What Are Binary Options?

The modern trading environment is developing and upgrading day by day. There are plenty of options for entering this alluring space, some of them already tested and implemented, others yet new and under measurement of accompanying pluses and risks.

Binary options have become increasingly popular among traders seeking a straightforward way to engage in financial markets. Whether you’re a novice or an experienced investor, understanding the intricacies of binary options can help you make more informed decisions.

Let’s explore the definition of binary options, the mechanics of binary options trading, and strategies for success.

Key Takeaways

- Binary options are financial instruments that allow traders to speculate on the price movement of an asset, offering a fixed return if the prediction is correct.

- This type of trading involves predicting whether the price of an asset will rise or fall within a specified time frame.

- Developing a robust binary options strategy is crucial for maximising potential profits and minimising risks.

The Essence of Binary Options

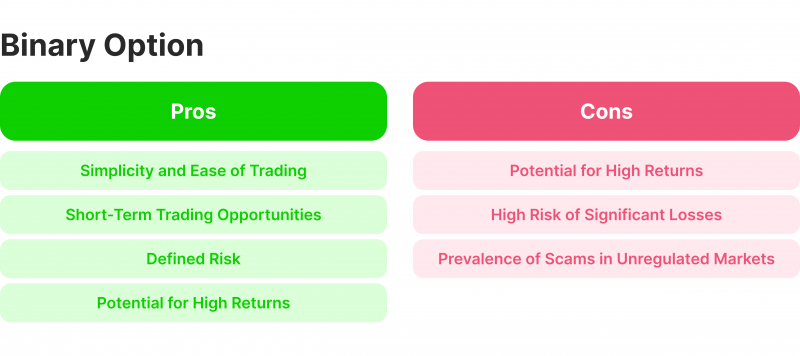

Binary options have gained traction recently, but what exactly are they? In essence, binary options are a form of financial derivative that presents an all-or-nothing proposition for traders. Unlike traditional stock trading, where you can profit from price fluctuations, binary options focus on a single question: will the price of an asset go up or down within a set time frame? If you predict correctly, you receive a predetermined payout. If you’re wrong, you lose your entire investment. This “yes or no” format seems straightforward, but binary options trading can be a complex and risky undertaking.

The term “binary” stems from the fact that there are only two possible outcomes: a fixed payout if the option expires in the money or a total loss of the investment if it expires out of the money.

How Binary Options Work: A Step-by-Step Breakdown

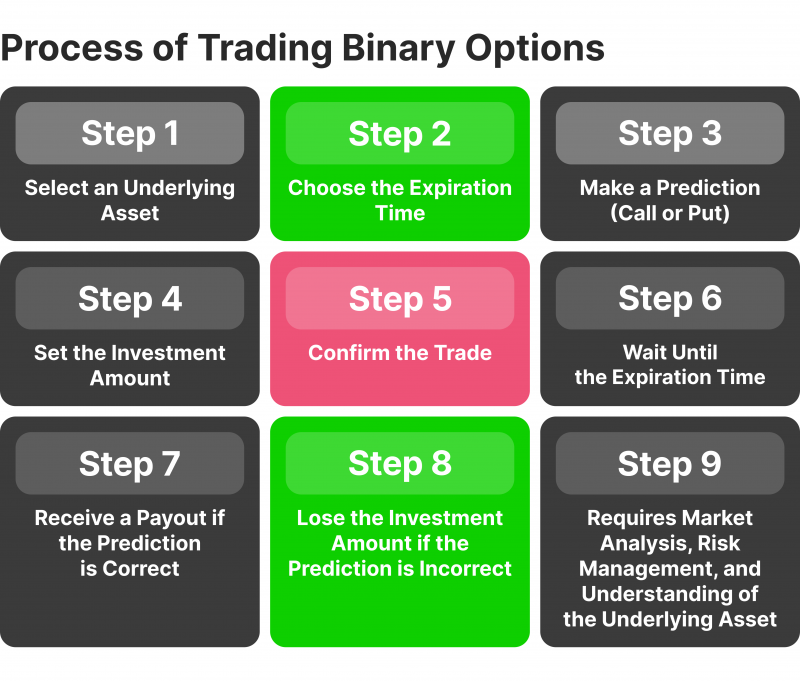

Binary options trading is relatively straightforward. Traders choose an asset and predict whether its price will rise or fall within a predetermined time frame, ranging from a few minutes to several months. If the prediction is correct, the trader receives a fixed payout. If incorrect, the trader loses the invested amount.

