What is a call option?

Crypto investing and trading has become as advanced as its fiat counterpart. In 2023, crypto traders have much more freedom and options to profit from their industry expertise. The introduction of margin trading, arbitrage, options trading, and other strategies has deepened the market opportunities for specialists.

These trading mechanisms can become highly lucrative in the right hands. However, they are exponentially more intricate and require extensive industry knowledge. In short, you need to master the ins and outs of the crypto landscape to consider these trading strategies. Today, we will dissect one of these complex methodologies – option trading and call options. Let’s jump right in!

What is Crypto Option Trading?

To truly understand the call options and their significance, we must first define options trading in general:

Options Trading is a practice that lets traders acquire rights to purchasing or selling a currency at a specific price and period.

This trading method is highly effective for traders who wish to receive profits from the expected price changes in the market. In essence, options trading is similar to the fiat and crypto markets. Naturally, there are certain differences related to contract terms.

In general, options trading is another masterfully designed strategy that rewards diligent and experienced traders with limited budgets. With this mechanism, skilled investors will no longer have to stay inactive due to insufficient funds in their possession.

Call Options, Put Options, and the Strike Price

Now that we have covered broad strokes of options trading let us discuss the primary strategies within this methodology.

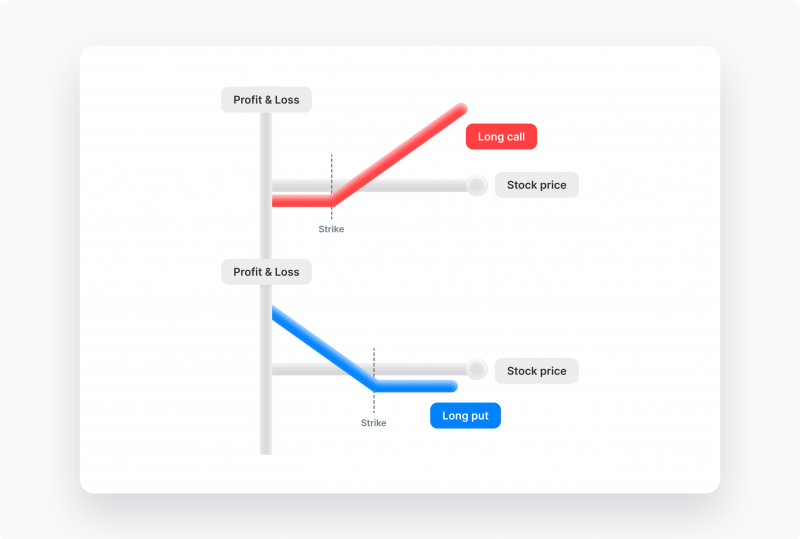

- Call Options are the most popular segment of options trading. They allow their respective owners to acquire the rights to purchase a specific crypto currency in a certain period.

With this opportunity, the contract owner, also known as the call buyer, can receive significant rewards if their pricing prediction comes to fruition in the specified period.

- Put Options are on the flipside of the coin, representing a right to sell a particular crypto currency within a specific timeframe. With this strategy, contract owners can sell their assets at a higher market value and fortify their portfolio against an expected price drop.

Now, let’s examine the fundamental concepts that are essential in any options trading contract:

- The Strike Price is a price of an underlying asset to be sold or bought (depending on the trading option type). This figure is the most crucial variable in the option contract since it will determine whether your options trading is a success or a costly failure. It is essential to determine a strike price diligently.

- Expiration date is the final deadline for the option deal to be fulfilled. It is important to note that expiration date has a different connotation in US and UK markets. In the USA, the expiration date is the latest period you can exercise the trading option. In Uk, this date is the only time you can sell or purchase the agreed crypto currency.

- Premium paid is simply the purchasing price of a trading option. It is mostly calculated based on market conditions and varies depending on the cryptocurrency. Premium and strike prices are the most important values in options trading. It’s crucial to analyze these two figures and ensure that your potential profits will be higher than the overall contract price.

How do Call Options Work?

Call options are the bread and butter of option traders across the globe. They encourage experienced speculation and diligent market analysis. The goal with call options is relatively simple. To reap profits, you must purchase a call option with a strike price lower than the market price at a specified period. You also have to account for the premium paid for the contract itself.

If the market value of a given crypto unit can surpass the strike price and premium fee combined, then your call option is a winning one. However, achieving this goal is much more challenging in practice. So, let us examine the challenges and details of call option trading:

Call Options: A Practical Use Case

Imagine an investor X that has been trading on the crypto market for some time with quite a successful track record. Despite their profitable strategies, investor X has needed help breaking the barrier of limited budgets. After all, it’s difficult to profit from successful speculation without an appropriate investment volume.

