Institutional Adoption of Cryptocurrency: 2025-2026 Market Analysis

In 2026, institutional crypto adoption is no longer a question of if — it’s about how fast. According to Coinbase Institutional, 76% of global investors planned to expand digital asset exposure, and nearly 60% expected to allocate over 5% of AUM to crypto this year.

For brokers, fintechs, and asset managers, this is a decisive moment. Market infrastructure, regulation, and liquidity have matured enough to act.

This guide helps you understand where the market is moving, what risks to manage, and how to build scalable, compliant systems that turn crypto adoption into a competitive advantage.

Key Takeaways

- Institutional crypto adoption in 2026 is being driven by regulation, tokenization, and the rise of compliant yield instruments such as tokenized Treasuries.

- Regional frameworks (MiCA in Europe and the MAS stablecoin regime in Asia) are creating structured, scalable environments for institutional participation.

- Infrastructure maturity—qualified custody, on-chain settlement, and API connectivity—is transforming crypto into a regulated asset class for professional investors.

- Risk management now focuses on integration, cybersecurity, and multi-jurisdictional compliance rather than market speculation.

Discover the Tools That Power 500+ Brokerages

Explore our complete ecosystem — from liquidity to CRM to trading infrastructure.

What Is Institutional Adoption of Cryptocurrency?

In 2025, digital assets moved from speculative interest to strategic allocation across the financial industry. Hedge funds, banks, and pension funds are now treating crypto as a core asset class, and that changes everything for market infrastructure providers.

Over the past two years, institutional engagement has accelerated faster than any other stage of crypto’s evolution. Spot Bitcoin and Ethereum ETFs have opened regulated pathways for participation, drawing in traditional players who once stayed on the sidelines.

The Scale and Growth of Institutional Investment

Institutional capital has become the backbone of crypto’s new phase. By late 2025, spot Bitcoin ETFs managed more than $115 billion in combined assets, led by BlackRock’s IBIT ($75 billion) and Fidelity’s FBTC (> $20 billion). These inflows mark a decisive endorsement from established finance.

Combined, spot Bitcoin ETFs now represent over $115 billion in professionally managed exposure — capital from pension plans, family offices, and asset managers seeking regulated entry points.

Corporate participation reinforces the same signal. MicroStrategy (now rebranded as Strategy) holds over 640,000 BTC as of October 2024, transforming its balance sheet into a long-term digital treasury. Major investment banks such as Goldman Sachs are extending that maturity through tokenization platforms like GS DAP, providing regulated rails for institutional clients to issue and settle digital instruments.

Even pension funds are taking small but significant steps. The State of Wisconsin Investment Board and others have disclosed early ETF allocations, typically low single digits of their portfolios. This cautious participation signals a wider acceptance of crypto as a complementary asset for diversification and long-term inflation hedging.

Why Institutional Adoption Matters for Brokers and Financial Providers

Institutional adoption changes the expectations of every market participant. Brokers and fintech firms that once served retail traders are now asked to deliver institutional-grade execution, liquidity, and reporting. These clients operate under strict governance and demand infrastructure that meets audit, risk, and compliance standards.

For brokers, this momentum is a sitructural realignment of the financial industry. Those who build scalable, compliant, and transparent systems today will define how institutions trade, settle, and manage digital assets tomorrow.

Key Drivers of Institutional Adoption

Institutional adoption in 2025-2026 moves on clear catalysts you can act on now. If you run a brokerage, exchange, or fund platform, these drivers determine where client demand concentrates and what your trading, custody, and reporting stack must deliver.

1. ETF Access And Liquidity

Access through familiar products has become the cornerstone of institutional participation. The approval of spot Bitcoin and Ethereum exchange-traded funds gave investors a regulated path to digital exposure. These vehicles trade on established exchanges, supported by qualified custodians and market makers, allowing large allocators to treat crypto positions like any other asset class.

Liquidity has followed quickly. ETFs and their derivative products have deepened secondary market activity and reduced execution risk for institutions operating under strict compliance mandates. This structure turns crypto from an illiquid frontier into a transparent segment of institutional portfolios.

