Trump Bitcoin Reserve: How Will it Work?

After boasting about crypto adoption and blockchain developments throughout his presidential campaign, President Donald Trump suggests integrating decentralised assets into the country’s financial system.

The Senate banking subcommittee is seriously considering the strategic Bitcoin reserve, with new bills supporting this plan remaining under Congress’s discussion.

Advocates argue it will modernise the nation’s financial strategies, while critics worry about its volatility and regulatory challenges.

The ultimate goal is to stimulate economic growth through surging instruments. Will the Trump Bitcoin reserve be a success story, or will it add to the current challenges facing the new US president?

Key Takeaways

- The Bitcoin Strategic Reserve suggests adding BTC to the national reserves, besides gold, foreign currencies, and petroleum.

- The initiative relies on the substantial valuation of cryptocurrencies and the rising adoption rate at centralised institutions.

- The strategy suggests buying and holding $100 billion worth of BTC over five years to combat inflation and spur economic growth.

What is The Trump Bitcoin Reserve?

The Trump Bitcoin Reserve is a proposed initiative to include Bitcoin within the United States’ national reserves. It suggests allocating a portion of the reserve budget to hold and accumulate BTC as a strategic asset.

The idea originated from Senator Cynthia Lummis, who introduced the BITCOIN Act to create such a reserve. It faced big support from the Trump administration, adding to his future plans and promising policies to lead crypto developments in the country.

This initiative is a two-pronged strategy. First, it’s intended as a hedge against potential inflation within the traditional financial system. Second, it’s a direct investment in a high-growth asset class, aiming to capitalise on crypto market trends.

The proposal is also seen as a move to legitimise digital assets and operators, who have struggled under the previous financial regulators led by the SEC’s former chairman, Gary Gensler.

Understanding National Strategic Reserves

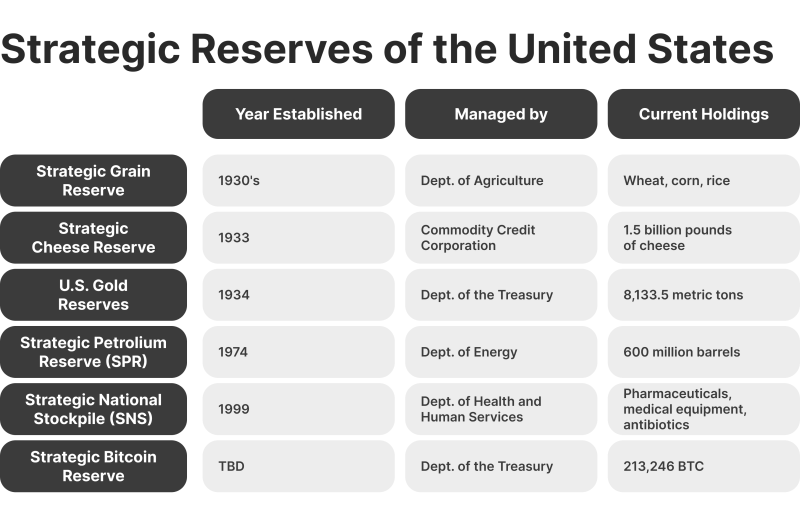

It’s important to start with the fundamentals. National reserves are a country’s primary stability fund. They exist for severe crises: a market collapse, geopolitical conflict, or a financial contagion. Their entire purpose is to provide stability when the broader environment is volatile.

Typically, this fund consists of highly stable and predictable assets: major foreign currencies, physical gold, and key commodities like oil. The reason is that these assets are stable and liquid. They serve as a safety net that allows a nation to support its currency and markets during periods of stress.

Gold has been a cornerstone of these reserves for centuries due to its universal acceptance as a store of value and its finite supply. Holding major foreign currencies is equally pragmatic—they are essential for international trade and for managing domestic currency fluctuations.

But recently, this dynamic has started to shift. Some nations, concerned about over-reliance on a single currency, have begun to seek alternatives. They are diversifying into assets like sovereign wealth funds and, in some cases, exploring digital assets.

Have a Question About Your Brokerage Setup?

