CFD Liquidity

In the time of online trading and digital platforms, trading CFDs has become more prominent due to its simplicity. Traders no longer need to physically own or transfer underlying assets, such as stocks and commodities.

For brokers, they must ensure sufficient CFD liquidity to supply these growing needs, offering executable pricing and depth sourced from institutional counterparties. Therefore, brokers must deliver reliable, consistent CFD trading liquidity that withstands changing market conditions.

In this article, we will explain how liquidity for CFD works, focusing on price formation, execution quality, and risk management that matter to multi-asset brokerage firms and OTC desks that rely heavily on liquidity providers rather than centralized exchanges.

Key Takeaways

- CFD liquidity determines execution quality by affecting fill reliability, slippage, and spread stability across market conditions.

- CFDs offer simplified access to trading instruments without asset ownership or transfer.

- Liquidity’s effectiveness and consistency impact the broker’s risk and scalability, especially during volatile markets.

- Sustainable CFD setups must support long-term growth and asset/volume expansion without requiring infrastructure rework.

What Is CFD Liquidity?

CFD liquidity refers to the availability of executable bid and ask prices supplied by liquidity providers, market makers, and other financial institutions. This depth allows brokers to fill client CFD orders quickly and at scale.

It is not just about seeing prices on a screen, but about whether those prices can actually absorb significant order flows without causing excessive slippage, order rejection, or processing delays.

CFDs are over-the-counter financial derivatives that rely on liquidity providers to supply prices and assets, not on centralized order books where participants meet.

Banks, non-bank investment firms, prime brokers, and prime-of-prime providers are key market participants who stream quotes and provide executable liquidity to CFD trading platforms. Contract prices are quoted based on the underlying asset’s value, whether it is equities, indices, FX pairs, commodities, or cryptocurrencies.

Therefore, brokers treat CFD liquidity as a service layer, where prices are sourced, aggregated, marked up, routed, and hedged through one infrastructure rather than price discovery on public exchanges.

Liquidity quality determines how smoothly client trades are executed, how predictable risk management is, and how scalable the brokerage operation becomes as volume grows.

Brokers must also account for market depth. A tight top-of-book spread must be coupled with sufficient size that supports execution during high volatility. As such, the real CFD liquidity is measured in consistency across market conditions, financial instruments, and client behavior.

