensuring the exchange of capital between different countries. Forex trading involves central banks of different countries, companies conducting international business, commercial banks, and various traders (speculators).

Owning a Forex brokerage has numerous advantages, including the profits its owners can make. By setting up a Forex brokerage company, it’s possible to take advantage of this market by offering clients a high-quality trading platform and tools for online trading. However, despite all the benefits the Forex business offers, starting and maintaining it is complex and requires a well-thought-out plan, time, and persistence.

Forex Brokerage Models

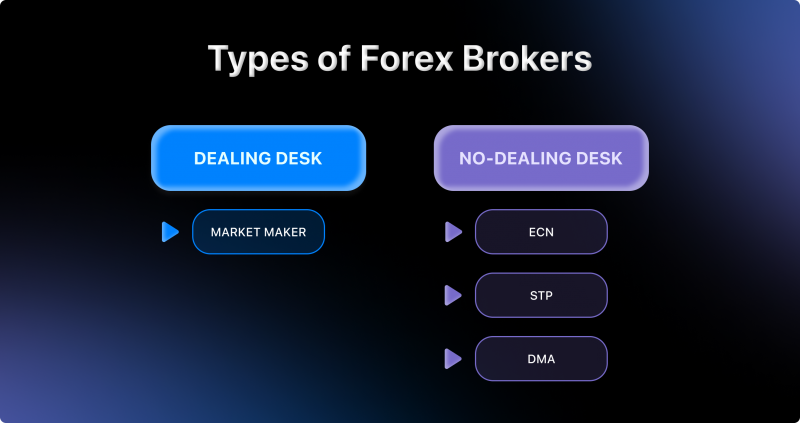

Today, there are three models by which all Forex brokerages work. Each of them has its advantages and disadvantages, but the principle of their work is similar. The choice of the brokerage system operation model directly affects the level of earnings and the general scheme of business operation. Let’s consider each of them in detail.

A-Book Broker Model – NDD (No Dealing Desk) Mechanism

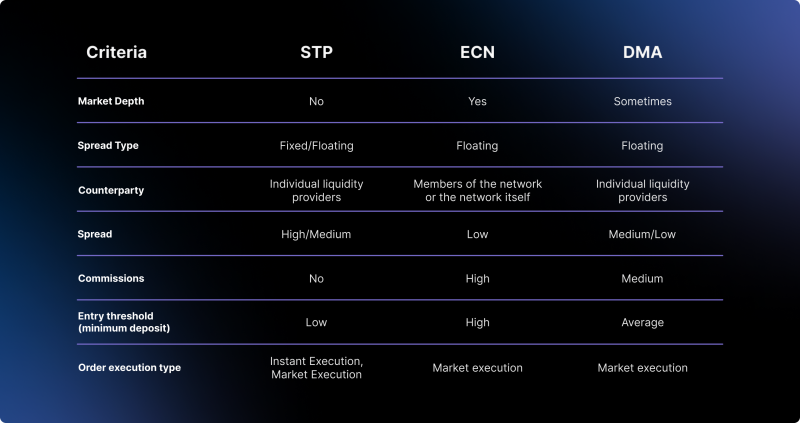

A-Book brokers are client-counterparty brokers who do not trade directly with a company’s clients and do not make money on their losses or profits. They get their main income from margins and commissions. Further, such brokers are divided into three subtypes: STP (Straight Through Processing), ECN (Electronic Communications Network), and DMA (Direct Market Access).

The main feature of STP brokerage is the direct connection between the client and the liquidity provider. As a rule, the provider aggregates many sources of liquidity, resulting in increased liquidity and better prices. STP broker offers a choice of floating or fixed spreads. While the main liquidity providers are the large banks, which provide a fixed spread, the aggregator can choose the best prices among all the sell and buy offers. This can sometimes lead to zero or even a negative spread.

The ECN system makes it possible to make direct trades between clients. In fact, the broker, in this case, provides a platform where banks, market-makers, and private traders can make transactions with one another directly, which sometimes makes it possible to make transactions at a better price than when using external counterparties. Moreover, it allows getting rid of trading delays, which, with sufficient liquidity, gives practically perfect execution.

The main advantage of DMA technology is direct access to the market: all orders are sent directly to the liquidity providers without the intervention of a broker. Each order enters the order book of the liquidity provider without intermediaries and “creates a market.” DMA orders usually have a high speed of execution. With this model, traders receive the most transparent execution at the best market price according to the Best Bid – Best Ask principle.

B-Book Broker Model – DD (Dealing Desk) Mechanism

Brokers working on the B-Book model are market makers who are usually directly involved in executing transactions. Their main task is to maintain bilateral buy and sell orders, corresponding to the requirements for the size of the spread (the discrepancy between the price of the buy and sell order) issued by the bank.

Brokers working on this model are both buyers and sellers. The main income, in this case, comes from fixed spreads and clients’ trading operations. The clients’ requests of such brokers are not transferred to the external counterparties because, in such a case, the broker himself is the counterparty and thoroughly monitors and controls all trading operations of his clients. Therefore, the activities of market makers imply the use of various schemes of profitability limitation, including the delay of trade orders, cancellation of transactions, etc.