2. Clearer Rules—Enough To Move

Regulation remains uneven globally, but 2025 has brought enough harmonization for institutions to act. In Europe, the MiCA framework is fully active, establishing clear licensing standards for custodians, issuers, and service providers. The regulatory perimeter now gives large financial institutions confidence to scale crypto-related offerings within a unified set of EU rules.

At the banking level, the Basel Committee’s crypto exposure standards are gradually being implemented across jurisdictions, setting capital treatment requirements and risk thresholds for digital assets. This process gives global banks a consistent structure for measuring crypto exposure, allowing risk and compliance teams to move from policy discussions to execution.

3. Friendlier Accounting For Corporates

Corporate accounting was one of the final barriers to institutional adoption. The FASB’s ASU 2023-08 fair-value standard, effective for reporting periods beginning after December 2024, allows companies to record crypto assets at market value rather than cost minus impairment.

This simple shift has wide implications. Corporations can now hold and mark digital assets transparently on their balance sheets without fear of distorting earnings during market cycles. For treasury departments exploring diversification or blockchain-based payment strategies, this change transforms crypto from an accounting burden into a usable financial instrument.

4. Tokenization Of Real-World Assets (RWAs)

Tokenization has become the bridge between traditional finance and blockchain infrastructure. Institutional pilots have evolved into active products backed by major asset managers. BlackRock’s BUIDL fund, Franklin Templeton’s on-chain money-market vehicles, and the DTCC’s Smart NAV initiative demonstrate that tokenized treasuries and funds can operate at scale under regulatory oversight.

The rapid expansion of on-chain treasury products — now accounting for several billion dollars in value — proves institutional comfort with tokenized finance. Beyond liquidity gains, these projects showcase operational readiness: automated settlement, transparent ownership, and programmable compliance baked directly into financial instruments.

5. Market Infrastructure & Custody Maturity

Institutional engagement depends on trust in infrastructure. Over the past year, custody technology and settlement systems have advanced significantly. Cold wallets, insurance coverage, and third-party audits have turned asset safekeeping into a regulated, insurable service rather than a technical experiment.

At the same time, qualified custodians now integrate directly with trading venues and prime brokers through standardized APIs, reducing fragmentation and settlement delays. This maturity allows funds and banks to design secure, auditable strategies that meet institutional control requirements while maintaining operational efficiency.

6. Portfolio Construction & Macro Fit

Digital assets have earned a defined role within institutional portfolios. Beyond speculative positioning, they now serve as tactical instruments for diversification, liquidity management, and macro hedging. Allocators treat Bitcoin and Ethereum exposures as alternative assets that respond differently to monetary policy cycles and inflation dynamics.

Institutional-grade derivatives have strengthened this use case. Regulated futures, options, and structured notes allow portfolio managers to express directional or yield-seeking strategies while maintaining exposure within approved risk limits. For many funds, these products offer carry and volatility opportunities that complement fixed income and commodity positions in multi-asset mandates.

7. Payments & Settlement Via Stablecoins

Stablecoins are quietly reshaping institutional finance from the back office outward. With annual on-chain transfer volumes surpassing $27 trillion in 2024, tokenized cash instruments have proven their efficiency in real settlement environments. Financial institutions now experiment with stablecoin-based payment rails to streamline treasury operations and cross-border transfers.

Regulatory agencies in the U.S., EU, and Singapore are now developing specific stablecoin frameworks to standardize issuance and custody, signaling that this innovation is moving from fintech experimentation to financial infrastructure.

8. Leadership Signals From Top Asset Managers

Institutional confidence often follows leadership, and global asset managers have provided it. Larry Fink, CEO of BlackRock, publicly described tokenization as the next generation of financial markets. Public advocacy from such figures validates crypto as a credible asset class rather than a speculative detour.

This signaling matters. Pension funds, insurers, and sovereign investors take cues from industry leaders with proven governance standards. Their engagement creates a network effect where peer institutions accelerate adoption to avoid strategic lag.