Here’s a simplified breakdown of how binary options function:

- Choose an Underlying Asset: This could be a stock, currency pair, commodity, or even an index.

- Set the Time Frame: You decide how long the option will be active, ranging from minutes to hours or days.

- Predict the Price Movement: Will the price be “Higher” or “Lower” at the expiry time compared to the current price?

- Invest an Amount: This is your potential gain if your prediction is correct.

- Option Expires: At the predetermined time, the option settles.

- Successful Prediction: Congratulations! You receive the pre-defined payout, typically 70-95% of your investment.

- Incorrect Prediction: Unfortunately, you lose your entire investment.

Example: Imagine you believe the price of Google stock (underlying asset) will increase within the next hour (timeframe). You invest $100 on a “Higher” option. If Google’s stock price is higher at expiry, you might receive a payout of $170 (70% return on your $100 investment). However, you lose your entire $100 if the price goes down.

Types of Binary Options

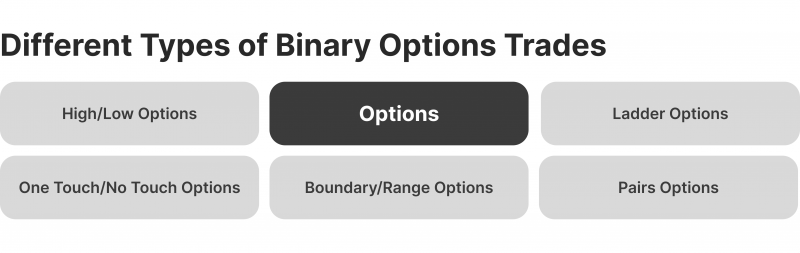

Here are the main types of binary options:

1. High/Low Options: Also known as call/put options. Traders predict whether the underlying asset’s price will be higher or lower than the current price at the expiration time.

Example: If a trader believes that the price of gold will be higher at the end of the trading day than now, they will place a “high” or “call” option.

2. One Touch/No Touch Options: These options involve predicting whether the price of an asset will touch or not touch a predetermined level before the expiration.

Explore Deeper Industry Insights

Learn from experts shaping the future of financial services — get the latest strategies and trends.

Example: If a trader thinks the price of a stock will touch $150 before the option expires, they place a “one touch” option.

3. Boundary/Range Options: Traders predict whether the price of an asset will remain within a set range or break out of that range by the expiration.

Example: If a trader believes that a currency pair will trade between $1.20 and $1.25 for the next hour, they place a boundary option within that range.

4. Ladder Options: These are similar to traditional high/low options but with multiple levels or “rungs” to predict. Each rung has its own payout and risk level.

Example: A trader may predict that a stock will hit multiple specific price levels (e.g., $100, $105, $110) at different times.

5. Pairs Options: Traders bet on the relative performance of two assets. They predict which assets will perform better by a specific expiration time.

Example: If a trader believes that Apple will perform better than Microsoft over the next week, they would choose a pairs option comparing the two.

6. 60 Seconds Options: A type of high/low option with a very short expiration time, typically 60 seconds. They allow traders to make quick decisions and potentially quick profits.

Example: A trader might predict that the price of a cryptocurrency will be higher in the next 60 seconds.

7. Long-Term Options: These options have longer expiration times, ranging from a few days to several months or even a year. They are used for more stable, less volatile trading strategies.

Example: A trader might predict that the oil price will be higher in six months than it is now.

8. Touch/No Touch Options: These are similar to one-touch/no-touch options but generally involve more straightforward predictions on whether the price will touch a specific level.

Example: A trader might predict that a stock will touch $50 but not touch $60 before the option expires.

9. Digital Options: A type of option where the payout is all or nothing, depending on whether the underlying asset’s price is above or below a specified strike price at expiration.