How CFD Liquidity Differs From Exchange-Traded Liquidity

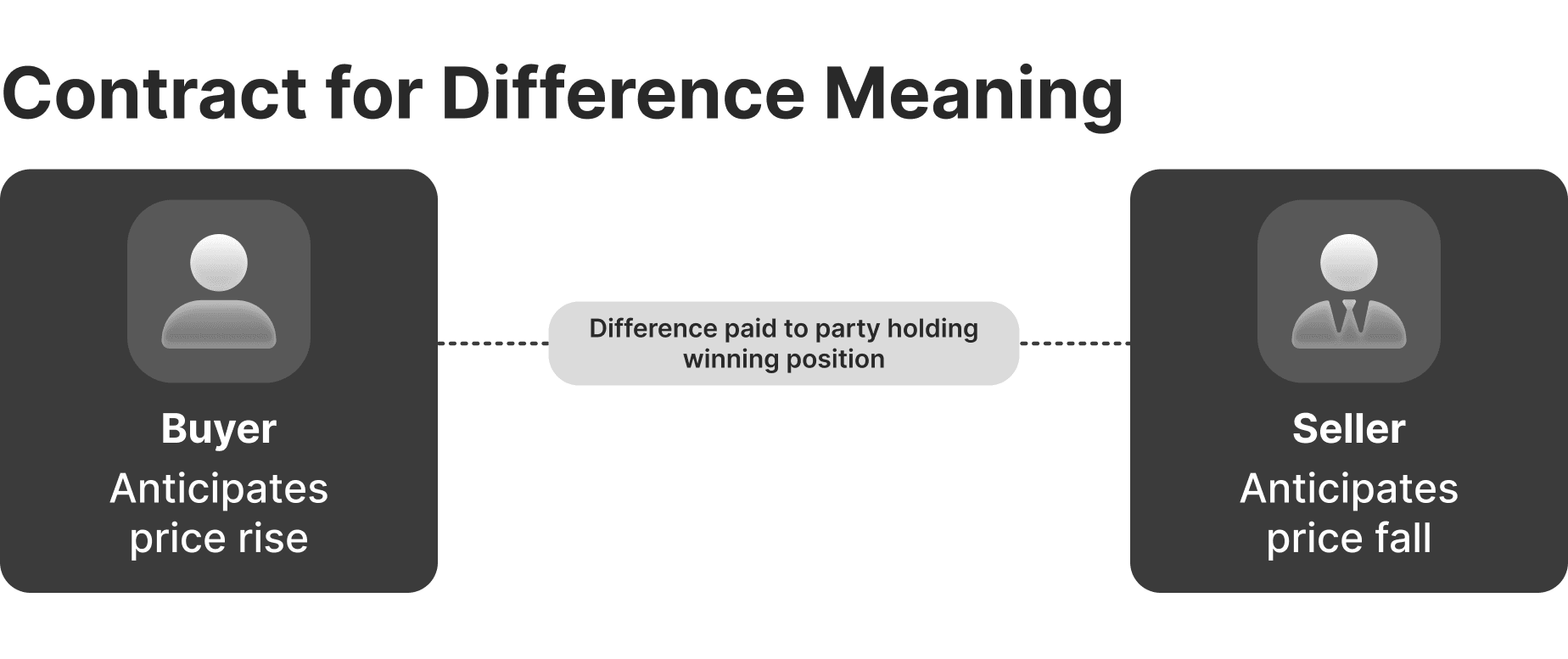

Contract for differences operates in a fundamentally different structure than exchange-traded products, such as stocks or futures.

Exchange-traded liquidity is centralized, with orders from all participants matched on a public order book, providing transparent depth, time sensitivity, and centralized clearing. Additionally, market price discovery happens directly through supply and demand.

On the other hand, CFDs are bilateral OTC instruments that do not involve a central clearing agency or a public order book. Pricing is derived from the underlying market and distributed through liquidity providers who take on risk and hedging strategies.

This structural difference has several implications:

- Transparency: There is no visible depth beyond what LPs choose to stream, and brokers can only see the liquidity they are connected to.

- Counterparty risk exposure: Brokers manage credit and execution risk with LPs, while also managing client exposure internally.

- Execution behavior: Fills depend on the provider’s risk appetite, available depth, and execution rules, without guaranteed matching.

As a result, CFD liquidity is shaped by liquidity providers, their behavior, aggregation logic, and broker order processing flows. This makes finding a reliable liquidity provider for CFDs a strategic decision that impacts the broker’s growth and scalability.

2026 ranking of top liquidity providers across forex, crypto, and CFD markets with a focus on technology, asset coverage, and execution.

23.05.25

Why CFD Liquidity Matters for Brokers

CFD liquidity directly influences the broker’s profitability, scalability, and regulatory status. Poor liquidity streams do not just lead to worse prices, but they also create operational inefficiencies that compound over time.

Additionally, when liquidity streams are unreliable or deliver thin order book depth, spreads can widen unexpectedly during major market movements, causing slippage, worsening the user experience, and causing operational workload that can overwhelm the broker’s platform.

At the execution level, liquidity quality affects the following:

- Slippage: high liquidity reduces price slippage, especially during active sessions or news events.

- Rejections: Sufficient order books can validate orders quickly without overwhelming support teams or receiving more price complaints.

- Spreads: Deep liquidity streams tighten the bid-ask spread and make trading more profitable for traders.

Furthermore, liquidity quality comes with legal considerations. Inconsistent execution can raise concerns around best execution obligations, fairness, and transparency. Questionable liquidity connections lead to regulatory and reputational damage.

