10 Best Day Trading Strategies to Maximise Profits

In this article, we will discuss the benefits of this popular trading strategy, some of the day trading tips, and discover the 10 best day trading strategies you can use to make a profit in any market.

Despite being primarily practised by professionals, day trading has gained popularity among retail traders due to the rise of online platforms and brokers, attracting a new generation of traders eager to profit from market fluctuations. Day trading can be a part-time hobby or a full-time career, with a low long-term success rate. It is also a great option for novice traders as it is less emotionally exhausting and offers immediate results, which boosts confidence.

Key Takeaways

- Day trading implies that short-term trades are made within regular trading hours to profit.

- Various day trading strategies can be employed in diverse markets.

- This type of trading can be stressful and often comes with many losses.

- Gap trading, pivot points, and others are the most common strategies for day trading.

What Is Day Trading and How Does It Work?

Day trading is the practice of buying and selling the same security on the same day to profit from small price movements.

Day trading involves making short-term trades during regular trading hours to make profits in financial markets. It is an online investment technique where investors open and close positions before the end of the trading day. As a day trader, you can focus on various assets such as currencies, stocks, cryptos, commodities, ETFs, bonds, and indices.

Unlike traditional investments like stocks and bonds, day trades are held for hours or minutes, allowing investors to place numerous individual orders daily. The main goal is to aim for small gains, which can lead to healthy profits for experienced traders. Regardless of experience, everyone encounters losses and failures, making it crucial to develop clear day trading strategies from the start.

Day trading techniques offer several advantages, including quick profits, easy access, excitement, no overnight risk, and the potential to work for oneself. It is a high-risk yet high-reward strategy that requires diligence, education, and luck.

Day trading also comes with fees and taxes, with higher taxes for short-term capital gains and higher taxes for long-term capital gains. The market moves quickly, and day trading can be stressful, especially if trades don’t work out. It is a form of gambling that can become addictive, straining health and relationships.

Time commitment is a significant part of day trading, requiring hours of research, tracking, and making trades. Competing against other investors and professionals from major financial institutions can be challenging. Financial regulations require at least $25,000 in a brokerage account to be a day trader; even more may be needed to provide a buffer against losses and have money ready for trades.

A study of 1,600 day traders found that 97% of those who day traded for more than 300 days lost money.

Best Strategies for Day Trading

Below, you will find a list of some of the most used and most profitable strategies for day trading. While these strategies can help make cash within a day, it’s important not to expect immediate success and to have a risk tolerance to lose all trades.

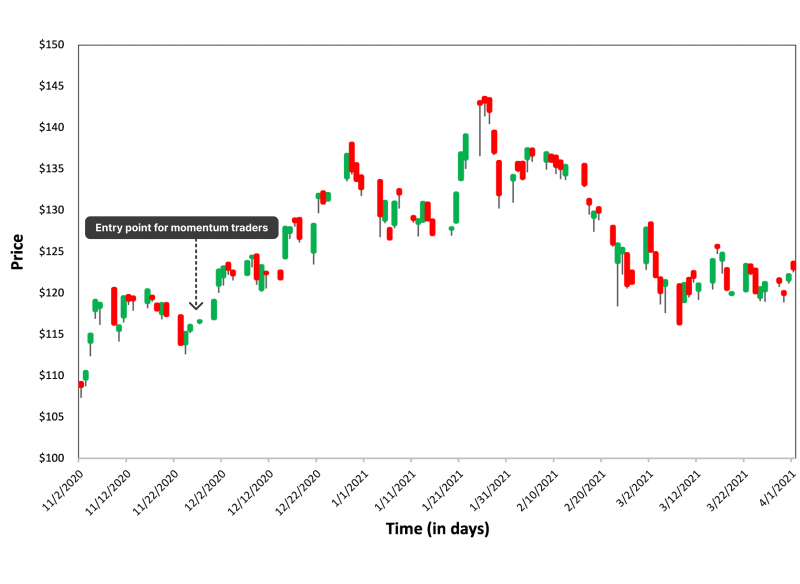

Momentum Trading

This type of strategy often focuses on high-performing stocks. Momentum trading is a strategy where traders capitalise on the principle that an object in motion stays in motion until a counterforce is applied. They enter positions when momentum is rising and exit when it begins to decline.

This strategy requires the use of indicators like Moving Average Convergence Divergence (MACD), Rate of Change (ROC), Stochastic Oscillator, and Relative Strength Index (RSI).

The MACD divergence signals a potential upcoming trend reversal from uptrend to downtrend. To initiate a trade, look for bearish MACD divergence from price action, placing an initial stop-loss order just above the stock’s high of the day.

A market reversal move to the downside often features a quick, substantial drop in price, allowing for a substantial profit in just a short amount of time. The MACD divergence signal is stronger when trading volume falls off as the stock makes a new high. Identifying “rolling divergence” increases the odds of a trade being a winner.