Example: If the current price of a stock is $100, a trader might buy a digital option, predicting that it will be above $105 at expiration.

10. Binary Option Spread: Involves predicting whether the price of an asset will be within a particular spread or range at expiration.

Example: A trader might predict that a stock will be between $50 and $55 at the end of the day.

The European Securities and Markets Authority (ESMA) has banned retail binary options trading. The Australian Securities & Investments Commission (ASIC) considers binary options a “high-risk” and “unpredictable” investment option and finally banned the sale of binary options to retail investors in 2021.

Developing Binary Options Trading Strategy: Can You Outsmart the Market?

The allure of binary options lies in their potential for quick profits. However, devising a successful binary options trading strategy is challenging. Here are some factors to consider:

Discover the Tools That Power 500+ Brokerages

Explore our complete ecosystem — from liquidity to CRM to trading infrastructure.

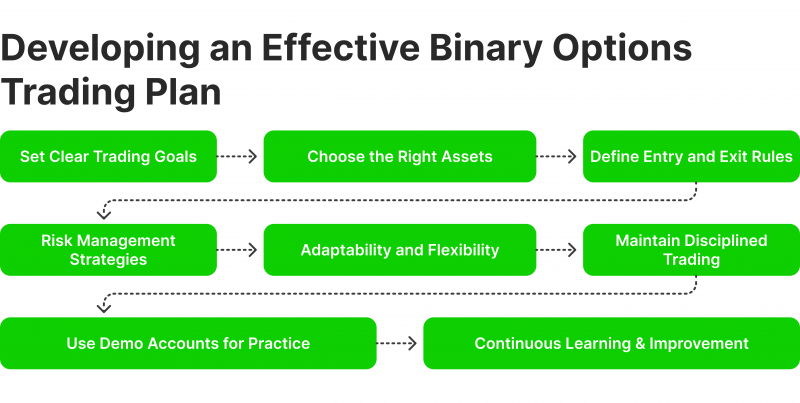

Developing a binary options strategy is critical for success in this high-risk, high-reward environment. Effective strategies combine market analysis, risk management, and disciplined trading practices.

Technical Analysis

Technical analysis involves studying past price movements and using indicators such as moving averages and oscillators to predict future price changes. This method helps traders identify trends and potential reversal points, providing a solid foundation for making informed trading decisions.

Fundamental Analysis

Fundamental analysis examines the underlying factors affecting an asset’s price, such as economic indicators, corporate earnings, and geopolitical events. This approach helps traders anticipate market movements based on real-world events and data.

Trend Following Strategy

The trend-following strategy involves identifying and trading in the direction of the prevailing market trend. Traders use tools like trend lines, moving averages, and other technical indicators to confirm the trend direction and enter trades accordingly.

Range Trading Strategy

Range trading involves identifying assets within a specific range and placing trades at the support or resistance levels. This strategy is effective in markets that lack clear trends and move sideways.

News Trading Strategy

The news trading strategy capitalises on market volatility caused by significant news events. Traders analyse news releases and economic reports to predict short-term price movements and place trades accordingly.

Final Remarks

Binary options offer a simple and potentially lucrative way to trade various financial assets. However, they come with significant risks that require a solid understanding of the market and a well-developed trading strategy. By mastering the basics of binary options trading and choosing the right binary options brokers, traders can improve their chances of success.

FAQ

Is binary option trading Legal?

Binary options are legal and available to trade in the U.S. but must be traded on a regulated U.S. exchange. These exchanges are Designated Contract Markets (DCMs). Some binary options are listed on registered exchanges or traded on DCMs that are subject to oversight by the CFTC or SEC.

Can binary options brokers be trusted?

One of the most critical indicators of a trustworthy and reliable broker is that they are licensed and regulated by a reputable authority. This means they must comply with specific standards and rules that protect your interests and rights as a client.

Is the binary option real or fake?

Like many investments, binary options can be a risky form of trading. But not all binary options trading is fraudulent. They can be legally traded on regulated exchanges in the United States. However, there are many other websites that operate illegally and commit fraud.