6 Best Forex Trading Strategies and Tactics

The foreign exchange market is probably the largest venue for forex trading strategies, where investors experiment with various trading techniques and styles. These strategies gained a massive boost with the introduction of social and copy trading systems.

How do you choose the best Forex trading strategy? How can you track trends and accurately predict the market? Let’s discuss.

Financial markets are diverse and full of opportunities to make money. The Forex market is a classic destination for investors. It is the busiest trading marketplace, where institutional investors, professional traders and beginners who want to make extra income share the massive market returns.

Key Takeaways

- Forex is the largest and most liquid trading market, with a daily trading value of over $6.6 trillion.

- Only a small portion of FX traders realise significant returns after years of practice and investing.

- Traders diversify their portfolios between short-, medium-, and long-term strategies that suit their goals, capital, and experience.

Overview of The Forex Market

Forex has long been known as the most valuable and liquid market worldwide. On a daily average, $6.6 trillion worth of transactions circulate in Forex. Its overall value is estimated at $2.4 quadrillion, outstripping the stock market 35 times and the derivatives market three times.

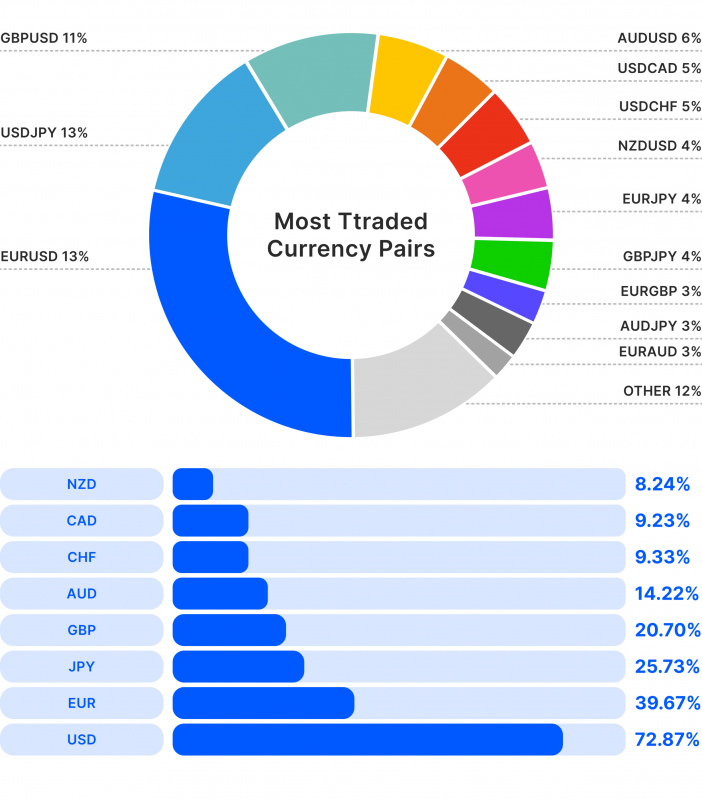

The US Dollar still dominates the market as 73% of global trades involve the “greenback”, followed by the Euro, which accounts for almost 40% of trades, including the EUR/USD positions.

Many factors affect the Forex market, and the last two years have been eventful, which was enough to shake the market and mix traders’ predictions.

The geopolitical instability, rush in gold prices, USD drops by BRICS countries and potentially declining interest rates are significant factors that affect the Forex market.

Foreign Exchange Trading Tips

Despite the significant liquidity in the Forex market, it is pretty volatile due to the diversity of factors that affect traders’ decisions, the huge speculations in foreign currencies and the ability of market whales to sway the market either way.

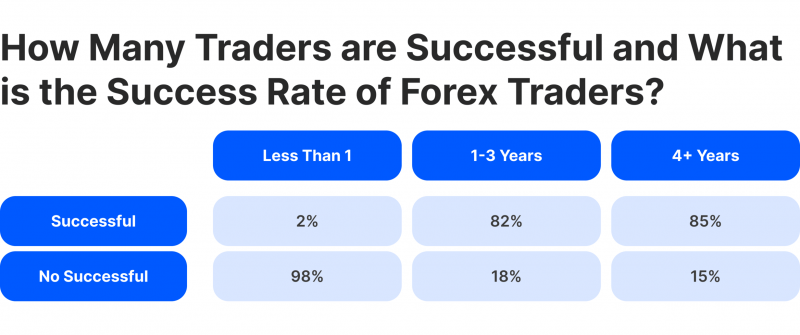

Trading in the currency market must be done with caution. Over 70% of FX traders lose money, and it takes many years to excel and realise noticeable gains in the market.

Therefore, it is vital to develop your skills and find the right FX trading strategy that suits your financial needs, capital and time horizon. Most Forex trading brokers offer a demo account that you can utilise to hone your skills and craft the best approach to succeeding in Forex before trading with real funds.

Providing your clients with winning strategies is crucial. Providing them with a world-class platform to execute those strategies is what sets your brokerage apart. This article explores the theory; our solutions provide the professional-grade infrastructure for your business.