9. 24/7 Market Accessibility

Crypto’s always-on nature has become one of its defining institutional advantages. Global desks can manage exposures continuously, rebalance risk in real time, and respond instantly to macro events without waiting for market reopenings.

For risk managers and traders, the 24/7 cycle also enhances liquidity modeling and hedging precision. It shortens feedback loops between strategy and performance, offering agility that traditional markets cannot replicate.

10. Diversification Pressure and Portfolio Evolution

Muted returns in equities and fixed income have increased pressure on allocators to identify non-correlated growth. Crypto’s independent return profile and expanding regulatory clarity make it a viable solution to that demand. Digital assets now sit alongside gold, private credit, and infrastructure in institutional diversification models.

As risk frameworks mature and infrastructure stabilizes, allocations to digital assets are no longer viewed as fringe. They represent a measured evolution of portfolio construction — an acknowledgment that global capital markets are changing shape. For institutions, the question has shifted from whether to participate to how efficiently they can scale exposure within compliant, risk-controlled structures.

Power Your Institutional Strategy

Launch faster with institutional-grade liquidity, custody, and trading technology built for compliance and scalability.

Institutional Players Leading The Way

Institutional adoption of digital assets is now defined by a small group of market leaders shaping the standards for custody and regulated trading. Their activity demonstrates that digital assets are being integrated—not merely tested—within global financial infrastructure.

Traditional Finance Giants

Large financial institutions are setting the pace through regulated products and infrastructure pilots. Their participation provides the credibility and operational depth required for the next phase of institutional growth.

- BlackRock expanded its European digital-asset offering in 2025 with a listed Bitcoin product and continues developing tokenized bond strategies under its BUIDL framework.

- Fidelity Investments provides direct custody and execution services for institutions, integrating blockchain-based settlement processes across investment operations.

JPMorgan runs its Onyx platform for tokenized payments and securities, using JPM Coin for intraday settlement among institutional clients.

These firms are defining compliance models, liquidity standards, and technical interoperability that other market participants now follow. Their projects show that tokenization and regulated exposure can scale within existing financial systems.

Crypto-Native Institutions

Crypto-native companies supply the infrastructure that allows traditional finance to participate safely. Their focus on custody, execution, and network security bridges operational gaps between on-chain systems and regulated capital markets.

- Coinbase Institutional offers a unified venue for execution, custody, and reporting under U.S. regulatory oversight.

- Galaxy Digital structures investment vehicles and liquidity strategies for institutional clients entering tokenized markets.

- Anchorage Digital and Fireblocks provide qualified custody and secure transaction networks used by banks, asset managers, and fintechs.

Emerging Sectors

Pension funds, insurers, and sovereign wealth funds are beginning limited allocations through ETFs and tokenized instruments. Recent disclosures show European and U.S. pension plans testing exposures below 3% of portfolios. Insurers are exploring tokenized bonds to boost yield, while sovereign funds are evaluating blockchain-based cash equivalents for liquidity management.

This gradual entry reflects a risk-controlled approach. Institutions with long-term mandates view digital assets as a diversification tool and inflation hedge, supported by improved regulation, custody, and accounting clarity.

Global Trends and Regional Differences

Institutional adoption of digital assets is advancing unevenly across regions, shaped by local regulation, infrastructure, and macroeconomic priorities. These differences define where liquidity forms, how products are structured, and which markets global brokers and fintech providers prioritize.

