What is Copy Trading, and How Profitable is it?

Trading has become easier over the years. From what used to be a complicated analytical task combined with in-depth charts and figures, investing in the financial market can be done with a click of a button.

Social and copy investing have made the due diligence process much easier, especially for beginners who lack practical experience and rely on others’ knowledge to make informed decisions.

All you need to do is find a reliable trader and follow their strategies, but there are other considerations that you need to take into account. Let’s explain what copy trading is and how to start with it.

Key Takeaways

- Copy trading is an advanced investment strategy that involves following another trader’s steps and strategies.

- New traders pay subscription fees and share profits with an expert with a compelling investing record and past performance.

- Copying experienced traders is legal in most jurisdictions and countries but is subject to strict regulatory requirements and monitoring.

What is Copy Trading?

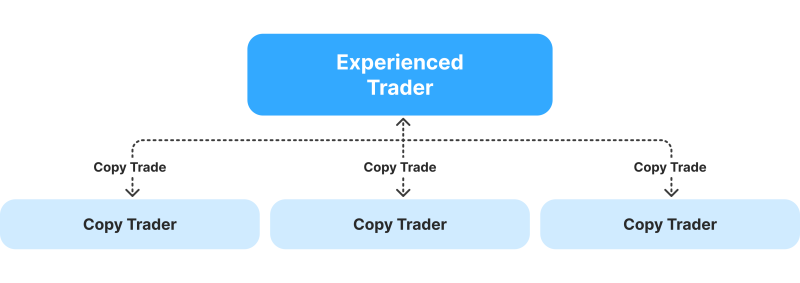

Copy trading is a trading strategy that involves an experienced trader who is active in financial markets and another market participant who wants to gain exposure to advanced strategies and better decision-making during challenging market conditions.

The beginner trader follows the master account, including the investment technique, buy/sell signals, asset allocation approach, and risk profile. As such, most of the research job and market analysis is done by the expert while followers mimic the same decisions, hoping to achieve similar returns.

The advancement of financial technology and the digitalisation of platforms made this process more accessible to online traders and brokerage software. Now, you can find copy-and-paste trading with most online financial services, and all you need to do is pick and choose.

Copy trading started in 2005 when traders started sharing tips and strategies with each other using algorithmic and automated investments.

How Does Copy Trading Work?

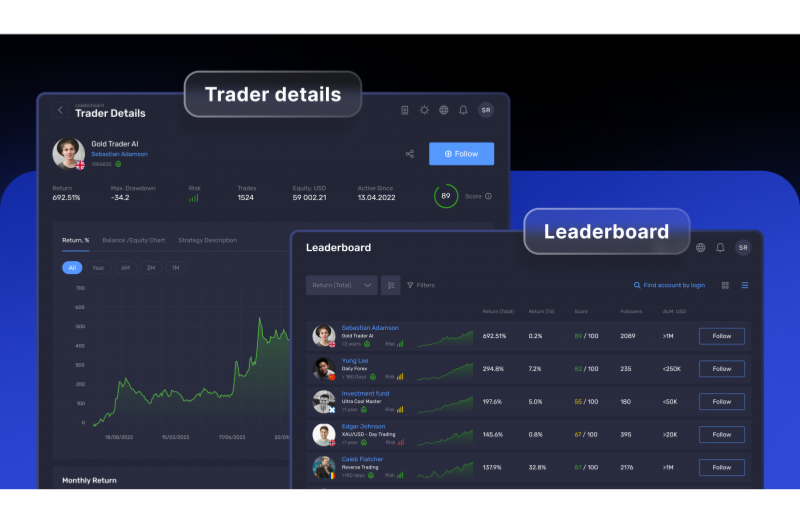

In essence, a professional trader creates a master account on an online brokerage platform, stating their experience, portfolio, annual returns, and other insights. Other users can view the list of master traders and choose the one that suits their budget, preferences and risk characteristics.

One master account can have multiple followers simultaneously, and when the investor opens or closes a position, the activity is broadcast to other linked accounts.

Depending on the copy trading software used, followers can choose to immediately implement the master’s activity or allow adjustments before processing the order.

Master accounts charge different fees for sharing copy trading signals:

Explore Deeper Industry Insights

Learn from experts shaping the future of financial services — get the latest strategies and trends.

- Subscription fees are directly charged for accessing the master account’s server and receiving different trading strategies.

- Performance fees are percentages set by the main traders and deducted from the copiers’ revenue.

- The platform sets profit-sharing models, deciding the distribution of copiers’ earnings between the master and followers.

Some brokers allow traders to follow more than one master account to diversify their portfolios and mitigate risks. Platforms can now handle multi-copiers with separate lot allocations, unified monitoring and execution without overlapping.

Is Copy Trading Legal?

Following other traders’ activities is legal in most jurisdictions and locations. For example, in the UK and EU, trade copying is generally allowed and is regulated by authorities like the FCA and CySEC. These entities enforce transparency and disclosure rules, mandating risk warnings and meeting specific operations standards to protect users’ funds.

In the US, the Securities and Exchange Commission and the Commodity Futures Trading Commission oversee the landscape based on the underlying asset. The SEC is concerned with copying and pasting securities like stocks and derivatives, while the CFTC is responsible for commodity and Forex markets.

These bodies treat mirror trading similarly to managed accounts, requiring special licenses to acquire and operate dedicated software.

Other jurisdictions, like Australia and Singapore, regulate through comprehensive compliance requirements and risk management. They may require segregated accounts and rigorous trader authenticity to ensure investors’ safety and market integrity.