Our team is here to guide you — whether you're starting out or expanding.

Adding Bitcoin to this framework is presented as the next step in this evolution. The argument is that its core features—decentralisation, inherent scarcity, and growing adoption—make it a viable, modern option for a national reserve.

This is not a uniquely American idea. Similar discussions are occurring in the EU, where some policymakers have described the current financial system as “outdated.” This coincides with their internal debates regarding the development of a central bank digital Euro.

But in practical terms, the extreme price volatility and lack of regulatory clarity for cryptocurrencies are not minor issues. They are significant, fundamental challenges that raise questions about the overall viability of the strategy.

How Will the US Bitcoin Reserve Work?

The Trump Bitcoin Reserve involves a multi-year plan to incorporate BTC into the US national reserves. Purchases would be distributed strategically, ensuring price stability while accumulating assets.

The government aims to spend up to $100 billion over five years to acquire BTC gradually, minimising market impact. The acquired coins would then be stored in secure, state-controlled cold wallets to protect against cyber threats.

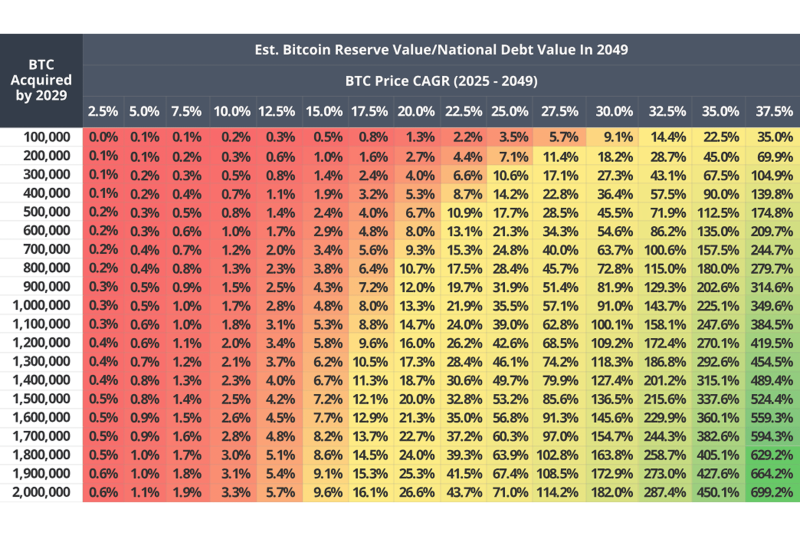

The Bitcoin Strategic Reserve bill’s purpose extends beyond hedging inflation; it could generate significant returns to offset the striking US national debt. These assets would be managed similarly to gold reserves, with secure storage and periodic audits.

This gives the federal state quick access to cash during crises. For example, during economic downturns, the government can sell these assets at peak valuations to get immediate liquidity. This strategy can boast Bitcoin as a fiscal policy tool for reducing debt and enhancing financial resilience.

Trump and Bitcoin

After being sceptical about cryptocurrencies in his previous presidential term, Trump on Bitcoin has changed dramatically recently. Today, some of his decentralised products include NFTs, sneakers, and the recently announced TRUMP coin.

Trump accepted Bitcoin donations during his campaign and promised an executive order to ease the SEC’s hold on crypto brokerages in the US.

His advocacy for a blockchain-based reserve aligns with his broader push for financial innovation and economic independence. He promises to become a global leader in blockchain development.

On January 18, 2025, Donald Trump launched his official memecoin, TRUMP Coin. Within one day, it reached a market cap of $15 billion. Today, it ranks as the 25th largest cryptocurrency globally.

Benefits of The Bitcoin Strategic Reserve Bill

The Strategic BTC Reserve Bill offers potential advantages, such as economic diversification, inflation hedging, and technological advancement. It positions the US economy for recovery through digitalised instruments.

Economic Stability

Besides relying on fiat currencies, gold, and petroleum reserves, Bitcoin can enhance economic stability by diversifying the asset base. It operates independently of centralised systems, reducing exposure to geopolitical risks and monetary policy fluctuations.