North America

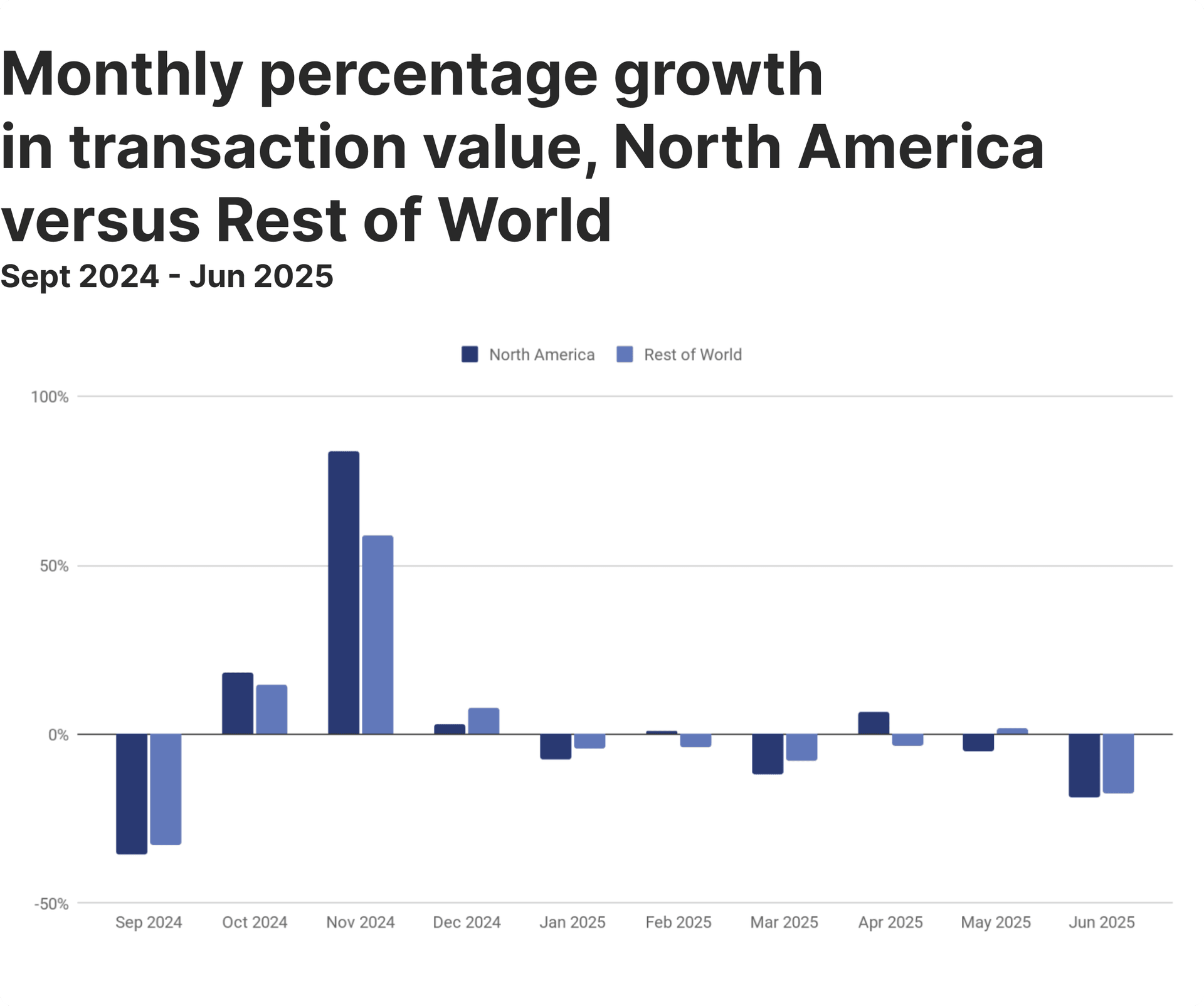

North America remains the largest institutional crypto market by volume and value. Chainalysis estimates that the region processed $2.3 trillion in cryptocurrency transaction value between July 2024 and June 2025.

U.S. regulators have refined ETF and custody frameworks, allowing retirement funds and corporate treasuries to participate through approved investment vehicles. Public companies increasingly disclose digital holdings, while service providers extend institutional-grade liquidity, clearing, and reporting infrastructure. Canada and the U.S. now represent the most mature environment for large-scale institutional trading and risk management.

Europe

Europe’s progress is defined by regulation. The MiCA framework—effective for stablecoins from mid-2024 and for service providers by December 2024—creates the first unified licensing system across 27 member states.

