Liquidity Coverage Ratio (LCR) Explained

Sudden changes in user demands, especially during economic meltdowns or public panic, can massively impact financial institutions. When a significant number of users withdraw their funds and suspend their savings, banks will eventually become unable to deliver these demands.

Therefore, after multiple historical lessons, the liquidity coverage ratio system was introduced. It safeguards the rights of institutions and consumers.

Let’s explain the liquidity coverage ratio (LCR) rule and why it has become a necessary tool.

Key Takeaways

- The liquidity coverage ratio is a financial standard to ensure banks meet short-term obligations during a market crisis.

- The framework requires banking institutions to maintain a combination of cash and high-quality liquidity assets to remain operational within a 30-day stress scenario.

- During the 2023 banking crisis, these regulations were effective for large institutions, while smaller ones suffered significantly.

What is The Liquidity Coverage Ratio?

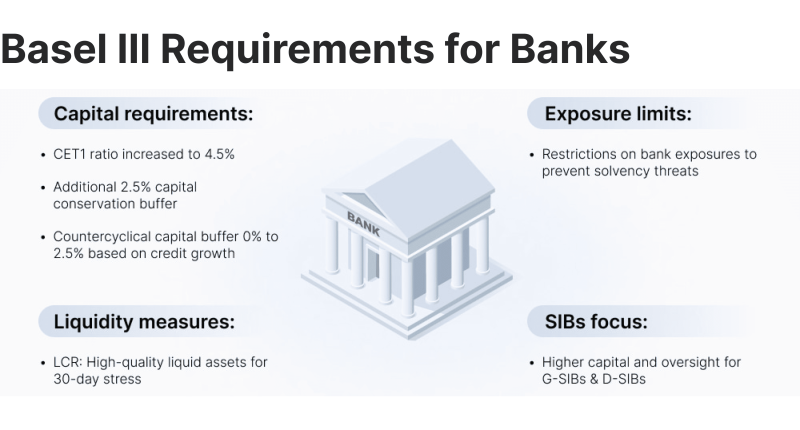

The Liquidity Coverage Ratio (LCR) is a regulatory standard introduced by the Basel III international framework to ensure banks maintain adequate high-quality liquid assets (HQLA) to meet short-term obligations.

It is designed to enable banks and financial institutions to withstand a 30-day stress scenario by having a liquidity coverage of at least 100%.

This system mitigates liquidity risks and enhances economic stability, offering a safeguard against potential financial crises and failures. Similar to the net stable funding ratio, the LCR was introduced following historical events that exposed significant weaknesses that led to systemic risks and instability.

Who Uses The Liquidity Coverage Ratio (LCR)?

The LCR is widely used by banks and global financial institutions to manage liquidity and mitigate associated risks, aligning with international regulatory standards.

Regulatory bodies such as central bank liquidity facilities and supervisory authorities monitor and enforce compliance to maintain systemic stability. This is particularly critical for Globally Systemically Important Banks (G-SIBs), large financial institutions whose failure can affect the entire system worldwide.

Smaller financial institutions may also adhere to some LCR standards in proportions tailored to their operational scale and risk levels. Fostering a uniform liquidity framework ensures resilience across diverse financial ecosystems.

While the LCR regulations are standardly designed for banking institutions, they can also be applied to other industries, such as FinTech, payment processors, credit institutions, and insurance firms.

Regulatory Overview

The Basel Committee on Banking Supervision (BCBS) introduced the Liquidity Coverage Ratio final rule as part of the Basel III framework following the 2008 financial crisis.

Its primary objective is to bolster banks’ short-term liquidity by requiring them to hold sufficient high-quality liquid assets (HQLA) to cover projected net cash outflows over a 30-day stress scenario.

Explore Deeper Industry Insights

Learn from experts shaping the future of financial services — get the latest strategies and trends.