Improve Your Liquidity Setup

Execute with tight spreads, ultra-low delays, and optimal execution logic using our liquidity infrastructure

How CFD Pricing Is Formed

CFD pricing begins with liquidity providers sourcing prices from underlying markets, such as stock exchanges, futures venues, foreign exchange ECNs, and other financial markets.

From the liquidity provider’s side, this stream is adjusted based on the LP’s risk model, inventory setup, and market conditions. Then the best buy price (bid) and best sell price (ask) are selected and sent to the broker.

Quotes can be firm pricing, where execution is guaranteed up to a specific size, or indicative, which reflects market conditions but may be subject to the provider’s last-look.

From the broker’s side, on top of these quotes, they apply their own pricing model on top of these quotes. This can be done by adding a markup to the spread or charging a separate commission.

Broker Execution Models and Liquidity Interaction

Broker execution models determine how trader orders interact with liquidity and how the broker manages associated risks. This process can be done in one of three book types.

A-Book (STP Model)

Client orders are passed through to liquidity providers for processing. The broker focuses on execution quality and earns via markups or commissions. The straight-through processing model connects traders to available order books, making liquidity depth and stability crucial for order fills and execution timing.

B-Book (Internalization)

Client trades are internalized, with the broker taking the opposite side to each position. Here, liquidity is mainly used for risk management rather than order processing. Internal execution provides greater control for brokers but increases market risk if not managed carefully.

C-Book (Hybrid Model)

Most mature brokers operate within hybrid setups, internalizing some flow while hedging their exposure externally. In this model, liquidity is used selectively based on client profiles, instrument behavior, or risk thresholds.

There is no universally superior processing model. Each depends on the broker’s preferences, risk tolerance, and profitability strategy. The optimal setup relies on volume, client mix, and regulatory environment.

Upgrade Your Liquidity Infrastructure

B2CONNECT offers one of the fastest execution models using fine-tuned infrastructure and pre-integrated liquidity bridges

What Affects CFD Liquidity Quality

CFD liquidity is dynamic. It varies by instrument, trading conditions, provider behavior, and broker configurations. For example, two brokers can source prices from the same provider and experience very different execution outcomes—why? Because they have different routing logic, personalized risk controls, and unique client flow characteristics.

Also, some markets are naturally more liquid than others. For instance, Forex liquidity is much deeper than CFDs, which are linked to underlying markets with lower or fragmented liquidity, directly affecting pricing and fill consistency.

