An Overview of The Crypto Derivatives Exchange Development

Articles

Conventional crypto trading sites have now expanded their range of trading choices to include more sophisticated alternatives, such as trading in crypto derivatives.

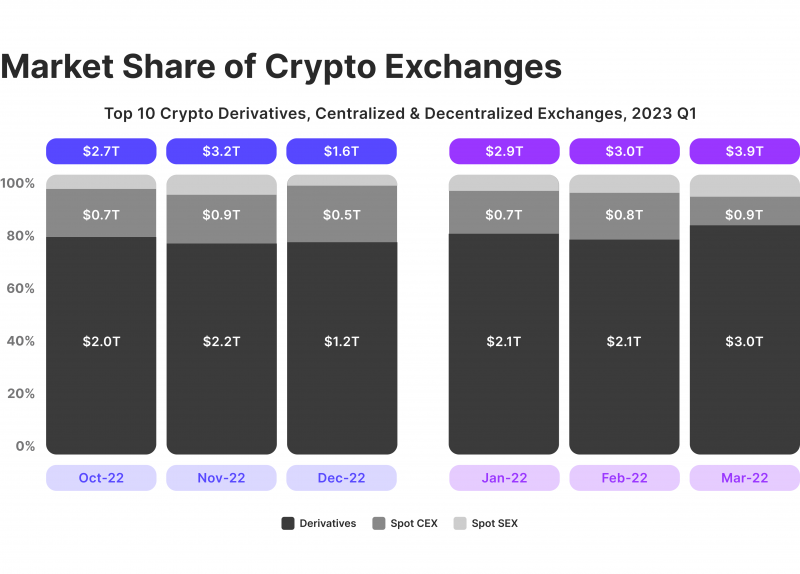

These instruments have generated millions and billions of dollars in revenue: in March 2023, the crypto derivatives market size reached 74.8% share of the total transacted volume of $2.95 trillion in the crypto market.

Due to their increasing popularity, many new businesses and entrepreneurs are venturing into the creation of crypto derivative trading platforms.

The major online venues for purchasing and selling digital assets have a significant influence on crypto trading as a whole, playing a crucial role in the crypto industry.

In this article, we will discuss this type of derivative contracts, its features and benefits, and explore the phenomenon of crypto derivatives exchange development.

Key Takeaways

- A crypto derivative is a tradable security based on the future price of an asset.

- Examples of crypto derivatives are perpetual swaps, forward contracts, futures contracts, and options contracts.

- Crypto derivatives exchange development involves creating software for managing and running platforms for crypto trading on contracts.

- A good crypto derivative exchange should be secure and transparent and have a competitive fee structure.

What Are Crypto Derivatives?

A crypto derivative functions as a tradable wager on the future market price of an asset. These arrangements are akin to betting on the price motion of a virtual currency. Individuals can speculate on the price of cryptos without the necessity of buying or selling the coins themselves.

Virtual money derivatives function similarly to traditional derivatives in financial markets, with contracts specifying purchase or sale conditions, validity period, price, and quantity.

They enable experienced traders to execute advanced trading strategies using leverage and can be used to hedge digital asset portfolios or large long positions in a crypto asset. For instance, Bitcoin mining companies may sell Bitcoin options to protect their natural long position.

Crypto derivative instruments offer several benefits, including leverage, risk management, and the ability to execute complex trading strategies.

They let traders enter larger positions than their capital would allow in the spot market and can be used to hedge digital asset market exposure, reducing market risk and market sentiment.

However, leverage can also amplify losses, as the volatile nature of virtual coins can lead to significant damage if not adequately hedged.

Additionally, over-the-counter (OTC) derivatives trade faces default credit risk and lack of due diligence and transaction security exchanges.

Crypto derivatives have traditionally been traded on centralised exchanges due to their liquidity and responsive trading environment.

However, allegations of abuse and potential offline trading during major market events have led to concerns about the safety of customers.

As DeFi matures, there are now a few viable decentralised derivatives platforms, although they still lack centralised exchanges’ liquidity depth and responsiveness. However, these differences are expected to narrow over time.

Crypto derivative trading operates similarly to derivative trading but focuses on trading crypto assets. The Chicago Board Options Exchange (CBOE) and Chicago Mercantile Exchange (CME) have introduced digital currency derivatives trading options, which have attracted global traders.

Exchanges like Binance and Bybit also offer crypto derivative trading options. The feature is accepted between admins and traders through contracts that can be used for hedging or speculation.