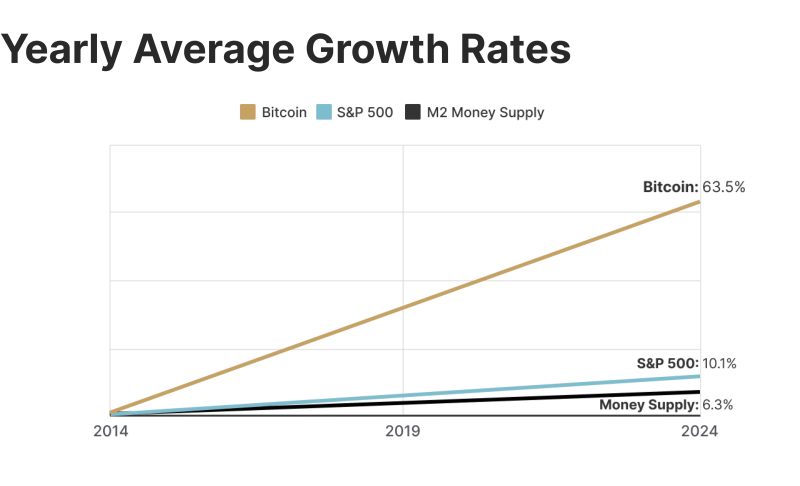

The positive case is straightforward: Bitcoin has a finite supply. This inherent scarcity offers a potential hedge against the inflation that can result from fiat currency issuance. Combined with increasing institutional adoption, it presents as a liquid asset with long-term growth potential.

The stated goal, according to supporters, is to align the US with modern financial trends. The strategy is about diversifying the nation’s asset base, reducing vulnerabilities tied to the traditional system, and building a more resilient economic foundation.