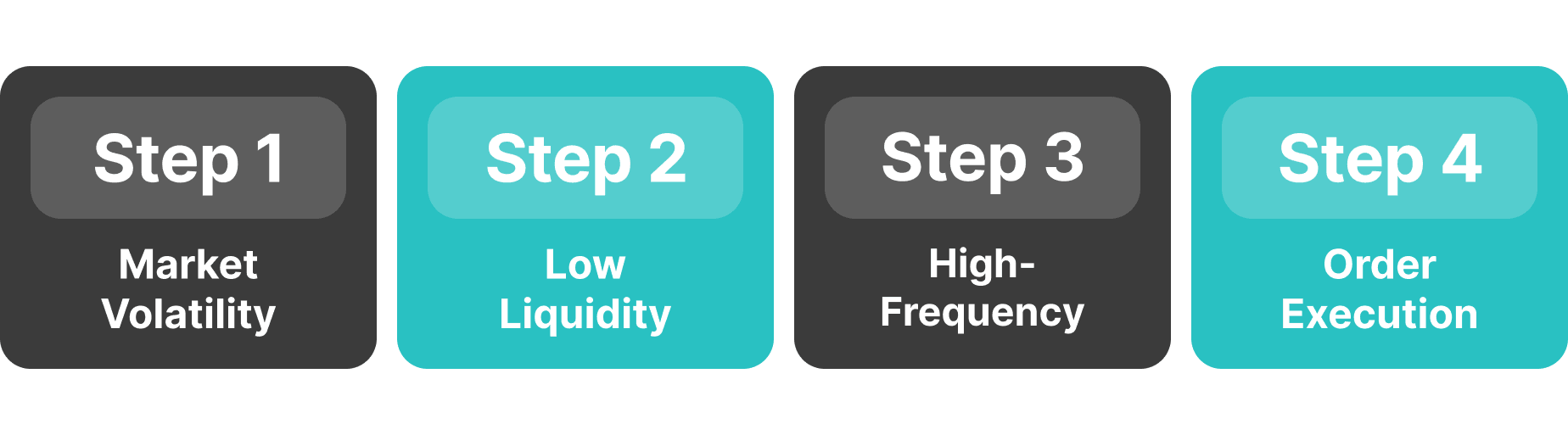

Liquidity tends to improve when the underlying market is active and stable, and to deteriorate during periods of high volatility, market openings, or off-hours trading. Let’s take a look at the factors that affect CFD pricing.

Deep, Reliable Liquidity Across 10 Major Asset Classes

FX, Crypto, Commodities, Indices & More from One Single Margin Account

Tight Spreads and Ultra-Low Latency Execution

Seamless API Integration with Your Trading Platform

Underlying Market Liquidity and Volumes

The depth and reliability of CFD liquidity are directly tied to the availability of the underlying market. Highly active Instruments, such as major FX pairs, flagship equity indices, large-cap stocks, and heavily traded crypto assets, naturally support tighter spreads and deeper executable size.

In these markets, LPs can hedge exposure quickly and at low cost, which allows them to quote more aggressively and maintain stable pricing throughout normal trading sessions.

By contrast, CFDs based on less active instruments, such as small-cap equities, regional indices, or niche commodities, come with lower trading volumes, wider spreads, thinner depth, and greater sensitivity to order size.

Volatility and Liquidity Provider Risk Controls

Market volatility plays a central role in shaping CFD liquidity behavior. During periods of market uncertainty, such as geopolitical events, macroeconomic announcements, or sharp equity sell-offs, providers face increased hedging risk. LPs apply structural protections to manage these risk warnings, including:

- Temporary spread widening

- Reduced maximum executable size

- Faster quote refresh or shorter quote lifetimes

- More conservative pricing models

Brokers need to recognize these dynamics and adapt execution rules accordingly, adjusting size limits, modifying routing behavior, or temporarily prioritizing stability over tight pricing.

Managing Slippage, Rejections, and Execution Risk

Slippage is unavoidable, but not all slippage is equal. Brokers must distinguish between expected market slippage and that caused by avoidable execution inefficiencies.

Expected slippage occurs when prices move between order submission and execution, particularly in fast markets. This type of slippage happens more naturally and is generally accepted by clients when execution is consistent and transparent.

Systemic slippage often stems from insufficient depth behind top-of-book pricing, delayed order routing, overly aggressive pricing with poor liquidity, and poor alignment between execution rules and LP behavior.

When these issues persist, they lead not only to worse fills but also to higher rejection rates and increased operational workload.

Execution Controls That Reduce Avoidable Slippage

Brokers can mitigate avoidable execution risk using a combination of pre-trade and real-time controls. These measures do not eliminate market risk, but they help prevent failures caused by mismatched expectations.

Common approaches include:

- Pre-trade size validation against available depth

- Dynamic order routing based on instrument and market state

- Adaptable execution rules that follow volatility or price changes

The objective here is to ensure that orders are routed in a way that reflects actual liquidity conditions rather than idealized pricing assumptions.

Execution KPIs Brokers Monitor

Brokers can track a set of execution-focused KPIs that reveal how LPs behave in practice and assess liquidity performance objectively. These include:

- Rejection rate, indicating whether the available depth is sufficient

- Average slippage, highlighting execution predictability

- Fill rate, measuring how often orders are executed without intervention

- Quote stability, reflecting pricing consistency over time

These metrics are consistently monitored to help brokers identify whether pricing issues originate from specific providers, instruments, market regimes, or internal execution logic.

How Brokers Secure Market Depth

Market depth in CFD trading provides a live visual representation of pending buy (bids) and sell (asks) orders at various price levels, which brokers actively design and maintain. The DOM depends on provider selection and diversification, as well as on internal liquidity management.