By maintaining adequate reserves, banks can operate during unexpected market volatility and avoid service disruptions. The LCR was implemented globally in 2015, with specific requirements adapted to local market contexts.

Jurisdictions have tailored asset eligibility criteria and reporting obligations to align with regional financial systems. Banks are required to submit periodic LCR metrics to regulators, undergo stress tests, and maintain compliance with liquidity thresholds.

Regulators play a pivotal role in enforcing adherence through audits, compliance reviews, and supervisory frameworks. Non-compliance can lead to severe consequences, including penalties, higher capital requirements, or even restrictions on banking activities.

The LCR framework has become a cornerstone of financial stability, promoting resilience against liquidity shocks and ensuring institutions are better equipped to navigate periods of market uncertainty.

Key Components

Understanding the Liquidity Coverage Ratio (LCR) structure is crucial to mitigating liquidity risks, especially during economic recessions. The LCR ensures that banks maintain sufficient high-quality liquid assets to cover net cash outflows over a 30-day stress period.

By focusing on HQLA and balance sheet management, the ratio provides a framework for maintaining short-term solvency under adverse conditions. Here are the key components defining how the LCR operates effectively:

High-Quality Liquid Assets (HQLA)

Level 1: Cash, central bank reserves, and sovereign bonds. L1 assets are not deducted from the valuation when calculating the liquidity ratio.

Level 2A: High-rated corporate or government bonds and multilateral development banks’ securities. 2A assets have a 15% reduction in regulatory valuation to account for potential market fluctuations.

Level 2B: Lower-rated corporate bonds and publicly traded common stocks. 2B assets have a 25-50% discount from the overall liquidity coverage ratio calculation.

Net Cash Outflows

The outgoing net cash flow is the difference between total expected cash inflows and outflows over a 30-day stress scenario. These conditions include deposit withdrawals, loss of secured funding, and derivative obligations.

Threshold

Banks must maintain high-quality liquid assets sufficient to cover their total expected cash outflows over a 30-day stress scenario. Achieving this ratio is critical to maintaining market confidence and operational stability, with regulators closely monitoring compliance to mitigate systemic risks.

Practical Implementation of the LCR Regulations

Following the Liquidity Coverage Ratio regulations requires banks to adapt their operational frameworks and financial strategies. Beyond mere compliance, LCR rules have reshaped how institutions manage liquidity risks and prepare for market disruptions.

A key benefit of LCR is enabling banks to craft robust contingency plans, ensuring flexibility during financial stress. Real-world applications of these principles were evident during the COVID-19 pandemic when banks with strong liquidity frameworks were better positioned to manage unexpected cash flow pressures.

To meet these standards, institutions must integrate specific practices into their operations:

- Use advanced monitoring systems to track HQLA levels and forecast net cash outflows.

- Conduct stress testing regularly to simulate adverse scenarios and validate liquidity adequacy.

- Optimise asset portfolios to ensure compliance with HQLA requirements, balancing Level 1 and Level 2 assets.

- Adopt comprehensive governance and oversight by boards and committees dedicated to managing risks.

- Submit periodic LCR reports to regulators detailing compliance status and any observed vulnerabilities.

- Develop contingency funding strategies to address potential liquidity shortfalls during crises.

- Training staff and focus on enhancing the understanding of liquidity risks and regulatory expectations.

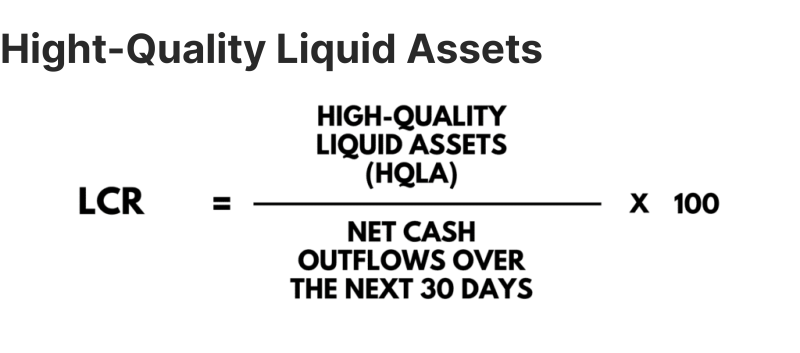

Explaining The Liquidity Coverage Ratio Formula

The Liquidity Coverage Ratio is calculated using the formula:

A result of at least 100% demonstrates that a bank can adequately cover its short-term obligations during times of significant liquidity stress.