The Best 6 Forex Trading Strategies

Professional traders succeed after years of trial and error. They try different Forex tactics and styles until they find the best Forex trading strategies that suit their targets, capital and expectations.

Most Forex traders build their trading system based on the top Forex strategies mentioned below.

Scalping

Scalping is a Forex trading system in which the trader enters the market and holds a position for a very short period of time. This approach tries to capitalise on small gains repeated several times per day.

Forex scalpers chase returns as little as 5 pips per session, whereas each trade can last from a few seconds to a few minutes, usually up to one minute or 15 minutes as a maximum limit.

Have a Question About Your Brokerage Setup?

Our team is here to guide you — whether you're starting out or expanding.

This system enables traders to focus on one market at a time, whether EUR/USD or USD/JPY, the most popular two currency pairs. Professional traders use scalping because it requires a thorough understanding of market movements and quick decision-making on the spot.

The drawback of this strategy is that it is easy to miss out on greater profits because investors close their positions after a few minutes. Moreover, traders must resist the pressure of declining prices and decide whether to close the position to avoid more losses or hold it in the hopes of recovering.

Day Trading

Unlike scalping, day trading requires keeping the positions open for longer intervals, typically lasting a few hours before pausing all activities by the end of the trading day.

Day trading is one of the best Forex trading techniques as investors can smoothly integrate it into their working day, starting as the trading day commences and closing the last position by session-end.

Day traders may find two or three suitable opportunities in different Forex markets and assets and take their time before closing them, whether simultaneously or one at a time. Forex day trading strategy requires careful technical and fundamental analysis to find a position that can bring profits.

These strategies demand ultra-fast execution and the tightest possible spreads. Offer your traders a competitive edge with our Tier-1 Liquidity and the B2TRADER platform, engineered for speed and tight spreads.

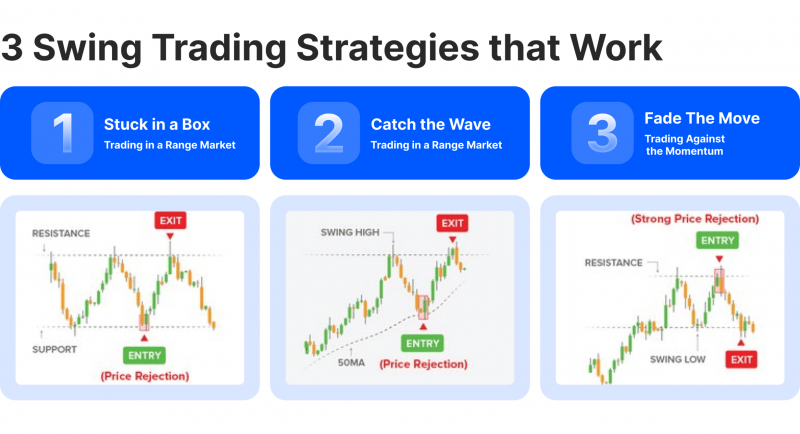

Swing Trading

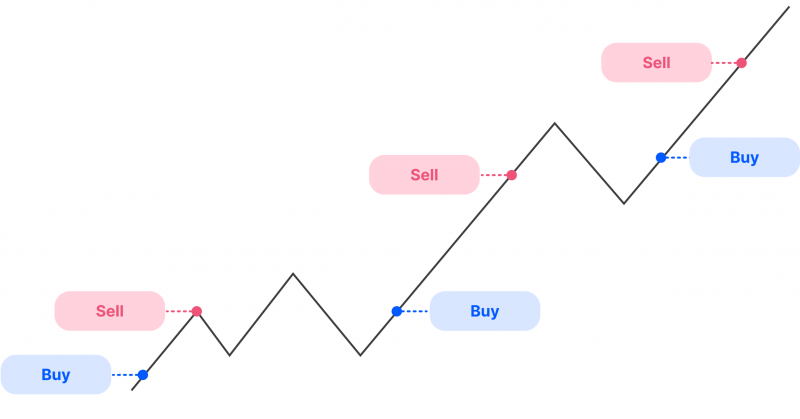

Swing trading is a medium-term strategy that requires opening a market position for hours or days following the price momentum until it changes direction.

It is one of the most common Forex trading strategies. It aims to capitalise on growing trends on both sides when the price increases or decreases. As such, a trader must find the perfect moment to enter a bullish market and place a buy (long) position. Conversely, a trader can execute a sell (short) position after finding the right bearish movement.

To excel at this strategy, investors use a combination of trading indicators to find trends, such as the Bollinger bands, stochastic oscillator and relative strength index.

These tools help traders find overselling and overbuying ranges, suggesting a long and short position, respectively.

Position Trading

Position trading in Forex is a long-term strategy that requires investors to open and hold a position for weeks, months or years. It is one of the best Forex trading strategies for those who do not want to achieve quick returns or spend considerable time looking at charts and newsfeeds.