Here are popular ways brokers source CFD market depth:

Aggregating Multiple Liquidity Providers

Collecting assets and quotes from multiple liquidity providers is one of the most effective ways to improve depth and execution resilience. By aggregating prices from several CFD providers, brokers benefit from price competition, increased available size, and reduced dependency on a single counterparty.

Multi-provider setups also improve continuity. For example, if one LP widens spreads, reduces size, or experiences technical issues, others can continue to support execution at better conditions. However, aggregation introduces its own considerations, including quote conflicts, latency sensitivity, and failover behavior, all of which must be managed carefully.

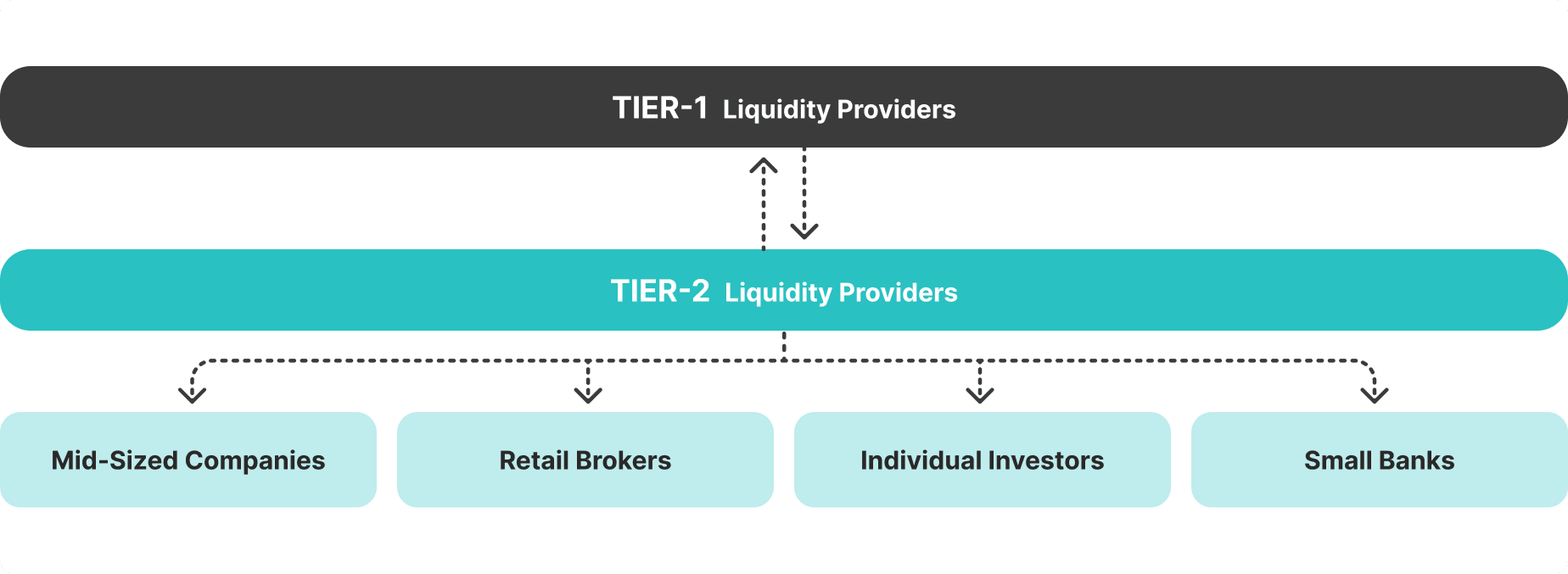

Using Prime of Prime Providers

Prime of prime (PoP) providers play a key role for brokers that do not have direct access to tier-1 banks or exchanges. PoPs aggregate institutional liquidity, manage credit relationships, and provide a single point of access to deep markets for new brokerages and trading platforms with a limited user base.