- HQLA: Represents the total value of cash and other liquid assets that meet regulatory standards.

- Net Cash Outflows: Refers to the expected cash outflows minus inflows over a 30-day period under stressed conditions.

If a bank has a Liquidity Coverage Ratio (LCR) of less than 100%, it means the institution does not have enough High-Quality Liquid Assets to cover its net cash outflows over a 30-day stress period.

Discover the Tools That Power 500+ Brokerages

Explore our complete ecosystem — from liquidity to CRM to trading infrastructure.

Non-compliance can trigger several consequences, such as regulatory intervention, higher capital requirements, operational restrictions, and increasing borrowing costs due to a damaged reputation.

LCR Requirements

Banks must adhere to Liquidity Coverage Ratio (LCR) regulations to ensure they can withstand periods of financial stress. The framework mandates several requirements to ensure banks are prepared to address liquidity risks effectively while maintaining operational stability.

- Minimum Threshold: Banks must maintain an LCR of at least 100% to meet short-term obligations.

- HQLA Composition: Banks must have high-quality liquidity assets in a given distribution.

- Level 1 Assets: Include cash, central bank reserves, and sovereign bonds, with no limits or valuation reductions.

- Level 2 Assets: Comprising 2A and 2B categories, capped at 40% of total HQLA and subject to regulatory valuation adjustments (15% for 2A assets and 25-50% for 2B assets).

- Stress Scenarios: Regulatory standards account for adverse market conditions, including significant deposit outflows, funding losses, and payment obligations.

- Proportional Standards: Smaller banks may follow adjusted LCR requirements based on their risk profiles and operational scope.

- Regulatory Oversight: Compliance is monitored through periodic reporting, audits, and stress testing. Non-adherence can result in fines, increased capital requirements, or operational restrictions.

Benefits and Limitations

Many argue the effectiveness of the liquidity coverage ratio regulations. For example, in the 2023 crisis, the LCR was effective for large, important banks, leaving smaller institutions vulnerable. The framework did not account for the speed at which modern banks run, exacerbated by digital banking and social media.

Nevertheless, this event reinforced calls for tighter regulations on regional banks and potential revisions to stress scenarios and HQLA requirements. Let’s review the key benefits and challenges of this model.

Benefits

- Enhancing liquidity risk management financial resilience.

- Reducing the likelihood of bank failures during high market risk.

- Building confidence in financial markets and promoting stability.

- Encouraging banks to maintain high-quality, liquid portfolios.

- Supporting a uniform global standard for liquidity regulation.

Limitations

- Compliance requires significant investment in monitoring systems and high-quality liquidity assets.

- Limiting banks’ ability to extend credit, potentially reducing profitability.

- Smaller institutions may face disproportionate challenges in meeting requirements.

- Differences in jurisdictional implementation create complexities for internationally active banks.

- The regulations can be resource-intensive, especially for smaller banks.

Conclusion

The liquidity coverage ratio is a banking requirement that strengthens financial institutions during economic crises and public panic. The framework mandates that banks must have a buffer of cash reserves and high-quality liquidity assets to meet short-term demands in a 30-day stress condition.

These regulations minimise the possibility of a large-scale financial collapse if consumers decide to withdraw their deposits and stop their savings. However, it can be challenging for smaller financial institutions to maintain expensive, high-quality assets and incorporate effective monitoring systems.