Thus, investor X has decided to broaden their horizons and acquire an options contract. First, investor X identified a lucrative call opportunity on the market – Crypto currency A, currently sold at a market value of $100. Our investor X has a solid reason to speculate that crypto A will sell at a $110 price in three months.

Explore Deeper Industry Insights

Learn from experts shaping the future of financial services — get the latest strategies and trends.

With this information, investor X scours the market to find a call option seller that will present favorable contract terms. Finally, investor X finds a call option contract with a premium of $1 per share and a strike price of $105.

Our diligent investor does the math and correctly speculates that the contract is worth it. As a call buyer, investor X purchases a right to acquire 500 units of Crypto A. Thus, our investor pays $ 500 for the entire contract.

Scenario A

Fast forward three months, and the price speculation finally arrives as expected. Investor X decides to exercise the contract, purchase crypto A at a strike price and re-sell it immediately. As a result, Investor X receives the profit of $ 2000. This figure comes from taking a market value per currency unit ($110) and deducting a sum of the strike price and a premium per currency ($106). As a result, Investor X received a $4 profit per unit, which amounts to $2000 per 500 units.

Scenario B

Since we covered a scenario where everything goes to plan, let us examine an opposite case. Imagine that the price of crypto A did not achieve the projections and only went up to $104 in the duration of three months. Now, investor X will suffer losses if they decide to go through with the purchase.

Since the strike price and premium amount to $106 per crypto A unit, executing a call option will result in a loss of $2 per unit. Therefore, investor X will decide only to suffer the expenses of purchasing a call option without ever executing it.

Why a call Option is a right and not the obligation

One of the most crucial aspects that separate call options from other financial mechanisms is their liberating nature to the owners. Unlike the obligatory nature of margin trading, exercising a call option is, as the name implies, entirely optional. Although call options sometimes include hefty premium fees, they guarantee flexibility.

If you are a crypto trader interested in profiting from crypto price variations, margin and option trading present an interesting trade-off. With the former, you don’t have to pay any expenses upfront, but you will be obligated to return the asset in a given period. With the latter, a premium paid on an options contract is the only liability.

Key Takeaways

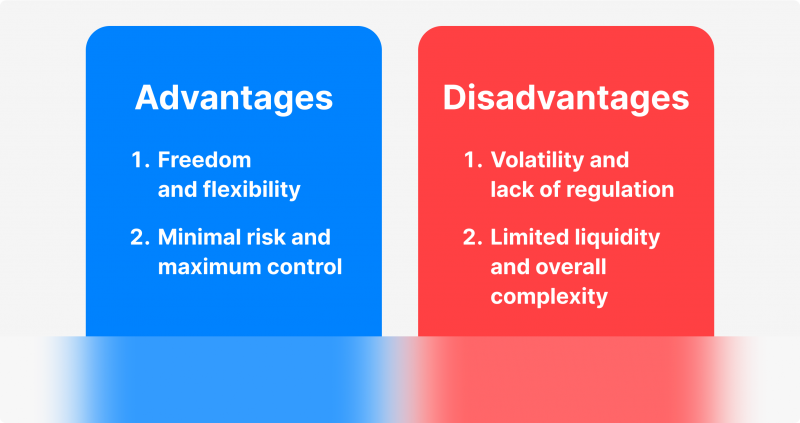

- Call options grant their owners freedom and flexibility to choose a perfect options contract for their intentions.

- Call options also help investors mitigate and hedge risks in their overall portfolio.

- On the flip side, crypto options suffer from the general market volatility, lack of strict regulations, and inherent complexity required to utilize this financial instrument successfully.

The Pros and Cons of Call Options

Options trading and call options, in particular, are a match made in heaven for capable and skilled crypto traders. However, dealing with this complex financial instrument might prove unwieldy in certain cases. So, let us recount the advantages and disadvantages of call options:

Advantages

Freedom and flexibility

As discussed above, call options let the investors stay free of obligation while maintaining an advantageous position on purchasing cryptos. However, the level of freedom goes further than the rights and obligations. Call options market has become diverse and ripe with different choices.

Simply put, if you’re looking for an options contract with fairly realistic figures, chances are you will find it. Call sellers present abundant choices regarding contract periods, underlying stock price, and premium fees.

Minimal risk and maximum control

Few financial instruments can provide limited risk and control over significant funds simultaneously. Call options accommodate just that. Once you purchase your contract from a call seller, you have no further liabilities and all the flexibility to hedge your crypto bets.