For brokers, PoPs offer:

- Simplified onboarding and integration

- Access to institutional-grade pricing

- Credit intermediation and risk buffering

While PoPs add an additional layer in the execution chain, they often improve overall stability and scalability, particularly for growing or multi-asset brokerages.

Get Prime-of-Prime Liquidity Solutions

Access liquidity from tier-1 providers, simplified onboarding, and rapid setup deployment to compete with key players

Technology Infrastructure That Supports CFD Liquidity

Liquidity quality is part of the broker’s tech stack. Even the best pricing degrades if connectivity is unreliable or systems are poorly integrated.

Therefore, brokers must consider key components within their trading infrastructure, including:

- FIX-based connectivity to liquidity providers

- Platform bridges that stream orders and prices accurately

- Integration with risk management and back-office systems

When these components operate cohesively, brokers can maintain consistent execution even as volumes, instruments, and client activity expand.

How CFD Brokers Scale Liquidity Over Time

Liquidity requirements evolve as brokers grow.

Early-stage platforms focus on simplicity, using a single provider and basic execution logic. This approach can work at lower volumes for retail investors but becomes increasingly fragile as activity increases.

Mid-stage brokers need multi-provider aggregation, instrument-specific execution rules, and more proactive monitoring to keep up with increasing volume and trading activity.

Mature brokerages focus on governance, define liquidity benchmarks, stress-test execution behavior, and continuously optimize provider mixes, requiring a top-notch tech stack and liquidity infrastructure.

Therefore, choosing scalable setups at an early stage helps brokers move smoothly through these stages without disrupting workflow or causing service outages that can affect user experience.

Choosing a CFD Liquidity Approach That Supports Broker Goals

In today’s competitive market, CFD liquidity cannot be treated as a standalone component. Traders increasingly expect institutional-grade execution regardless of broker size, asset class, or geography.

If you are looking to expand asset coverage, modernize execution practices, or scale volumes sustainably, upgrading liquidity is a competitive requirement.

B2BROKER offers the best ecosystem to start and grow your CFD trading platform, leveraging multi-asset liquidity, 10+ market coverage, pre-integrated platform and liquidity connectivities, built-in payment gateways, and more.

Get a Top-Tier CFD Liquidity Infrastructure

World-class trading infrastructure with pre-integrated liquidity bridges, FIX connectivities, liquidity risk controls, and back-office CRM

Frequently Asked Questions about CFD Liquidity

- What makes CFD liquidity “good” or “poor” from a broker’s perspective?

Good CFD liquidity means brokers can consistently execute client orders at quoted prices with minimal slippage, low rejection rates, and stable spreads across market conditions. Poor liquidity typically shows up as frequent requotes, partial fills, spread widening during normal sessions, or execution delays that increase operational strain and client complaints.

- How does CFD liquidity affect a broker’s risk exposure?

CFD liquidity directly impacts how quickly and efficiently a broker can hedge net client exposure. Limited depth or slow execution makes it harder to offset risk during fast markets, increasing the likelihood of directional exposure. Strong liquidity allows brokers to manage risk dynamically without overcorrecting spreads or leverage.

- Can brokers offer tight spreads without deep CFD liquidity?

Tight headline spreads are possible without deep liquidity, but they are often unstable. Without sufficient depth behind the top of the book, spreads tend to widen sharply during sharp price movements, leading to slippage and execution issues. Sustainable tight spreads usually require competitive pricing and reliable depth across providers.

- How often should brokers re-evaluate their CFD liquidity setup?

Brokers should review liquidity performance continuously using execution metrics like slippage, rejection rates, and fill quality, with more formal evaluations during periods of growth or changing market conditions. Liquidity setups that work at lower volumes often need adjustment as client activity, asset coverage, or volatility increases.

- Is one liquidity provider enough for a CFD brokerage?

A single provider can be sufficient for early-stage brokers or limited product offerings, but it introduces concentration risk. As volumes grow, relying on one provider increases vulnerability to outages, spread changes, or degraded execution. Many brokers move to multi-provider or prime-of-prime setups to improve resilience and pricing consistency.