However, it requires huge discipline because short-term fluctuations will happen, and traders might be tempted to exit the market to avoid excessive losses or realise earned returns.

This approach is suitable for major currency pairs, such as EUR/USD, USD/JPY, GBP/USD, and USD/CHF, because they move only a few pips per day, which might not be significant for one-day trading.

However, opening a USD/JPY position, for example, over a few weeks or months can be profitable as the market momentum moves in a particular direction for a long time.

Long-term strategies require long-term clients and a powerful client cabinet. Allow your traders to seamlessly manage their accounts and funds with B2CORE, our all-in-one back-office and CRM solution for brokerages.

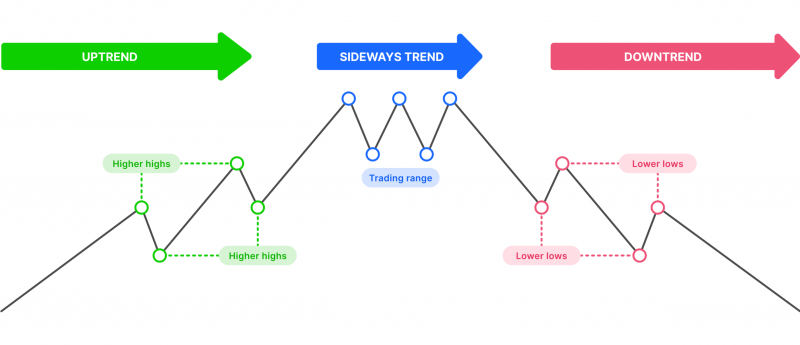

Trending Line Strategy

The line trading strategy in Forex is used to locate current and potential trend movements based on historical price action. This system connects the dots formed by each previous upward and downward trend and draws a line.

The drawn lines help find the support and resistance ranges, which help locate the optimum time to open or close a market position.

It is one of the Forex trading techniques that requires advanced analytical and technical skills to use the right charting tools. It is best used when extending the chart timeline to longer periods, like one year, to create as many peaks and troughs as possible and derive more accurate signals.

It consists of upper and lower lines, similar to the Bollinger bands, and when the price reaches each, the investor makes decisions. If the market reaches the lower line, it suggests a “buy” order, while intersecting with the upper line indicates a “sell” order.

Carry Trade Strategy

The carry trade Forex strategy entails investing in a currency pair consisting of a high-yield interest rate currency and a low-yield interest rate currency. The notion of this approach is to benefit from interest differentials when carrying the position overnight.

Forex rollovers happen when a trader keeps the market position running until the next trading day, which includes a swap payment charged or credited to the trader’s account.

Discover the Tools That Power 500+ Brokerages

Explore our complete ecosystem — from liquidity to CRM to trading infrastructure.

The carry trade strategy takes advantage of this detail to increase profits. Traders must find currency pairs that achieve the largest positive interest differential. USD/JPY is a famous pair. The Bank of Japan is known for keeping interest rates ultra-low to spur economic growth.

AUD/JPY is another Forex pair traders use because of Australia’s historically high interest rates. The same applies to EUR/TRY, an exotic pair that signifies the spiking interest rates in Turkey.

The spiking inflation rates in Turkey raised the interest rates to 50% starting from 21 March 2024 until the day of writing.

How to Choose Your Forex Trading Strategies?

The right approach in Forex depends on your expectations, income, time, and experience. You might test different styles and techniques until you find the most profitable Forex trading strategies that boost your capital and advance your skills.

It is significantly vital to do the following when trading in Forex:

- Take your time because the learning curve in Forex can extend for years.

- Do not make emotional decisions. Most traders quit because they make repetitive trades to retaliate for losing ones.

- Test your forex trading strategies in a demo account before investing with your real money.

- Major pairs require significant investment or longer periods to realise gains, while minor and exotic pairs can bring faster returns at higher risks.

Not all clients want to trade themselves. With our B2COPY investment platform, you can offer them the ability to follow successful “Master” traders, boosting your trading volumes and client retention.

Final Notes

Excelling in the Forex market requires a combination of the right strategies and the right technology. Providing your clients with a professional trading ecosystem, deep liquidity, and robust management tools is what separates leading brokerages from the rest.

Get breaking industry news, technology insights, and B2BROKER product updates from our team of experts.

FAQ

What are the most effective Forex trading strategies for beginners?

Some of the best Forex trading strategies for beginners include scalping for short-term gains, day trading for structured daily trades, and swing trading to capitalize on medium-term trends. These approaches help build skills gradually while managing risk.

How do I choose the right Forex trading strategy?

To pick the right Forex trading strategy, consider your capital, time availability, and risk tolerance. Short-term strategies like scalping suit active traders, while long-term methods like position trading are ideal for those seeking steady gains over months or years.

What are the risks of Forex trading strategies?

All Forex trading strategies carry risks, such as market volatility, emotional trading, and unexpected global events. Managing risks with stop-loss orders, careful analysis, and demo testing can improve outcomes and limit losses.