National Debt Relief

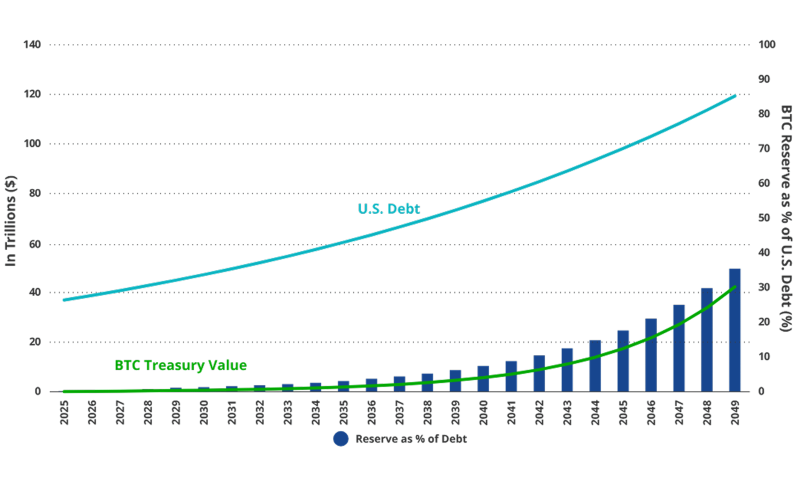

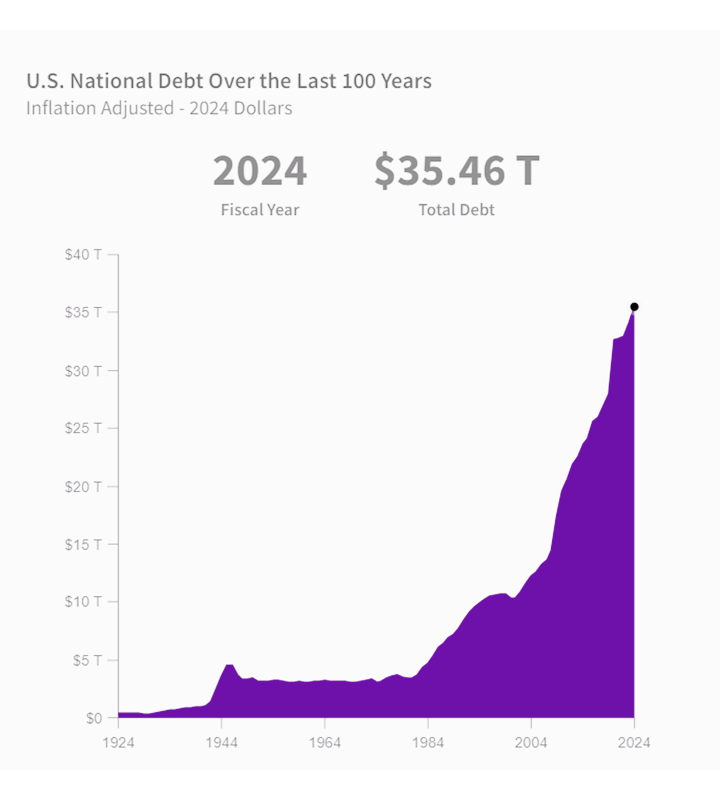

Here is the most compelling aspect of the proposal: using Bitcoin’s potential appreciation to address the national debt. With the debt reaching $36 trillion, the concept of such a novel solution is understandably appealing.

In contrast, Bitcoin has experienced phenomenal growth over the years, achieving a growth rate of approximately 35,000%, from just under $300 in 2015 to over $105,000 in 2025. As this trend is expected to stay for the coming years, the US economy can leverage its holdings to reduce the national debt.

Selling portions of the reserve during periods of high valuation can generate significant revenue without raising taxes or cutting essential programmes.

Global Crypto Stance

Adopting a Bitcoin reserve positions the US as a global leader in cryptocurrency innovation, which aligns perfectly with the newly elected president’s ambitions. It demonstrates a forward-thinking approach to financial strategy, encouraging other nations to follow suit.

This type of leadership could serve as a powerful draw for investment and talent. It would signal that the US is a primary hub for blockchain innovation, attracting capital beyond the scope of current ETFs. It would also allow the US to take a more definitive role in shaping global cryptocurrency regulations.

Discover the Tools That Power 500+ Brokerages

Explore our complete ecosystem — from liquidity to CRM to trading infrastructure.

Boosting Decentralised Security

Bitcoin’s decentralised nature enhances financial security by reducing reliance on centralised systems vulnerable to cyberattacks or geopolitical pressures.

Adding Bitcoin to the mix provides a resilient alternative to traditional assets, safeguarding national wealth against external threats. Its blockchain technology ensures transparency and tamper-proof transactions, increasing trust and accountability.

Additionally, decentralisation reduces the risk of asset seizure or manipulation, offering a secure financial foundation and providing a strategic advantage that aligns with modern security needs.

Possible Challenges

Despite the numerous benefits the US Bitcoin reserve can provide, this unconventional approach faces several challenges. Let’s examine them.

- Volatility: Bitcoin’s price movements are extreme. A substantial drop in a short period is a common occurrence. One must consider the political consequences of the nation’s strategic reserve losing a significant portion of its value in a matter of days.

- Regulatory Gaps: The cryptocurrency space still lacks a comprehensive regulatory framework. Committing public funds to this environment presents considerable legal and compliance challenges that have not yet been resolved.

- Security Risks: Securing a state-level holding of $100 billion in Bitcoin is a task of immense complexity. A failure in security resulting in theft would be catastrophic and, due to the nature of the asset, likely irreversible.

- Political Opposition: Critics argue that integrating Bitcoin could legitimise unregulated asset dealing, potentially undermining traditional financial systems. As such, convincing investors of its benefits requires significant effort and evidence.

- Public Perception: Many US citizens remain sceptical of crypto assets, associating them with fraud and internet scams. Building trust in public and political circles is essential for gaining support.

Conclusion

The Trump Bitcoin Reserve represents a bold and innovative approach to modernising the US financial system amidst the rising debt and underperforming economy.

The Bitcoin Strategic Reserve bill offers economic diversification, inflation hedging, and technological leadership by integrating decentralised assets into national reserves. However, its success relies on overcoming volatility, security risks, public perception, and regulatory hurdles.

If passed, the proposal can position the US as a global leader in digital finance and blockchain adoption, shaping the future of digital assets in the national and world economic forum.