This clarity attracts banks and asset managers developing tokenized funds, on-chain settlement tools, and DeFi-related products under regulated supervision. European institutions are also integrating sustainability criteria into digital-asset strategies, aligning crypto operations with ESG and cross-border payment initiatives promoted by the European Commission and ESMA.

Latin America’s Real-World Adoption Momentum

Latin America today is a testing ground for real-world crypto applications. Brazil’s central bank continues to pilot its CBDC, known as Drex, linking blockchain rails with commercial banking infrastructure. Local fintechs are implementing stablecoin-based settlement systems that reduce remittance friction and FX costs.

High inflation and volatile currencies drive real adoption rather than speculation. Financial firms in Mexico, Colombia, and Argentina explore tokenized debt instruments and cross-border liquidity pools. For brokers and liquidity providers, LATAM’s rapid digitalization represents a first-mover opportunity in an underserved institutional market.

Asia and Other Emerging Markets

Asia’s institutional crypto landscape is complex but rapidly formalizing.

- Singapore leads with a finalized stablecoin framework from the Monetary Authority of Singapore, giving banks and fintechs a compliant structure for tokenized payments.

- Hong Kong launched the first Asian spot crypto ETFs in 2024, positioning itself as a regional hub for regulated trading and custody.

- Japan maintains strict but transparent rules that enable banks to issue and custody digital assets within licensed frameworks.

- South Korea has enacted its Virtual Asset User Protection Act, adding supervision for exchanges and custodians ahead of expanded cross-border oversight in 2025.

- In the Middle East, Dubai’s VARA and Abu Dhabi’s ADGM are establishing comprehensive digital-asset regimes to attract global institutions seeking clarity and tax-efficient environments.

These regional developments reveal a clear trajectory: institutional adoption is global but localized. Markets are converging on regulation and transparency, giving financial operators a predictable framework for expanding digital-asset services worldwide.

Use Cases and Strategies Emerging in 2026

Here is how institutions actually deploy digital asset strategies today—and why these practices persist regardless of market cycles.

1. Institutional Yield Through Tokenized Treasuries And Money Market Funds

Tokenized cash equivalents have become a core yield sleeve. BlackRock’s BUIDL crossed $1B AUM in March 2025 and later became eligible as off-exchange collateral at a major venue, signaling operational readiness for institutional workflows and custody integrations.

Franklin Templeton expanded on-chain money market funds in the US and launched UCITS structures in Luxembourg for European allocators. These vehicles deliver short-duration yield with daily liquidity, standardized reporting, and programmable settlement, allowing desks to post or recall collateral without disrupting treasury operations.

2. Stablecoin-Based Payments And Cross-Border Settlement

Stablecoins now function as institutional payment rails. Industry estimates place 2024 on-chain stablecoin transfers at roughly $27.6T, while central banks and payments firms refine standards for reserves, redemption, and disclosures. This combination anchors confidence in tokenized cash instruments.

Fund managers and corporates adopt stablecoin settlement to compress cut-offs and reduce FX friction. Under clarified regimes—such as Singapore’s finalized stablecoin framework—treasury teams execute intra-day movement of funds, reconcile instantly, and preserve audit trails, improving liquidity management across entities and jurisdictions.

Understand the use case of stablecoins for businesses. Increase speed, reduce costs, and future-proof your infrastructure with the right tools.

3. Hedging And Derivatives Integration

Risk desks increasingly route exposure through regulated derivatives. On the CME, institutional participation reached new breadth in 2025, with record counts of large reportable traders in BTC futures, indicating deeper two-sided liquidity and more efficient basis trading for carry or hedge mandates.

ETF-linked options and cleared swaps expand the toolkit. Portfolio managers adjust delta, duration, and convexity of crypto sleeves without touching spot custody, keeping mandates within policy limits. The result is clean execution, standardized margining, and transparent risk attribution aligned to existing governance.

4. Tokenization Of Private Credit And Real Assets

Tokenization moved from pilots to production. J.P. Morgan’s TCN executed live transactions where tokenized money-market fund shares from a major manager served as collateral with a global bank—proof that high-grade assets can secure obligations on-chain under institutional controls.