Hedging involves mitigating future risks, while speculation involves predicting and mitigating risks. This feature has helped increase the user base and attract global traders.

According to Coinmarketcap, Binance is the biggest crypto derivatives exchange with a derivative trading volume of over $43 million.

Types of Crypto Derivatives

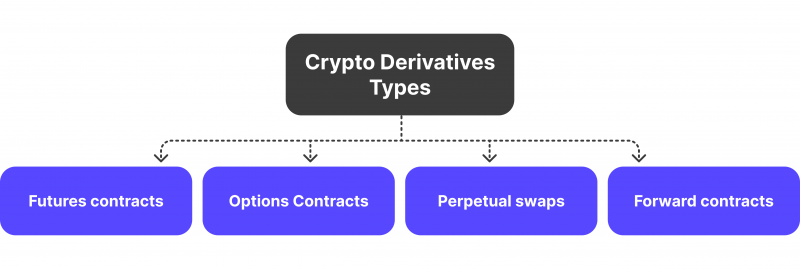

Crypto derivatives are financial contracts whose values are determined by the price movements of underlying crypto or their associated assets. Common types include the following.

Futures Contracts

Engaging in crypto futures means agreeing to buy or sell an agreed quantity of virtual currency at a fixed price on a specified future date. These contracts let traders bet on the price of digital assets without owning them, and they can make money if the price goes up or down.

Options Contracts

Options are derivative contracts that grant the right to buy or sell an underlying asset at a predetermined price in the future. The buyer enjoys the right, while the seller has an obligation to fulfil their part if the option holder chooses.

Crypto options can be used to speculate about price movements or hedge digital asset market exposure. However, options offer more flexibility than futures as they are not obliged to exercise the option.

Options come in call and put variants: call options allow the holder to buy crypto at a predetermined price, while put options allow the holder to sell at a predetermined price.

For instance, a trader might purchase a Bitcoin call option with a strike price of $100,000, which expires in three months. If BTC exceeds $100,000 before expiry, they can buy at a lower price and potentially profit.

Perpetual Swaps

Perpetual swaps are financial derivatives that allow traders to hold positions indefinitely without the need to roll over contracts. They don’t have expiration dates like traditional future contracts and use a funding rate mechanism to maintain the contract price close to the spot market.

The funding rate is determined by the difference between the contract’s trading price and the underlying asset’s spot price. This structure balances demand for long and short positions by offering incentives for the less popular market side.

Forward Contracts

The forward contracts are similar to futures contracts. They allow customisation based on the needs of both parties, enabling both buyers and sellers to customise the contract and underlying asset.

With forward contracts, two parties exchange cryptos or assets at a predetermined price, allowing them to hedge against potential asset price fluctuations and future exchanges.

What Is A Crypto Derivatives Exchange?

Derivative exchanges are gaining popularity due to high-stakes bets on cryptos, offering many benefits such as high throughput rates, enhanced order types, etc.

Exchanges for virtual currency derivatives hold a crucial position within the digital currency market. Traders are offered a venue for trading financial products connected to digital coins.

By using these exchanges, traders have the opportunity to wager on the fluctuations in crypto prices without physically possessing the digital money.

How Such Exchanges Work

Crypto derivatives trading involves speculating on the future price of a virtual currency. Regardless of market price, this finance contract allows investors to profit by purchasing at a lower price and selling at a higher price.

Derivatives trading platforms offer flexibility and access to new markets, making them attractive to exchange owners and investors.

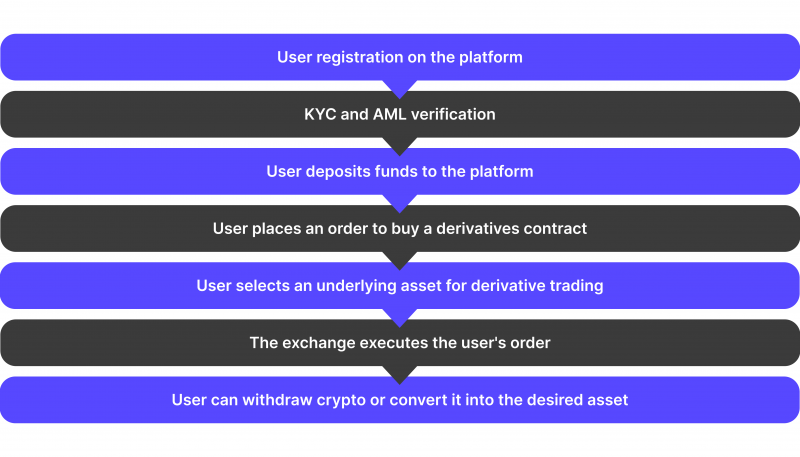

A trader opens an account on a derivate exchange and undergoes KYC and AML verification for platform safety. Then, users deposit cryptos to place an order to buy derivative contracts, specifying the order parameters such as type, price, and size.