Hybrid Model

Brokers operating under a hybrid model can decide where to send profitable trades: to liquidity providers or for internal execution. The stream of profitable trades usually sent to liquidity providers is commonly referred to as “toxic.” When a liquidity provider notices a toxic stream, they can lower the quality of execution for that broker. This can affect traders in the form of frequent slippage.

How Forex Brokers Operate

Forex is a vast global market with no geographic boundaries, making it incredibly popular for its inclusivity and the continual trading opportunities it offers. Investors appreciate the market’s 24-hour accessibility, ensuring that trading is possible at any time with partners from around the world.

The primary trading centers in this market are located in cities like Singapore, Hong Kong, London, New York, and Sydney. These hubs highlight the extensive reach and immense scale of Forex, which is unparalleled in terms of size and volume.

Unlike gambling, Forex trading relies not on luck but on the trader’s ability to analyze and forecast market changes. As demand for various currencies fluctuates, their values change, and traders aim to buy or sell these currencies to make a profit.

Currency prices can shift rapidly, and these changes are tracked on charts that traders use to guide their decisions, basing their trades on both these charts and their market knowledge.

Forex’s resilience during financial crises is another of its strengths. It operates with large sums of money that aren’t confined by physical limits or reliant on the physical attributes of commodities. This absence of liquidity issues, along with the inherent liquidity of money itself, positions Forex as a robust platform for investment, especially during periods of significant currency volatility, which can present substantial profit opportunities.

Technical Infrastructure of Forex Brokerage

Before creating a Forex brokerage, it is necessary to remember that the exchange where buyers and sellers meet is a complex system of interconnected elements that work offline and provide access to all the necessary tools for a comfortable and, most importantly, uninterrupted trading process. Below is a list of integral elements of the structure of the Forex exchange, without which its existence is impossible.

1. Matching Engine

An order matching engine (or simply a matching system) is an electronic system that matches buy and sell orders for a stock exchange, commodities market, or other financial exchange. The order matching system is the core of all electronic exchanges and is used to execute orders of exchange users.

The matching engine acts as an order book for each individual trading pair. This is where buyers and sellers come together to complete a trade. The matching engine ensures that transactions occur quickly and efficiently, with the best price possible for both parties.

2. Liquidity

In the Forex market, the daily trading volumes are in the trillions of dollars, which means there is maximum liquidity. The process of trading on the Forex market consists of a massive number of transactions with different currencies. Each specific transaction requires a counterparty ready to buy or sell the desired currency. That is why many currency market participants are large financial organisations called liquidity providers. They provide liquidity to different players in the Forex market.

Liquidity providers may be Forex banks, usual banks, and large brokerage companies. These are intermediaries through which many brokers and private traders trade. They accumulate such funds in different currencies that they can fulfill the request for the required amount at any time. The spread and volatility are significant for ordinary traders, depending on the level of liquidity providers can deliver.

3. Trader’s Room/CRM

Almost all brokers today have their own web service, which offers various trading tools conveniently combined in one place – the trader’s room. Even though the majority of companies provide traders with a trading room to access a wide range of market tools, companies have recently begun offering traders more precise and detailed information about trading.

The trader’s room is an imperative service necessary for the operation of a brokerage business. It organizes the client’s personal space on the brokerage company’s website. In addition, it is used to create the functionality of the back office, work with payment systems, and process documents and client identification requests. The trader’s room, in most cases, also includes CRM software for easy interaction with traders.

4. Trading Platform

Simply put, a platform is a trader’s portal to the Forex market. Regardless of your trading style or preferred trading instrument, the technology of the trading platform you use can affect virtually every aspect of your trading experience. From accessing fundamental research regarding the foreign exchange market to analysing moment-to-moment news events or performing technical analysis of currency pairs on charts, Forex trading platforms have the common goal of making it easier for traders to trade and open up opportunities while managing their investments.

5. Data Centers and Hosting

The special program installed on the server opens and closes orders, independently watches the market, analyzes price changes, and determines optimal points for profitable entrance into the agreement. It makes trading on Forex more effective and independent of the broker’s presence in the network.

Selection and use of VPS/VDS servers for installation of the trader’s terminal and its use in Forex trading is caused by the necessity of constant connection to the broker’s servers. In the case of using automated trading systems, the work of advisors is vital for high speed and continuity of obtaining the latest market quotes. The robot algorithm must have time to process the incoming data, make a trading decision on their basis, and successfully send the order to the server of the broker.

How to Create Forex Brokerage: Step-by-Step Guide

Now that you know all about the types of Forex brokers, the features of Forex trading, and what kind of technical equipment a Forex broker has, it is time to learn how to start your own Forex brokerage company. There are two ways – with White Label/Turnkey solutions or from scratch. Below we will look at the sequence of steps to start a brokerage business from scratch.