Infrastructure providers also addressed data integrity. DTCC Smart NAV delivered fund NAVs on-chain via secure infrastructure, enabling transfer agents, oracles, and venues to reference a single, tamper-evident record. This supports fund tokenization and automated compliance checks across distribution.

5. On-Chain Collateral And Treasury Management

Repo and short-term funding increasingly run on distributed ledgers. Broadridge DLR reported $339B average daily volumes in September 2025 and $385B in October, reflecting the adoption of programmable settlement in high-grade financing markets with enterprise controls and supervision.

In parallel, Eurex/HQLAx advanced DLT-based collateral mobility for European participants. Under MAS Project Guardian, UBS, SBI, and DBS executed cross-border repo using tokenized assets, demonstrating real-time collateral movement and standardized workflows across regulated counterparties.

6. ESG And Sustainability-Linked Digital Assets

Sustainability reporting gains precision on-chain. Under Project Guardian, academic and banking consortia tokenized impact metrics for green instruments, enabling automated disclosure and audit. Parallel efforts explored tokenized carbon credits, with market-data providers and banks testing standardized issuance and verification models.

These designs do not solve every challenge in voluntary carbon markets, but they introduce verifiable data flows, immutable attestations, and programmable controls—features that help compliance teams evidence impact and reduce reconciliation overhead for ESG mandates.

7. Integration Of Digital Assets Into Portfolio Strategy

Institutions now blend Bitcoin, Ethereum, and tokenized cash equivalents into multi-asset sleeves. Derivatives handle exposure and income, while tokenized treasuries manage liquidity and collateral. Compliance frameworks reference recognized standards, and operations teams run familiar controls across custody, valuation, and reporting.

The common thread is operational quality. When collateral moves programmatically and data arrives on-chain from authoritative sources, allocation teams scale positions with fewer operational bottlenecks. That is why these use cases persist: they improve yield and control without rewriting institutional governance.

Deep, Reliable Liquidity Across 10 Major Asset Classes

FX, Crypto, Commodities, Indices & More from One Single Margin Account

Tight Spreads and Ultra-Low Latency Execution

Seamless API Integration with Your Trading Platform

Infrastructure and Custody Solutions for Institutions

Institutional crypto adoption depends on professional-grade plumbing: qualified custody, prime access to liquidity, reliable settlement rails, and automated compliance. These components turn blockchain assets into operational instruments that fit banking controls, audit requirements, and board-level risk frameworks in 2026.

Secure Custody and Prime Brokerage

Qualified custodians now anchor institutional control. Anchorage Digital Bank holds an OCC federal trust charter; in 2025, regulators lifted a prior consent order after BSA/AML remediation. Coinbase Custody Trust operates under a NYDFS charter as a limited-purpose trust.

Accounting frictions eased as the SEC rescinded SAB 121 in January 2025, reducing capital and disclosure hurdles for banks that safeguard digital assets. On the technology side, MPC architectures and SOC 2 Type II attestations moved from optional features to baseline expectations for enterprise custody.

Prime services consolidate operational complexity. Institutions source netted margin, cross-venue access, and standardized collateral schedules through a single interface, rather than stitching bilateral connections. The model shortens funding cycles and gives risk teams a unified lens across positions.

Integrated Trading Platforms

Front-to-back platforms now expose FIX and REST APIs, real-time risk, and policy controls that gate orders by mandate, exposure, or counterparty. Automation handles account routing, margin checks, and allocations, while surveillance flags exceptions for compliance review in-flight.

Deep liquidity aggregation and venue connectivity matter as much as tools. Engines normalize tick sizes, fees, and throttles, then optimize routing for impact and fill probability. Risk modules compute portfolio-level Greeks and liquidity haircuts to keep trading inside governance boundaries.

Liquidity still fragments across venues and instruments. Brokers bridge that gap with technology that normalizes feeds and balances flow, so clients see consistent execution without building connectivity from scratch.

Multi-Asset Liquidity Access

Aggregation layers combine spot, derivatives, and tokenized cash equivalents into a unified book with predictable spreads and execution policies. Providers such as B2BROKER expose this via white-label stacks and APIs, letting institutions add asset coverage without expanding their internal footprint.