Next, users can select the crypto that should be a base asset for derivative trading. Finally, the exchange executes the order, and after the order is fulfilled, it is possible to withdraw the crypto or convert it into the desired asset available on the platform.

How Crypto Derivative Platforms Get Their Profit?

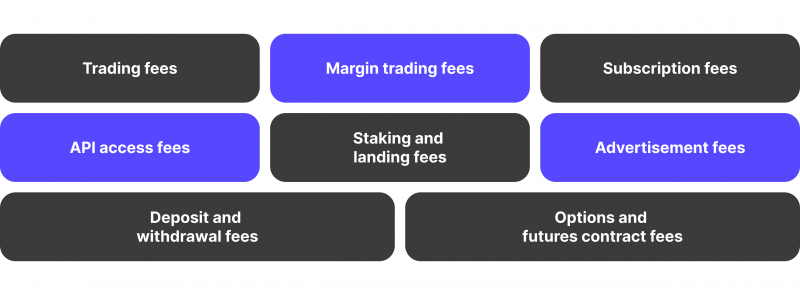

A derivatives broker operating on a crypto derivatives platform can gain revenue differently. Here are the options for profiting from digital currency derivatives trading.

Trading fees

Trading fees are the primary revenue source for a crypto derivative exchange platform, charged to users for transactions. These fees are typically fixed per trade or a percentage of the transaction volume.

Margin trading fees

Some crypto derivatives exchange development services include margin trading support, which charges interest on borrowed amounts, thereby improving trading volume and exchange revenue by charging interest on borrowed amounts.

Subscription fees

The platforms can charge a one-time subscription fee for individuals or businesses to use it to set up their crypto exchange.

Deposit and withdrawal fees

Crypto derivative platforms impose minimal fees for users to deposit or withdraw funds from their accounts, yet they still contribute to the exchange’s overall revenue.

Options and futures contract fees

Traders are required to make payments in order to engage in options trading on a swap platform. The exchange imposes these fees to offset the expenses of maintaining the trading options platform.

The fees associated with trading futures contracts refer to the required payments to conduct transactions for buying or selling futures.- It aids in funding the exchange’s operations and streamlining the trading process.

Staking and lending fees

Some crypto derivative exchange development services include staking and lending services, allowing platform owners to reduce interest or a percentage of users’ deposits for locking or borrowing cryptos from the platform.

API access fees

API access fees are charges that crypto derivative exchange development services providers impose for accessing their API. APIs enable third-party platforms, developers, or traders to connect their systems to the exchange’s infrastructure, retrieve market data, execute trades, and access various functionalities.

Advertisement fees

The crypto-derivative platform generates revenue by enabling sponsors or advertisers to promote their products to the exchange’s audience, with platform owners able to charge advertisement fees on a monthly or yearly basis.

Explaining Crypto Derivatives Exchange Development

Crypto derivatives exchange development is creating software for managing and running platforms for crypto trading on contracts, including centralised or decentralised software for various derivative trading activities.

This process requires strategic planning, technical expertise, and an understanding of dynamic markets. Launching a crypto-based derivatives exchange website or app can help beat the difficult competition in the crypto world. Most traders prefer a crypto derivative trading option, which can help build a strong crypto community.

Crypto derivatives exchange companies offer experience and expert market insights to help build successful exchange platforms and establish top crypto derivative exchanges in the growing crypto space.

They provide the necessary tools and solutions to help users navigate the derivatives market. The offered solutions involve the complete process of developing a robust and fully functional virtual currency derivatives exchange platform, benefiting the owner of the platform.

Commonly, digital currency derivatives exchange development solutions offer four different types of modes: one-way mode, hedge mode, cross margin, and isolated margin.

One-way mode allows users to perform derivative trading in one way, either long or short, allowing them to make profits by closing one trade at a time.

Hedge mode is a trading strategy where users can choose between long and short positions, allowing them to protect themselves from losses. This mode is an alternative to one-way trading, allowing users to sell off long positions in the event of a bearish market, ensuring they are protected from further losses.