For momentum reversal strategy success, only stocks with similar collapsing patterns, weak catalysts, or multi-day upside price action should be shorted.

Pivot Points Trading

This is an ancient technique used by floor traders and day traders on electronic exchanges. It involves entering a short trade when the price hits a pivot point resistance from below and taking a long trade when it hits a supporting pivot point from above.

This strategy works best when pivot points appear at the same price level as other support and resistance levels. It can be a powerful day trading strategy for investors with large accounts trading large-cap stocks with low bid-ask spreads.

Detecting potential pivot points involves analysing supply and demand zones, overbought and oversold zones, and pivot points. It is difficult to predict a specific pivot point, but determining the corridor in which the price will reverse with a high probability is possible. The demand zone range between L1 and L2 signals an uptrend, while a reversal in this zone signals a downtrend.

Have a Question About Your Brokerage Setup?

Our team is here to guide you — whether you're starting out or expanding.

Scalping

Scalping is a strategy for quick traders that allows swift decisions and quick action to profit from market movements. It often results in multiple trades within seconds. It uses technical indicators like the Moving Average Ribbon Entry Strategy, the Relative Strength/Weakness Exit Strategy, and Multiple Chart Scaling to identify market trends.

Scalpers use automated bots to increase trade frequency and profit from small price fluctuations through resale. This strategy involves higher frequency, larger trading volumes, and larger positions but can be risky due to the difficulty in identifying reliable patterns.

Scalping can be approached in two ways: high-frequency scalping, which involves many trades at high volume, or slower scalping, which focuses on smaller price movements, lower trades, smaller position sizing, and longer holding periods.

Scalping requires intense focus, quick decision-making, and discipline, making it best for confident traders who can handle rapid-fire trading. However, this strategy may not be suitable for those who are easily distracted or lack focus.

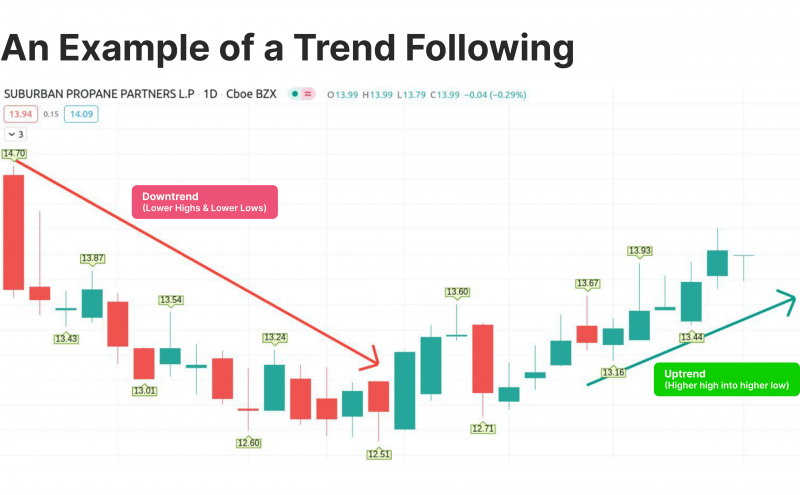

Trend Following

Trend trading involves trading in the direction of the overall trend, with corrections ignored. Trend-following traders aim to capture prevailing trends, focusing on short-, intermediate-, or long-term trends. They use trend indicators like trend lines and moving averages to guide their decisions, trading on any time frame chart.

The position is closed after price reversal or at the end of the trading day. Signals of a new trend beginning include important news releases, reversal patterns, rebound from strong resistance or support levels, trend line breakouts, trend exhaustion in supply or demand zones, and creation of artificial demand or supply by market makers. The intraday strategy involves closing the position by the end of each day, depending on the duration of the trend and the willingness to accept possible risks.

Day traders avoid taking positions in market opening or closing minutes, as they don’t necessarily reflect the day’s market trend. They focus on real money flows and avoid getting bogged down by opening or closing trades, which may be position-squaring.

Gap Trading

The gap strategy is a popular technique involving leading gappers with high volatility and community awareness. Gap trading is a strategy where traders identify and exploit price gaps on a chart where an asset’s price moves sharply up or down without much trading.

These gaps, often caused by fundamental or technical factors, can present lucrative trading opportunities. Success relies on highs and lows, high momentum during breakouts, and high relative volume with tight bid-ask spreads.

However, it requires careful planning, in-depth market and technical analysis, technical indicators, and an understanding of market psychology. For those who enjoy treasure hunts and discovering hidden opportunities, gap trading may be the perfect strategy.