After execution, cash and collateral must move with certainty. Production settlement now mixes on-chain rails with traditional clearing to meet timing, finality, and reporting obligations.

The future of trading is here: the multi-asset brokerage. Learn why today's top traders demand access to all markets from one platform and how to build it.

01.07.25

Settlement, Clearing, And Reconciliation

Institutional settlement infrastructure in 2026 is defined by precision and auditability. Large custodians and clearing agents now operate hybrid models that link blockchain rails with conventional payment and securities networks, allowing same-day transaction finality under regulated controls.

Tokenized financing platforms demonstrate the shift. Broadridge’s DLR processes hundreds of billions in daily repo volume through programmable settlement contracts.

Compliance, Reporting, And Regulatory Technology

Firms implement screening, blockchain analytics, and trade surveillance at the message layer, not after settlement. FATF’s Travel Rule remains uneven globally, which increases the need for policy engines that validate counterparties and payloads before execution.

For banks, Basel crypto-exposure disclosures begin rolling into 2026 in many jurisdictions, pushing standardized data pipelines for capital, liquidity, and concentration metrics. RegTech platforms now expose reporting APIs that map digital-asset events to regulatory templates with immutable proofs.

All of this relies on clean integration between custody, trading, risk, and finance systems.

API Connectivity And System Integration

Institutions link custody nodes, OMS/EMS, risk, and general ledger via event-driven APIs. Banks also connect fiat rails and stablecoin reserves; for example, U.S. Bank announced custody services for stablecoin reserves with Anchorage, aligning banking oversight with digital cash operations.

Interoperability across DLT networks and legacy stacks differentiates programs that scale. B2BROKER’s API-first and white-label solutions let institutions add digital assets without rewriting core systems, so teams preserve controls while expanding trading, liquidity, and settlement capabilities.

Have a Question About Your Brokerage Setup?

Our team is here to guide you — whether you're starting out or expanding.

Challenges and Risk Management for Institutional Investors

Institutional participation has advanced, yet crypto still presents distinct risks. The following areas remain central to risk committees in 2026.

Remaining Regulatory Uncertainty In Key Markets (e.g., U.S. vs. Asia)

Rules differ widely across major jurisdictions. In the U.S., overlapping oversight and enforcement-driven policy keep licensing and disclosure fragmented. Institutions mitigate this through subsidiary structures and region-specific compliance models.

Asian financial centers, including Singapore and Hong Kong, have established formal licensing for tokenized assets and stablecoins, giving institutions defined parameters for custody, issuance, and reporting. Regional divergence makes multi-jurisdictional compliance essential for any cross-border strategy.

Market Volatility And Liquidity Fragmentation

Liquidity remains uneven across exchanges and OTC venues, creating execution and pricing challenges for institutional desks. Limited depth can trigger intraday volatility and complicate risk hedging.

The steady growth of regulated derivatives markets has begun to stabilize activity. Futures and options allow standardized risk transfer and margin discipline, helping institutions manage exposure without depending solely on spot liquidity.

Custody And Cybersecurity Risks

Custody is a structural risk driver. The finality of blockchain transactions leaves no margin for operational error, making key management and segregation of duties core to institutional control.

Multi-party computation (MPC), independent audits, and expanded insurance coverage have strengthened custodial resilience. Regulatory frameworks for qualified custodians now require periodic penetration testing and incident response validation comparable to traditional securities custody.

Integration Hurdles With Legacy Systems

Integrating blockchain assets into existing treasury, accounting, and reporting stacks remains complex. Data, pricing, and settlement workflows must align with audit and reconciliation standards.

API-driven middleware and tokenization platforms now bridge these systems, synchronizing custody, execution, and risk data in real time. This interoperability converts fragmented workflows into standardized, reviewable operations—laying the groundwork for scalable, compliant institutional adoption.