To perform futures trading or perpetual trading, users must use margin trading, leveraging funds from the admin. If their predicted market goes wrong, the initial amount deposited for margin trading will reduce, causing both long and short positions to share the unrealised profit or loss.

Isolated margin mode allows users to manage risk based on isolated liquidation, such as when maintenance margin funds are at a crossroads. This mode also allows users to leverage an isolated margin amount to continue and maintain trading.

Essential Features of A Good Crypto Derivatives Exchange

When starting a crypto derivatives exchange company, you should pay attention to the key features a good venue must have.

Security

Security is the top priority for any exchange, as it protects users’ funds, assets, and personal data. Crypto derivative exchanges should prioritise security as hacker attacks increase. To ensure safety, exchanges must offer 2FA, such as Google Authenticator and other defence measures like cold storage asset reserves and custodial storage services.

Insurance funds

Insurance funds help traders prevent adverse losses, known as “socialised losses.” A well-capitalised insurance fund ensures traders do not worry about socialised losses, as the exchange is responsible for the deficit. Some exchanges may operate multiple insurance funds to cover losses during extreme volume spikes.

Transparency

Such exchanges are a financial tool that requires operators to maintain trading policies, fees, and dispute resolution policies and inform traders about policy changes.

Technology and infrastructure

These aspects are crucial for a comprehensible trading experience. The matching engine is a fundamental element of any exchange, enabling users to transact orders efficiently. A high-performance engine can meet high demand levels, even during volume spikes. It provides infrastructure for launching new order types and trading pairs, enhancing the venue’s product for all users.

Liquidity and volume

Traders prefer exchange platforms with high liquidity for easy and quick trades, which also helps evade market variations. Market liquidity and volume are crucial for traders as they also can affect transaction costs.

In a liquid market, sellers can quickly find buyers without reducing asset prices, while buyers don’t have to pay more. This type of market also has less risk, as there’s usually a counterparty willing to support the other side, attracting speculators and investors and thereby enhancing market conditions.

Fees

A crypto derivative exchange’s key feature is offering competitive fees, extra features, and enhanced security to traders. Thus, some exchanges may offer a floating fee that decreases with trading volume.

Benefits of Crypto Derivatives Exchange Development Solution

The rising demand for digital assets makes establishing a crypto derivatives exchange a promising business opportunity. The increasing popularity of trading tools implies a greater desire for complex financial products. Offering the latest technology, strong security, and special features enables new players to innovate and introduce new ideas.

Digital derivatives are finance instruments that offer traders opportunities for speculation, hedging against price fluctuations, and leveraging their positions to boost probable returns. These instruments have gained popularity due to their numerous advantages and diverse use cases in the digital market.

One key benefit is the ability to speculate about cryptos’ price activities without owning the base asset, potentially generating profits in any market condition.

Hedging is another important use case, as traders can use contracts to offset conceivable losses in their holdings, creating a hedge against market fluxes.

Leveraging is another advantage, letting traders control a larger position with less capital, but it also increases potential risks, as losses can be magnified.

Crypto derivatives trading offers more than just profits; it helps investors mitigate risks linked to volatile digital assets, increasing its appeal. Derivative exchange development offers financial institutions access to the DeFi world, untapped crypto holders, faster transaction processing through automated smart contracts, and efficient execution of complex strategies.

However, navigating regulatory challenges is crucial for success. The potential for global reach and revenue streams from trading fees, leverage fees, and subscription models make this venture attractive.

Final Takeaways

The demand for digital asset derivatives is growing due to the blossoming of global crypto markets. Perpetual swaps and futures and options markets are attracting traders, indicating the demand for derivative contracts in this emerging digital asset class.

Digital currency derivatives serve various purposes, including hedging, leveraging, risk mitigation, etc. To succeed in the expanding derivatives market, businesses must analyse current trends and user picks before starting crypto derivatives exchange development.

FAQs

What types of crypto derivatives can be traded?

Different types include forwards, futures, swaps, and options.

What are the advantages of building a digital money derivatives exchange platform?

There are many advantages to using such platforms, including the ability to make money, attract experienced traders, enhance the market, compete effectively, and introduce innovative products.

What is crypto derivatives regulation?

The US Commodity Futures Trading Commission (CFTC) continues to approve digital money derivatives and other assets through the “self-certification” method.

Why is trading crypto derivatives essential?

Derivatives enable investors to diversify portfolios, experiment with various cryptos, and safeguard against unexpected risks, making them increasingly popular for price discovery.