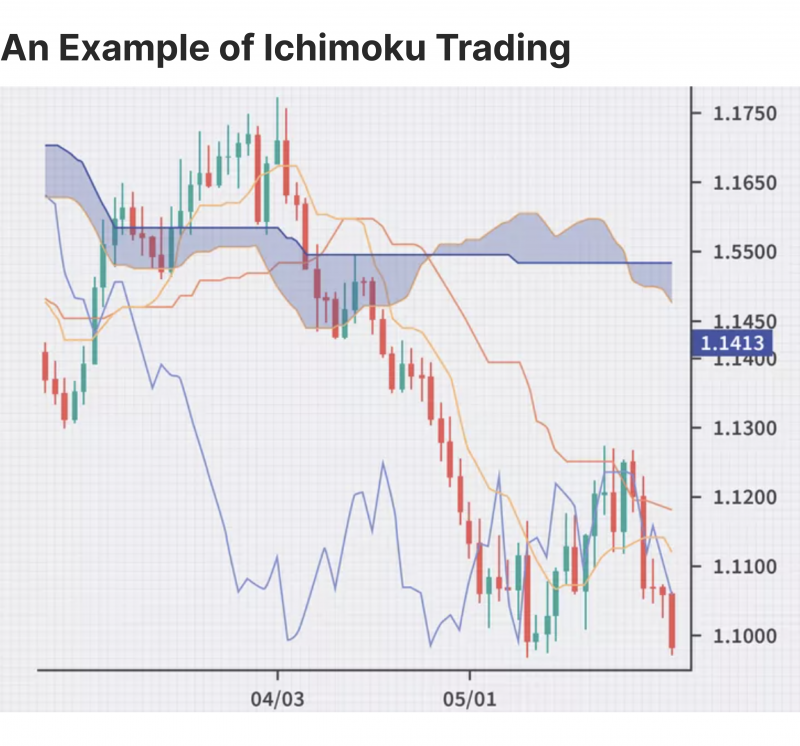

Ichimoku Kinko Hyo Indicator Trading

The Ichimoku Kinko Hyo or Ichimoku Cloud indicator provides intraday technical trading signals. This is a multi-functional tool for professional trading. It functions as a trend, momentum, and filter indicator, with five lines forming clouds and three acting as filtering oscillators.

Interpreting signals involves opening long positions above the ascending cloud and short positions below the descending cloud. Traders can enter trades when the price moves outside the cloud, hold them until trading ends or use a trailing stop loss on the opposite side of the Kijun Sen line.

Breakout Trading

This is a strategy where a trade is entered when a key level, such as resistance, support, or a trend line, is broken. Breakout trading strategies involve buying a stock after it overcomes a significant resistance level, such as an intraday high, weekly or monthly high, or pivot point price level.

One popular breakout day trading strategy is the ascending triangle pattern, a bullish price consolidation pattern that often appears at a key resistance level. This pattern is often seen as a buying opportunity during an overall uptrend. The pattern unfolds as an uptrend temporarily stalls at a price resistance level, and the price consolidates through a series of swing lows and swing highs.

A buy trade is signalled when the price breaks above the resistance level, indicating the existing uptrend is resumed and likely to push higher. An ascending triangle pattern also provides traders with a clear profit target and stop-loss price levels.

Breakout trading is a strategy used by ambitious traders who take risks by going beyond the established price range of security. However, it comes with risks, such as planning exits, setting profit targets, and determining stop-loss points.

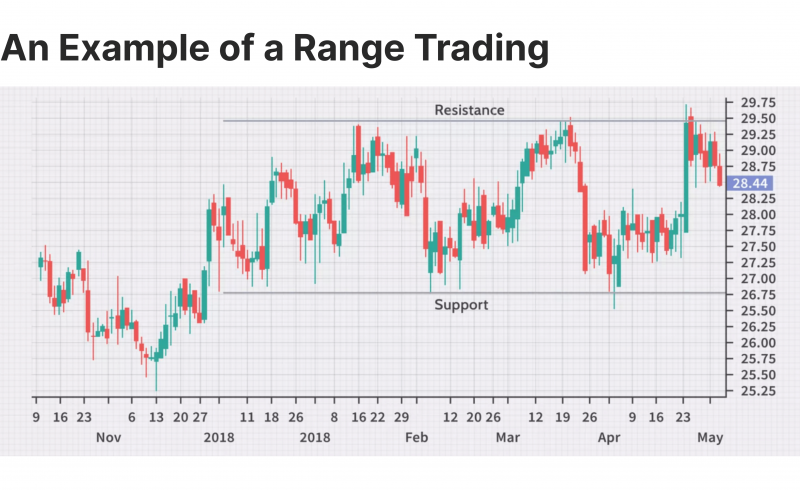

Range Trading

Range traders are adept at markets with less turbulence, using technical indicators like volume trends and price patterns to identify key junctures. They buy at low prices near support levels and sell when prices peak near resistance levels.