The myriad of options available on the market give the investors the power to fortify their crypto portfolios against various price volatility threats and predictions. Some investors utilize the call options to hedge their risks well into the future, purchasing options contracts with the same strike price but dramatically different timeframes.

Disadvantages

Volatility and lack of regulation

On the flipside of the coin, we have an inherent crypto risk. As with everything else, a diligent crypto trader must always incorporate volatility into their strategies. Call options are no different and could lead to significant losses if crypto prices change unexpectedly.

While crypto call options have a more lucrative upside than regular stocks and fiat markets, the ever-present volatility renders numerous call options obsolete. So, be mindful of the premium fees on your options contract, as they could swiftly turn into sunk costs.

Additionally, the crypto landscape is less regulated than traditional markets. Thus, call options and other instruments generally include inherent risks of fraud, financial crime, and simply not honoring the contracts. For that reason, investors in the crypto landscape must exercise caution and stick with the established names.

Limited liquidity and overall complexity

Despite the best efforts of liquidity providers across the crypto landscape, the market still remains considerably illiquid compared to the fiat sector. Due to this unstable flow of funds, purchasing a call option could pose risks of execution. Simply put, you might not always have a chance to sell the acquired coins at a favorable price due to the lack of buyers on a given platform.

So, it is crucial to incorporate liquidity risks within your call option strategies and whether to purchase them at all. Additionally, the overall complexity of this financial instrument is another considerable roadblock. Numerous variables and intricacies are involved in selecting, exercising, and profiting from a call option contract.

There are numerous scenarios where your seemingly perfect call option might be a losing investment. So, it is highly recommended to consider call options only after becoming highly experienced in crypto.

Call Options vs Put Options

Now that we have dissected the nature, significance, benefits and risks of call options, let us examine its tightly-knit counterpart – put option. Unlike the opportunistic nature of call options, this financial instrument is designed to profit from a price drop for a given crypto.

Crypto traders utilize put options in case they expect a market downturn. Suppose a crypto A is selling at $250, but in three months, it is expected to go down to $200. Investors, in this case, will look to purchase a put option with a strike price that leaves them in a profitable situation even including the premium fees.

Discover the Tools That Power 500+ Brokerages

Explore our complete ecosystem — from liquidity to CRM to trading infrastructure.

Put options are great instruments to mitigate risks, since they offer investors ample opportunity to fortify their crypto portfolio against significant price drops. If any given trader is worried about the market volatility, they can simply purchase a put option that will give them the right to sell their entire portfolio at a predetermined price. So, when you decide on the type of your options contract, it is essential to have a great foresight on where the crypto market is heading.

How to Acquire and Sell Call Options

The technical aspect of purchasing and selling call options is seamless thanks to numerous exchange platforms offering options contracts. Acquiring such a contract is only a matter of creating a respective exchange account and having sufficient funds to cover the specified contract premium. There are numerous choices to select from and it is essential to identify call options with a favorable strike price, expiration date and premium.

Selecting a reputable source

Another aspect to consider is the reputation of the exchange platform or an individual counterparty. As discussed in previous chapters, the crypto industry lacks strict regulation, emphasizing the need for diligence when choosing a counterparty. There have been numerous cases of fraud and fund displacement in the options trading scene, so choose your suppliers carefully.

Exercising or selling a call option

After purchasing a fitting contract from a reputable source, you have the total ownership of this right. Now, you can either exercise the option or sell it on the open market. Exercising the option is quite simple if tied to an exchange platform, as everything is executed via smart contracts. Selling your call option depends on finding the call buyer on the market. Most crypto investors transfer their call option ownership through exchange platforms to ensure safety.

Determining the resale price of a call option depends on the current market condition. When the price of underlying crypto rises above any expectations, then the call buyer pays extra and vice versa. So, in some limited cases, your call option might skyrocket in value and selling it could actually prove more lucrative than exercising.

In Summary

Call options in the crypto landscape are one of the most profitable financial instruments on the market. However, they match their lucrative nature with equal complexity and inherent challenge. While investors can utilize call options freely and hedge their potential risks as well, they need to be mindful of the overall uncertainty of the crypto market.

Call options are quite complicated even in traditional markets, and the crypto landscape adds additional layers of uncertainty to the equation. From volatility and lack of regulations to constrained market liquidity, call options could swiftly turn into expenses without due diligence. So, as with any advanced financial mechanism, it is crucial to understand call options deeply and utilize them with utmost caution.

Recommended articles

Recent news