1. Determining the Target Market

Launching an FX broker and developing such a company successfully requires careful analysis of your competitors and identification of your target audience. Among the parameters that should be determined are age, gender, hobbies, income level, country of residence, etc. Depending on this, your company’s legal address, your approach to platform promotion, the number of languages supported, etc., will be highly influenced.

2. Registration and Licensing

Before starting a Forex business, you must register a company and obtain the appropriate licenses. The license is one of the defining criteria for traders when choosing a Forex brokerage. Licenses are issued by various government regulators in different jurisdictions. Still, the choice of a particular one depends on the scale of the broker’s business, budget, and other variables, which we will discuss in this publication. If we talk about the legal side of the issue, the broker’s license indicates which regulator controls the broker’s activity and also, in fact, determines the company’s reputation.

3. Budgeting

You need to clearly define the costs you are willing to incur in the coming months and years in order to successfully launch a robust and promising brokerage business and then incur scaling expenses in the future if the launch is successful. This can be accomplished by determining the amount of operating and trading funds as well as their replenishment.

4. Partner with a Reliable Liquidity Provider

Forex brokerages, especially with direct transaction processing (STP), usually cooperate with many large liquidity providers to maintain their own prices and liquidity at the proper level. Most often, liquidity providers are large financial institutions or banks that trade currencies considerably. In other words, they dispose of such massive amounts that a trader, when selling currency, is most likely to choose them, respectively, to buy it from them.

Sometimes, a broker can sell the currency without transferring any deals to liquidity providers. In this case, when you buy, you are not buying from the liquidity provider to whom your broker sent the transaction but from the broker itself. These brokers are called “market makers,” representing counterparties.

5. Find a Powerful Payment Processor

Forex brokers have complicated tasks and badly need perfectly ironed-out technical processes. This also applies to customer deposit servicing. You must find payment service providers (PSPs) who can meet your needs depending on the geographical region and offer the methods your clients need. Most PSPs do not charge account opening fees, but processing fees vary. It is also highly recommended that you have more than one provider to redirect customers to another account if one is unavailable. Since this is an essential part of your business, you should always be on the lookout for payment providers.

6. Develop a Website

Beautiful, easy-to-navigate and concise websites are the calling card of any business. It is a place where users (in our case, traders) get acquainted with the company, its products and services. The website must work smoothly and have all the necessary elements to navigate users through all the services or products the broker offers. If you have knowledge of programming and computer science, creating a good website should not be difficult. Otherwise, it is worth turning to experienced specialists.

7. Choose a Trading Platform

A trading platform is an investor’s only access to the market. This is why Forex traders need to ensure that the trading platform and any trading software a broker offers are simple and straightforward, including several technical and fundamental analysis tools, and allow them to open and close trades easily. Today, one of the most popular trading platforms is MetaTrader 4 and 5, but they are pretty expensive and unavailable as a white label. In this case, you can consider options like cTrader or B2TRADER, which are not inferior in functionality and are characterised by a pleasant interface and ease of use.

8. Testing

Testing the usability of your exchange is essential for creating a business because it provides insight into whether your exchange is being used by your customers as you intended. Additionally, it provides information about any problems encountered with your exchange. The testing should be carried out as early as possible to ensure that any design changes can be made before your product is launched.

Your exchange must work at a high level in the beta version once you have completed the software development and followed the above steps. Developers should analyze and make changes to the site based on the experiences of the first users so that a full launch of the project can be achieved. Additionally, it can be utilised as an informational opportunity to advertise the Forex brokerage to the intended market.

Conclusion

The FX market is the most liquid and profitable today. Business related to Forex brokerages can become very lucrative and successful if you have the necessary knowledge and a competently made plan. As for the brokers’ work models, it is essential to understand that the main factor in choosing which model to work with is the trading system’s profitability, not the nuances of order execution.

That being said, the market-maker model has advantages because it can give better execution. On the other hand, the ECN/STP model provides the best prices. At the same time, this model is more transparent, and using a markup can significantly improve execution. In any case, whichever model you choose, the Forex business can open up limitless opportunities to make money, which is always in trend, even despite challenging economic times.

Create forex brokerage from scratch with our expertly crafted turnkey solution – find out how here.

FAQ

What are the key steps to start a Forex brokerage business?

1. Determining the Target Market,

2. Registration and Licensing,

3. Budgeting,

4. Partner with a Reliable Liquidity Provider,

5. Find a Powerful Payment Processor,

6. Develop a Website,

7. Choose a Trading Platform and

8. Testing.

What is a Forex Brokerage and how does it operate?

A Forex brokerage is a company that provides a trading platform for clients to buy and sell currency pairs, acting as an intermediary between traders and the Forex market. Brokers earn through spreads, commissions, and trading volumes.

What are the benefits of launching your own Forex Brokerage?

Starting a Forex brokerage offers high profit potential, global client reach, and flexibility in operations while tapping into the highly liquid $6 trillion Forex market.

By clicking “Subscribe”, you agree to the Privacy Policy. The information you provide will not be disclosed or shared with others.

Our team will present the solution, demonstrate demo-cases, and provide a commercial offer