Getting Started With Institutional Crypto Adoption Step by Step

Institutional adoption follows recognizable phases: define policy, secure plumbing, connect systems, and scale exposure with measurable controls. This roadmap gives your team a practical sequence you can execute now and refine as regulation and infrastructure continue to mature.

1. Establish a Clear Investment And Compliance Framework

Start with governance. Update investment policies to include crypto, define position limits, liquidity thresholds, and counterparty criteria. Align risk metrics, valuation methods, and audit controls with existing compliance standards before deploying capital.

2. Choose a Reliable Liquidity And Trading Partner

Execution defines trust. Select partners with transparent pricing, deep liquidity, and regulated infrastructure. B2BROKER offers institutional-grade pools across digital assets and stablecoins, integrating via APIs to ensure consistent fills and reduced slippage.

3. Implement Robust Custody And Risk Controls

Custody safeguards operational continuity. Use qualified custodians, MPC wallets, and insured arrangements. B2BROKER’s integrations with leading custodians and risk systems provide a unified custody and monitoring environment suitable for institutional oversight.

4. Integrate Crypto Into Legacy Infrastructure

Connect digital-asset flows to your existing OMS, treasury, and accounting systems. APIs and middleware should automate reconciliation, reporting, and funding. B2BROKER’s API-first architecture lets institutions add crypto without disrupting established workflows.

5. Diversify Through Tokenization And Yield Opportunities

Tokenized treasuries, private credit, and other on-chain instruments offer regulated yield and diversification. Evaluate platforms through due diligence, legal structuring, and liquidity testing. B2BROKER supports secure exposure to tokenized assets within compliance-ready frameworks.

6. Develop Internal Expertise And Partner Ecosystems

Educate teams on custody, blockchain analytics, and reporting. Build partnerships with custodians, liquidity providers, and fintech platforms to expand technical capability and resilience.

7. Start Small And Scale Strategically

Begin with controlled pilots—limited allocations or stablecoin settlements. Measure performance, refine risk models, and document procedures before expanding.

This sequence keeps progress visible and auditable. By moving in gated steps, you create a durable operating model that meets institutional standards and adapts as the market evolves.

Looking Ahead with B2BROKER

Institutional adoption is accelerating, but sustaining growth requires infrastructure that is fast, compliant, and ready for scale. B2BROKER helps financial businesses achieve that—partnering with brokers, exchanges, and fintech firms to simplify digital asset operations and unlock new revenue channels.

Our ecosystem was built for institutions that value reliability, transparency, and performance. Every component is engineered to shorten launch times, reduce costs, and maintain operational control across multi-asset environments.

With B2BROKER, you gain:

- Turnkey infrastructure: From matching engines and liquidity aggregation to full brokerage and exchange setups—all delivered as production-ready systems.

- Institutional liquidity: Prime of Prime spot, perpetual and CFD liquidity through a single gateway.

- Compliance-ready architecture: Built-in KYC/AML, reporting tools, and audit controls aligned with global standards.

- 24/7 enterprise support: A dedicated team assisting with integration, optimization, and live operations.

Today, more than 500 financial institutions rely on our technology to operate at scale, manage risk, and grow profitably in digital markets.

If your next step is expanding into crypto or upgrading your existing infrastructure, let’s build it together.

Ready to Build Your Own Exchange?

Take the next step toward building a compliant, scalable digital-asset business with enterprise-level support.

Frequently Asked Questions About Institutional Crypto Adoption

- Are institutions adopting Bitcoin?

Yes. Institutional allocations to Bitcoin continue to rise through regulated vehicles like ETFs and custody-managed funds.

- What is institutional custody for crypto?

It’s a regulated, insured storage model that uses qualified custodians, segregation of assets, and advanced security protocols.

- What crypto are institutions buying?

Primarily Bitcoin and Ethereum, alongside growing exposure to tokenized treasuries and stablecoins used for settlement.

- Who are the big three institutional investors in crypto?

The leading institutional holders are BlackRock, managing roughly 805,000 BTC through its ETF; Strategy (formerly MicroStrategy), holding close to 640,000 BTC as of October 2025; and Grayscale, with about 172,000 BTC.