Therefore, it is essential to verify the brokerage offering trade copying and background-check the license and the master account to avoid manipulation and capital loss.

Turkey and Belgium have stringent restrictions that make copying trades very challenging. Turkish jurisdiction requires individual investors to deposit at least $5,000 for CFD trading, while Belgium’s financial authorities ban retail CFD instruments.

What is an Example of Copy Trading?

Let’s say natural gas (commodity) offers lucrative opportunities, but you are unaware of the global macroeconomic factors and microeconomic conditions in the gas-producing countries.

Trading alone would require substantial time to understand the current trends and future expectations, and you can possibly miss the perfect entry. On the other hand, an experienced trader who is well ahead of the geopolitical factors affecting gas production and global demand and supply dynamics is more likely to make the right decision much faster.

Therefore, following the steps of these investors enables you to capitalise on the opportunities and make the right call at the right time.

Advantages and Disadvantages

Automating your trades with copying technologies is great. However, there are some drawbacks, including risk control and server issues, that you must consider. Let’s review the advantages and disadvantages.

Pros

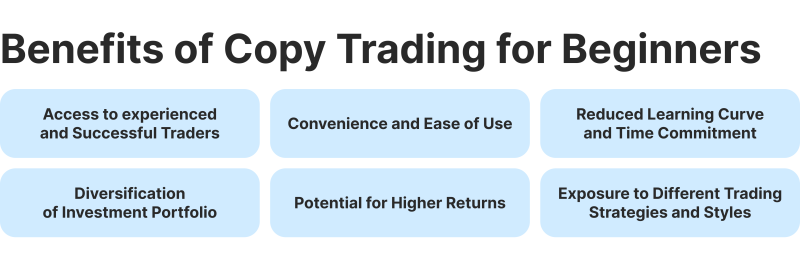

- Accessibility: Many online brokerage firms offer copy trading, making it highly accessible and affordable for beginners who have limited time to research and track market activities.

- Time-Saving: Following experienced investors’ strategies helps bypass the lengthy learning process and save costs, as new traders often start losing money rapidly in the first few months.

- Portfolio Diversification: Traders can diversify their portfolios and open positions in multiple markets and assets with minimum manual interference, relying on the master’s signals

- Flexible Risk Management: Copiers can choose the leading account based on their risk tolerance and trading approach, as well as adjust each order placed by the master account.

- Shorter Learning Curve: Learning by doing enables new investors to improve their knowledge and skills by analysing copy signals and their impact on current market conditions.

- Sharing Profits with Experts: Financial markets have a huge cash pool, and copying an experienced investor’s steps allows you to share the same profits the master trader is realising.

Cons

- Lack of Independence: Copiers can become highly reliant on the master account to make the smallest decision. Also, poor choices by the leading account can result in losses.

- Platform and Master Fees: Accessing copy trading signals requires additional payments for the broker, with another performance fee paid to the lead account.

- Misreading Risks: Relying on other traders’ decisions and steps can hinder one’s growth and skill development, leading to poor decision-making and underestimating the risks involved.

- Limited Control: Some platforms provide little control over linked accounts, offering low flexibility in open positions and loss limits.

- Limited Personalisation: Copied strategies do not always align with the trader’s personal goals and targets because experienced investors usually have higher expectations and budgets.

- Technology Dependence: Relying on technology to access copied accounts exposes the trader to high risks if the connection is poor or the server is down.

How do I Start Copy Trading?

Copying trades has proven profitability and has become highly available at most online brokers. However, regulatory risks are a major threat to investors’ funds if they register with the wrong platform.

Therefore, proper research and due diligence are required before creating your investment account. Here’s how you can start.

1. Find The Right Platform

Firstly, you need to find an online broker that offers copy trading. Do your research to find the best copy trading platform that suits your needs, budget, strategies and risk tolerance. Review the available markets and assets to create a balanced portfolio or if you want to hold multiple positions at the same time.

Also, review the associated fees with opening an account. Brokers may charge an entry fee to start copy trade and performance profit-sharing allocation between you and the master account.

2. Create an Account

Create an investing account at the chosen brokerage platform, go through the verification process and deposit funds into your account.

Research the market to find the securities and asset classes that offer the most lucrative opportunities.

3. Choose Master Traders Carefully

Check the list of copy accounts that you can follow. Review the trader’s expertise, risk characteristics, expected annual returns, preferred markets, and investment strategies.

Discover the Tools That Power 500+ Brokerages

Explore our complete ecosystem — from liquidity to CRM to trading infrastructure.

Also, check the performance fees and if there are any budget restrictions, as your funds may not align with the master account due to different expectations.

4. Customise Your Investing Limits and Controls

Subscribe to a master account that suits your trading style and portfolio. Set your risk and order limits before execution and ensure you have the flexibility to adjust your position or loss limits before every buy and sell activity.

5. Monitor Your Position and Interfere If Necessary

Closely monitor your position and remember that your budget and the amount of money that you can afford to lose may differ from the main trader. Therefore, you may have different loss tolerances and buffers to accommodate price fluctuations.

Track your gains and losses and adjust your limits and position if you believe the master’s decision may affect your equity.

Conclusion

Copy trading is an advanced investment technique that relies on technologies connecting multiple traders. As such, an experienced trader creates a master account and sets subscription fees, and other investors connect and follow their activities.

Every time the lead account executes a buy or sell position, the activity is replicated to the followers to process the same order. New traders and those who want to hold multiple orders with little manual involvement rely on copying others trades to automate their investments.