This range is defined by key levels of support and resistance, often represented by consolidation patterns. Traders enter or close positions at resistance, or close positions at support. Stop-loss orders are placed beyond the extremes to mitigate price movements.

Market dynamics can rapidly shift, so range traders must be able to discern if the market is stationary or moving and have an exit plan to mitigate risks and protect against unexpected market downturns.

News Trading

Trading on the news, also known as fundamental analysis trading, involves analysing the impact of news or economic data on an asset’s value. The market’s interpretation of the news determines the price’s direction.

Trading on the news requires considering forecasts, the likelihood of events, and news influence. The main tools for traders trading on the news include an economic calendar, financial statements of large companies, and a news feed.

News trading is a risky but potentially profitable day trading strategy, as dramatic price movements in stocks often follow the release of significant company news. Once the news is released, they watch for the market to break out of the pattern and initiate a position based on the pattern’s breakout.

They typically place their stop loss at a safe point beneath the breakout level, either a triangle width or a range width. However, markets can be extremely volatile during important news releases, so news traders should approach leaving stop loss orders cautiously to avoid significant slippage.

Successful news traders must act quickly and decisively since even a few seconds delay in making a trading decision can be costly.

Pullback Trading

A pullback day trading strategy involves finding a buy entry point for a stock that is generally trending upward during a pullback, anticipating continued upward progress. This method works well with any stock with a steady, ongoing uptrend with occasional moderate retracements.

Pullbacks are temporary dips in an asset’s price during an upward trend, offering traders an opportunity to buy the asset “on-sale” before it resumes its upward journey. Traders monitor technical support areas like moving averages, pivot points, or Fibonacci retracement levels to identify potential bargains.

If the trend is upward, a downward pullback is an entry point for day traders. For an effective pullback, traders look for an uptrend with at least two successive high price movements or two decreasing prices in a row.

Discover the Tools That Power 500+ Brokerages

Explore our complete ecosystem — from liquidity to CRM to trading infrastructure.

However, not every opportunity is profitable, and pullback trading requires a keen eye for detail, a disciplined approach, and the ability to seize opportunities.

How to Day Trade Successfully

Here are some of the day trading tips and tricks you can use if you want to know how to get good at day trading.

First of all, you should follow a predetermined plan and trade with money that can be lost painlessly.

Also, some of the basic day-trading rules include following risk management practices, gaining proficiency and knowledge, diversifying risks, using different assets, learning to control emotions, and always using a stop loss.

Trailing stops are essential for trading, as they follow the price in the direction of the forecast and are not returned if the price reverses.

Correlation is another useful tip, as increasing the volume of one position or opening multiple transactions on one asset increases risk.

Using different day trading strategies, such as combining indicators, patterns, levels, waves, and news, can help reduce the deposit load, increase income, and diversify risks.

By following these tips, traders can maximise their profits and minimise the risk associated with their trading activities.

Final Thoughts

Day trading is a profitable way to generate annual returns of 200% or more, providing significant liquidity to the market. It requires self-discipline and following trading rules. The best day trading strategies can be found through time, learning, research, and experience. These strategies can be used in various markets, including commodity futures, crypto, and forex trading.

However, successful day traders must understand market dynamics, manage risk, and cultivate discipline and patience in execution. It is also recommended that the chosen techniques be backtested before committing real money.

FAQ

How to day trade successfully?

To be successful at day trading, you should understand the stock market basics, choose a broker, and develop a trading strategy. It is also recommended to start small, be patient, and manage risks. Learning from profitable traders is also a good approach.

What to look for when day trading?

When day trading, you should pay close attention to such parameters as volatility, trading volume, liquidity, real-time market data, securities price charts, scaling, and momentum.

How to pick stocks for day trading?

Day traders use tools like moving averages and trend lines to spot consistent stock trends over short periods.

How do you learn day trading?

Day traders often learn day trading independently using free resources and trading books. However, finding the right starting point can be challenging, so it’s essential to research the market, strategies, and potential platforms. Learning from successful day traders can help develop the necessary skills.

What are some good trading strategies for beginners?

Good trading strategies for beginners include trend-following and breakout strategies. These strategies are designed to identify significant market trends and capitalize on them. A beginner should focus on learning how to read charts, understand market indicators, and use stop-loss orders to manage risk effectively. Day traders often use these strategies, particularly in fast-moving markets, to maximize short-term profits.

How can you become a profitable day trader?

To become a profitable day trader, it’s essential to develop and stick to a solid day trading strategy. This includes setting clear goals, using proper risk management techniques like stop-losses, and focusing on high-probability setups. Successful day traders also emphasize discipline, emotional control, and continuous learning. By analyzing market trends and using tools like technical analysis, you can increase your chances of consistently making profits.